Analyzing Palantir Stock Before The May 5th Earnings Release

Table of Contents

Recent Developments and News Affecting Palantir Stock

Recent news and developments significantly impact the current valuation and future trajectory of Palantir stock. Let's examine some key areas.

New Contracts and Partnerships

Securing new contracts, particularly large-scale ones, is a major driver of Palantir's growth. Recent wins in both the government and commercial sectors can significantly boost investor confidence and positively influence PLTR stock.

-

Government Sector: Palantir has continued to expand its presence within government agencies, recently securing contracts with [insert specific examples of recent government contracts and their approximate values if publicly available]. These contracts demonstrate the continued demand for Palantir's data analytics solutions in national security and intelligence. The long-term nature of these contracts ensures a steady revenue stream for the company, making PLTR stock more attractive to long-term investors.

-

Commercial Sector: Expansion into the commercial sector is vital for Palantir's growth beyond its established government clientele. Recent partnerships with [insert specific examples of recent commercial partnerships] indicate progress in this area. These partnerships demonstrate the versatility of Palantir's platform and its potential for wider adoption across various industries, directly affecting Palantir stock prices.

Product Innovation and Technological Advancements

Palantir's continued investment in research and development is crucial for maintaining its competitive edge. New product launches and updates can significantly impact its market position and investor sentiment.

-

Foundry Enhancements: Updates to Palantir's flagship product, Foundry, have focused on [mention specific improvements, such as increased scalability, enhanced user interface, or new integrations]. These advancements streamline data analysis and integration, increasing the platform's value proposition and strengthening its position within the market. This positive development may lead to increased adoption and consequently influence PLTR stock favorably.

-

AIP (Artificial Intelligence Platform): Palantir's focus on AI and machine learning is becoming increasingly important in today's data-driven world. Advances in AIP, such as [mention specific AI advancements and capabilities], position Palantir as a key player in the rapidly evolving AI landscape, potentially increasing demand and pushing the PLTR stock price higher.

Geopolitical Factors and Market Sentiment

Global events and market trends can significantly impact Palantir's stock price. Understanding these factors is essential for a comprehensive analysis of PLTR stock.

-

Geopolitical Risks: [Mention any relevant geopolitical events, such as ongoing conflicts or economic sanctions]. These events can impact government spending on national security and intelligence, which directly affects Palantir's business. A heightened geopolitical climate could either boost demand for Palantir's services, or lead to uncertainties that negatively affect investor confidence in PLTR stock.

-

Market Sentiment: Overall market sentiment towards technology stocks and growth companies influences Palantir stock's performance. Periods of market uncertainty can lead to increased volatility, impacting PLTR stock regardless of the company's specific performance.

Financial Performance Analysis: Key Metrics to Watch

Analyzing Palantir's financial performance is crucial for understanding its intrinsic value and forecasting future growth. Several key metrics should be carefully examined.

Revenue Growth and Profitability

Examining revenue growth, operating margins, and profitability trends provides insight into Palantir's financial health and its ability to generate profits.

-

Revenue Growth: Investors will closely scrutinize Palantir's year-over-year revenue growth. Sustained high growth rates will generally be viewed positively, increasing confidence in PLTR stock. A slowdown, however, could lead to concerns about future growth potential.

-

Profitability: Analyzing operating margins and net income will shed light on Palantir's ability to translate revenue into profit. Improvements in profitability indicate stronger financial performance and may support a higher valuation for PLTR stock.

Cash Flow and Liquidity

Evaluating Palantir's cash flow and liquidity is vital for assessing its financial stability and capacity for future investments.

-

Free Cash Flow (FCF): Positive and growing FCF indicates a healthy financial position and the ability to fund future growth initiatives, reinforcing the appeal of PLTR stock.

-

Debt Levels: Analyzing Palantir's debt levels helps determine its financial risk profile. High levels of debt could negatively impact investor sentiment towards PLTR stock.

Key Financial Ratios

Analyzing relevant financial ratios provides further insights into Palantir's financial performance and valuation.

