Analyzing RIOT Stock: Current Market Trends And Investment Strategies

Table of Contents

Understanding Riot Platforms, Inc. (RIOT) and its Business Model

Riot Platforms, Inc. (RIOT) is a publicly traded company primarily engaged in Bitcoin mining. Its business model centers around acquiring and operating large-scale Bitcoin mining facilities, leveraging advanced mining hardware to generate Bitcoin. Key operational aspects include the total mining capacity measured in petahashes per second (PH/s), the efficiency of its mining operations, and crucially, its energy sources. Riot has focused on securing affordable and sustainable energy, a significant advantage in the cost-sensitive Bitcoin mining industry.

-

Bitcoin Price and RIOT Stock Price: The price of Bitcoin (BTC) has a strong positive correlation with RIOT's stock price. When Bitcoin's price rises, RIOT's stock typically follows suit, reflecting increased profitability from Bitcoin mining. Conversely, a drop in Bitcoin's price generally leads to a decline in RIOT's stock value.

-

Expansion Plans and Growth Potential: Riot Platforms continually seeks to expand its mining capacity through the acquisition of new hardware and facilities. These expansion plans are a key driver of future growth, aiming to increase Bitcoin production and enhance profitability. Successful execution of these plans is crucial for maintaining a strong market position.

-

Partnerships and Collaborations: Strategic partnerships, such as those focused on securing energy supplies or technological advancements, can significantly impact RIOT's operational efficiency and profitability. Monitoring these collaborations is important for evaluating the company's overall growth trajectory.

Analyzing Current Market Trends Affecting RIOT Stock

Bitcoin's Price Volatility and its Impact on RIOT

Bitcoin's price is notoriously volatile, directly impacting RIOT's profitability and stock price. Regulatory changes, market sentiment, and macroeconomic factors all contribute to these fluctuations. A bullish Bitcoin market significantly boosts RIOT's revenue and stock valuation, while a bearish market can lead to substantial losses.

-

Past Price Drops and Their Effect: Historical data shows a strong correlation between Bitcoin price drops and RIOT's stock performance. For example, during significant market downturns, RIOT's stock price has experienced considerable declines, reflecting the direct impact of lower Bitcoin revenue.

-

Upcoming Bitcoin Halving Events: The Bitcoin halving event, which occurs approximately every four years, reduces the rate of newly minted Bitcoins. Historically, these events have been followed by periods of price appreciation, potentially benefiting RIOT's stock price due to the increased scarcity of Bitcoin.

The Energy Landscape and its Influence on RIOT's Operations

Energy costs represent a significant operational expense for Bitcoin mining companies. RIOT's strategy of securing affordable and sustainable energy sources is critical for maintaining its profitability and competitive edge. The cost of electricity directly impacts the profitability of Bitcoin mining.

-

Renewable Energy Sources: RIOT's commitment to using renewable energy sources like solar and wind power helps mitigate environmental concerns and can potentially lower long-term energy costs. This eco-friendly approach also aligns with growing ESG (Environmental, Social, and Governance) investment trends.

-

Government Policies on Energy Costs: Government regulations and policies related to energy production and consumption can significantly impact RIOT's operational costs. Changes in energy prices, tax incentives, or environmental regulations can affect the company's bottom line.

Competition within the Cryptocurrency Mining Industry

RIOT faces competition from other publicly traded and private Bitcoin mining companies. Key competitors often compete on factors like hashing power, operational efficiency, and access to affordable energy. Analyzing the competitive landscape is crucial for understanding RIOT's market position.

-

Key Competitors and Market Share: Several publicly traded companies operate at a similar scale to Riot, competing for market share in the Bitcoin mining industry. Monitoring their performance and strategic moves is essential for assessing RIOT's relative strength.

-

Competitive Landscape and Future Impact: The competitive landscape in the Bitcoin mining industry is dynamic. Technological advancements, regulatory changes, and the overall market environment constantly reshape the competitive dynamics, impacting RIOT's future prospects.

Investment Strategies for RIOT Stock

Risk Assessment and Due Diligence

Investing in RIOT, or any cryptocurrency-related asset, carries significant risk. The inherent volatility of Bitcoin and the cryptocurrency market necessitates thorough due diligence before investing.

-

Factors to Consider Before Investing: Before investing in RIOT, carefully assess the company's financial health, including its debt levels, revenue streams, and operational efficiency. Analyze market conditions, including the price of Bitcoin and the overall regulatory environment.

-

Resources for Due Diligence: Use reputable sources like financial news websites, SEC filings (10-K, 10-Q), and financial analysis reports to gather information and conduct thorough due diligence before making any investment decisions.

Diversification and Portfolio Allocation

Diversification is crucial for mitigating risk in any investment portfolio. Including RIOT in a well-diversified portfolio helps reduce the overall risk exposure.

