Analysis Of Thames Water Executive Compensation And Performance

Table of Contents

H2: Executive Compensation at Thames Water: A Detailed Look

H3: Salary, Bonuses, and Stock Options: Breakdown of compensation packages for key executives.

Thames Water's executive compensation packages are complex, comprising several key components:

- Base Salary: The fixed annual salary paid to each executive. Specific figures require access to the company's annual reports and regulatory filings.

- Performance-Related Bonuses: Bonuses tied to the achievement of pre-defined performance targets, which can vary significantly year to year. These targets often relate to financial performance, customer satisfaction, and operational efficiency.

- Long-Term Incentives (LTIs): These typically include stock options or performance shares, designed to align executive interests with long-term shareholder value creation. The value of LTIs depends on the company's share price performance over several years.

- Pension Contributions: Employer contributions to executive pension schemes, adding a significant element to overall compensation.

Comparing Thames Water executive compensation to other UK water companies and international counterparts is essential to establish whether their packages are in line with industry benchmarks or represent an outlier. Significant discrepancies could indicate potential issues with governance or reward structures. News reports often highlight the potentially excessive nature of some bonuses, sparking public debate about fairness and accountability.

H3: Transparency and Disclosure: Assessing the level of public disclosure regarding executive remuneration.

The level of transparency surrounding Thames Water's executive compensation is a subject of ongoing discussion. While the company is obliged to adhere to regulatory requirements for disclosure, questions remain about the extent to which all aspects of executive pay are fully and clearly communicated to the public.

- Regulatory Compliance: Thames Water must comply with UK regulations on corporate governance and reporting, including those concerning executive remuneration disclosure. However, the specifics of regulations and their interpretation can be subject to debate.

- Best Practices: Best practice in corporate governance emphasizes clear and comprehensive disclosure of all elements of executive pay, including bonuses, benefits, and LTIs. Any deviation from these best practices can raise concerns about potential conflicts of interest or lack of accountability.

- Criticisms: The company has faced criticism in the past regarding a perceived lack of transparency in its reporting of executive compensation, leading to calls for greater openness and accountability.

H2: Thames Water's Operational Performance: Assessing Key Metrics

H3: Water Supply and Quality: Evaluation of the company's performance in delivering clean and reliable water services.

Thames Water's performance in providing clean and reliable water services is a key indicator of its operational effectiveness. This assessment requires examining several metrics:

- Water Supply Interruptions: The frequency and duration of water supply interruptions experienced by customers. Higher rates indicate operational inefficiencies.

- Leaks: The volume of water lost through leaks in the distribution network. High leakage rates represent a significant waste of resources and highlight the need for infrastructure investment.

- Water Quality Incidents: The number and severity of incidents affecting the quality of water supplied to customers. Such incidents can pose serious health risks and damage public confidence.

- Customer Satisfaction: Regular customer satisfaction surveys provide valuable insights into customer perceptions of service quality. Low satisfaction scores reflect areas requiring improvement.

H3: Financial Performance: Examining profitability, debt levels, and investment in infrastructure.

Thames Water's financial performance provides crucial insights into its overall health and sustainability. Key metrics include:

- Profitability: Analysis of revenue, profit margins, and return on investment (ROI) helps assess the company's financial efficiency. Low profitability could indicate operational inefficiencies or inadequate pricing strategies.

