Analysis: OPEC+ And The Upcoming Oil Production Quota Adjustment

Table of Contents

Current Global Oil Market Conditions and OPEC+'s Role

The global oil market is currently characterized by a complex interplay of supply and demand. Geopolitical instability, particularly the ongoing war in Ukraine and resulting sanctions against Russia, has significantly disrupted the flow of oil, contributing to price volatility. OPEC+, comprising OPEC members and key allies like Russia, plays a pivotal role in managing global oil supply. Its decisions regarding production quotas directly influence the price of crude oil, impacting consumers and businesses globally.

- Current oil production levels by major OPEC+ members: Saudi Arabia, the UAE, and other major producers are carefully monitoring their output, balancing market needs with their own economic interests. Slight increases or decreases can have a ripple effect on global prices.

- Impact of sanctions on Russian oil production: Western sanctions on Russia, a major oil producer, have reduced its export capacity, creating a supply deficit that OPEC+ partially fills. This situation adds significant complexity to the quota adjustment decision.

- Growth of renewable energy and its effect on oil demand: The increasing adoption of renewable energy sources like solar and wind power is gradually reducing the long-term demand for oil. However, this transition is gradual, and oil remains a crucial energy source in the near to medium term.

- Global economic outlook and its influence on oil consumption: Global economic growth significantly influences oil demand. A robust global economy typically translates into higher oil consumption, while economic slowdowns can lead to reduced demand. OPEC+ must consider this dynamic when setting production quotas.

Factors Influencing the Upcoming OPEC+ Production Quota Decision

The upcoming OPEC+ decision is influenced by a multitude of factors, making it a complex and challenging undertaking. Internal disagreements among member states are common, with nations holding differing economic interests and priorities. Furthermore, external pressure from consuming nations to increase production further complicates the process.

- Differing economic interests among OPEC+ members: Some members might favor higher production to maximize revenue, while others might prefer lower production to support higher prices. This creates internal tension and necessitates negotiations to reach a consensus.

- Pressure from consuming nations to increase production: Many oil-consuming nations, particularly those facing inflationary pressures, urge OPEC+ to increase production to stabilize oil prices. However, OPEC+ is not obligated to yield to such pressure.

- Internal political dynamics within OPEC+ member states: Political changes and internal considerations within individual member states can influence their positions on production quotas. These internal dynamics can make predicting the outcome of OPEC+ meetings challenging.

- Concerns about future oil demand and price volatility: OPEC+ must consider the long-term outlook for oil demand and the potential for price volatility. Balancing short-term gains with long-term sustainability is a key factor in their decision-making process.

Potential Scenarios and Their Implications

The OPEC+ meeting could result in several scenarios: an increase in production, a decrease, or a maintenance of the status quo. Each scenario has significant implications for global oil prices, energy security, and various economies.

- Increased production: This would likely lead to lower oil prices, potentially easing inflationary pressures globally but potentially impacting the revenue of OPEC+ member states.

- Decreased production: This would likely lead to higher oil prices, potentially benefiting OPEC+ member states but increasing inflationary pressures in oil-consuming countries and potentially hindering economic growth.

- Maintaining the status quo: This would likely maintain current oil price levels, but it might not fully address the concerns of both oil-producing and oil-consuming nations.

Implications of each scenario:

- Impact on inflation in various countries: Changes in oil prices directly impact inflation, affecting the cost of goods and services.

- Effects on the global economy and economic growth: Oil price fluctuations influence economic growth, affecting various industries and sectors.

- Consequences for energy-dependent industries: Industries heavily reliant on oil, such as transportation and manufacturing, are particularly sensitive to oil price changes.

- Potential shifts in geopolitical alliances: Oil price dynamics can also influence geopolitical relations and alliances between nations.

Market Reactions and Investor Sentiment

The OPEC+ decision will undoubtedly trigger significant market reactions. Oil futures prices are expected to experience substantial volatility following the announcement, influencing investor sentiment in the energy sector and the broader stock market.

- Expected volatility in oil prices after the announcement: The market will react swiftly to the decision, with potential for sharp price movements depending on the outcome.

