Analyzing Proxy Statements (Form DEF 14A): Tips For Informed Decision-Making

Table of Contents

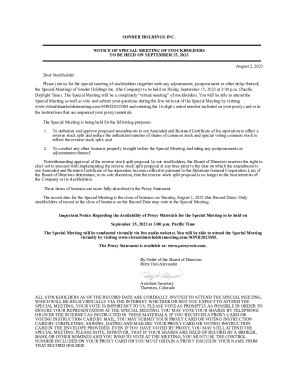

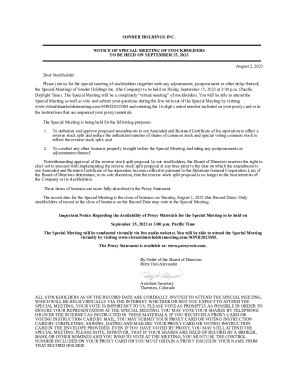

A proxy statement, also known as a Form DEF 14A, is a document that publicly traded companies are required to file with the Securities and Exchange Commission (SEC) before their annual shareholder meetings. It provides shareholders with crucial information needed to make informed voting decisions on important matters such as electing directors, approving executive compensation, and considering shareholder proposals. Analyzing these statements offers significant benefits, including a deeper understanding of corporate governance, executive compensation practices, and potential risks and opportunities. This article will provide key tips for effectively analyzing proxy statements to make informed investment decisions.

Understanding the Structure and Key Components of a Proxy Statement (Form DEF 14A)

Proxy statements are typically lengthy documents, but their structure is generally consistent. Understanding this structure is vital for efficient analysis. They usually include sections covering:

- Notice of Annual Meeting: This section outlines the date, time, and location (physical or virtual) of the shareholder meeting.

- Shareholder Proposals: This critical section details any proposals submitted by shareholders, addressing issues ranging from executive compensation to environmental sustainability. We'll discuss this in more detail below. Keywords: shareholder activism, shareholder resolutions, corporate governance.

- Election of Directors: This outlines the candidates for the board of directors, providing biographical information and qualifications. Keywords: board of directors, corporate governance, director nominations.

- Executive Compensation: This section is a goldmine of information on executive pay, including salaries, bonuses, stock options, and other benefits. Keywords: executive pay, compensation disclosure, CEO pay, director compensation.

- Auditor Information: Details the company's independent auditor, their reports, and confirmation of independence. Keywords: independent auditor, financial statements, audit report.

- Other Important Information: This often includes information on other significant matters requiring shareholder approval.

You can typically find these sections clearly labeled within the proxy statement, often with a table of contents for easy navigation. Familiarize yourself with the general layout of a proxy statement to easily locate these key areas.

Analyzing Executive Compensation: What to Look For

Analyzing executive compensation requires a discerning eye. Don't just look at the total compensation figure; dig deeper.

- Compensation Components: Analyze the breakdown of compensation: salary, bonuses, stock options, restricted stock units, and other benefits. Compare these components to industry benchmarks using resources like Glassdoor or compensation surveys. Keywords: executive compensation analysis, compensation benchmarking, pay ratios.

- Pay-for-Performance: Examine the correlation between executive pay and company performance. Does executive compensation reflect the company's financial results and shareholder returns? A lack of correlation could be a red flag. Keywords: pay-for-performance, executive incentives, shareholder value.

- Red Flags: Be wary of excessive compensation packages, golden parachutes (lucrative severance packages), and excessive stock options that are not aligned with long-term shareholder value. Keywords: excessive compensation, golden parachutes, stock options.

Deciphering Shareholder Proposals and Their Implications

Shareholder proposals offer a valuable window into the concerns and priorities of significant stakeholders.

- Assessing Impact: Evaluate how shareholder proposals might impact the company's strategy and governance. Proposals related to ESG (Environmental, Social, and Governance) factors are becoming increasingly common and influential. Keywords: ESG investing, environmental, social, and governance, shareholder engagement.

- Common Proposals: Familiarize yourself with common proposals, such as those relating to environmental sustainability, diversity on the board, political spending, and executive compensation. Keywords: proxy voting, shareholder democracy, corporate responsibility.

- Aligning with Goals: Determine your stance on shareholder proposals based on your investment goals and risk tolerance. Do the proposals align with your long-term investment strategy and values? Keywords: investment strategy, long-term investment, responsible investing.

Assessing the Board of Directors and Corporate Governance

The board of directors plays a critical role in overseeing company management and strategy.

- Board Composition: Analyze the diversity and independence of the board. A diverse board with a significant number of independent directors typically indicates stronger corporate governance. Keywords: board diversity, independent directors, corporate governance best practices.

- Director Qualifications: Review the background, experience, and expertise of each director. Look for potential conflicts of interest. Keywords: director independence, board composition, corporate governance structure.

- Governance Structure: Evaluate the effectiveness of the company's overall corporate governance structure using resources like corporate governance scorecards and ESG ratings. Keywords: corporate governance scorecards, ESG ratings, governance risk.

Utilizing Online Resources and Tools for Proxy Statement Analysis

Several resources can simplify the process of analyzing proxy statements.

- SEC's EDGAR Database: The SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system provides free access to company filings, including proxy statements. Keywords: SEC EDGAR, proxy statement database, financial data providers.

- Financial Data Providers: Companies like Bloomberg Terminal and Refinitiv provide in-depth financial data, including proxy statement analysis tools. Keywords: proxy voting tools, corporate governance data, ESG data.

Making Informed Decisions Through Proxy Statement Analysis

Analyzing proxy statements (Form DEF 14A) is crucial for informed investment decision-making. Understanding executive compensation, shareholder proposals, and board composition helps investors assess company performance, governance, and long-term prospects. Utilizing available resources, like the SEC's EDGAR database and financial data providers, streamlines the analysis process and enhances its effectiveness. Start analyzing proxy statements today to make more informed investment decisions and actively participate in corporate governance. Improve your investment strategy by mastering the art of analyzing proxy statements (Form DEF 14A).

Featured Posts

-

Ai Concerns Lead To Cancellation Of Star Wars Andor Book

May 17, 2025

Ai Concerns Lead To Cancellation Of Star Wars Andor Book

May 17, 2025 -

Viitorul Lui Stiller La Vf B Stuttgart Perspective Pentru Finala Cupei Germaniei

May 17, 2025

Viitorul Lui Stiller La Vf B Stuttgart Perspective Pentru Finala Cupei Germaniei

May 17, 2025 -

Future Of Doctor Who Christmas Specials Uncertain After Reported Cancellation

May 17, 2025

Future Of Doctor Who Christmas Specials Uncertain After Reported Cancellation

May 17, 2025 -

Ny Knicks Vs Brooklyn Nets Nba Season Finale Where To Watch The Game On April 13 2025

May 17, 2025

Ny Knicks Vs Brooklyn Nets Nba Season Finale Where To Watch The Game On April 13 2025

May 17, 2025 -

Kupovina Stanova U Inostranstvu Popularnost Medu Srbima

May 17, 2025

Kupovina Stanova U Inostranstvu Popularnost Medu Srbima

May 17, 2025