Analysis Of Ontario's $14.6 Billion Deficit: Tariff Effects And Solutions

Table of Contents

The Impact of Tariffs on Ontario's Economy

Tariffs, while sometimes used as a protective measure, can have far-reaching and detrimental consequences. Their impact on Ontario's economy is multifaceted and significant, contributing to the current budget deficit.

Increased Costs for Businesses and Consumers

Tariffs directly increase the price of imported goods. This leads to higher costs for businesses, impacting their production costs and potentially forcing price increases for consumers. This inflationary pressure reduces consumer spending and weakens economic activity.

- Manufacturing: Industries relying heavily on imported raw materials, like auto manufacturing, face significantly increased production costs.

- Agriculture: The cost of imported fertilizers and machinery directly impacts agricultural output and profitability.

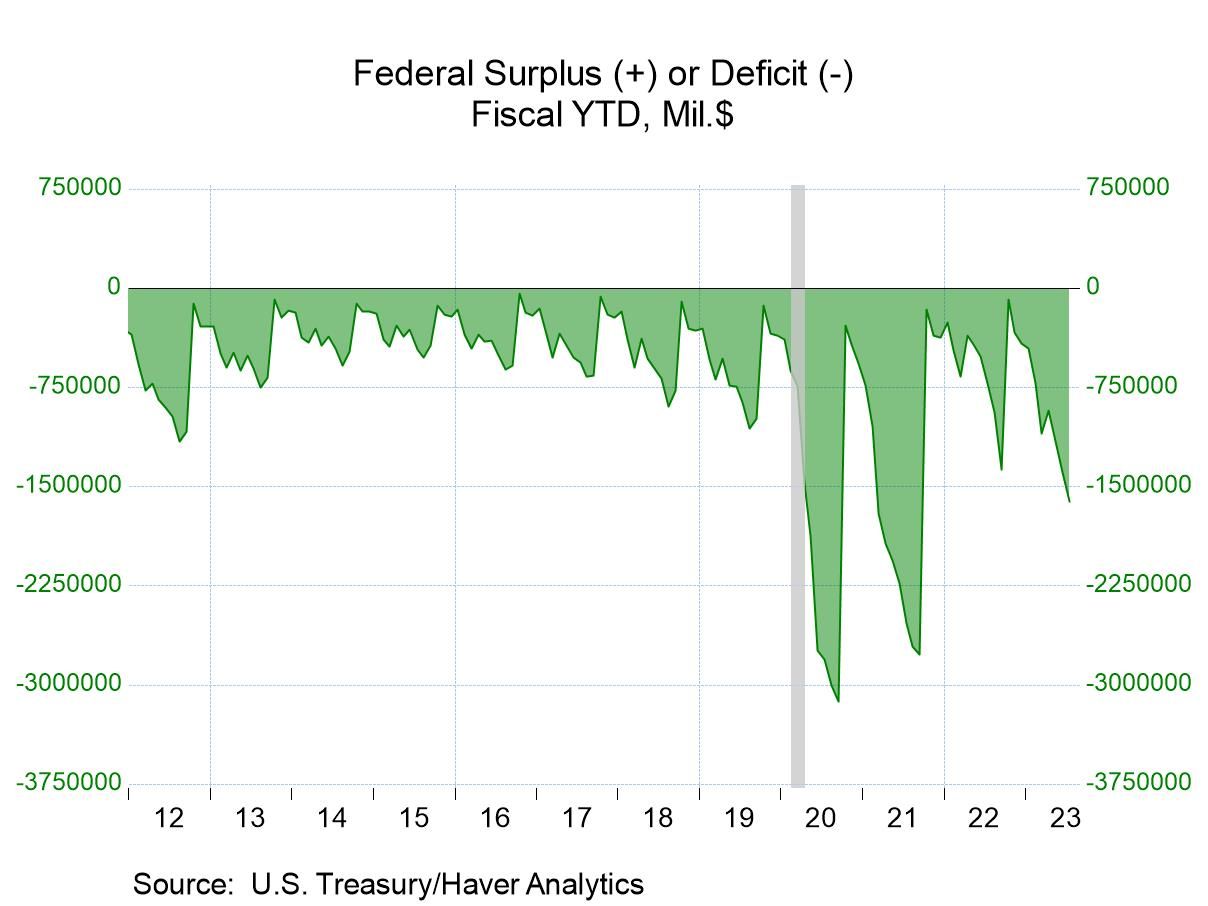

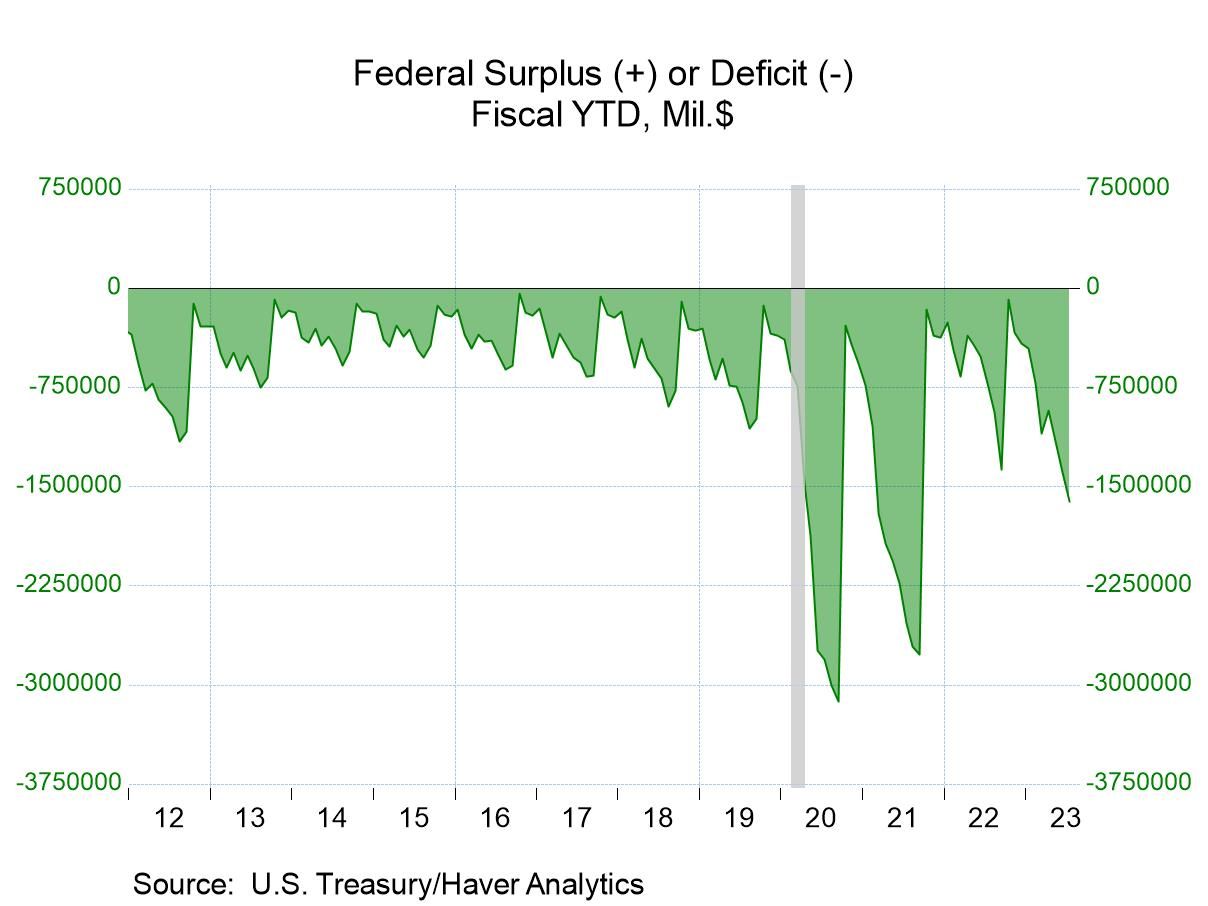

- Data: A recent study (cite a relevant source here if available) indicated that tariffs added X% to the cost of Y imported good, directly impacting Z number of businesses and consumers.

This increase in import costs puts pressure on businesses to reduce profit margins or pass increased costs onto consumers, further dampening economic activity and contributing to the tariff impact on the Ontario deficit.

Reduced Trade and Economic Growth

The imposition of tariffs can easily escalate into trade wars, with retaliatory tariffs imposed by other countries on Ontario exports. This decrease in export volume directly impacts economic growth and leads to job losses.

- Reduced export revenues strain provincial finances, widening the budget deficit.

- Specific industries, like those relying on international trade (e.g., agri-food, technology), are disproportionately affected by decreased export opportunities.

- The uncertainty created by trade disputes discourages investment and hampers business expansion, further slowing economic growth.

This cycle of reduced trade and slower growth significantly contributes to the overall Ontario deficit.

