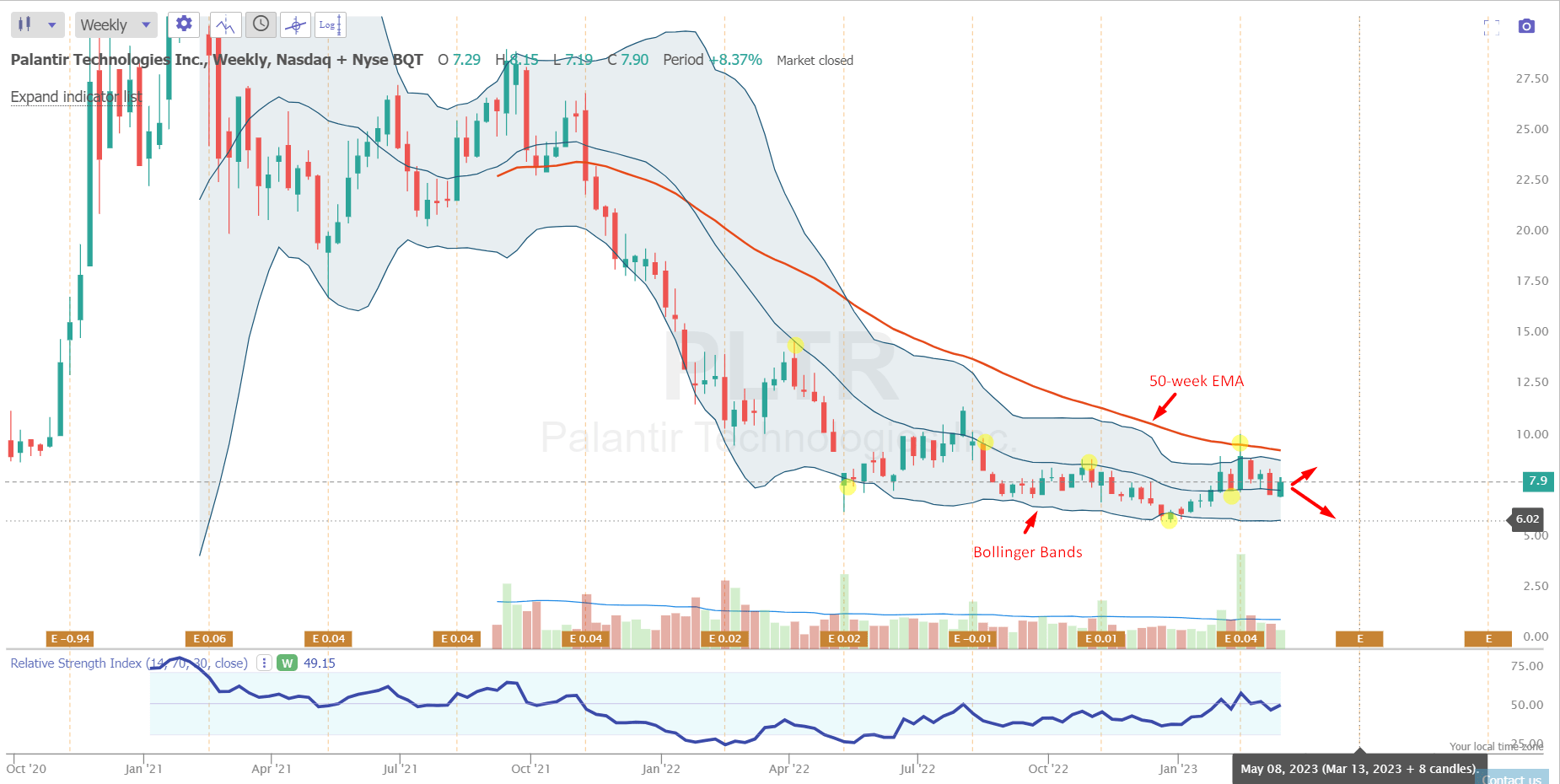

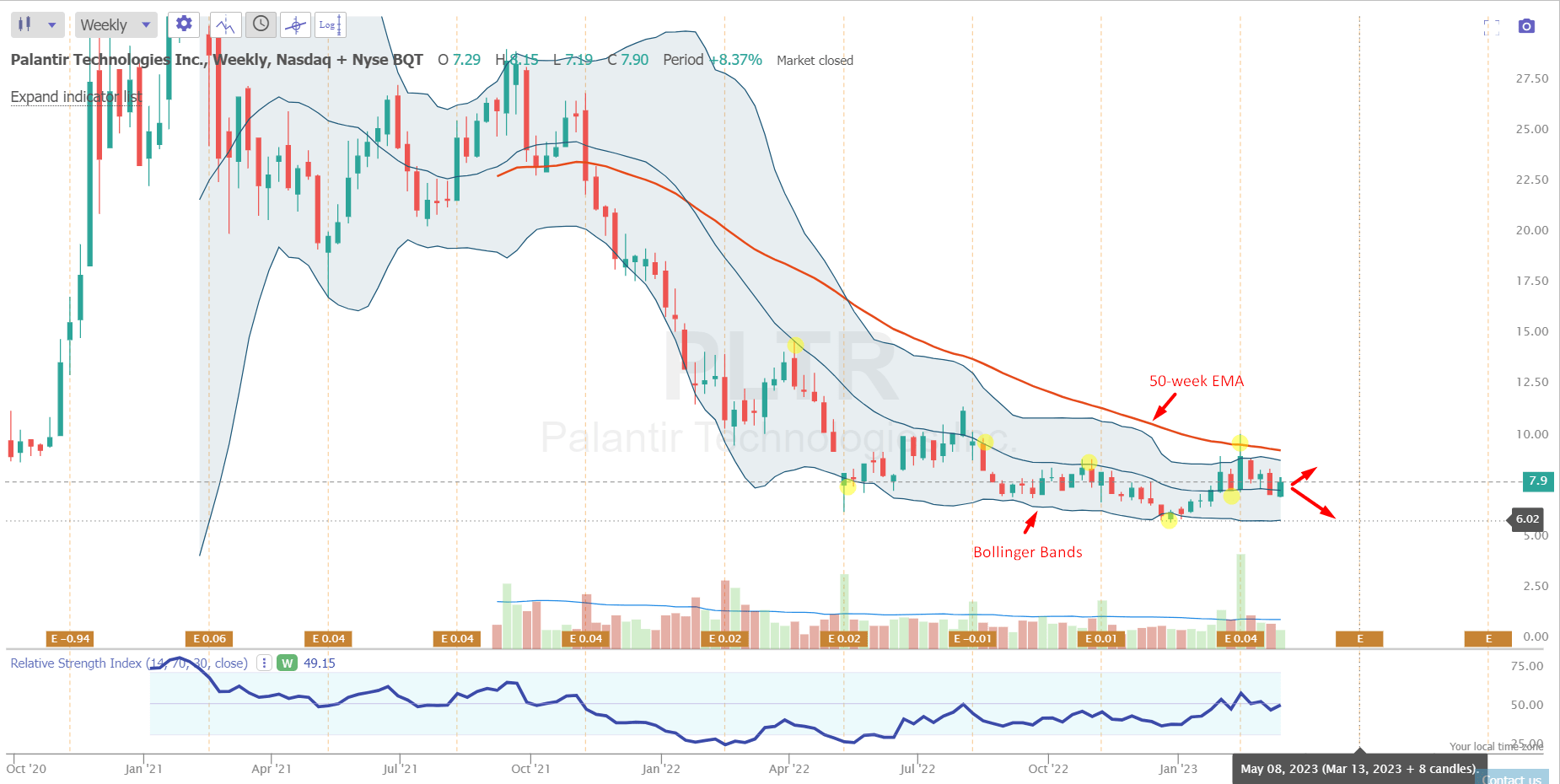

Analysts Reset Palantir Stock Forecast: Rally Impact Analyzed

Table of Contents

Reasons Behind the Reset of Palantir Stock Forecasts

Several factors contributed to the recent reset of Palantir stock forecasts. These revisions reflect a complex interplay of changing market conditions, company performance, and broader economic trends.

Revised Revenue Projections

Analysts have adjusted their revenue growth projections for Palantir, primarily due to several key factors influencing its financial performance and earnings estimates.

- JP Morgan's downgrade: JP Morgan recently lowered its price target for Palantir, citing concerns about slower-than-expected revenue growth in certain sectors. (Source: [Insert Link to JP Morgan Report])

- Increased competition: The intensified competition within the data analytics market has impacted revenue projections for some analysts. This reflects the challenges Palantir faces in maintaining its market share.

- Government contract delays: Potential delays in securing large government contracts have also contributed to the downward revisions in revenue estimates by some analysts.

Shifting Market Sentiment

Market volatility and shifts in investor confidence significantly influence Palantir's stock price. Macroeconomic factors and geopolitical events play a crucial role.

- Inflationary pressures: Rising inflation and interest rates have created uncertainty in the broader market, impacting investor sentiment towards growth stocks like Palantir.

- Geopolitical instability: Global geopolitical events can significantly impact investor confidence and risk appetite, leading to fluctuations in Palantir's stock price.

- Tech sector downturn: The overall downturn experienced by the technology sector has also contributed to the negative sentiment surrounding Palantir.

Impact of Recent Company Announcements

Palantir's recent announcements, both positive and negative, have played a role in shaping the revised Palantir stock forecast.

- New strategic partnerships: While Palantir has announced new partnerships, their immediate impact on revenue hasn't fully materialized, leading to some cautious forecasts.

- Successful product launches: The launch of new products has been met with mixed reactions, affecting short-term projections.

