Analysis: Trump's China Tariffs To Persist Until Late 2025

Table of Contents

Political Factors Prolonging the Tariffs

The continued existence of Trump's China tariffs is deeply intertwined with political realities in the United States. Removing them would be a complex and potentially risky maneuver for the current administration.

The Biden Administration's Cautious Approach

- Biden's reluctance to immediately lift tariffs: The Biden administration has inherited a complex trade relationship with China, fraught with issues beyond tariffs. Immediately lifting them could be interpreted as weakness and a lack of commitment to addressing long-standing concerns about unfair trade practices.

- Domestic lobbying pressure: Industries that benefited from the tariffs, such as steel producers, exert considerable political pressure, lobbying to maintain the protective measures. These industries argue the tariffs safeguard American jobs and prevent unfair competition.

- Ongoing concerns about intellectual property theft and unfair trade practices: Concerns about China's intellectual property practices and other unfair trade tactics remain significant, creating a political environment where completely removing the tariffs is not a simple decision.

The political cost of removing these tariffs is substantial. A sudden reversal could lead to accusations of weakness on trade and alienate key voting blocs who perceive China as a significant economic threat.

The Role of Bipartisan Support (or Lack Thereof)

- Limited bipartisan consensus: While there might be broad agreement on the need to address unfair trade practices from China, there's less consensus on the optimal approach. This lack of bipartisan unity makes it difficult for any administration to unilaterally remove the tariffs without significant political risk.

- Differing opinions within the Democratic and Republican parties: Both parties contain factions with differing views on trade policy. Some Republicans, particularly those aligned with protectionist viewpoints, see the tariffs as necessary to protect American interests, while others favor a more conciliatory approach. Similarly, Democrats are split between those who prioritize worker protections and those who champion free trade.

- Influence of special interest groups: Powerful lobbying groups representing various industries significantly influence the debate on tariffs. The interplay of these groups adds another layer of complexity to the political landscape surrounding these tariffs.

A bipartisan consensus on tariff removal is unlikely in the near future, further contributing to the prolonged duration of these trade restrictions.

Economic Considerations and their Impact

The economic consequences of the Trump China tariffs are far-reaching, influencing inflation, supply chains, and business uncertainty.

Inflationary Pressures and Consumer Costs

- Increased consumer prices: Tariffs directly increase the cost of imported goods, leading to higher prices for consumers. This impact is felt across various sectors, adding to the overall inflationary pressure on the US economy.

- Specific sectors affected: Sectors like electronics, apparel, and furniture, which heavily rely on Chinese imports, have been significantly affected, experiencing price increases that ripple through the economy.

- Tariff costs versus potential benefits: A crucial aspect of the debate centers on whether the economic benefits of the tariffs – such as protecting domestic industries – outweigh the increased costs for consumers and the potential negative impact on economic growth.

The economic data on the impact of these tariffs on inflation are complex and often debated. While some studies show a clear inflationary effect, others highlight the countervailing influence of other economic factors.

Supply Chain Disruptions and Business Uncertainty

- Long-term effects on supply chains: The imposition of these tariffs disrupted established supply chains, forcing businesses to find alternative sourcing options, often at higher costs and with added logistical complexity.

- Challenges faced by US businesses: Many US companies dependent on Chinese imports faced significant challenges, including increased production costs and reduced competitiveness in the global market.

- Alternative sourcing strategies: Businesses responded by diversifying their supply chains, exploring sources in countries like Vietnam, Mexico, and India. However, this diversification is a costly and time-consuming process.

Companies had to adapt their strategies, negotiating new contracts, incurring relocation costs, and managing increased logistical hurdles. The long-term consequences of this disruption are still unfolding.

Projected Timeline and Future Outlook

Predicting the precise timeline for the removal of Trump's China tariffs remains challenging, but several factors will likely play a crucial role.

Factors Influencing the Removal of Tariffs

- Political developments in both the US and China: The political climate in both countries significantly influences the trade relationship. Changes in administrations, shifts in domestic policy, and geopolitical events all play a role.