-

Suitable Asset Classes for Diversification: Consider diversifying into other asset classes, such as stocks, bonds, real estate, and other alternative investments, to reduce the impact of potential losses in the cryptocurrency market.

-

Appropriate Allocation Percentages: The percentage of your portfolio allocated to RIOT should depend on your risk tolerance and overall investment goals. A well-diversified portfolio typically limits exposure to any single asset class.

Long-Term vs. Short-Term Investment Strategies for RIOT

Investors can choose between long-term and short-term investment strategies for RIOT stock, each with its own advantages and disadvantages.

-

Risks and Rewards: Long-term investments benefit from potential growth over time but may be more susceptible to market fluctuations in the short term. Short-term investments offer greater flexibility but may involve higher risk.

-

Factors Influencing Strategy Choice: Your risk tolerance, investment timeline, and market outlook are crucial factors influencing the choice between long-term and short-term investment strategies.

Conclusion

Analyzing RIOT stock requires a thorough understanding of the cryptocurrency market, Bitcoin's price volatility, and the competitive landscape of Bitcoin mining. By carefully considering the factors discussed above, including market trends, the company’s operational efficiency, and your own risk tolerance, you can develop a sound investment strategy for RIOT. Remember that cryptocurrency investments are inherently risky, so always conduct thorough due diligence before investing. Start your RIOT stock research today and learn more about effectively analyzing RIOT stock to make informed investment decisions.

