Analyzing The Country's Newest Business Hotspots: Growth Potential And Investment Strategies

Table of Contents

Identifying Emerging Business Hotspots

Identifying promising business hotspots requires a multifaceted approach combining geographic and sector-specific analyses.

Geographic Analysis

Focusing on regions experiencing rapid transformation is crucial. Look for areas exhibiting strong economic indicators and substantial government investment in infrastructure.

- Examples of High-Growth Regions: Cities like [City A], known for its burgeoning tech scene and low unemployment rate (currently at 3.5%, according to the [Source]), and [City B], experiencing a construction boom fueled by government investment in renewable energy infrastructure (projected growth of 15% in GDP over the next 5 years, according to [Source]). These business hotspots show significant potential.

- Key Industries Driving Growth: The technology sector in [City A] is a major driver, with numerous startups and established tech companies contributing significantly to the region's GDP. In [City B], the renewable energy sector, including solar and wind power projects, is creating numerous jobs and attracting substantial foreign investment. These sectors are indicative of future potential in these business hotspots.

- Data & Statistics: Supporting data should include unemployment rates, GDP growth forecasts, and foreign direct investment figures from reputable sources like the World Bank, national statistics offices, and industry reports.

Sector-Specific Analysis

Beyond traditional industries, several high-growth sectors are transforming the economic landscape, creating lucrative business hotspots.

- Booming Sectors: The e-commerce sector is expanding rapidly, driven by increasing internet penetration and a growing middle class. Fintech is another area of significant growth, with innovative payment solutions and financial technology companies transforming the financial services landscape. The healthcare technology sector is also experiencing significant expansion, driven by advancements in medical technology and an aging population. These sectors offer multiple promising business hotspots.

- Growth Drivers: Technological advancements, changing demographics (e.g., a young, tech-savvy population), and supportive government policies (e.g., tax breaks for startups) contribute significantly to the growth of these sectors. Market size estimations and future projections from credible market research firms should be included here, quantifying the growth potential within these business hotspots.

Assessing Growth Potential and Investment Risks

A thorough assessment of growth potential and associated risks is crucial for successful investment in emerging business hotspots.

Economic Indicators

Analyzing key economic indicators provides a clearer picture of the growth trajectory.

- Key Indicators: The GDP growth rate offers a comprehensive overview of economic expansion. Inflation rates indicate price stability, while consumer spending reflects domestic demand. Foreign direct investment (FDI) demonstrates investor confidence in the region's future. Analyzing these indicators in the context of specific business hotspots is crucial.

- Indicator Correlation: High GDP growth, moderate inflation, strong consumer spending, and increasing FDI typically correlate with better investment opportunities. However, rapid inflation or volatile FDI can indicate higher investment risk. Charts and graphs visualizing these indicators within each identified business hotspot would improve clarity.

Risk Assessment and Mitigation

Investing in emerging markets always involves risks. Understanding and mitigating these is crucial for success.

- Potential Risks: Political instability can disrupt business operations. Regulatory changes can impact profitability. Infrastructure limitations can increase operational costs. Intense competition can reduce market share. Identifying these potential risks is vital for a robust investment strategy within these business hotspots.

- Risk Mitigation Strategies: Thorough due diligence is essential before any investment. Portfolio diversification reduces exposure to single market risks. Insurance can protect against unforeseen events. Seeking expert advice can provide valuable insights into specific business hotspots and their associated risks.

Developing Effective Investment Strategies

Developing a well-defined investment strategy is crucial for capitalizing on opportunities in emerging business hotspots.

Due Diligence and Market Research

Thorough research is fundamental before committing resources.

- Market Research Steps: Conduct a comprehensive competitor analysis to understand the competitive landscape. Accurately estimate the market size and potential for growth. Define your target customer segments. Understanding the local market is paramount when choosing an optimal business hotspot.

- Understanding the Local Context: Local regulations, cultural nuances, and business practices significantly influence success. Accessing reliable data sources, such as government reports, industry publications, and local market research firms is important when analyzing a potential business hotspot.

Investment Options and Portfolio Diversification

Several investment options exist for leveraging opportunities in business hotspots.

