Analyzing The Current Trends In The Indian Stock Market: Nifty's Momentum

Table of Contents

Global Factors Influencing Nifty's Performance

Global events significantly impact the Indian stock market and the Nifty 50 index. These external forces can create both opportunities and challenges for investors. Understanding these influences is paramount for successful investment in Nifty.

-

Impact of US Fed rate hikes on FII flows: The US Federal Reserve's monetary policy decisions, particularly interest rate hikes, directly affect Foreign Institutional Investor (FII) flows into emerging markets like India. Higher US interest rates often lead to capital repatriation, impacting Nifty's performance. A rise in US treasury yields makes dollar-denominated assets more attractive, potentially leading to a sell-off in Indian equities.

-

Geopolitical risks and their influence on market volatility: Geopolitical uncertainties, such as international conflicts or trade wars, can introduce considerable volatility into the Nifty. These events often lead to increased risk aversion among investors, resulting in market corrections. The Russia-Ukraine conflict, for example, had a ripple effect across global markets, including India.

-

Global inflation and its effect on Indian companies' profitability: High global inflation impacts input costs for Indian companies, potentially squeezing profit margins. This can negatively affect corporate earnings and, consequently, Nifty's valuation. Furthermore, rising inflation globally often leads to tighter monetary policies worldwide, impacting investment flows.

-

Correlation between Nifty and global indices like S&P 500, Dow Jones: The Nifty 50 index exhibits a degree of correlation with major global indices like the S&P 500 and the Dow Jones. Positive movements in these global markets often translate into positive sentiment for the Nifty, and vice-versa. However, it's crucial to remember that this correlation isn't always perfect and other factors play a crucial role.

Domestic Economic Indicators and Nifty's Trajectory

Domestic economic indicators play a vital role in shaping Nifty's trajectory. Strong fundamentals generally translate into positive market sentiment, while weak indicators can lead to bearish trends. Monitoring these indicators is crucial for gauging the health of the Indian economy and its impact on the stock market.

-

Impact of GDP growth on corporate earnings and market sentiment: Robust GDP growth fuels corporate earnings, boosting investor confidence and driving Nifty's upward momentum. Conversely, slower GDP growth can dampen market sentiment and lead to downward pressure on the index.

-

Inflation's effect on consumer spending and business investments: High inflation erodes purchasing power, impacting consumer spending and business investments. This can negatively affect corporate profitability and subsequently, Nifty's performance. The Reserve Bank of India's (RBI) inflation targets are closely watched by investors.

-

Rupee volatility and its influence on foreign investment: Significant fluctuations in the value of the Indian Rupee against major currencies can influence foreign investment flows. A weakening Rupee can make Indian assets cheaper for foreign investors, potentially attracting capital inflows. Conversely, a strengthening Rupee might discourage foreign investment.

-

Government policies and their impact on the stock market: Government policies, such as fiscal and monetary measures, significantly impact the stock market. Budget announcements, tax reforms, and infrastructure spending plans can influence investor sentiment and Nifty's performance.

Sectoral Trends Shaping Nifty's Momentum

Analyzing the performance of individual sectors within the Nifty 50 is crucial for understanding the index's overall momentum. Different sectors exhibit varying growth trajectories, influenced by specific industry dynamics and macroeconomic factors.

-

Growth prospects of the IT sector and its influence on Nifty: The IT sector's performance significantly impacts Nifty. Strong global demand for IT services and technological advancements usually result in positive contributions from this sector to the overall index.

-

Performance of the banking sector and its impact on market sentiment: The banking sector's health is a key indicator of the overall economy's strength. Positive developments in this sector often boost market confidence, positively affecting Nifty's trajectory. Non-performing assets (NPAs) and credit growth are key metrics to watch.

-

Analysis of FMCG and pharma sector performance: The FMCG and pharma sectors are considered relatively defensive, meaning they are less vulnerable to economic downturns. Their performance can provide insights into consumer spending patterns and healthcare trends.

-

Emerging sectors and their potential contribution to Nifty's momentum: Emerging sectors like renewable energy, electric vehicles, and fintech hold significant growth potential. Their performance can contribute considerably to Nifty's future momentum.

