Analyzing Palantir's Potential: A 40% Stock Increase By 2025 - Is It Achievable?

Table of Contents

Palantir's Current Market Position and Competitive Advantages

H3: Dominance in Government and Commercial Data Analytics:

Palantir has established a strong foothold in the government sector, securing lucrative contracts with various intelligence agencies and defense departments worldwide. This provides a stable revenue stream and a strong foundation for future growth. However, Palantir is increasingly focusing on expanding its commercial clientele, leveraging its powerful data integration and analysis capabilities to serve a broader range of industries.

- Government Contracts: Palantir's expertise in handling sensitive data and its ability to integrate diverse datasets have made it a preferred partner for government organizations worldwide. These contracts contribute significantly to its revenue and provide a reliable income stream.

- Commercial Clients: Palantir's commercial arm is rapidly expanding, targeting sectors like healthcare, finance, and manufacturing. Its platform offers solutions for fraud detection, risk management, and operational optimization.

- Competitive Edge: While facing competition from established players like AWS, Microsoft, and Google Cloud, Palantir differentiates itself through its specialized software, robust data security features, and its ability to handle complex, unstructured data. This provides a competitive edge in specific niche markets.

- Keywords: Government contracts, Commercial clients, Data integration, Data analytics platform, Artificial intelligence in data analysis, Competitive landscape.

H3: Growth in Key Market Segments:

Palantir's success is largely driven by its expansion into key market segments. The healthcare sector offers significant growth opportunities, with Palantir's platform enabling better disease surveillance, drug discovery, and personalized medicine. Similarly, the financial services industry benefits from Palantir's fraud detection and risk management capabilities.

- Healthcare Analytics: Palantir is actively involved in projects related to public health, utilizing its platform for disease outbreak detection and response. This segment shows significant potential for future growth.

- Financial Data Analytics: Palantir helps financial institutions improve risk assessment, regulatory compliance, and anti-money laundering efforts, driving adoption in this sector.

- Emerging Markets: Expanding into emerging markets presents a significant opportunity for Palantir to tap into new customer bases and drive international growth.

- Keywords: Healthcare analytics, Financial data analytics, Emerging markets, Palantir case studies, Market share growth.

Factors Influencing Palantir's Future Stock Performance

H3: Revenue Growth and Profitability:

Palantir's historical revenue growth has been impressive, but its path to profitability is crucial for sustained stock price appreciation. Factors such as operating expenses, R&D investment, and the success of its commercial initiatives will significantly influence its financial performance.

- Revenue Growth: Maintaining a strong revenue growth trajectory is essential for justifying the current Palantir stock valuation and fueling investor confidence. Sustained growth in both government and commercial sectors is critical.

- Profitability: Achieving profitability is a major milestone for Palantir. Efficient cost management, effective scaling, and successful commercial expansion are key to achieving sustainable profitability.

- Keywords: Revenue growth, Profitability, Operating margin, R&D investment, Palantir financial performance.

H3: Technological Innovation and Product Development:

Palantir's continued investment in R&D and its ability to innovate new products and services are paramount to its long-term success. The integration of AI and machine learning capabilities into its platform is crucial for enhancing its data analysis capabilities and attracting new customers.

- Artificial Intelligence and Machine Learning: Palantir’s continued investment in AI and machine learning capabilities is crucial to stay ahead of the curve and provide advanced analytical solutions to its clients.

- Product Innovation: The development of new products and features that address evolving market needs and enhance existing offerings is essential for maintaining a competitive edge.

- Keywords: Artificial intelligence, Machine learning, Product innovation, R&D spending, Technological advancements.

H3: Geopolitical and Economic Factors:

Global events and economic conditions can significantly impact Palantir's business. Geopolitical instability could affect government contracts, while economic downturns might reduce commercial spending on data analytics solutions.

- Geopolitical Risk: International conflicts and political instability can create uncertainty in the global market, potentially impacting Palantir's contracts and operations.

- Economic Outlook: Economic downturns can lead to reduced spending on non-essential services, potentially impacting demand for Palantir's data analytics platform.

- Keywords: Geopolitical risk, Economic outlook, Global market conditions, Industry trends, Macroeconomic factors.

Valuation and Investment Considerations

H3: Assessing Palantir's Stock Valuation:

Analyzing Palantir's current stock valuation relative to its competitors and growth prospects is critical for potential investors. Factors like price-to-earnings ratio (P/E) and market capitalization need careful consideration.

- Stock Valuation Metrics: A comprehensive analysis of key valuation metrics is crucial to determine whether the current Palantir stock price accurately reflects its intrinsic value.

- Comparison to Competitors: Comparing Palantir's valuation with similar companies in the data analytics sector can provide a benchmark for assessing its relative attractiveness.

- Keywords: Stock valuation, Price-to-earnings ratio, Market capitalization, Investment analysis, Palantir stock valuation.

H3: Investment Risks and Potential Returns:

Investing in Palantir stock carries inherent risks, including market volatility, competition, and potential regulatory hurdles. However, if the predicted 40% growth materializes, the potential returns could be substantial.

- Investment Risk Assessment: A thorough assessment of the potential risks associated with investing in Palantir stock is crucial before making any investment decisions.

- Potential Returns: While risky, the potential for significant returns if the 40% growth prediction is accurate is a compelling factor for some investors.

- Keywords: Investment risk, Return on investment, Stock market volatility, Investment strategy, Palantir investment risk.