-

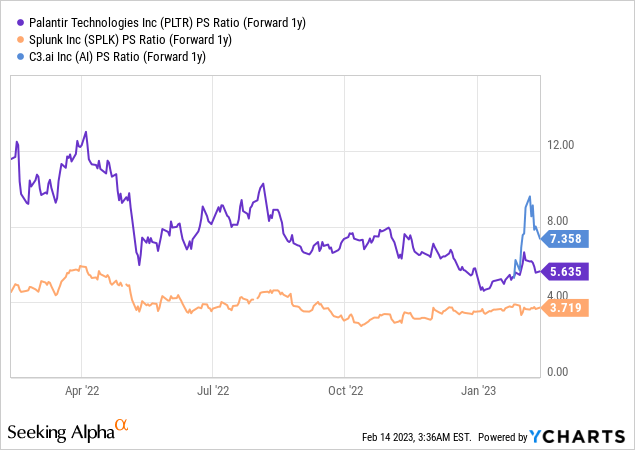

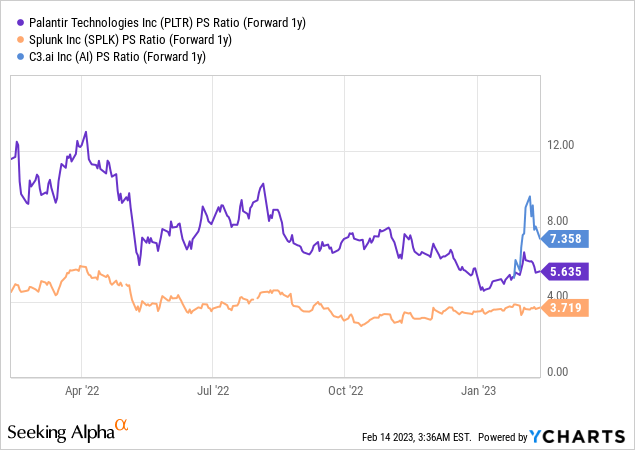

Price-to-Sales (P/S) Ratio: This ratio compares Palantir's market capitalization to its revenue. A high P/S ratio indicates that investors are willing to pay a premium for future growth, while a low P/S ratio could indicate undervaluation.

-

Price-to-Earnings (P/E) Ratio: This ratio compares Palantir's stock price to its earnings per share. It helps determine whether Palantir stock is overvalued or undervalued relative to its earnings. This is a crucial metric investors analyze before buying or selling PLTR stock.

Analyst Ratings and Price Targets for Palantir Stock

Understanding analyst sentiment is important for getting a broader perspective on Palantir stock. Analyst ratings and price targets provide insights into market expectations.

-

Consensus Rating: [Summarize the consensus view of major investment banks covering Palantir stock, including a summary of buy, hold, and sell ratings].

-

Price Targets: [List the average price targets provided by analysts and briefly explain their rationale]. These targets provide insights into analysts' expectations for PLTR stock's future price movement. However, these should be viewed with caution as they are merely predictions.

Conclusion

Analyzing Palantir stock requires careful consideration of various factors, including recent contracts, product innovation, geopolitical events, financial performance, and analyst sentiment. While the May 5th earnings release will provide crucial new data, this pre-earnings analysis highlights key aspects to watch. Remember, positive developments in new contracts, product launches, and improving financial metrics could positively affect the PLTR stock price. Conversely, negative news or disappointments could lead to downward pressure.

Before making any investment decisions regarding Palantir stock, it's crucial to conduct your own thorough due diligence. Consider consulting with a financial advisor before buying or selling PLTR stock based on this analysis. Remember, analyzing Palantir stock requires careful consideration of various factors, and this article provides a starting point for your own research. Stay informed about Palantir earnings and continue analyzing Palantir stock to make the best investment choices for your portfolio.

Featured Posts

-

Proposed Changes To Bond Forward Regulations For Indian Insurers

May 09, 2025

Proposed Changes To Bond Forward Regulations For Indian Insurers

May 09, 2025 -

Benson Boone Vs Harry Styles A Look At The Similarities And Differences

May 09, 2025

Benson Boone Vs Harry Styles A Look At The Similarities And Differences

May 09, 2025 -

Reaktsiya Stivena Kinga Na Trampa Ta Maska Pislya Povernennya Na Platformu Kh

May 09, 2025

Reaktsiya Stivena Kinga Na Trampa Ta Maska Pislya Povernennya Na Platformu Kh

May 09, 2025 -

Williams Releases Franco Colapinto To Alpine The Full Explanation

May 09, 2025

Williams Releases Franco Colapinto To Alpine The Full Explanation

May 09, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6 Reporting

May 09, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6 Reporting

May 09, 2025

Latest Posts

-

Analyzing Luis Enriques Success Psgs Ligue 1 Victory

May 09, 2025

Analyzing Luis Enriques Success Psgs Ligue 1 Victory

May 09, 2025 -

Paris Saint Germains Triumph Luis Enriques Impact On Ligue 1

May 09, 2025

Paris Saint Germains Triumph Luis Enriques Impact On Ligue 1

May 09, 2025 -

The Unexpected Rise From Wolves Reject To Europes Best

May 09, 2025

The Unexpected Rise From Wolves Reject To Europes Best

May 09, 2025 -

How Luis Enrique Reshaped Paris Saint Germain A Winning Strategy

May 09, 2025

How Luis Enrique Reshaped Paris Saint Germain A Winning Strategy

May 09, 2025 -

From Wolves To European Glory A Remarkable Football Story

May 09, 2025

From Wolves To European Glory A Remarkable Football Story

May 09, 2025