Analysis: Trump Tariffs And The $174 Billion Drop In Billionaire Wealth

Table of Contents

The Direct Impact of Tariffs on Specific Sectors

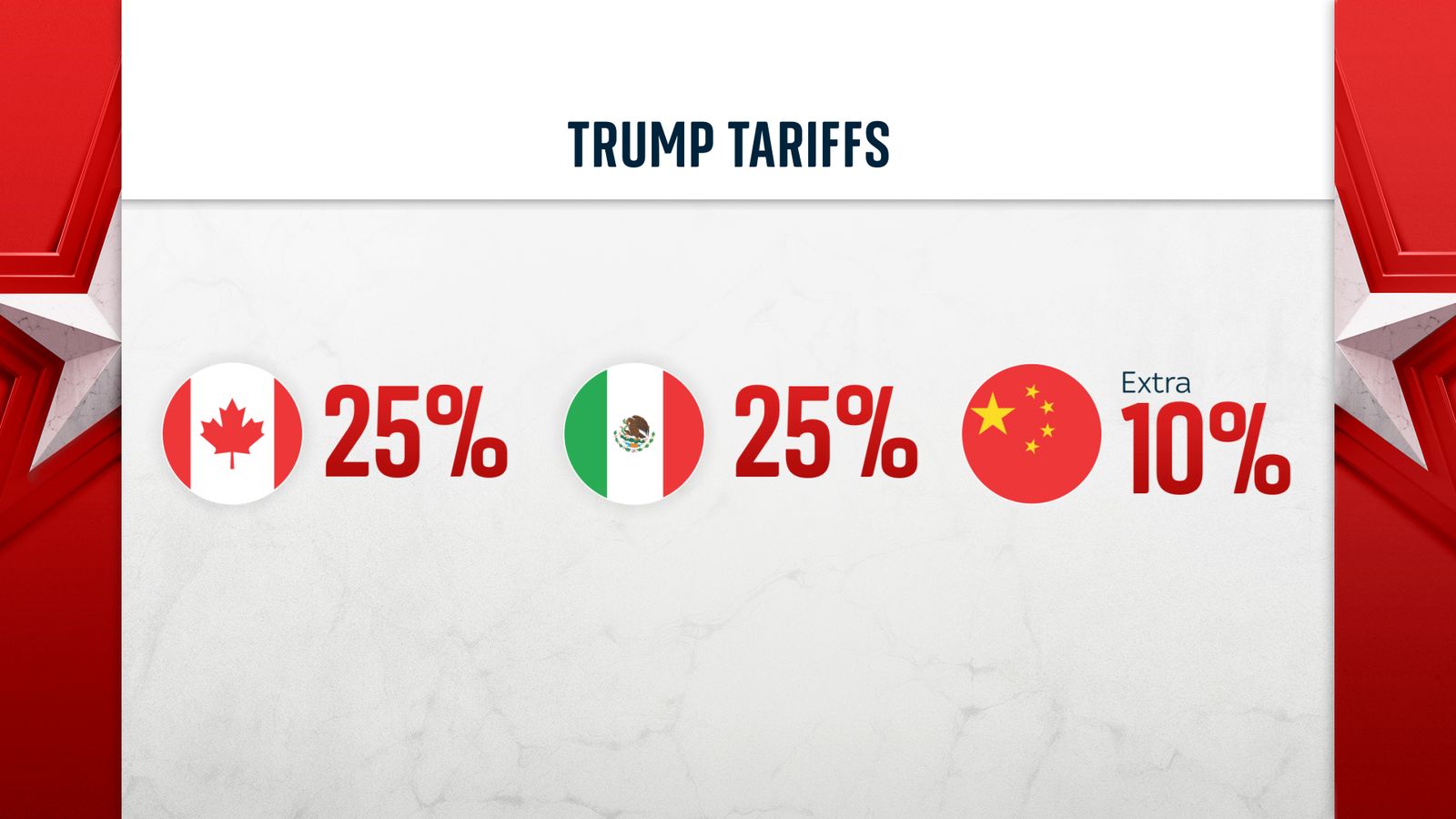

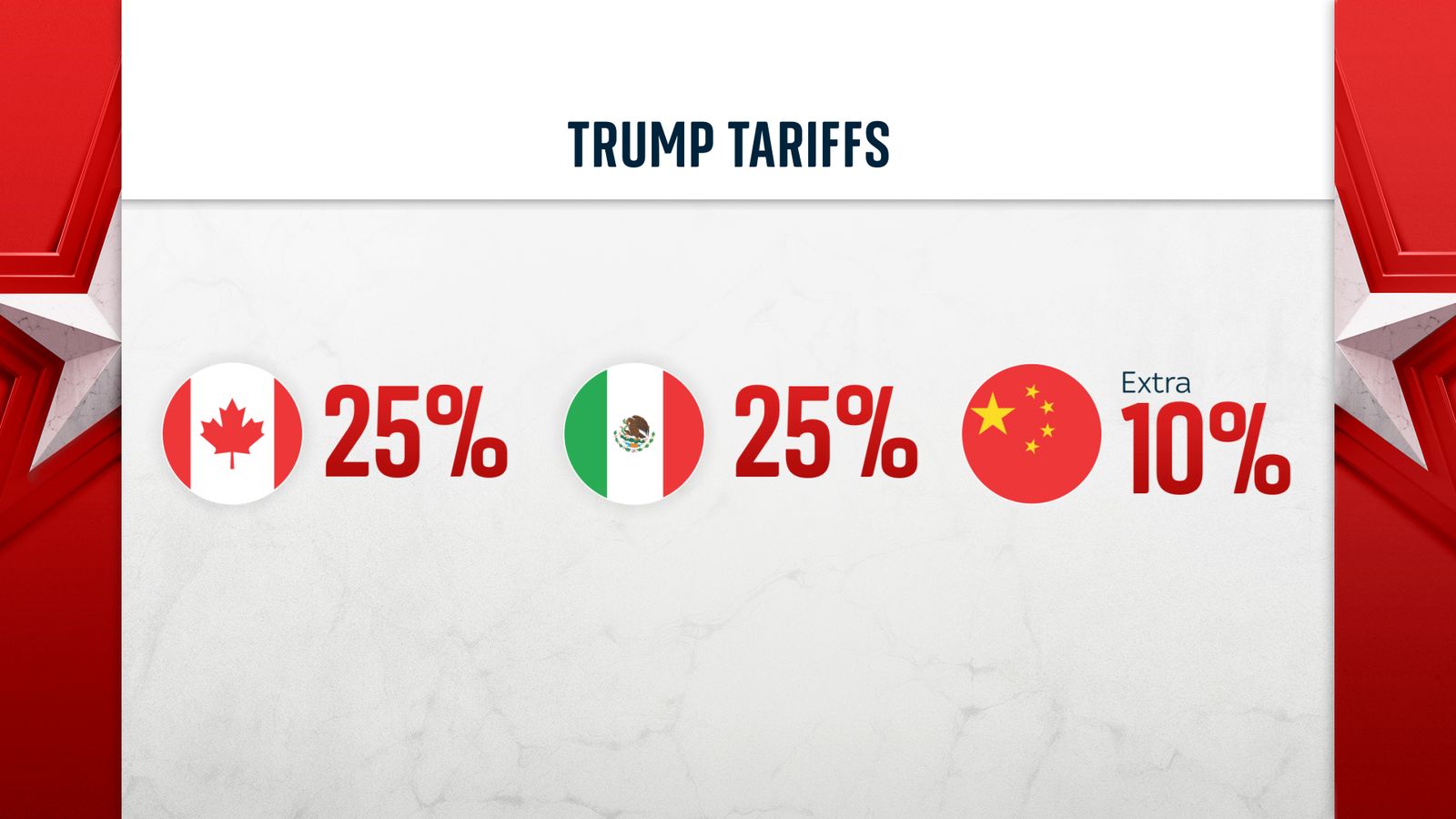

The Trump administration's tariffs had a demonstrably negative impact on several key sectors, directly affecting the wealth of billionaires invested in those areas.

Manufacturing and the Decline in Export Revenue

Tariffs on imported goods triggered retaliatory tariffs from other countries, significantly reducing US export revenue. This directly impacted the bottom lines of numerous manufacturing billionaires.

- Reduced Export Markets: The imposition of tariffs led to a decrease in demand for US-manufactured goods in international markets, resulting in lost sales and profits.

- Increased Production Costs: Retaliatory tariffs increased the cost of imported raw materials and components, pushing up production costs for US manufacturers.

- Examples: Several prominent billionaires in the steel and aluminum industries, for example, experienced significant wealth reductions due to decreased export demand and increased production costs resulting from retaliatory tariffs. While precise figures are difficult to isolate for individual billionaires impacted by tariffs, industry-wide data clearly shows the negative effect. Specific examples, if publicly available data allows, could be included here.

The impact on supply chains was also substantial, leading to disruptions and increased uncertainty, ultimately impacting profitability and billionaire net worth. Data from [cite relevant economic source] illustrates a [percentage]% drop in export revenue for specific manufacturing sub-sectors during the period of tariff implementation.

