Analysis: SSE's £3 Billion Spending Reduction And Its Implications

Table of Contents

Analyzing the Drivers of SSE's Cost-Cutting Measures

SSE's £3 billion spending reduction is a multifaceted response to several converging pressures. The changing energy market landscape, characterized by increasing regulatory scrutiny and volatile energy prices, has forced the company to reassess its expenditure strategy.

-

Regulatory Pressures and Market Dynamics: The UK government's ambitious renewable energy targets, while driving investment in green technologies, also impose significant regulatory burdens and compliance costs. The fluctuating price of fossil fuels further adds to the uncertainty, impacting profitability and investment decisions.

-

Renewable Energy Focus and Fossil Fuel Transition: SSE is committed to a transition towards renewable energy sources. This shift requires substantial upfront investment in infrastructure, such as onshore and offshore wind farms and solar power plants. Government policies supporting renewable energy, while beneficial in the long run, also necessitate strategic reallocation of resources.

-

Profitability and Shareholder Returns: In the face of market volatility, improving profitability and delivering strong shareholder returns are paramount. SSE's £3 billion spending reduction reflects a strategic decision to optimize resource allocation and enhance financial performance. This includes focusing on projects with the highest return on investment.

-

Inflation and Interest Rates: The current economic climate, characterized by rising inflation and interest rates, has significantly impacted capital expenditure across various sectors. SSE's decision reflects a prudent approach to managing financial risk in a challenging economic environment.

-

Specific Examples of Spending Cuts: The £3 billion reduction encompasses a range of measures, including:

- Reduced capital expenditure on certain fossil fuel-based projects.

- Streamlining operational processes to enhance efficiency.

- Delaying or scaling back some less profitable investments.

- Prioritizing projects with faster returns and reduced risk.

The Implications for SSE's Future Investment Strategy

SSE's £3 billion spending reduction will undoubtedly reshape its future investment strategy. While the company remains committed to its renewable energy goals, the reduced budget necessitates careful prioritization of projects.

-

Renewable Energy Projects: Investments in onshore and offshore wind projects, along with solar power initiatives, will likely be affected. Some projects might experience delays, while others may be reassessed for feasibility and profitability.

-

Network Infrastructure: Upgrades and expansions to the electricity network are crucial for integrating renewable energy sources. The spending reduction may necessitate a re-evaluation of the timeline and scope of these critical infrastructure developments.

-

Research and Development: Investments in research and development of new energy technologies, including innovative energy storage solutions and smart grid technologies, may be scaled back.

-

Potential Scenarios: SSE might:

- Focus on larger-scale, more profitable renewable energy projects.

- Prioritize projects with shorter lead times and quicker returns on investment.

- Seek strategic partnerships to share investment costs and risks.

Ripple Effects: Consequences for Consumers and the Energy Market

The impact of SSE's £3 billion spending reduction extends beyond the company itself, affecting consumers and the wider energy market.

-

Energy Prices: The potential impact on energy prices is a key concern. While cost-cutting measures might lead to some efficiencies, any delays in renewable energy projects could potentially affect the long-term supply of clean energy and indirectly influence prices.

-

Job Security: The spending reduction could lead to job losses within SSE and its supply chain, potentially impacting communities reliant on the energy sector.

-

Market Competitiveness: SSE's strategic decision will have implications for the competitiveness of the UK energy market, potentially impacting the overall investment landscape and the pace of the energy transition.

-

Renewable Energy Targets: Delays in renewable energy projects might hinder the UK's progress toward achieving its ambitious renewable energy targets.

-

Potential Consequences:

- Potential for slightly higher energy bills in the short term due to reduced investment in efficiency improvements.

- Potential for long-term benefits through more efficient energy production and lower carbon emissions.

SSE's Long-Term Vision: Sustainability and Growth After the Spending Cuts

Despite the significant spending reduction, SSE maintains its commitment to its long-term sustainability goals and aims to balance cost-cutting with its ambitious renewable energy targets. The company plans to achieve this through increased operational efficiency, strategic partnerships, and a focused approach to capital allocation.

-

Alignment with Sustainability Commitments: The spending reduction is presented as a strategic recalibration to enhance long-term financial health, which is considered essential for sustaining its commitment to renewable energy investments.