- Government contract wins: New government contracts, though positive, may not always immediately translate into substantial revenue increases, leading to a more tempered outlook.

Analyzing the Impact of the Forecast Reset on Palantir Stock

The reset of Palantir stock forecasts has had a notable impact on the company's stock performance, both short-term and long-term.

Short-Term Market Reaction

The immediate reaction to the revised forecasts was a significant drop in Palantir's stock price.

- Stock price decline: Following the release of the revised forecasts, Palantir experienced a [percentage]% decrease in its stock price.

- Increased trading volume: The news also led to a spike in trading volume as investors reacted to the changed outlook.

- Market capitalization impact: The stock price decline directly impacted Palantir's overall market capitalization.

Long-Term Implications for Investors

The long-term consequences of the revised forecasts depend heavily on individual investor strategies and risk tolerance.

- Long-term holders: Long-term investors with a high-risk tolerance might view the dip as a buying opportunity, anticipating future growth.

- Short-term traders: Short-term traders might have been prompted to sell their shares, realizing losses or cutting their potential profits.

- Risk assessment: Investors need to reassess their risk assessment based on the updated Palantir stock forecast and the potential for future volatility.

Comparison with Competitor Performance

Comparing Palantir's performance with its competitors provides context for understanding the revisions.

- Similar trends: Some competitors in the data analytics space have also experienced downward revisions in their stock forecasts.

- Differing factors: However, the specific reasons behind the revisions vary across companies, reflecting individual company-specific challenges and opportunities.

- Market share implications: The competitive landscape continues to evolve, impacting Palantir's potential market share and future growth.

Future Outlook for Palantir Stock: Predictions and Analysis

The future outlook for Palantir stock is complex and depends on various factors.

Analyst Consensus

The consensus among analysts is mixed, with a range of price targets reflecting differing levels of optimism.

- Range of price targets: Analysts have set price targets ranging from [low price] to [high price].

- Growth potential: The long-term growth potential remains a point of contention amongst analysts.

- Earnings per share: Future earnings per share (EPS) projections vary widely depending on the analyst and their assumptions.

Potential Catalysts for Future Growth

Several factors could impact Palantir's stock in the future.

- Technological advancements: Further development of AI and machine learning technologies could positively impact Palantir's offerings and market position.

- Government spending: Increased government spending on data analytics and cybersecurity could be a significant growth driver.

- Competitive pressures: Intense competition from established and emerging players presents a substantial challenge.

Conclusion: Summarizing the Palantir Stock Forecast Reset

The recent reset of the Palantir stock forecast reflects a combination of revised revenue projections, shifting market sentiment, and the impact of recent company announcements. While short-term market reactions have been negative, the long-term outlook for Palantir remains a subject of debate among analysts. Investors need to carefully consider the updated Palantir stock forecast, analyze the potential risks and rewards, and conduct thorough research before making any investment decisions. Stay informed about future developments impacting the Palantir stock forecast and consult reliable financial resources to make well-informed investment choices. Understanding the nuances of the Palantir stock forecast is crucial for successful investment strategies in this dynamic market.

Featured Posts

-

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Can Lam Gi

May 09, 2025

Vu Viec Bao Mau Bao Hanh Tre Em Tien Giang Cong Dong Can Lam Gi

May 09, 2025 -

Williams Releases Franco Colapinto To Alpine The Full Explanation

May 09, 2025

Williams Releases Franco Colapinto To Alpine The Full Explanation

May 09, 2025 -

Uk Visa Restrictions Report On Potential Nationality Limits

May 09, 2025

Uk Visa Restrictions Report On Potential Nationality Limits

May 09, 2025 -

Democratizing Stock Investment The Jazz Cash And K Trade Partnership

May 09, 2025

Democratizing Stock Investment The Jazz Cash And K Trade Partnership

May 09, 2025 -

Can Lam Gi De Ngan Chan Bao Hanh Tre Em Sau Vu Viec O Tien Giang

May 09, 2025

Can Lam Gi De Ngan Chan Bao Hanh Tre Em Sau Vu Viec O Tien Giang

May 09, 2025

Latest Posts

-

The Kilmar Abrego Garcia Case A Microcosm Of Us Immigration Policy Challenges

May 10, 2025

The Kilmar Abrego Garcia Case A Microcosm Of Us Immigration Policy Challenges

May 10, 2025 -

El Salvadoran Refugee Kilmar Abrego Garcia Becomes A Symbol In Us Immigration Debate

May 10, 2025

El Salvadoran Refugee Kilmar Abrego Garcia Becomes A Symbol In Us Immigration Debate

May 10, 2025 -

Maha Influencer Selected For Us Surgeon General After White House Nomination Withdrawal

May 10, 2025

Maha Influencer Selected For Us Surgeon General After White House Nomination Withdrawal

May 10, 2025 -

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025 -

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025