Featured Posts

-

Tulsa Prepares For Winter Weather Road Pre Treatment Underway

May 02, 2025

Tulsa Prepares For Winter Weather Road Pre Treatment Underway

May 02, 2025 -

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025 -

Lotto 6aus49 Alle Ergebnisse Vom 19 April 2025

May 02, 2025

Lotto 6aus49 Alle Ergebnisse Vom 19 April 2025

May 02, 2025 -

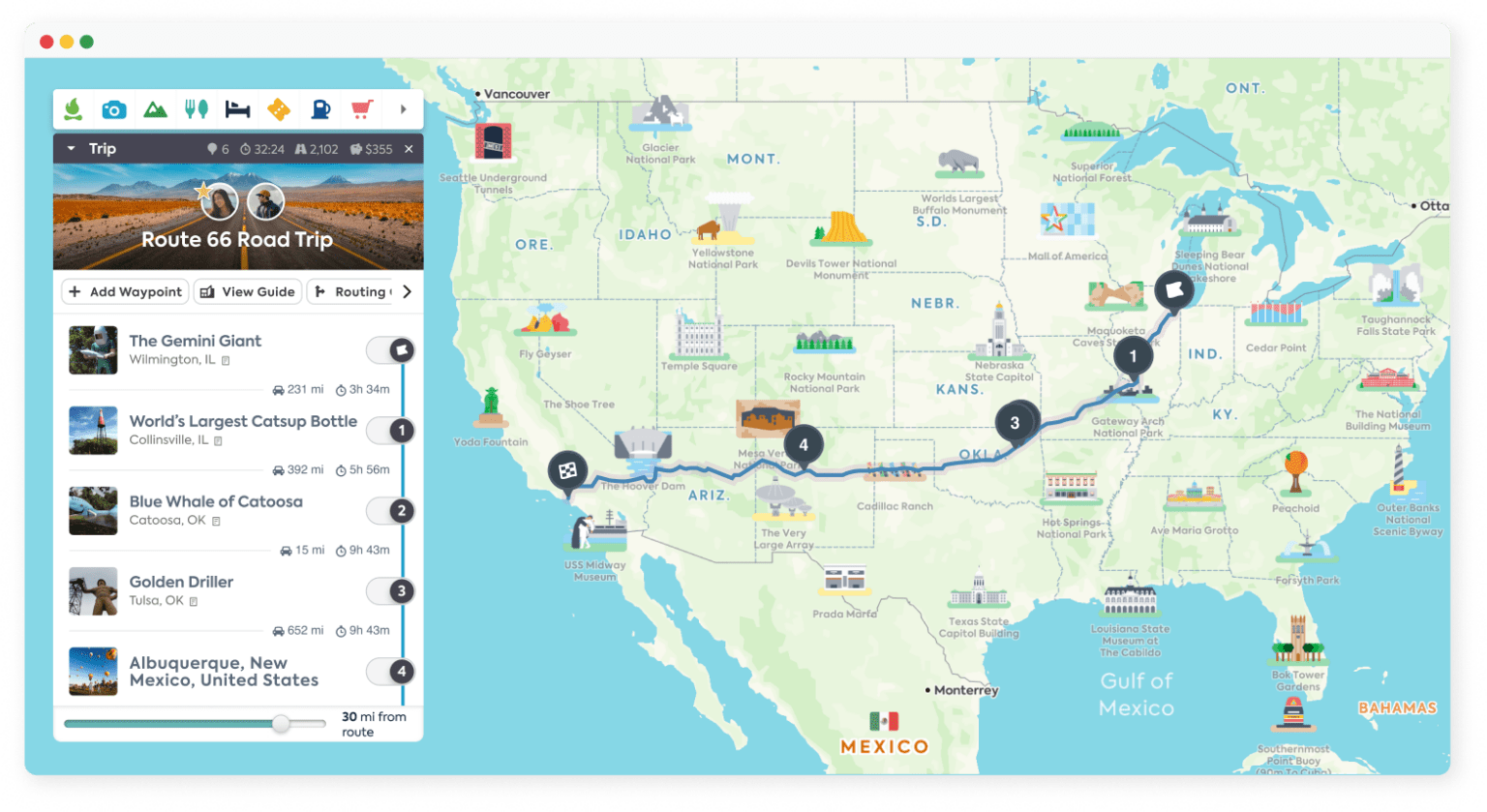

Planning Your Trip To This Country Essential Information

May 02, 2025

Planning Your Trip To This Country Essential Information

May 02, 2025 -

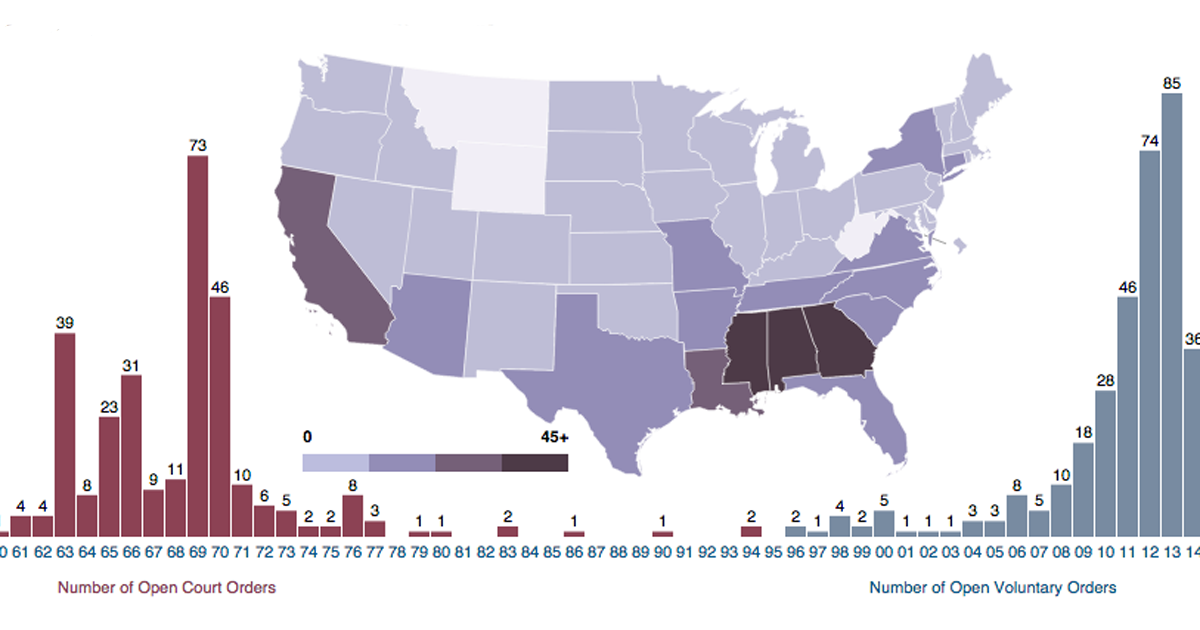

Justice Department Ends School Desegregation Order What Happens Next

May 02, 2025

Justice Department Ends School Desegregation Order What Happens Next

May 02, 2025

Latest Posts

-

Renaissance Et Modem Vers Une Fusion Pour Clarifier La Ligne Gouvernementale

May 10, 2025

Renaissance Et Modem Vers Une Fusion Pour Clarifier La Ligne Gouvernementale

May 10, 2025 -

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 10, 2025

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 10, 2025 -

Addressing Accessibility Challenges For Wheelchair Users On The Elizabeth Line

May 10, 2025

Addressing Accessibility Challenges For Wheelchair Users On The Elizabeth Line

May 10, 2025 -

Accessibility Audit Elizabeth Line And Wheelchair Users

May 10, 2025

Accessibility Audit Elizabeth Line And Wheelchair Users

May 10, 2025 -

Wheelchair Accessibility Issues And Solutions On The Elizabeth Line

May 10, 2025

Wheelchair Accessibility Issues And Solutions On The Elizabeth Line

May 10, 2025