Analysis: Reduced Chinese Steel Production And The Iron Ore Market

Table of Contents

The Decline in Chinese Steel Production

The decrease in Chinese steel production is a multifaceted issue stemming from both government initiatives and weakening domestic demand.

Government Regulations and Environmental Concerns

China's commitment to environmental protection has led to stricter regulations aimed at curtailing pollution from its steel mills. This includes:

- Increased scrutiny on carbon emissions and air quality: The Chinese government is enforcing stricter emission standards, pushing steel mills to adopt cleaner production technologies or face penalties.

- Implementation of stricter production quotas and capacity cuts: Production quotas and capacity cuts are being implemented to limit overall steel output and reduce environmental impact. This directly impacts the amount of iron ore required.

- Examples of specific policies and their effects on steel output: Specific policies like the "dual control" mechanism for energy consumption and carbon emissions have significantly constrained steel production in various regions. These policies have demonstrably reduced overall steel output, creating a ripple effect throughout the supply chain.

Weakening Domestic Demand

Simultaneously, decreased domestic demand within China is contributing to the slowdown in steel production. This weakening demand is driven by several factors:

- Slowdown in the Chinese construction sector: The once booming construction sector, a major consumer of steel, has experienced a significant slowdown, reducing the demand for steel products.

- Reduced infrastructure spending: Government spending on infrastructure projects, another key driver of steel demand, has been scaled back, further dampening demand.

- Impact of the real estate market downturn: The real estate crisis in China has significantly reduced the demand for steel used in construction and development.

- Shifting focus towards higher-value steel products: While overall demand might be down, there's a shift towards higher-value, specialized steel products, which may not require the same volume of raw materials.

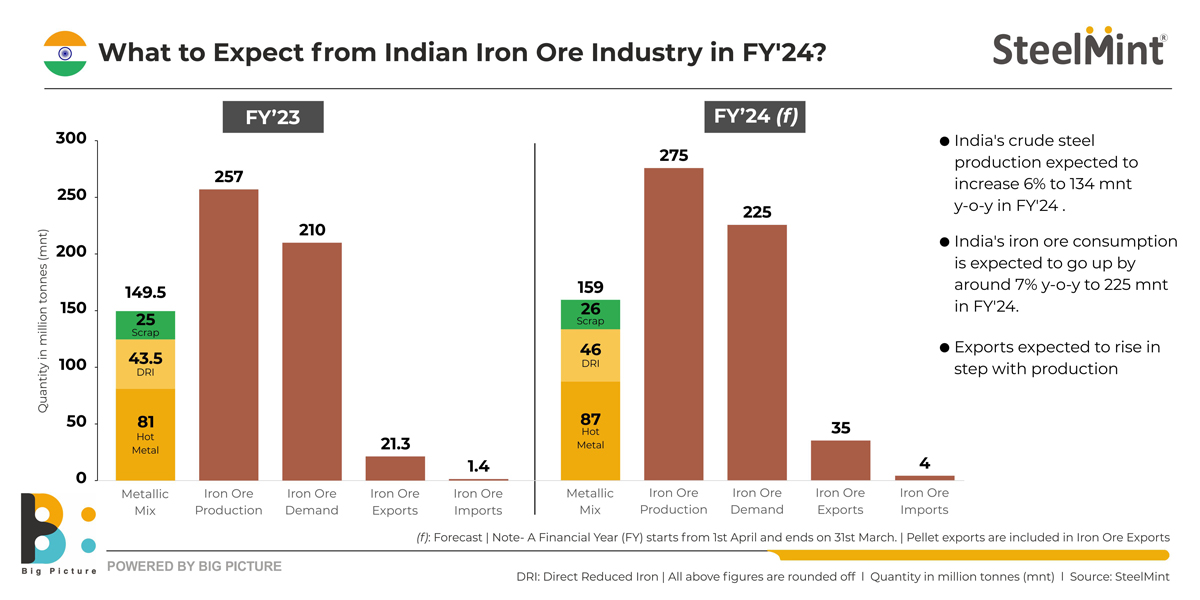

Impact on Iron Ore Prices and Supply

The decline in Chinese steel production has directly impacted iron ore prices and the overall supply chain.