- Investment Options: Starting a new business allows for greater control but demands significant upfront investment. Acquiring existing businesses provides immediate market access but may involve higher acquisition costs. Real estate investment offers potential for long-term capital appreciation but requires careful market analysis. Venture capital investment provides exposure to high-growth startups but carries higher risk. The best option depends on the specific business hotspot and investor risk tolerance.

- Diversification: Diversifying your investment portfolio across different sectors and geographic locations reduces overall risk. Successful investments in similar business hotspots can be showcased here as case studies to demonstrate effective strategies.

Conclusion

This analysis of the country's newest business hotspots has revealed significant growth potential across various sectors. By carefully assessing economic indicators, understanding the risks, and implementing effective investment strategies, investors can capitalize on these opportunities. Remember to conduct thorough due diligence and diversify your portfolio to maximize returns and minimize risk. Don't miss out on the chance to be a part of the growth story – start exploring these promising business hotspots today and unlock your investment potential. Further research into specific business hotspots and relevant sectors is recommended for a more detailed investment plan.

Featured Posts

-

The Goldbergs Impact And Cultural Significance

May 22, 2025

The Goldbergs Impact And Cultural Significance

May 22, 2025 -

Lady And The Tramp Hot Dog A Chicago Cubs Game Tradition

May 22, 2025

Lady And The Tramp Hot Dog A Chicago Cubs Game Tradition

May 22, 2025 -

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 22, 2025

Live Tv Chaos Bbc Breakfast Guest Interrupts Broadcast

May 22, 2025 -

Death Of Second Translocated Colorado Gray Wolf In Wyoming

May 22, 2025

Death Of Second Translocated Colorado Gray Wolf In Wyoming

May 22, 2025 -

Alfa Romeo Junior 1 2 Turbo Speciale Avis Et Essai Par Le Matin Auto

May 22, 2025

Alfa Romeo Junior 1 2 Turbo Speciale Avis Et Essai Par Le Matin Auto

May 22, 2025

Latest Posts

-

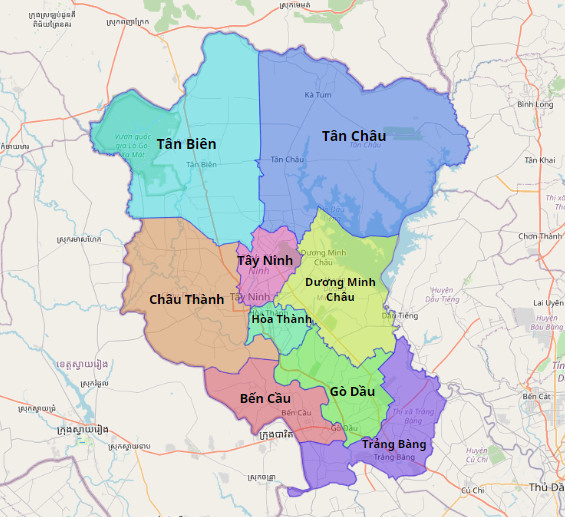

Cap Nhat Duong Va Cau Ket Noi Binh Duong Va Tay Ninh

May 22, 2025

Cap Nhat Duong Va Cau Ket Noi Binh Duong Va Tay Ninh

May 22, 2025 -

Cau Va Duong Cao Toc Binh Duong Tay Ninh Thong Tin Moi Nhat

May 22, 2025

Cau Va Duong Cao Toc Binh Duong Tay Ninh Thong Tin Moi Nhat

May 22, 2025 -

Binh Duong Tay Ninh Duong Bo Va Cau

May 22, 2025

Binh Duong Tay Ninh Duong Bo Va Cau

May 22, 2025 -

Tim Hieu Ve Cau Va Duong Ket Noi Binh Duong Tay Ninh

May 22, 2025

Tim Hieu Ve Cau Va Duong Ket Noi Binh Duong Tay Ninh

May 22, 2025 -

Tuyen Duong Va Cau Noi Binh Duong Voi Tay Ninh

May 22, 2025

Tuyen Duong Va Cau Noi Binh Duong Voi Tay Ninh

May 22, 2025