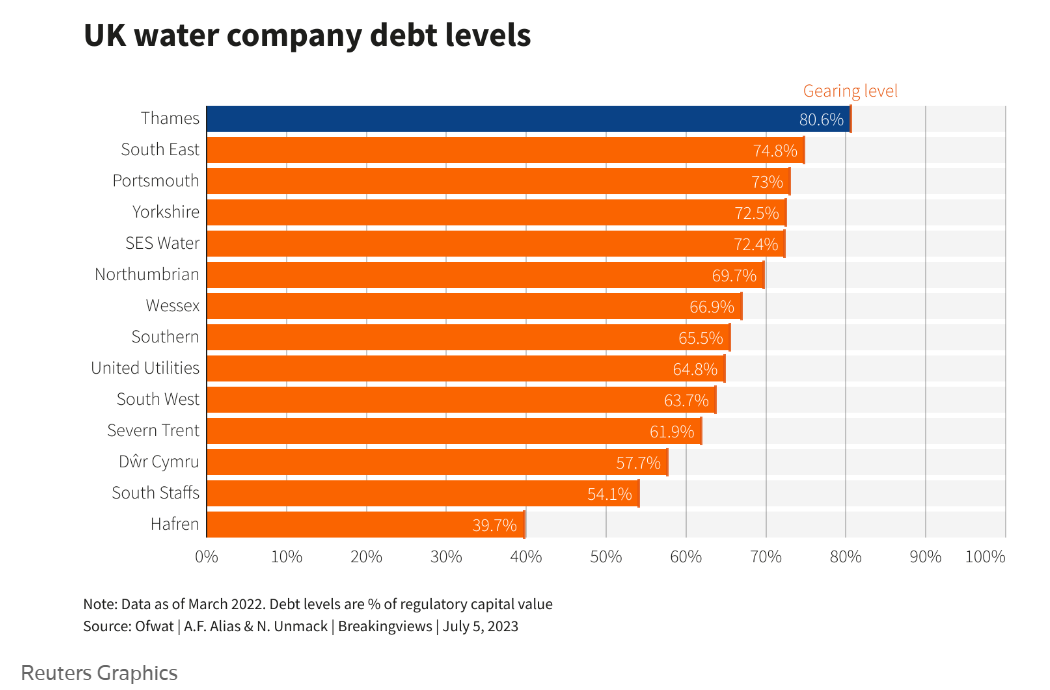

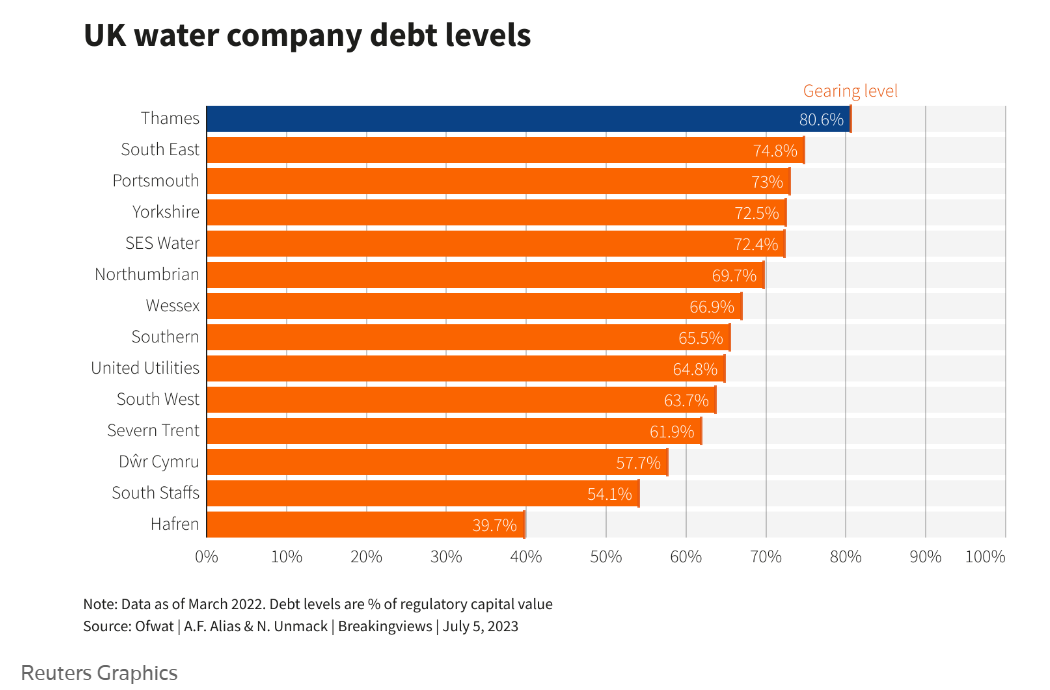

- Debt Levels: High debt levels can constrain the company's ability to invest in infrastructure upgrades and maintain financial stability. A deteriorating credit rating can signal increased financial risk.

- Infrastructure Investment: Adequate investment in maintaining and upgrading water infrastructure is crucial for ensuring the long-term reliability and quality of water services. Underinvestment can lead to increased leakage, supply interruptions, and higher maintenance costs in the long run.

H3: Environmental Performance: Assessment of the company's environmental impact and sustainability initiatives.

Thames Water's environmental performance is another critical aspect of its overall operational effectiveness. This includes:

- Water Leakage Rates: Efforts to reduce water leakage are crucial for minimizing environmental impact and improving operational efficiency. Higher leakage rates indicate operational inefficiencies and environmental waste.

- Carbon Footprint: Thames Water's carbon emissions need to be assessed and compared against industry benchmarks and sustainability targets. Reduction strategies are essential to mitigating climate change.