Price Volatility and Market Fluctuations

A direct correlation exists between Chinese steel production and iron ore prices. Decreased steel demand translates to lower iron ore prices due to reduced consumption of this crucial raw material.

- Explain how decreased demand translates to lower iron ore prices: Reduced steel production means less iron ore is needed, creating a surplus in the market and driving down prices. This is a fundamental principle of supply and demand.

- Analyze price charts and historical data to support the correlation: Historical data clearly shows a strong negative correlation between Chinese steel production and iron ore prices. Periods of reduced steel production consistently coincide with periods of lower iron ore prices.

- Mention the role of speculation and market sentiment: Market sentiment and speculation also play a significant role. News about reduced Chinese steel production can trigger sell-offs, further exacerbating price declines.

Implications for Iron Ore Producers

Major iron ore producing nations like Australia and Brazil are feeling the pinch.

- Examine production adjustments and cost-cutting measures by mining companies: Mining companies are adjusting production levels, implementing cost-cutting measures, and exploring new markets to mitigate the impact of lower iron ore prices.

- Analyze the impact on export revenues and economic growth in these countries: Reduced demand and lower prices negatively impact export revenues and economic growth in these iron ore-dependent economies.

- Discuss potential for mergers and acquisitions in the iron ore industry: The challenging market conditions may lead to increased mergers and acquisitions within the iron ore industry as companies seek consolidation and efficiency.

Global Implications of Reduced Chinese Steel Production

The reduction in Chinese steel production extends beyond the immediate iron ore market, impacting global steel markets and broader economic conditions.

Impact on Global Steel Markets

Reduced Chinese steel exports have created both challenges and opportunities in global steel markets.

- Analyze how reduced Chinese steel exports affect other steel-producing nations: Other steel-producing countries may see increased market share but also face potential price pressure.

- Examine the potential for increased market share for other steel producers: Countries like India, Japan, and South Korea may benefit from increased demand as China's steel exports decline.

Broader Economic Consequences

The effects cascade beyond the steel and iron ore sectors, influencing global trade and supply chains.

- The impact on global trade and supply chains: The reduced demand for shipping and transportation related to steel and iron ore impacts related industries.

- Potential implications for related industries (e.g., shipping, transportation): The shipping and transportation industries are directly affected by decreased volumes of steel and iron ore being transported globally.

- Long-term effects on global economic growth: The long-term impact on global economic growth will depend on the sustainability of the slowdown in Chinese steel production and the overall resilience of the global economy.

Conclusion

The reduction in Chinese steel production has demonstrably impacted the iron ore market, causing price volatility and influencing global steel trade dynamics. This analysis highlighted the complex interplay of government policies, economic slowdown, and market forces. Understanding these dynamics is crucial for stakeholders across the entire supply chain. To navigate this evolving landscape, it's essential to stay informed about developments in Chinese steel production and their impact on the global iron ore market. Continue to monitor changes in government regulations, economic indicators, and market sentiment to make informed decisions regarding your investments and strategies in the Chinese steel production and iron ore market.

