Analysis: RBC's Earnings Miss And The Implications For Loan Portfolio

Table of Contents

Reasons Behind RBC's Earnings Miss

RBC's earnings shortfall can be attributed to a confluence of factors, impacting its net interest margin, provisions for credit losses, and overall operating performance. These factors are interconnected and reflect a challenging macroeconomic environment.

-

Lower-than-Expected Net Interest Margin: The competitive landscape within the Canadian banking sector, coupled with a changing interest rate environment, has squeezed RBC's net interest margin. Intense competition has forced banks to offer more attractive loan rates, reducing profitability. Furthermore, the timing of interest rate hikes by the Bank of Canada hasn't perfectly aligned with the bank's asset and liability structures, impacting the overall margin.

-

Increased Provisions for Credit Losses: Reflecting a more cautious approach to the potential economic slowdown, RBC has significantly increased its provisions for credit losses. This proactive measure anticipates a rise in loan defaults as economic uncertainty mounts, impacting consumer and business spending. This suggests that RBC anticipates an increase in non-performing loans.

-

Higher Operating Expenses: Rising inflation has driven up operating costs across the board, impacting RBC's profitability. These increased expenses, including salaries, technology investments, and regulatory compliance, further contributed to the earnings miss.

-

Reduced Trading Revenue: Fluctuations in global financial markets have led to reduced trading revenue for RBC's capital markets division. This volatility, influenced by geopolitical events and economic uncertainty, negatively impacts the bank's overall performance.