- Regulatory Compliance: Adherence to environmental regulations is crucial for ensuring responsible environmental stewardship. Non-compliance can result in penalties and damage to reputation.

H2: Correlation Between Compensation and Performance at Thames Water

H3: Analysis of the Relationship: Exploring the link between executive compensation and operational performance metrics.

Determining whether a direct correlation exists between Thames Water's executive compensation and its operational performance requires a detailed analysis. This could involve:

- Statistical Analysis: Employing statistical methods to assess the correlation between executive pay and key performance indicators (KPIs) such as water supply reliability, customer satisfaction, and financial performance. This could reveal a positive correlation, a negative correlation, or no significant relationship.

- Influencing Factors: Other factors, such as regulatory changes, economic conditions, and investment decisions, can also influence operational performance. It's crucial to consider these confounding variables when analyzing the relationship between compensation and performance.

- Comparative Studies: Comparing Thames Water's experience with findings from other studies on the link between executive compensation and performance in similar industries can provide further context and insights.

H3: Stakeholder Perspectives: Examining the views of customers, investors, and regulators.

Stakeholder perspectives on the relationship between executive compensation and performance are invaluable.

- Customer Views: Customer opinions often reflect their experiences with service quality and reliability. Dissatisfaction with service levels can fuel criticism of executive compensation.

- Investor Sentiment: Investors' assessments of the company's financial performance and governance influence share prices and investment decisions. Concerns about executive pay can negatively impact investor sentiment.

- Regulatory Scrutiny: Regulators monitor the company's performance and governance, including executive compensation practices. Regulatory actions can reflect concerns about executive pay.

3. Conclusion: A Critical Assessment of Thames Water Executive Compensation and Performance

This Analysis of Thames Water Executive Compensation and Performance reveals a complex interplay between executive remuneration and operational outcomes. While a direct correlation may not be readily apparent, the substantial executive pay packages awarded amidst concerns about service reliability and financial stability raise critical questions about corporate governance and accountability. Further research is needed to fully understand the nuances of this relationship, including a more detailed statistical analysis and a broader examination of stakeholder views. Transparency and accountability are paramount in the water industry, and increased scrutiny of executive compensation practices is crucial for ensuring that these essential services are provided efficiently and effectively. We urge readers to engage in further discussion and research on this crucial topic, contacting Ofwat (the water services regulator) or other relevant organizations to advocate for greater transparency and accountability in the water industry. A more robust Analysis of Thames Water Executive Compensation and Performance, involving more comprehensive data and stakeholder engagement, is necessary to ensure effective governance and protect public interest.

Featured Posts

-

A Former French Prime Minister Speaks Out Against Macron

May 24, 2025

A Former French Prime Minister Speaks Out Against Macron

May 24, 2025 -

Mathieu Avanzi Au Dela De La Classe L Evolution Du Francais

May 24, 2025

Mathieu Avanzi Au Dela De La Classe L Evolution Du Francais

May 24, 2025 -

The Perils Of Dissent When Seeking Change Leads To Punishment

May 24, 2025

The Perils Of Dissent When Seeking Change Leads To Punishment

May 24, 2025 -

Airplane Safety Understanding The Frequency Of Close Calls And Crashes

May 24, 2025

Airplane Safety Understanding The Frequency Of Close Calls And Crashes

May 24, 2025 -

Meregdraga Porsche 911 Extrak Atalakitasok

May 24, 2025

Meregdraga Porsche 911 Extrak Atalakitasok

May 24, 2025

Latest Posts

-

Elena Rybakina Ne V Optimalnoy Forme Chto Dalshe

May 24, 2025

Elena Rybakina Ne V Optimalnoy Forme Chto Dalshe

May 24, 2025 -

Poslednie Novosti O Rybakinoy Kommentarii O Forme

May 24, 2025

Poslednie Novosti O Rybakinoy Kommentarii O Forme

May 24, 2025 -

Sostoyanie Rybakinoy Slova Tennisistki O Forme Posle Turnira

May 24, 2025

Sostoyanie Rybakinoy Slova Tennisistki O Forme Posle Turnira

May 24, 2025 -

Rybakina Otkrovenno O Nedostatkakh V Forme

May 24, 2025

Rybakina Otkrovenno O Nedostatkakh V Forme

May 24, 2025 -

Rybakina O Svoey Forme Poka Ne Na Pike

May 24, 2025

Rybakina O Svoey Forme Poka Ne Na Pike

May 24, 2025