Featured Posts

-

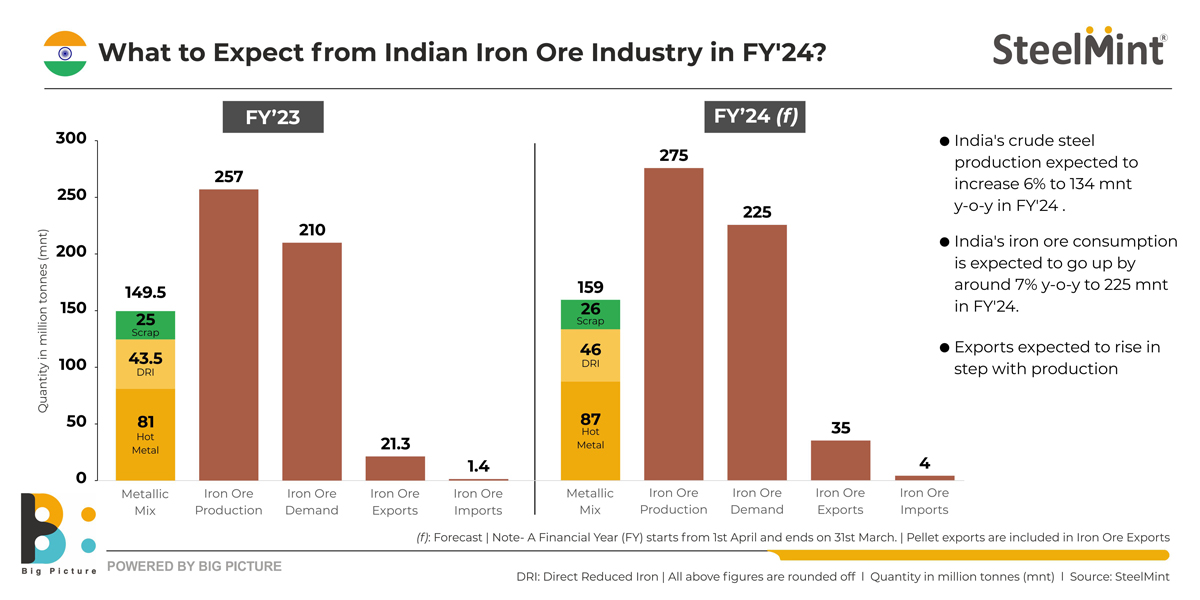

Tramway Dijon La Concertation Pour La 3e Ligne Est Lancee

May 10, 2025

Tramway Dijon La Concertation Pour La 3e Ligne Est Lancee

May 10, 2025 -

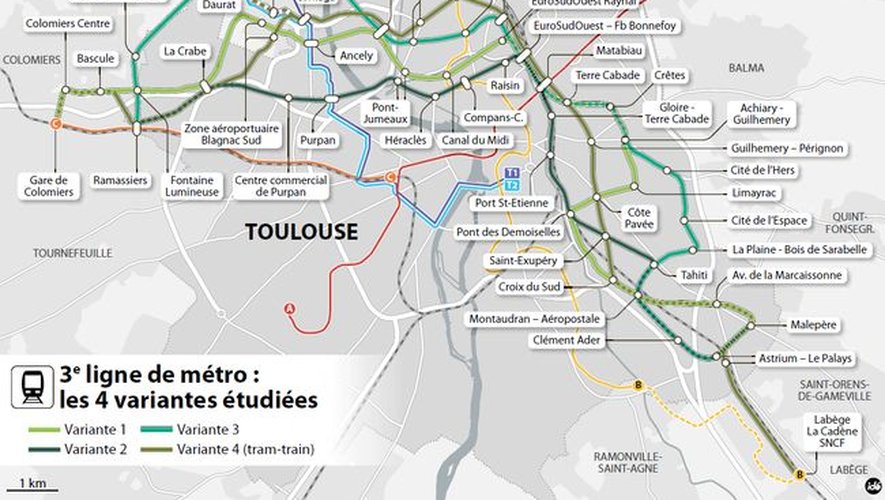

Dakota Johnsons Film Choices Coincidence Or Relationship Influence

May 10, 2025

Dakota Johnsons Film Choices Coincidence Or Relationship Influence

May 10, 2025 -

Wife Cheating Joke Jesse Watters Branded A Hypocrite

May 10, 2025

Wife Cheating Joke Jesse Watters Branded A Hypocrite

May 10, 2025 -

Strictly Come Dancing Star Wynne Evans Breaks Silence On Future Plans

May 10, 2025

Strictly Come Dancing Star Wynne Evans Breaks Silence On Future Plans

May 10, 2025 -

5 Factors Driving Todays Surge In The Indian Stock Market Sensex And Nifty Analysis

May 10, 2025

5 Factors Driving Todays Surge In The Indian Stock Market Sensex And Nifty Analysis

May 10, 2025