Analysis Of D-Wave Quantum (QBTS) Stock's Unexpected Friday Increase

Table of Contents

Potential Catalysts for the QBTS Stock Jump

Several factors could have converged to propel the D-Wave Quantum (QBTS) stock price higher on that particular Friday. Let's explore the most likely candidates:

Positive News and Press Releases

Positive news and press releases often significantly impact investor sentiment. Any recent announcements from D-Wave Quantum or within the broader quantum computing industry could be responsible for the surge.

- New Partnerships or Contracts: Did D-Wave secure a major contract with a prominent company in a sector like finance, pharmaceuticals, or materials science? Such collaborations could signal significant growth potential. [Insert link to relevant news article if available].

- Technological Breakthroughs: A successful trial run of a new quantum algorithm or hardware advancement could have boosted investor confidence in D-Wave's technological leadership. [Insert link to relevant news article if available].

- Industry Recognition: Did D-Wave receive an award or acknowledgment from a reputable industry body, further enhancing its credibility and attracting investment? [Insert link to relevant news article if available].

Market Sentiment and Investor Behavior

The overall market climate and investor behavior play a significant role in stock price fluctuations.

- Broader Market Trends: Was the overall market experiencing a positive trend on that Friday, potentially lifting D-Wave Quantum (QBTS) along with other stocks? Analyzing the broader market indices can offer valuable context. [Insert link to relevant market index data].

- Short Squeeze: Did a short squeeze contribute to the rapid price increase? A short squeeze happens when investors who bet against the stock (short sellers) are forced to buy shares to cover their positions, driving up the price.

- Increased Trading Volume: An unusually high trading volume for D-Wave Quantum (QBTS) stock on that day could also indicate increased investor interest and activity. [Insert chart showing trading volume if available].

Competitor Activity and Industry Developments

While D-Wave's own actions are crucial, competitor activity and broader industry developments can also influence its stock price.

- Competitor Setbacks: Negative news for a competitor could indirectly benefit D-Wave Quantum, potentially shifting investor attention and capital towards it.

- Government Funding or Policy: Announcements of increased government funding for quantum computing research or supportive policy changes could uplift the entire sector, including D-Wave Quantum (QBTS).

- Positive Industry Reports: Positive reports and forecasts from industry analysts on the future of quantum computing could improve overall investor sentiment toward the sector.

Analyzing the Financial Performance of D-Wave Quantum (QBTS)

To gain a deeper understanding of the stock surge, analyzing D-Wave Quantum's financial health is critical.

Recent Financial Reports and Earnings

D-Wave's latest financial reports and earnings calls provide vital clues about its performance and prospects.

- Revenue Growth: Did D-Wave show signs of increased revenue or a promising revenue pipeline in its recent reports? This could bolster investor confidence.

- Cost Management: Evidence of improved cost management or increased efficiency could also be a positive factor, suggesting better profitability.

- Guidance for Future Growth: Management's outlook for future growth and profitability can profoundly affect investor sentiment.

Analyst Ratings and Price Targets

Analyst ratings and price targets offer valuable insights into how professionals view D-Wave Quantum (QBTS).

- Rating Upgrades: Any recent upgrades in analyst ratings could have directly contributed to the stock's rise.

- Increased Price Targets: Higher price targets suggest a more optimistic outlook for the stock's future value.

Assessing the Long-Term Outlook for D-Wave Quantum (QBTS) Stock

While the recent surge offers a short-term perspective, assessing the long-term prospects of D-Wave Quantum (QBTS) is essential for informed investment decisions.

Quantum Computing Market Growth Potential

The quantum computing market is poised for significant growth.

- Market Size Projections: Research firms predict substantial growth in the quantum computing market over the next decade. [Insert relevant statistics and projections with source citations].

- Industry Adoption: Increasing adoption of quantum computing technologies across various industries offers significant potential for D-Wave's growth.

D-Wave's Technological Advantages and Challenges

D-Wave's technological strengths and weaknesses within the competitive landscape must be carefully considered.

- Unique Technology: Highlight D-Wave's unique approach to quantum computing and its potential advantages over other technologies.

- Competitive Landscape: Analyze the competitive landscape and identify potential threats and opportunities.

Risk Assessment and Investment Considerations

Investing in D-Wave Quantum (QBTS) stock involves inherent risks.

- Technological Risks: The quantum computing field is still developing, and technological setbacks could impact the company's success.

- Market Risks: Market fluctuations and broader economic conditions can significantly affect the stock's performance.

- Competition: Intense competition from other companies in the quantum computing space is a significant factor.

Understanding the Future Trajectory of D-Wave Quantum (QBTS) Stock

The unexpected Friday increase in D-Wave Quantum (QBTS) stock likely resulted from a confluence of factors, including positive news, market sentiment, and perhaps even a short squeeze. While the short-term volatility is noteworthy, the long-term outlook for D-Wave Quantum (QBTS) depends on its ability to execute its strategy, navigate the competitive landscape, and capitalize on the immense growth potential of the quantum computing market. Key takeaways include the need to closely monitor news releases, analyze financial reports, and understand the competitive dynamics within the quantum computing industry. Stay informed about the latest developments in D-Wave Quantum (QBTS) stock, and remember that further research into D-Wave Quantum (QBTS) is crucial for informed investing. Understanding these factors is essential for navigating the complexities of investing in this cutting-edge technology company.