The Retail Sector and Increased Consumer Prices

Tariffs on imported goods increased prices for consumers, impacting retail sales and the wealth of billionaires in the retail industry. The ripple effect was felt across various retail segments.

- Increased Consumer Prices: Tariffs led to higher prices on imported goods, reducing consumer purchasing power and impacting overall retail sales.

- Reduced Profit Margins: Retailers faced pressure to absorb some of the increased costs, leading to reduced profit margins and impacting shareholder value, including billionaire investors.

- Examples: Major retail giants, dependent on imported goods, saw profits reduced and stock prices decline, directly impacting the net worth of their billionaire shareholders. Again, citing specific examples requires publicly available data correlating individual losses with tariff impacts.

- Shifting Consumer Behavior: Consumers responded to higher prices by reducing spending or shifting to cheaper alternatives, further impacting retail sales and profitability.

Data from [cite source, e.g., Bureau of Labor Statistics] shows a correlation between tariff implementation and increases in consumer prices for specific goods, supporting the link between tariffs, inflation, and decreased retail billionaire wealth.

The Agricultural Sector and Global Trade Wars

The agricultural sector was particularly hard hit by tariffs, particularly impacting the export of soybeans and other crops.

- Retaliatory Tariffs: China, a major importer of US soybeans, imposed retaliatory tariffs, significantly reducing demand for US agricultural products.

- Lost Export Revenue: This resulted in substantial losses for agricultural billionaires whose businesses heavily rely on international markets.

- Trade Disputes: The escalating trade disputes further destabilized global markets, creating uncertainty and impacting investment decisions in the sector.

- Data: [Cite data sources showing the impact on soybean exports and the financial losses suffered by agricultural businesses].

Mechanisms Linking Tariffs and Billionaire Wealth Reduction

The relationship between tariffs and the reduction in billionaire wealth is complex, but several key mechanisms are evident.

Stock Market Volatility and Investor Sentiment

The uncertainty created by the imposition of tariffs significantly impacted stock market performance.

- Investor Uncertainty: The unpredictable nature of trade policies created uncertainty among investors, leading to decreased market confidence and volatility.

- Stock Price Decline: This uncertainty resulted in a decline in stock prices across various sectors, directly impacting the net worth of billionaires holding significant stock portfolios.

- Economic Indicators: A decline in consumer confidence, coupled with negative economic forecasts related to trade disputes, further contributed to stock market volatility.

References to specific economic indicators like the VIX volatility index and stock market indices during the period of tariff implementation can be included here to support the link.

Decreased Corporate Profits and Dividend Payments

Tariffs reduced corporate profits in affected sectors, impacting dividend payments and the wealth of shareholders.

- Reduced Profitability: The increased costs and reduced sales in the manufacturing, retail, and agricultural sectors led to lower corporate profits.

- Dividend Cuts: Companies responded to reduced profitability by cutting or suspending dividend payments, impacting the wealth of their shareholders, including many billionaires.

- Financial Data: [Cite financial data showcasing decreased corporate profits and dividend payments in relevant sectors].

Increased Investment Costs and Reduced Returns

Tariffs increased costs associated with international investments, impacting returns for billionaires.

- Higher Transaction Costs: Tariffs increased the cost of importing and exporting goods, affecting businesses involved in global trade and investment.

- Supply Chain Disruptions: Disruptions to global supply chains increased uncertainty and risk for investors, impacting returns on investments.

- Reduced Investment Returns: This overall created a negative climate for international investments, contributing to reduced returns and decreased net worth for billionaires involved in global business.

- Data: [Include data demonstrating increased costs and reduced investment returns].

Broader Implications and Economic Inequality

The impact of Trump's tariffs had broader implications, potentially exacerbating existing economic inequalities.

Exacerbation of Existing Economic Disparities

The impact of tariffs was not evenly distributed across the population.

- Disproportionate Impact: Certain segments of the population, particularly those working in affected industries, suffered disproportionately from job losses and reduced income, while billionaires saw a reduction in their wealth.

- Widening Wealth Gap: This could have further widened the gap between the wealthiest and the rest of the population, potentially leading to social and political instability.

Long-Term Economic Consequences

The long-term economic consequences of Trump's tariffs remain a subject of ongoing debate.

- Global Trade Relations: The tariffs damaged US relationships with key trading partners.

- Economic Uncertainty: The unpredictable nature of trade policy created uncertainty and impacted business investment.

- Future Policy Adjustments: The experience of the Trump tariffs provides valuable lessons for policymakers in designing future trade policies.