-

Long-Term Financial Implications: Careful management of the reduced budget is crucial for maintaining a strong financial position and securing future funding for renewable energy projects.

-

Balancing Cost-Cutting and Renewable Targets: SSE is likely to prioritize projects with high environmental and economic returns, focusing on efficiency improvements across its operations.

-

Future Growth and Innovation: Despite the reduced spending, SSE anticipates continued growth and innovation within its renewable energy portfolio through optimized investment strategies and strategic partnerships.

-

Key Aspects of SSE's Long-Term Strategy:

- Focus on delivering shareholder value while remaining committed to environmental goals.

- Prioritization of cost-effective and efficient renewable energy solutions.

- Exploration of innovative technologies to enhance renewable energy generation and storage.

Understanding the Long-Term Effects of SSE's £3 Billion Spending Reduction

SSE's £3 billion spending reduction represents a significant strategic shift within the UK energy sector. While the reasons behind this decision are multifaceted, ranging from regulatory pressures to economic uncertainty, its long-term impacts on investment in renewable energy, consumer bills, and job security remain to be seen. The consequences will depend heavily on how effectively SSE manages its resources and navigates the evolving energy landscape. It’s crucial to monitor further developments regarding SSE's cost-cutting measures and their influence on the future of the energy sector. Stay informed about the impact of SSE's spending reduction and its long-term effects on the UK's energy transition.

Featured Posts

-

Ai And Healthcare Key Findings From The Philips Future Health Index 2025

May 25, 2025

Ai And Healthcare Key Findings From The Philips Future Health Index 2025

May 25, 2025 -

Departure Of Guccis Chief Industrial And Supply Chain Officer

May 25, 2025

Departure Of Guccis Chief Industrial And Supply Chain Officer

May 25, 2025 -

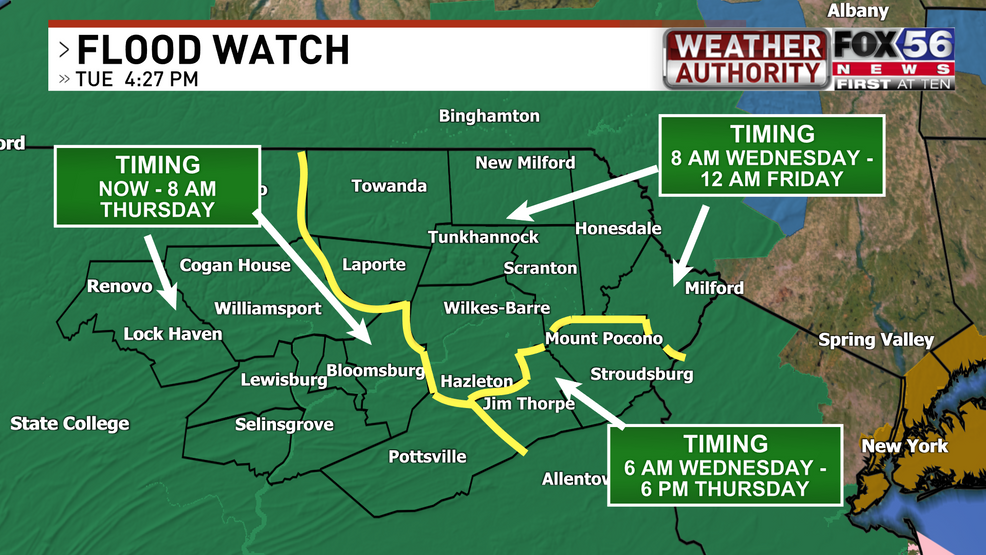

Southeast Pa Coastal Flood Advisory Issued For Wednesday

May 25, 2025

Southeast Pa Coastal Flood Advisory Issued For Wednesday

May 25, 2025 -

Yevrobachennya 2025 Chi Spravdyatsya Peredbachennya Konchiti Vurst

May 25, 2025

Yevrobachennya 2025 Chi Spravdyatsya Peredbachennya Konchiti Vurst

May 25, 2025 -

Relx Sterke Financiele Resultaten Dankzij Ai Investeringen Ook Voor 2025

May 25, 2025

Relx Sterke Financiele Resultaten Dankzij Ai Investeringen Ook Voor 2025

May 25, 2025