Shifting Supply Chains and Investment

Tariffs disrupt global supply chains, forcing businesses to re-evaluate sourcing strategies. This can lead to a shift in investment away from Ontario as companies seek more cost-effective locations. The implications for FDI are particularly concerning.

- Businesses may relocate production to countries with lower tariff barriers.

- Reduced FDI translates to fewer jobs and less economic activity within the province.

- The uncertainty caused by tariff-related disruptions deters potential investors.

Analyzing Ontario's Fiscal Challenges Beyond Tariffs

While tariffs play a significant role, other factors contribute substantially to Ontario's fiscal difficulties.

Provincial Spending and Revenue Shortfalls

Beyond the tariff effects, Ontario faces challenges with managing provincial spending across various sectors. Increasing healthcare costs, demands on social programs, and substantial infrastructure investments put pressure on the provincial budget.

- Healthcare: Aging population and rising healthcare costs strain provincial resources.

- Social Programs: Demand for social assistance programs continues to grow.

- Infrastructure: The need for significant investment in infrastructure projects adds to the fiscal burden.

- Revenue shortfalls: Current tax policy may not be generating sufficient revenue to meet the growing demands. Analysis of the efficiency and fairness of the current system is necessary.

The Role of Intergovernmental Fiscal Transfers

The fiscal transfers from the federal government play a crucial role in Ontario's budget. Understanding the level of federal funding and its influence is essential.

- Changes in federal funding programs significantly impact provincial budgets.

- The effectiveness of current intergovernmental relations in addressing provincial fiscal needs requires review.

Potential Solutions for Reducing Ontario's Deficit

Addressing Ontario's $14.6 billion Ontario deficit requires a multifaceted approach encompassing both fiscal and trade-related strategies.

Fiscal Policy Adjustments

Implementing sound fiscal consolidation measures is critical. This involves a combination of strategies:

- Expenditure Reviews: Thorough reviews of government spending programs to identify areas for efficiency gains and potential cuts.

- Tax Reform: Examining the current tax policy to identify areas for improvement, considering both fairness and revenue generation.

- Asset Sales: Exploring the possibility of strategically selling non-core government assets to generate revenue. This requires careful consideration to ensure long-term benefits are not compromised.

Promoting Trade Diversification

Reducing reliance on specific trade partners and diversifying export markets is crucial. This requires:

- Exploring new trade agreements and partnerships to open up new export markets.

- Investing in market research to identify and cultivate new trading relationships.

- Supporting Ontario businesses in adapting to changing global trade dynamics.

Investing in Economic Growth

Investing in areas that promote long-term economic growth is essential:

- Investing in education and skills development to create a highly skilled workforce.

- Supporting innovation and technology to foster economic diversification.

- Investing in infrastructure to improve transportation and logistics, which are crucial for international trade.

Conclusion: Addressing Ontario's $14.6 Billion Deficit: A Call to Action

Ontario's $14.6 billion deficit is a serious issue stemming from a complex interplay of factors, including the impact of tariffs, provincial spending, and revenue generation. Addressing this Ontario deficit requires a comprehensive strategy combining fiscal policy adjustments, trade diversification, and investment in long-term economic solutions. Reducing the negative tariff effects is a key part of this. We must engage in a robust discussion about these critical issues, demanding that policymakers implement effective solutions to stabilize the province's finances and secure its economic future. Further research into sustainable fiscal policy and effective economic solutions is urgently needed. Let's work together to tackle this challenge and build a stronger, more prosperous Ontario.

Featured Posts

-

Novak Djokovic Miami Acik Ta Finale Yuekseliyor

May 17, 2025

Novak Djokovic Miami Acik Ta Finale Yuekseliyor

May 17, 2025 -

Resultado Penarol Olimpia 0 2 Resumen Completo Y Analisis Del Partido

May 17, 2025

Resultado Penarol Olimpia 0 2 Resumen Completo Y Analisis Del Partido

May 17, 2025 -

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025

Canadas New Tariffs On Us Goods Plummet Near Zero Rates With Key Exemptions

May 17, 2025 -

Weekly Failure Review Identifying Patterns And Improving Performance

May 17, 2025

Weekly Failure Review Identifying Patterns And Improving Performance

May 17, 2025 -

Investitsii V Industrialnye Parki Riski I Vozmozhnosti V Usloviyakh Vysokoy Konkurentsii

May 17, 2025

Investitsii V Industrialnye Parki Riski I Vozmozhnosti V Usloviyakh Vysokoy Konkurentsii

May 17, 2025