- Reactions from investors and financial institutions: Investors will adjust their portfolios based on their assessment of the decision’s impact on oil prices and related industries.

- Potential hedging strategies employed by energy companies: Energy companies will utilize various hedging strategies to mitigate risks associated with price volatility.

- Impact on the energy sector's stock performance: The energy sector's stock performance will be strongly influenced by the OPEC+ decision and the subsequent market reaction.

Conclusion

The upcoming OPEC+ oil production quota adjustment is a crucial event with significant implications for the global energy market and various economies. Numerous factors influence the decision, including geopolitical considerations, economic interests of member states, and the global demand outlook. The potential scenarios – increased production, decreased production, or maintaining the status quo – each carry distinct consequences for oil prices, inflation, economic growth, and geopolitical relations. Staying informed about this decision and its implications is crucial. To further your understanding, we recommend following reputable news sources and conducting in-depth research on the specific impact of the OPEC+ oil production quota adjustment on individual countries, industries, and investment strategies. Keep a close eye on developments surrounding the OPEC+ oil production quota adjustment for valuable insights into the future of global energy markets.

Featured Posts

-

Bekende Ajax Speler Zwaar Bekritiseerd Door Clubicoon

May 29, 2025

Bekende Ajax Speler Zwaar Bekritiseerd Door Clubicoon

May 29, 2025 -

Friends Remember Nky Environmentalist Lost In Floods

May 29, 2025

Friends Remember Nky Environmentalist Lost In Floods

May 29, 2025 -

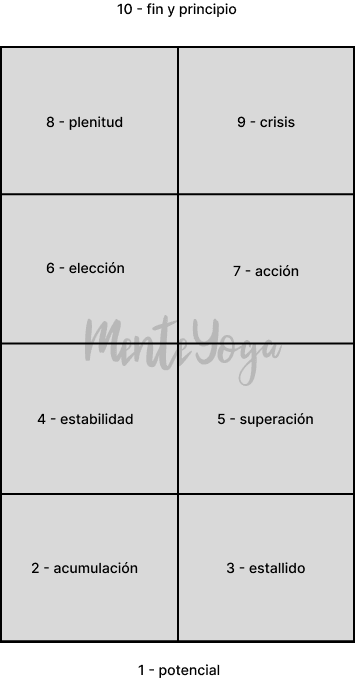

Los Arcanos Menores Del Tarot Una Guia Completa

May 29, 2025

Los Arcanos Menores Del Tarot Una Guia Completa

May 29, 2025 -

Living Fence Construction Choosing The Right Plants And Techniques

May 29, 2025

Living Fence Construction Choosing The Right Plants And Techniques

May 29, 2025 -

The Jonathan Tah To Manchester United Transfer Saga Facts And Speculation

May 29, 2025

The Jonathan Tah To Manchester United Transfer Saga Facts And Speculation

May 29, 2025

Latest Posts

-

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025 -

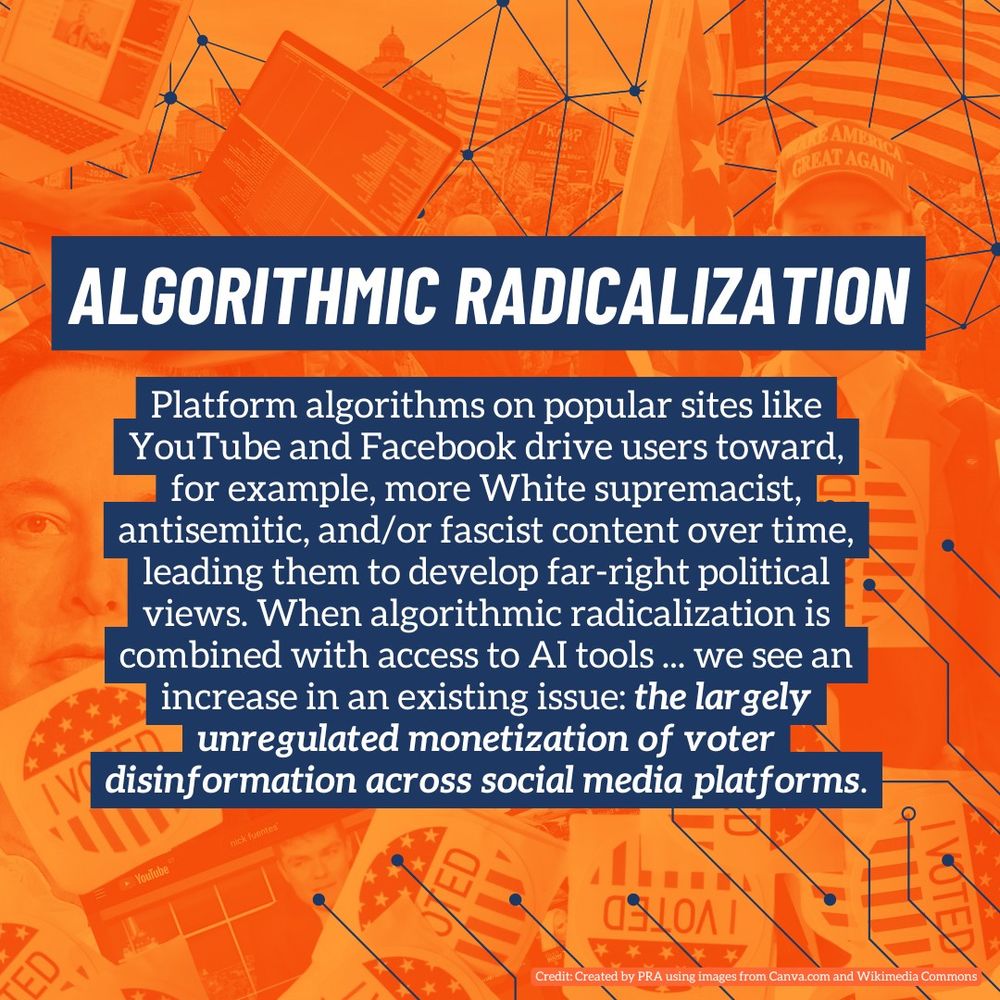

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025 -

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025 -

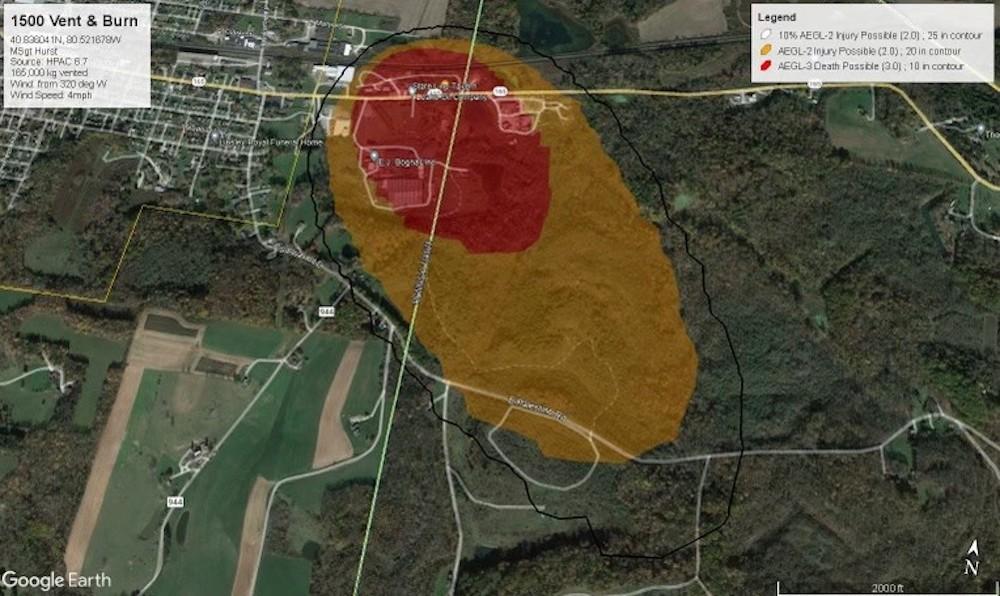

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

May 31, 2025

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

May 31, 2025 -

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 31, 2025

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 31, 2025