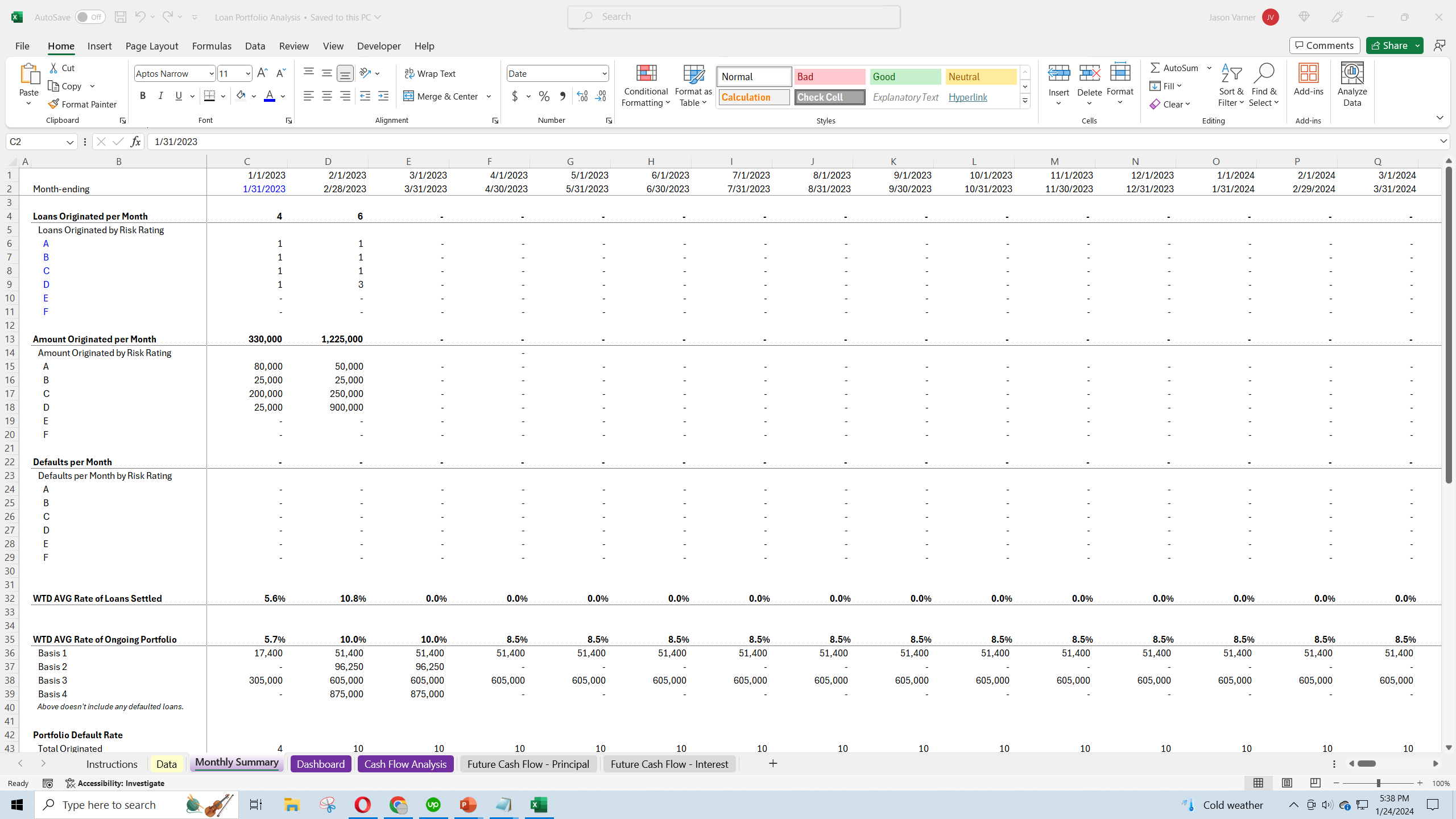

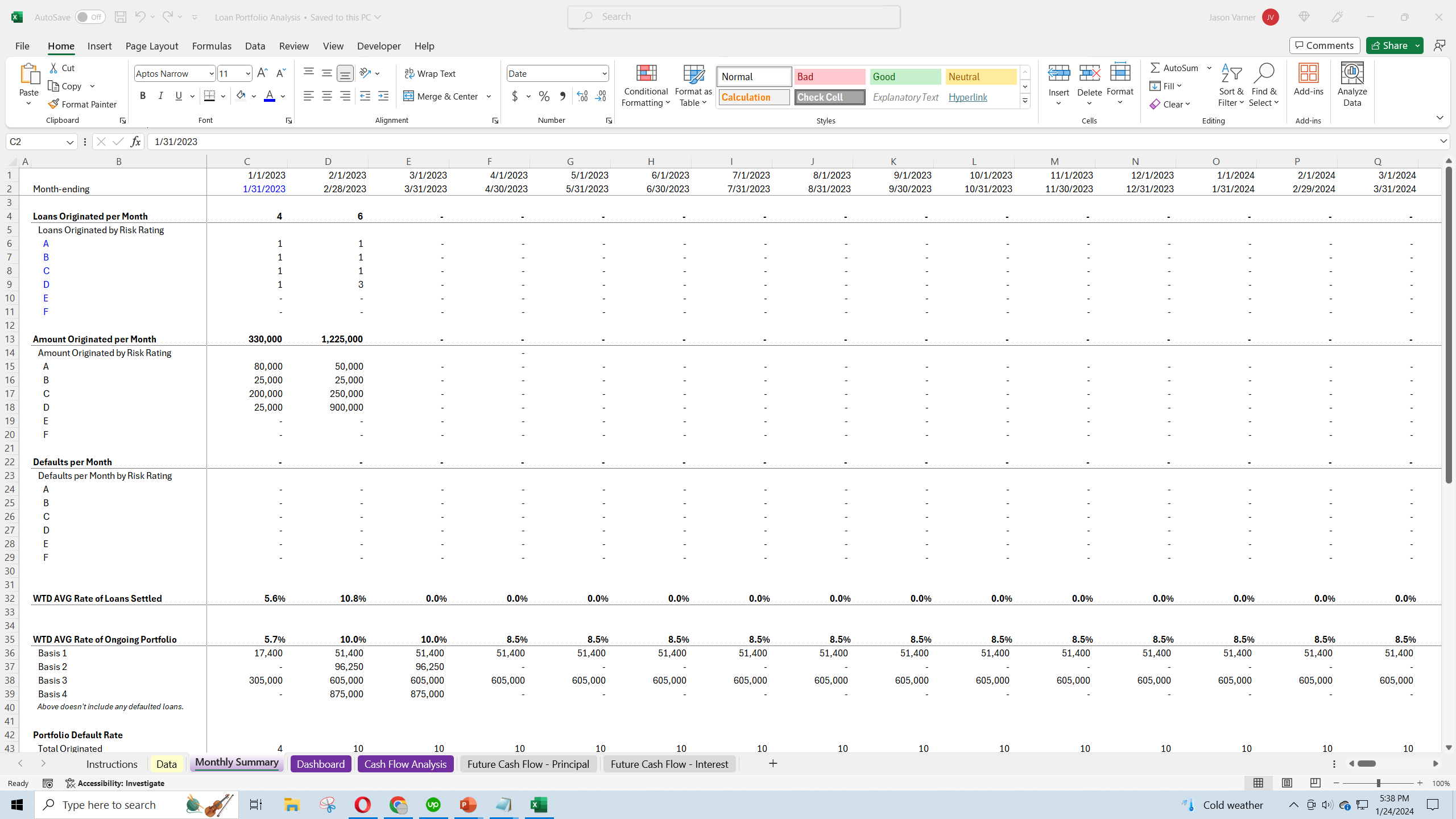

Analysis of RBC's Loan Portfolio Performance

The performance of RBC's loan portfolio is central to understanding the implications of the earnings miss. A detailed analysis is necessary to assess the potential risks and vulnerabilities within the different loan segments.

