Analyzing The 30% Palantir Stock Drop: A Buyer's Perspective.

Table of Contents

Understanding the 30% Stock Drop: Key Contributing Factors

Several factors contributed to Palantir's recent stock price decline. Understanding these is crucial to assessing whether the current valuation reflects the company's true potential.

Disappointing Earnings Report

Palantir's latest earnings report fell short of analyst expectations, triggering a significant sell-off. This disappointment stemmed from several key metrics:

- Revenue Growth: While Palantir reported revenue growth, it was slower than anticipated by analysts, fueling concerns about the company's future growth trajectory. Specific numbers need to be referenced here once the report is released (e.g., "Revenue growth of X%, compared to analyst expectations of Y%").

- Profitability: Profitability margins also missed expectations, raising questions about the company's ability to translate revenue growth into sustainable profits. Again, specific figures from the earnings report would be inserted here.

- Guidance: The company's guidance for future quarters was more conservative than hoped, further dampening investor enthusiasm and contributing to the stock price decline. Including the specific guidance provided by Palantir is essential.

- Impact on Investor Sentiment: The combined effect of these factors significantly impacted investor sentiment, leading to a wave of selling and the subsequent 30% drop.

Macroeconomic Headwinds

The broader macroeconomic environment also played a role in exacerbating Palantir's stock price decline. Several factors contributed:

- Rising Interest Rates: Rising interest rates increase borrowing costs for companies, potentially impacting Palantir's growth and profitability.

- Inflationary Pressures: High inflation erodes purchasing power and can lead to reduced spending on software and technology solutions like those offered by Palantir.

- Concerns about a Potential Recession: Fears of a looming recession further fueled investor risk aversion, leading to a sell-off in growth stocks, including Palantir.

- Impact on Tech Stocks: The overall tech sector experienced a downturn, with Palantir being particularly vulnerable due to its high valuation and growth-focused business model.

Concerns about Government Contracts

Palantir's significant reliance on government contracts has always been a point of concern for some investors. This concern was likely amplified during the recent downturn:

- Percentage of Revenue: A significant portion of Palantir's revenue comes from government contracts. The exact percentage needs to be included here. This reliance makes the company vulnerable to changes in government spending priorities or budget cuts.

- Potential Risks: Government budget cuts, changes in political priorities, or delays in contract awards could significantly impact Palantir's revenue stream and profitability.

- Diversification Efforts: While Palantir is actively diversifying its client base, its success in the commercial sector remains a key factor in mitigating the risks associated with its government contracts. Highlight specific examples of diversification efforts.

Assessing the Long-Term Potential of Palantir

Despite the recent setback, Palantir's long-term potential remains significant, driven by several key factors.

Growth in Data Analytics and AI

Palantir operates in the rapidly expanding data analytics and artificial intelligence markets. This provides a significant tailwind for long-term growth:

- Market Size Projections: The market for data analytics and AI is projected to experience substantial growth in the coming years. Include relevant market size projections from reputable sources.

- Palantir's Competitive Advantages: Palantir possesses unique technological capabilities and expertise, giving it a competitive edge in this market. Detail these advantages.

- Potential for Future Innovation: Palantir's ongoing investment in research and development positions it well for future innovation and market share gains.

Strategic Partnerships and Client Acquisition

Palantir's strategic partnerships and success in attracting new clients are further indicators of its long-term potential:

- Key Partnerships: Highlight examples of key partnerships Palantir has forged, emphasizing their strategic importance and potential for future revenue generation.

- Growth in Commercial Clients: Showcase the growth in Palantir's commercial client base, demonstrating its ability to expand beyond its traditional government clients.

- Expansion into New Markets: Discuss Palantir's expansion into new markets and sectors, demonstrating its ability to broaden its revenue streams and reduce reliance on any single market.

Valuation and Risk Assessment

A balanced perspective requires evaluating Palantir's valuation and potential risks:

- Comparison to Peer Companies: Compare Palantir's valuation to its competitors in the data analytics and AI markets.

- Key Risks: Acknowledge potential risks such as competition from established players, regulatory hurdles, and the inherent volatility of the technology sector.

- Potential Upside: Despite the risks, the potential upside remains significant given the company's growth potential and market position.

Is Now the Time to Buy Palantir Stock? A Buyer's Perspective

The decision of whether to buy Palantir stock following its recent decline requires careful consideration.

Analyzing the Risk-Reward Ratio

Investing in Palantir at the current price involves assessing the risk-reward ratio:

- Potential for Further Price Declines: Acknowledge the possibility of further price declines, given the current market uncertainty.

- Upside Potential: Weigh this against the potential for substantial upside based on the company's long-term growth prospects.

- Risk Tolerance: Consider your own risk tolerance and investment goals before making a decision.

Long-Term Investment Strategy

Investing in Palantir requires a long-term perspective:

- Importance of Patience: Investing in growth stocks often requires patience, as short-term fluctuations are common.

- Focus on Long-Term Growth: Focus on Palantir's long-term growth potential rather than reacting to short-term market movements.

- Portfolio Diversification: Ensure adequate diversification within your investment portfolio to mitigate risk.

Due Diligence and Professional Advice

Before making any investment decision, conduct thorough due diligence:

- Investment Goals: Clearly define your investment goals and risk tolerance.

- Financial Advisor: Consult with a qualified financial advisor to obtain personalized advice.