Conclusion: Is a 40% Palantir Stock Increase by 2025 Achievable?

Predicting a 40% increase in Palantir stock price by 2025 is ambitious. While Palantir boasts a strong market position, innovative technology, and significant growth potential, several factors could hinder this prediction. Maintaining strong revenue growth, achieving profitability, navigating geopolitical risks, and successfully competing in a dynamic market are all crucial for realizing this ambitious Palantir stock forecast. The potential for significant returns is balanced by considerable risk. Therefore, a thorough understanding of Palantir's business model, its competitive landscape, and the broader macroeconomic factors is essential before making any investment decisions. Conduct thorough research, analyze the Palantir stock forecast from multiple sources, and carefully consider the inherent Palantir investment risks before investing. Remember to consult with a financial advisor before making any investment decisions related to Palantir stock or any other security.

Featured Posts

-

Trade War Mark Warner On Trumps Reliance On Tariffs

May 10, 2025

Trade War Mark Warner On Trumps Reliance On Tariffs

May 10, 2025 -

Incredibly Dangerous Internal Warnings Before Newark Air Traffic Control Outage

May 10, 2025

Incredibly Dangerous Internal Warnings Before Newark Air Traffic Control Outage

May 10, 2025 -

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025 -

Unprovoked Hate Crime Family Torn Apart By Racist Violence

May 10, 2025

Unprovoked Hate Crime Family Torn Apart By Racist Violence

May 10, 2025 -

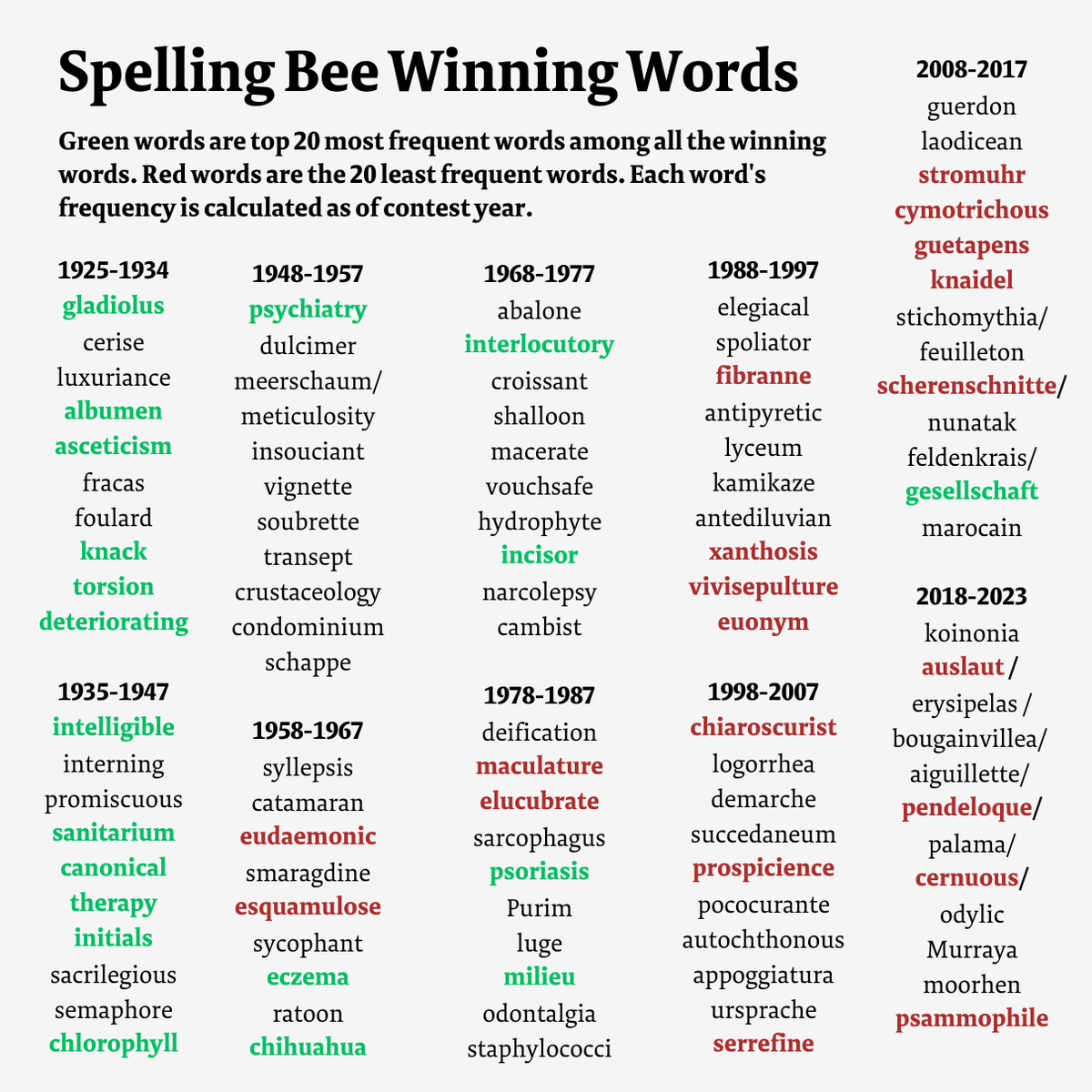

Solve The Nyt Spelling Bee April 1 2025 Puzzle Solutions

May 10, 2025

Solve The Nyt Spelling Bee April 1 2025 Puzzle Solutions

May 10, 2025