- Progress in trade negotiations: The success (or failure) of future trade negotiations between the US and China will significantly affect the future of these tariffs. Reaching comprehensive agreements on key issues such as intellectual property protection could pave the way for tariff removal.

- The state of the global economy: The overall global economic situation impacts trade policy decisions. A global recession or significant economic downturn could incentivize a more conciliatory approach to trade.

- Evolving geopolitical landscape: Geopolitical tensions and shifts in global alliances can affect trade relations, making it difficult to predict the trajectory of the US-China trade relationship.

The interplay of these factors creates significant uncertainty regarding the timeline for tariff removal.

The Potential for a Gradual Phase-Out

- Gradual reduction of tariffs: A gradual phase-out of tariffs, rather than a sudden removal, is politically and economically more viable. This approach allows for a more managed transition and minimizes potential disruption for businesses.

- Benefits and drawbacks of this approach: A gradual phase-out minimizes immediate economic shocks but prolongs uncertainty for businesses. It allows industries to adjust gradually to a changing market but also extends the period of uncertainty.

- Potential timelines: A gradual phase-out might stretch over several years, allowing for careful monitoring of the economic impact and adjustments as needed. However, this is still highly dependent on political factors.

A gradual approach seems more likely to achieve political support and minimize economic fallout.

Conclusion

This analysis suggests that the lingering effects of Trump's China tariffs are likely to extend until at least late 2025. Political considerations, economic impacts, and the complex interplay between US and Chinese interests all contribute to this protracted timeline. While a complete removal is possible, a gradual phase-out seems more likely given the political sensitivities involved and the need to manage economic consequences. The ongoing uncertainty highlights the need for businesses to develop robust strategies to navigate this volatile trade environment and to carefully consider the long-term implications of these Trump China tariffs on their supply chains and operational efficiency.

Call to Action: Stay informed on developments surrounding Trump's China tariffs and their projected impact through continued monitoring of this evolving situation. Understanding the complexities of Trump's China tariffs is crucial for navigating the future of US-China trade relations and formulating effective business strategies. Access further analysis on our website [link to website here] for in-depth insights into this critical area of global trade.