- Independent Research: Don't rely solely on online analysis; conduct your own thorough research.

Conclusion

The 30% drop in Palantir stock presents a complex scenario. While concerns about earnings and macroeconomic factors are valid, Palantir's position in the growing data analytics and AI markets, combined with its strategic partnerships, suggests significant long-term potential. The decision to buy Palantir stock following this decline hinges on a careful assessment of the risk-reward ratio and your personal investment strategy. Conduct thorough due diligence, consider your risk tolerance, and consult with a financial advisor before making any investment decisions related to Palantir stock. Remember, this analysis is for informational purposes and should not be considered financial advice. Consider your own risk tolerance and financial situation before making any decisions regarding Palantir or any other investment.

Featured Posts

-

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025 -

Selling Sunset Star Exposes Price Gouging By Landlords After La Fires

May 09, 2025

Selling Sunset Star Exposes Price Gouging By Landlords After La Fires

May 09, 2025 -

F1 Update Alpine Bosss Direct Communication With Doohan

May 09, 2025

F1 Update Alpine Bosss Direct Communication With Doohan

May 09, 2025 -

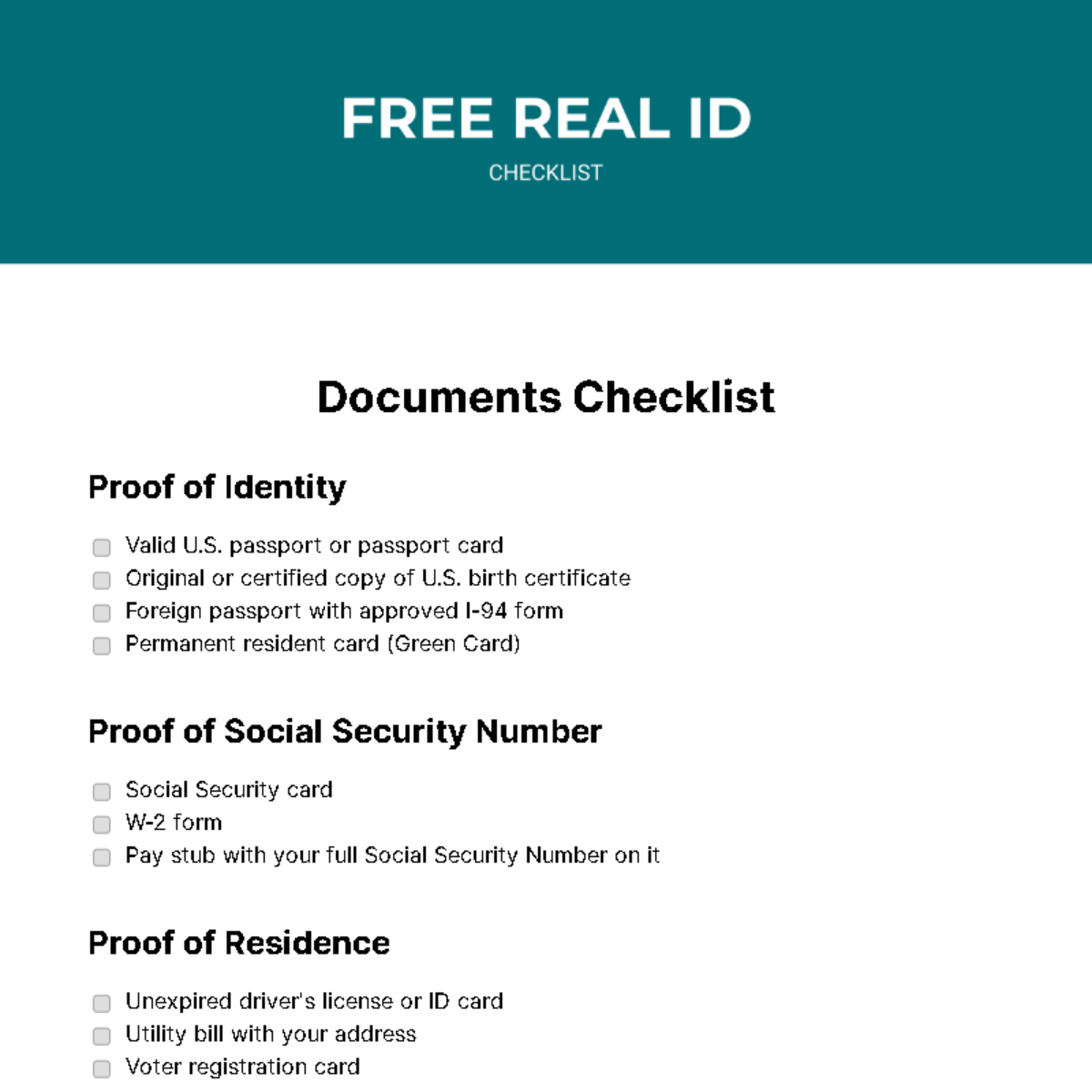

Real Id And Summer Travel A Checklist For Smooth Airport Security

May 09, 2025

Real Id And Summer Travel A Checklist For Smooth Airport Security

May 09, 2025 -

Vremennoe Zakrytie Aeroporta Permi Prichiny I Posledstviya Snegopada

May 09, 2025

Vremennoe Zakrytie Aeroporta Permi Prichiny I Posledstviya Snegopada

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025