-

Loan Portfolio Composition: RBC's loan portfolio is diversified, encompassing mortgages, consumer loans, and commercial loans. The relative performance of each segment will significantly influence the overall health of the portfolio. A closer look at the proportion of each type of loan is vital for understanding potential risks.

-

Loan Growth Rates and Trends: Analyzing the growth rates of different loan types will provide insights into the bank's lending strategies and the demand for credit in various sectors. Slowing growth could indicate reduced borrowing activity and potential future challenges.

-

Credit Quality Metrics: Key credit quality metrics such as non-performing loans (NPLs) and delinquency rates are crucial indicators of asset quality within the loan portfolio. A sharp increase in these metrics would signal a significant deterioration in credit quality.

-

Potential Risks within Specific Loan Segments: Specific loan segments, particularly those exposed to sectors vulnerable to economic downturns (e.g., real estate, construction), may face increased credit risk. Careful monitoring of these segments is essential for risk mitigation.

-

Comparison to Competitors: Comparing RBC's performance to its competitors, such as TD Bank and Bank of Montreal, provides valuable context and allows for a relative assessment of the severity of the earnings miss and the challenges faced by the broader Canadian banking sector.

Implications for RBC's Future Financial Performance

The earnings miss has significant implications for RBC's future financial performance, investor confidence, and its strategic direction.

-

Projected Impact on Future Profitability: The combination of a squeezed net interest margin, increased credit loss provisions, and higher operating expenses will likely impact RBC's profitability in the coming quarters. Accurate forecasting of future earnings will require careful consideration of these factors.

-

Impact on Stock Price and Investor Sentiment: The earnings miss has already affected RBC's stock price. Maintaining investor confidence will require transparency and a credible strategic response to address the challenges.

-

Strategic Response: RBC will need to implement a strategic response to navigate the current challenges. This might include cost-cutting measures, adjustments to lending strategies, and potentially, a more conservative approach to risk management.

-

Outlook for the Canadian Banking Sector: RBC's performance reflects broader challenges within the Canadian banking sector. The performance of other major banks will be crucial in assessing the systemic impact of these issues.

The Broader Economic Context

The macroeconomic environment plays a significant role in shaping RBC's performance and the outlook for its loan portfolio.

-

Inflation, Recession Risk, and Interest Rate Hikes: High inflation, the risk of a recession, and subsequent interest rate hikes by the Bank of Canada all contribute to a challenging operating environment. These factors affect consumer and business spending, influencing loan demand and credit risk.

-

Regulatory Environment: The regulatory environment for Canadian banks has a direct impact on their operations and profitability. Changes in regulations can affect lending practices, capital requirements, and overall risk management strategies.

Conclusion

This analysis of RBC's earnings miss underscores significant concerns regarding the performance of its loan portfolio, driven by factors such as a compressed net interest margin, increased provisions for credit losses, and a challenging macroeconomic landscape. The potential for a recession and the ongoing impact of inflation add further complexity. RBC's strategic response, including its management of credit risk and adaptation to the changing economic environment, will be crucial in determining its future financial performance.

Call to Action: Stay informed on the evolving situation with RBC and the implications for its loan portfolio. Continue to follow our analysis for further updates on RBC's financial performance and the Canadian banking sector. Subscribe to our newsletter for more in-depth analysis on RBC and related topics!

Featured Posts

-

Understanding Money A Podcast For A New Era Of Finance

May 31, 2025

Understanding Money A Podcast For A New Era Of Finance

May 31, 2025 -

Vatican City To Feature As The Dramatic Finale For Giro D Italia 2025

May 31, 2025

Vatican City To Feature As The Dramatic Finale For Giro D Italia 2025

May 31, 2025 -

22 777 000 In Banksy Print Sales A Year Of Record Breaking Success

May 31, 2025

22 777 000 In Banksy Print Sales A Year Of Record Breaking Success

May 31, 2025 -

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025 -

Alfoeldi Noevenykulturak Strategiak A Hideg Es A Szarazsag Ellen

May 31, 2025

Alfoeldi Noevenykulturak Strategiak A Hideg Es A Szarazsag Ellen

May 31, 2025