Featured Posts

-

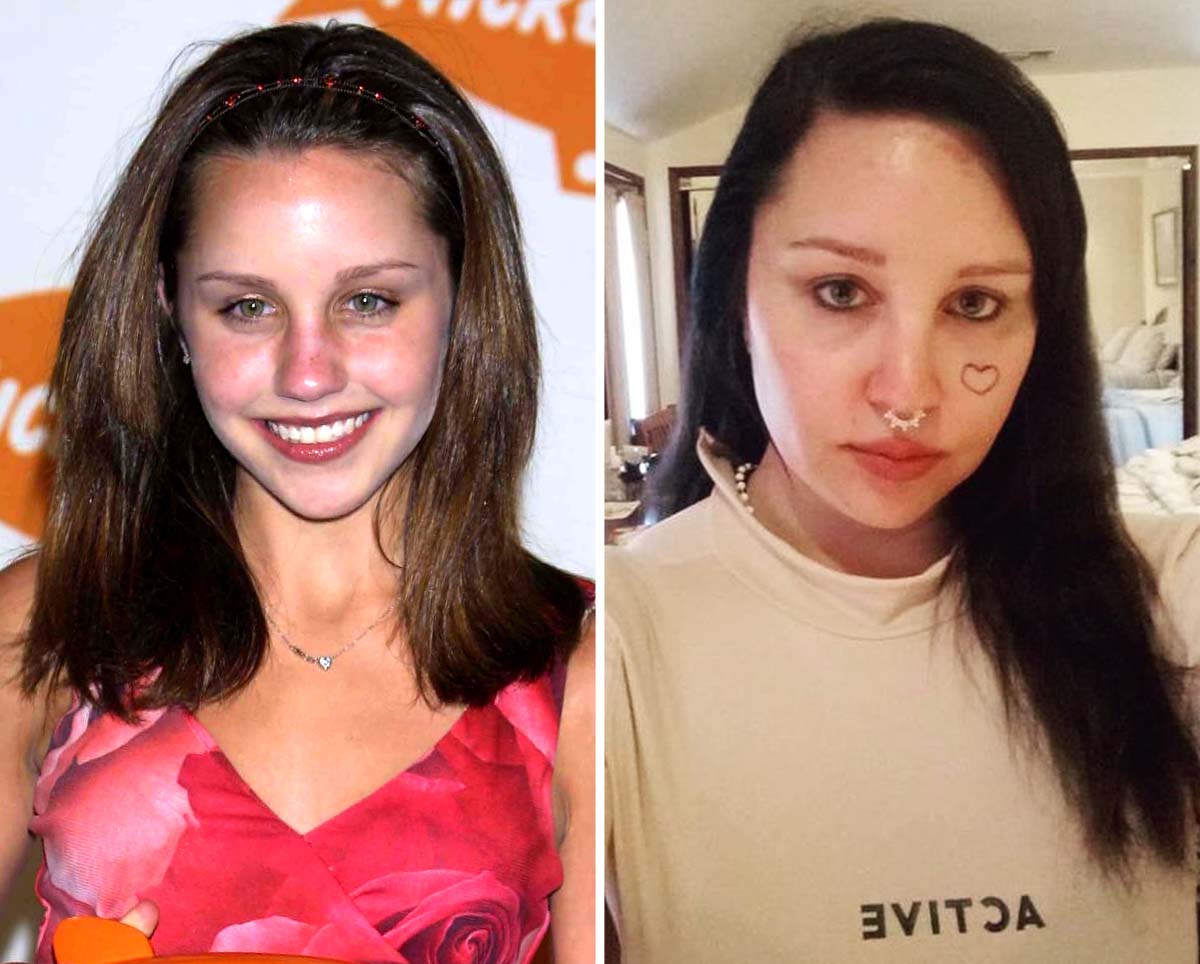

Amanda Bynes Only Fans Debut 50 Monthly Fee 15 Years After Acting Retirement

May 18, 2025

Amanda Bynes Only Fans Debut 50 Monthly Fee 15 Years After Acting Retirement

May 18, 2025 -

Rozriv Kanye Vesta Ta B Yanki Tsenzori Scho Stalosya

May 18, 2025

Rozriv Kanye Vesta Ta B Yanki Tsenzori Scho Stalosya

May 18, 2025 -

Broadcoms V Mware Acquisition At And T Details A Staggering 1 050 Price Surge

May 18, 2025

Broadcoms V Mware Acquisition At And T Details A Staggering 1 050 Price Surge

May 18, 2025 -

The King Day Debate Celebration Or Abolition

May 18, 2025

The King Day Debate Celebration Or Abolition

May 18, 2025 -

Ohio Derailment Aftermath Lingering Toxic Chemicals In Buildings Raise Concerns

May 18, 2025

Ohio Derailment Aftermath Lingering Toxic Chemicals In Buildings Raise Concerns

May 18, 2025

Latest Posts

-

Amanda Bynes Steps Out Only Fans Debut And What To Expect

May 18, 2025

Amanda Bynes Steps Out Only Fans Debut And What To Expect

May 18, 2025 -

Fifteen Years Later Amanda Byness Comeback Project Announced

May 18, 2025

Fifteen Years Later Amanda Byness Comeback Project Announced

May 18, 2025 -

Find Easy A On Bbc Three Hd Your Complete Tv Guide

May 18, 2025

Find Easy A On Bbc Three Hd Your Complete Tv Guide

May 18, 2025 -

From Hollywood To Only Fans Amanda Bynes Career Transition

May 18, 2025

From Hollywood To Only Fans Amanda Bynes Career Transition

May 18, 2025 -

Amanda Bynes Announces New Showbiz Venture Her First In 15 Years

May 18, 2025

Amanda Bynes Announces New Showbiz Venture Her First In 15 Years

May 18, 2025