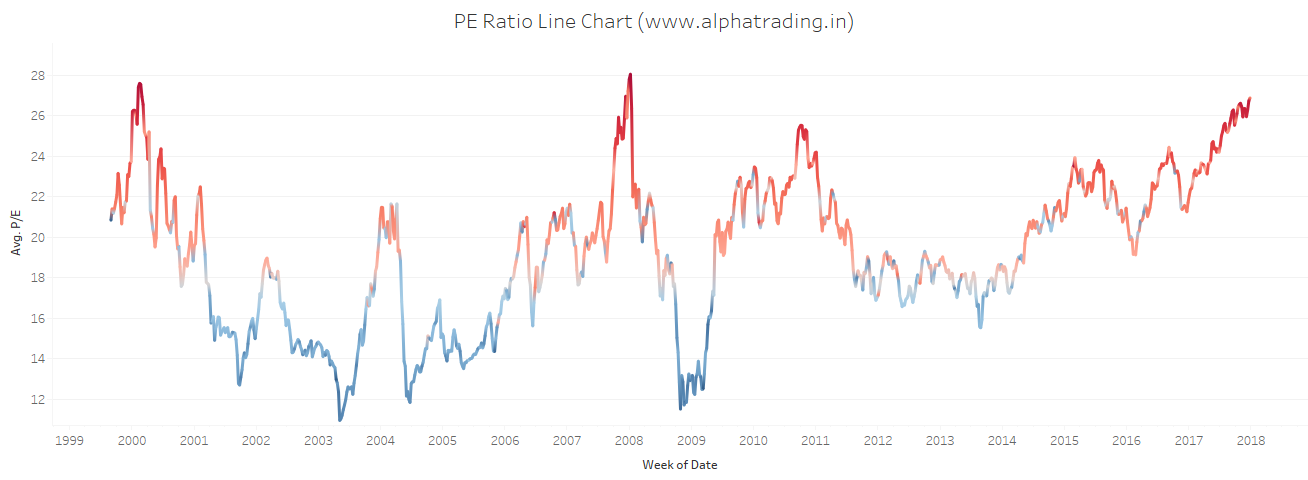

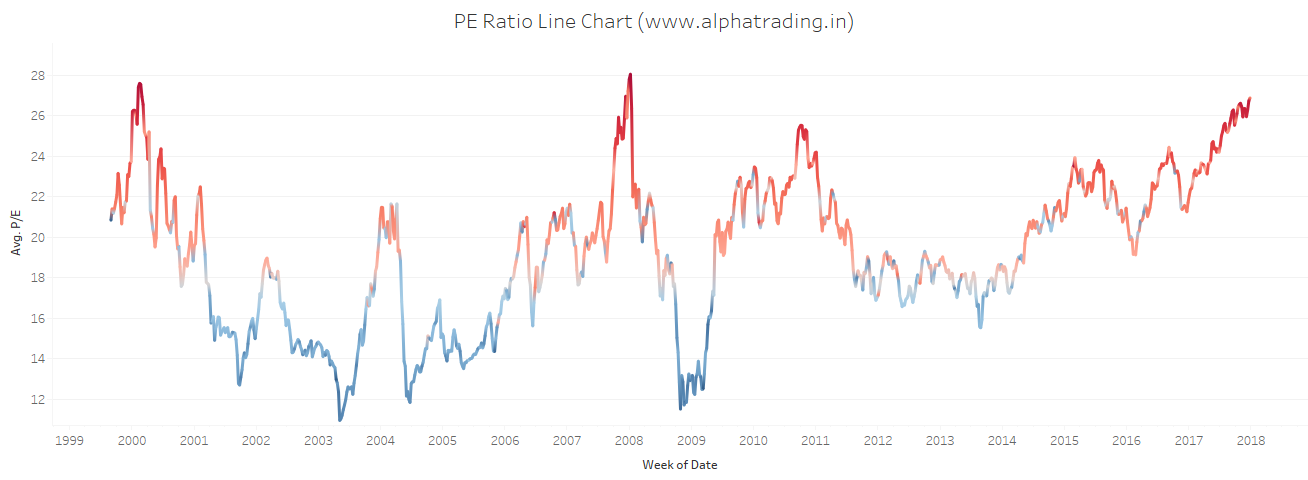

Analyzing Nifty's Technical Indicators

Technical analysis provides valuable insights into Nifty's short-term and long-term trends. Technical indicators, such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), help identify potential price movements and support/resistance levels.

-

Interpretation of key technical indicators for Nifty: Analyzing indicators like moving averages helps identify trends, while RSI and MACD provide insights into momentum and potential reversals.

-

Identifying support and resistance levels: Support and resistance levels are crucial for identifying potential price turning points. These levels represent price points where buying or selling pressure is strong.

-

Predicting potential price movements using technical charts: Technical charts, combined with indicators, allow for the prediction of potential price movements, assisting in informed trading decisions.

-

Limitations of technical analysis and the need for fundamental analysis: It's crucial to remember that technical analysis is just one piece of the puzzle. Fundamental analysis, which examines a company's financial health and industry prospects, is essential for a comprehensive investment strategy.

Conclusion: Navigating Nifty's Momentum for Smart Investments

Analyzing Nifty's momentum requires considering a multitude of factors, including global economic conditions, domestic economic indicators, sectoral trends, and technical analysis. Investors should adopt diversified investment strategies to mitigate risks and leverage opportunities. Understanding the interplay between global and domestic factors is crucial for making well-informed investment decisions. Remember to conduct thorough research and seek professional financial advice before investing in the Nifty 50 or any other asset. Stay informed on Nifty's momentum and make well-informed investment choices.

Featured Posts

-

Instagram Aims To Steal Tik Tok Creators With New Editing App

Apr 24, 2025

Instagram Aims To Steal Tik Tok Creators With New Editing App

Apr 24, 2025 -

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025 -

Key Bench Players Hield And Payton Secure Warriors Win Against Blazers

Apr 24, 2025

Key Bench Players Hield And Payton Secure Warriors Win Against Blazers

Apr 24, 2025 -

Rep Nancy Mace Faces Heated Exchange With Constituent In South Carolina

Apr 24, 2025

Rep Nancy Mace Faces Heated Exchange With Constituent In South Carolina

Apr 24, 2025 -

The Bold And The Beautiful April 16 Liams Actions And Bridgets Discovery

Apr 24, 2025

The Bold And The Beautiful April 16 Liams Actions And Bridgets Discovery

Apr 24, 2025