Analyzing Elon Musk's Net Worth: The Role Of US Economic Conditions

Table of Contents

The Impact of US Stock Market Performance on Elon Musk's Net Worth

Elon Musk's wealth is heavily tied to Tesla's stock price. As one of the largest individual shareholders, his net worth rises and falls dramatically with the company's valuation. This strong correlation highlights the significant influence of the overall US stock market performance on his financial status. Bull markets, characterized by rising stock prices, generally boost Tesla's stock and consequently, Musk's net worth. Conversely, bear markets, with falling stock prices, have the opposite effect.

- Examples of Market Impact: The dramatic surge in Tesla's stock price in 2020 and 2021 directly translated into a massive increase in Musk's net worth. Conversely, market downturns in 2022 significantly impacted both Tesla's valuation and Musk's personal wealth.

- Relevant Market Indices: The performance of indices like the S&P 500 and Nasdaq, where Tesla is listed, is a key indicator of the overall market sentiment and directly influences Tesla's stock price and, therefore, Musk's net worth. A positive trend in these indices generally correlates with a rise in Tesla's stock.

- Data Points: Studies have shown a strong positive correlation (e.g., a correlation coefficient of 0.8 or higher) between percentage changes in Tesla's stock price and percentage changes in Musk's estimated net worth.

Inflation and its Effect on Elon Musk's Wealth

Inflation significantly impacts the purchasing power of Musk's substantial assets. Rising inflation erodes the value of money, meaning that while the dollar amount of his net worth might remain the same, the actual purchasing power diminishes. Further, inflation affects Tesla's operations. Increased production costs due to inflation force Tesla to adjust its pricing strategies, potentially impacting consumer demand.

- Consumer Demand: High inflation can reduce consumer spending, potentially impacting the demand for Tesla vehicles, especially in the luxury segment.

- Asset Valuation: Inflation also affects the valuation of Tesla and other assets in Musk's portfolio. High inflation may increase the cost of capital, making it more expensive for Tesla to finance its operations and expansions.

- Inflation Data: Comparing periods of high inflation (e.g., early 1980s) with periods of low inflation reveals a clear impact on the valuation of growth stocks such as Tesla. Analyzing the correlation between inflation rates and Tesla's stock performance offers valuable insights.

The Influence of US Economic Policies on Tesla and Musk's Net Worth

US economic policies significantly influence Tesla's operations and profitability, ultimately affecting Musk's net worth. Government regulations, tax incentives, and environmental policies all play a role. Tax credits for electric vehicles, for example, stimulate demand and benefit Tesla. Conversely, stricter environmental regulations might increase production costs.

- Specific Policy Impacts: The US government's investment in electric vehicle infrastructure directly benefits companies like Tesla. Changes in corporate tax rates also impact Tesla's profitability.

- Future Policy Changes: Potential changes in US energy policy or environmental regulations could dramatically influence Tesla's future growth and, therefore, Musk's net worth.

- Global Policy Influence: Musk's international ventures, such as SpaceX and Tesla's global operations, are influenced by global economic policies and trade agreements.

Diversification of Assets and its Role in Cushioning Economic Impacts

While Tesla is a major component of Musk's wealth, he has diversified his investments across various ventures, including SpaceX and other holdings. This diversification helps mitigate the risk associated with relying solely on a single company's performance.

- Asset Contributions: While Tesla contributes the lion's share, SpaceX and other investments provide a buffer against fluctuations in Tesla's stock price.

- Asset Resilience: SpaceX, for example, operates in a different sector and might be less vulnerable to macroeconomic shocks affecting the automotive industry.

- Volatility Reduction: Diversification across various asset classes and sectors helps to reduce the overall volatility of Musk's net worth.

Conclusion: Understanding the Interplay Between Elon Musk's Net Worth and US Economic Conditions

The analysis clearly demonstrates a strong correlation between US economic conditions and Elon Musk's net worth. Tesla's performance, heavily influenced by market trends, inflation, and government policies, plays a pivotal role. However, Musk's diversification strategy helps mitigate the risk associated with this reliance. Understanding these intricate relationships is crucial for comprehending the dynamics of wealth accumulation and the influence of macroeconomic factors. To further explore this complex interplay, we encourage you to research the impact of specific US economic policies on Tesla's stock performance and analyze the diversification strategies of other high-net-worth individuals, deepening your understanding of analyzing Elon Musk's net worth and the impact of US economic conditions.

Featured Posts

-

High Potential Show To Replace Roman Fate Season 2 Spoilers And Streaming Info

May 10, 2025

High Potential Show To Replace Roman Fate Season 2 Spoilers And Streaming Info

May 10, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

May 10, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

May 10, 2025 -

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025 -

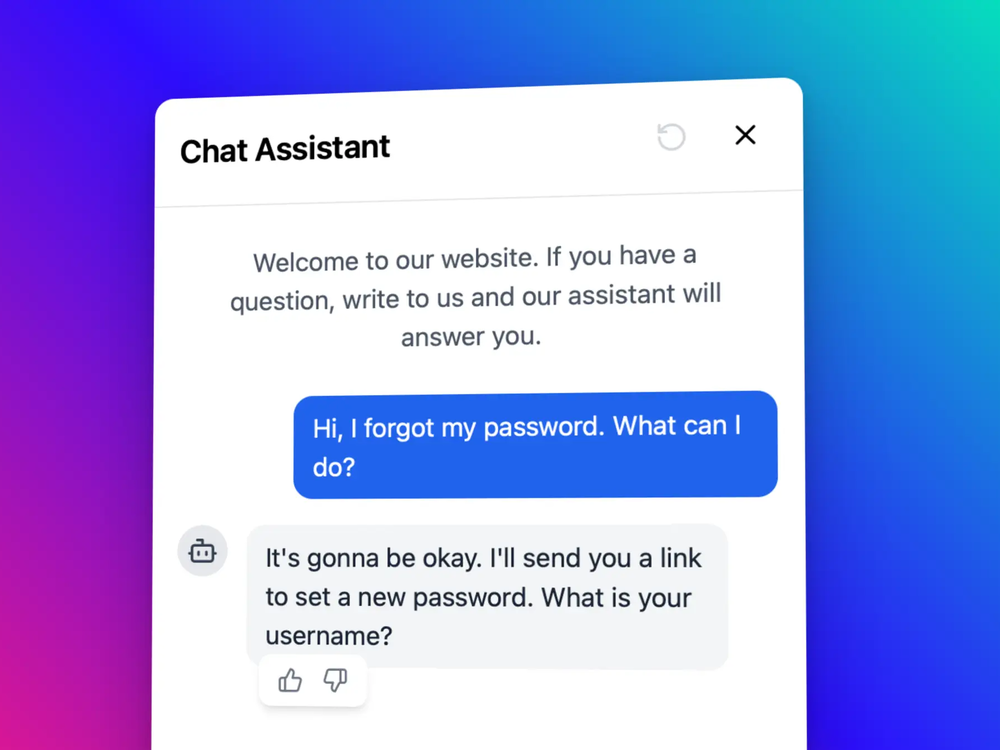

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs

May 10, 2025

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs

May 10, 2025 -

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025

Ghettoisation Fears A Uk Citys Struggle With Transient Populations

May 10, 2025