Featured Posts

-

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 20, 2025

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 20, 2025 -

Megali Tessarakosti Symmetoxi Stin Esperida Tis Patriarxikis Akadimias Kritis

May 20, 2025

Megali Tessarakosti Symmetoxi Stin Esperida Tis Patriarxikis Akadimias Kritis

May 20, 2025 -

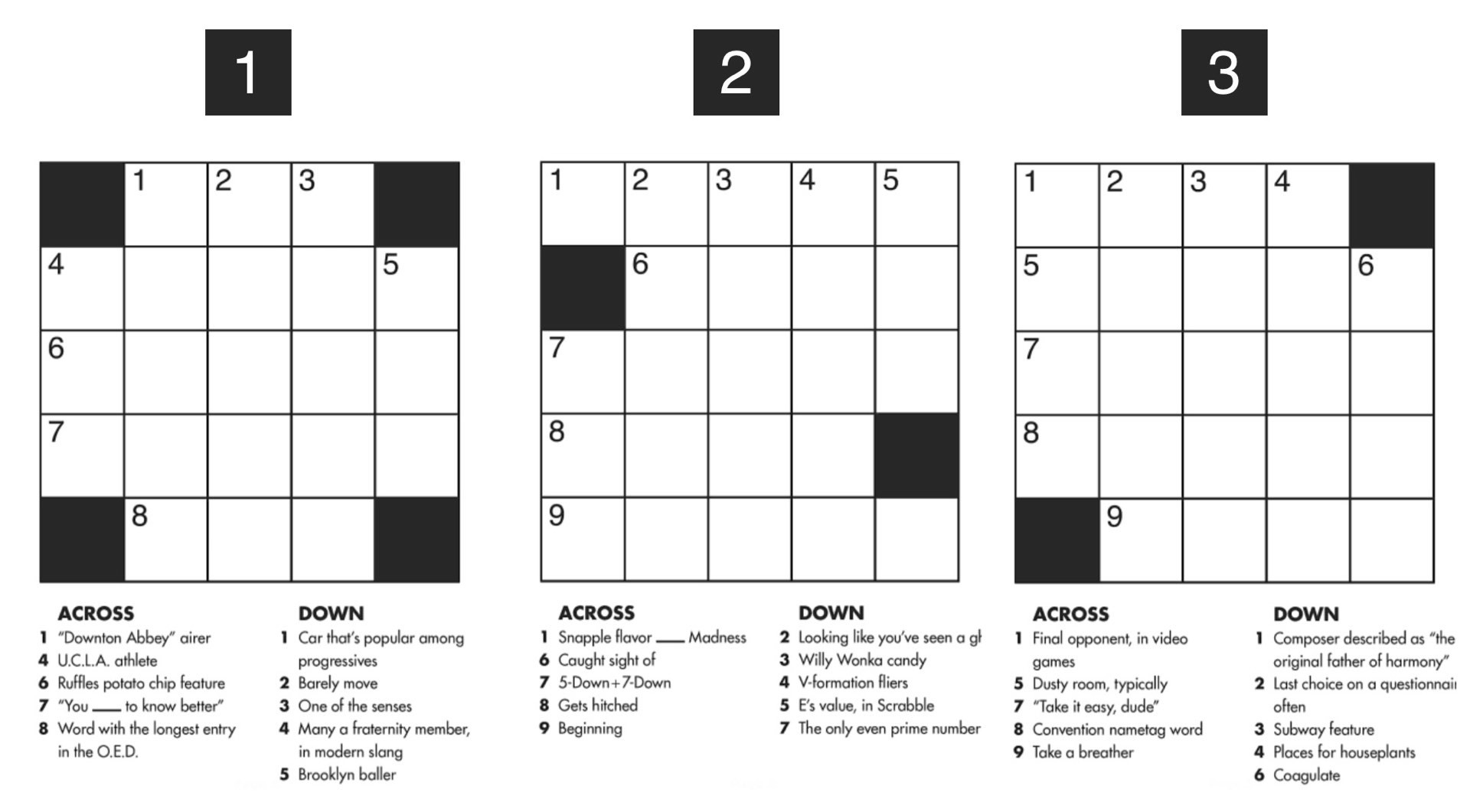

Solve The Nyt Mini Crossword Hints For April 26 2025

May 20, 2025

Solve The Nyt Mini Crossword Hints For April 26 2025

May 20, 2025 -

Jan 6th Falsehoods Allegation Ray Epps Defamation Case Against Fox News

May 20, 2025

Jan 6th Falsehoods Allegation Ray Epps Defamation Case Against Fox News

May 20, 2025 -

Nyt Mini Crossword Answers For March 13

May 20, 2025

Nyt Mini Crossword Answers For March 13

May 20, 2025