Conclusion

This analysis of the impact of Trump's tariffs reveals a significant correlation between the imposed trade policies and a substantial decrease in billionaire wealth, totaling a staggering $174 billion. The sectors most affected, including manufacturing, retail, and agriculture, experienced decreased profits, reduced exports, and increased consumer prices. These consequences highlight the intricate links between trade policy, corporate performance, and the distribution of wealth. Understanding the complex mechanisms driving this wealth reduction is crucial for developing informed economic strategies. For a deeper dive into the intricate relationship between trade policies and wealth distribution, continue exploring the impact of Trump tariffs on different economic sectors. Further research on the effects of tariffs on billionaire wealth is encouraged to better understand the long-term economic consequences.

Featured Posts

-

Sergio Perez And Franco Colapinto Pay Respects Following F1 Loss

May 09, 2025

Sergio Perez And Franco Colapinto Pay Respects Following F1 Loss

May 09, 2025 -

Jeanine Pirros Dc Attorney Nomination Examining Past Controversies

May 09, 2025

Jeanine Pirros Dc Attorney Nomination Examining Past Controversies

May 09, 2025 -

Disney Parks And Streaming Fuel Increased Profit Projections

May 09, 2025

Disney Parks And Streaming Fuel Increased Profit Projections

May 09, 2025 -

Eleven Years Of High Potential A Legacy Of Psych Spiritual Growth

May 09, 2025

Eleven Years Of High Potential A Legacy Of Psych Spiritual Growth

May 09, 2025 -

Joanna Page And Wynne Evans Bbc Show Feud Explained

May 09, 2025

Joanna Page And Wynne Evans Bbc Show Feud Explained

May 09, 2025

Latest Posts

-

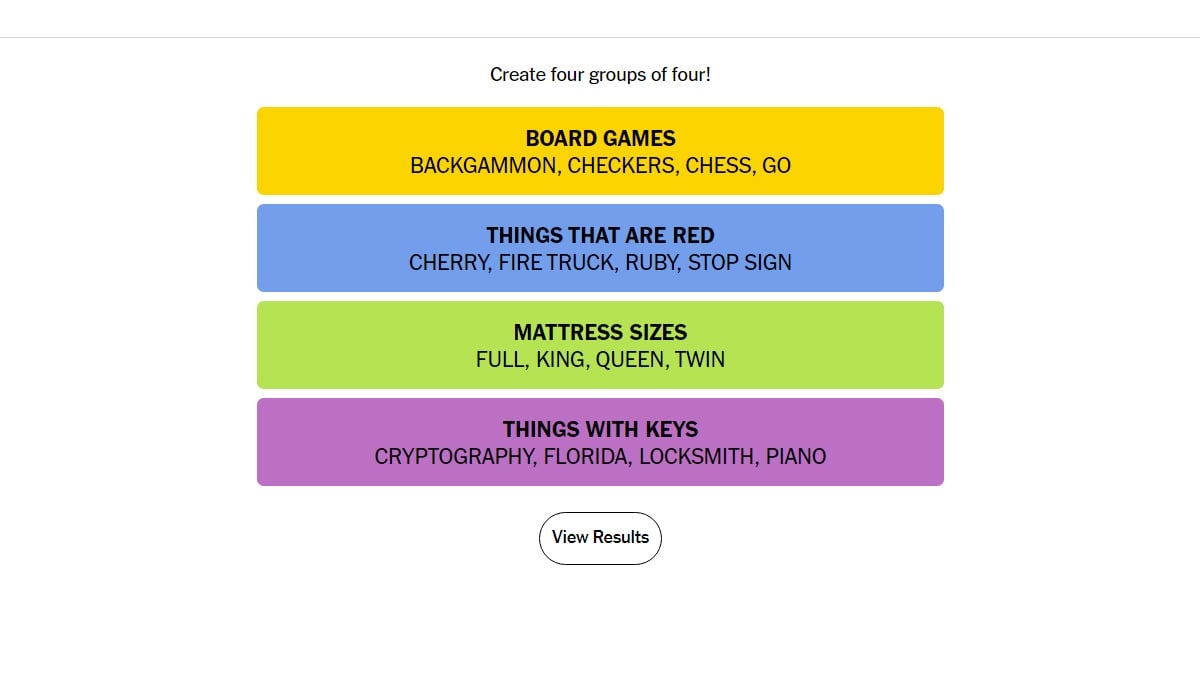

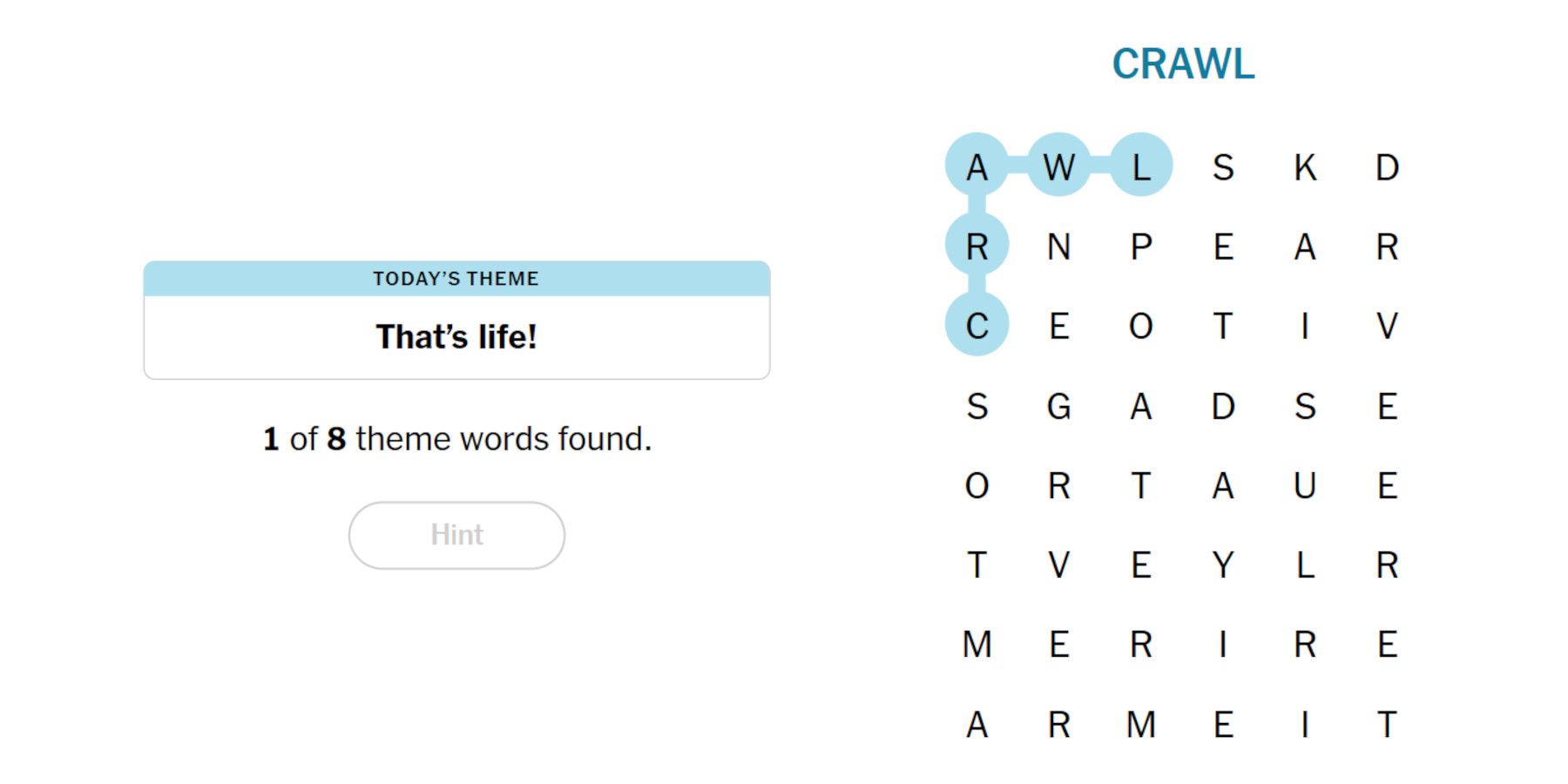

Nyt Strands Answers And Hints Saturday March 15th Game 377

May 09, 2025

Nyt Strands Answers And Hints Saturday March 15th Game 377

May 09, 2025 -

Solve Nyt Strands Game 377 March 15 Complete Hints And Answers

May 09, 2025

Solve Nyt Strands Game 377 March 15 Complete Hints And Answers

May 09, 2025 -

Strands Nyt Crossword Game 405 Answers Saturday April 12

May 09, 2025

Strands Nyt Crossword Game 405 Answers Saturday April 12

May 09, 2025 -

April 10th Nyt Strands Answers Game 403 Complete Guide

May 09, 2025

April 10th Nyt Strands Answers Game 403 Complete Guide

May 09, 2025 -

Nyt Strands April 12 2024 Solutions Game 405

May 09, 2025

Nyt Strands April 12 2024 Solutions Game 405

May 09, 2025