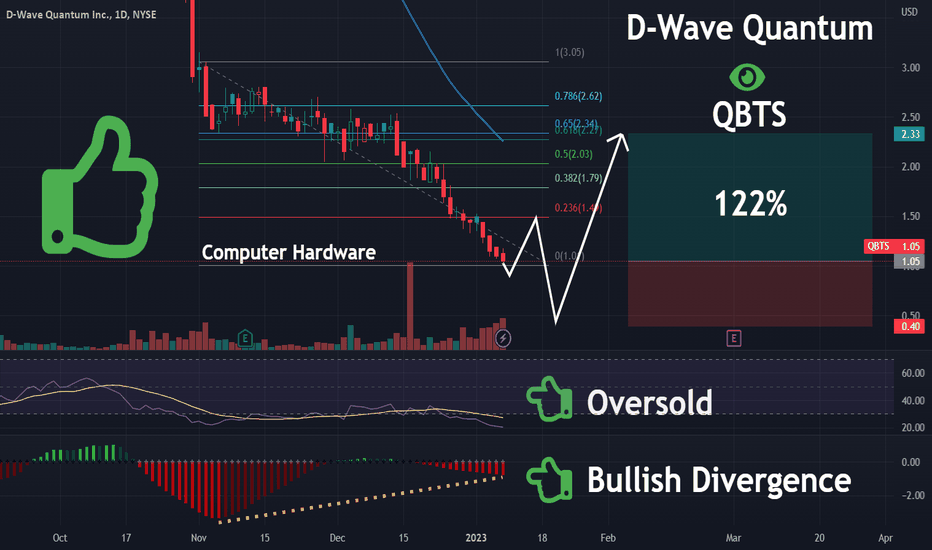

Analyzing The D-Wave Quantum (QBTS) Stock Drop On Monday

Table of Contents

On Monday, shares of D-Wave Quantum (QBTS), a leading player in the burgeoning quantum computing market, experienced a significant drop. This article analyzes the potential causes behind this sudden decline in the quantum computing stock, examining market factors, company news, and broader industry trends that may have contributed to the QBTS stock price volatility. We'll explore the implications for investors and provide insights into the future outlook for D-Wave Quantum and the quantum computing market.

Market Sentiment and the Broader Tech Sector

Monday saw a general downturn in the tech sector, impacting many technology stocks. This broader market weakness likely played a role in the QBTS stock decline. The negative sentiment wasn't confined to quantum computing; it affected the entire technology landscape.

- Market Indices: The NASDAQ Composite, a key indicator of the tech sector's performance, experienced a [insert percentage]% decrease on Monday. This downward trend likely influenced investor behavior across the board, including QBTS. You can find detailed information on the NASDAQ performance on sites like [link to reputable financial news source, e.g., Yahoo Finance].

- Broader Tech Sell-Offs: The sell-off wasn't isolated to a specific niche within the tech sector. Many large-cap tech companies experienced similar declines, suggesting a broader risk-off sentiment among investors. This overall negative market sentiment could have exacerbated the QBTS stock drop. For instance, [mention specific tech company and its performance]. [Link to relevant financial news article].

- Correlation, not Causation: While the overall market downturn contributed to the negative sentiment, it's important to note that correlation doesn't equal causation. Other factors specific to D-Wave Quantum likely played a role in the severity of its stock drop.

D-Wave Quantum Specific News and Announcements

The timing and nature of any company announcements are crucial in understanding stock price fluctuations. Analyzing news released by D-Wave Quantum around Monday's drop is vital.

- Specific News Items: Were there any press releases, earnings reports, or regulatory filings issued by D-Wave Quantum before or on Monday? [If yes, mention them and link to the official source. For example: "A press release announcing a delay in a key project could have negatively impacted investor confidence."] If no specific news was released, this itself is a data point that needs to be considered.

- Impact on Investor Confidence: The lack of any specific negative news might suggest that the drop was primarily driven by external factors like broader market sentiment or competitive pressures. Alternatively, the absence of positive news could have led to a decline in investor optimism.

- Market Expectations: It's important to compare any news released with market expectations. If the news was in line with analysts' predictions, the impact on the stock price might be less significant than if it was a complete surprise.

Competition in the Quantum Computing Market

The quantum computing industry is highly competitive, with several major players vying for market share. Competitor activity can significantly influence investor sentiment towards individual companies.

- Key Competitors: D-Wave Quantum faces stiff competition from giants like IBM, Google, and IonQ, each making strides in various aspects of quantum computing. These companies' advancements and announcements can influence the overall perception of the quantum computing sector and affect investor decisions regarding QBTS.

- Recent Breakthroughs: Any significant breakthroughs or announcements by competitors could lead investors to reassess the relative value of D-Wave Quantum's technology and future prospects. For instance, a major advancement in qubit technology by a competitor might prompt investors to shift their attention and capital. [Mention any recent news from competitors and provide links].

- Competitive Pressure: The competitive landscape affects not only the technological trajectory but also the financial performance of companies. The constant pressure to innovate and deliver results can influence investor confidence, especially in a rapidly evolving sector like quantum computing.

Investor Sentiment and Trading Volume

Examining the trading volume for QBTS on Monday can offer valuable insights into investor behavior.

- Trading Volume Analysis: Was the trading volume unusually high or low compared to previous days? High volume could indicate panic selling, while low volume might suggest a lack of significant investor interest or a more passive market reaction. [Include data on trading volume if available].

- Causes for High/Low Volume: High volume might indicate a rush to exit positions due to negative sentiment or news. Low volume might signify that investors are waiting for more information before making decisions, or that the overall market is less active.

- Short-Selling and Speculative Trading: The role of short-selling and other speculative trading strategies should also be considered. High short interest could contribute to downward pressure on the stock price, especially during periods of uncertainty.

Analyzing the Long-Term Implications for QBTS Stock

The Monday drop raises questions about the long-term outlook for D-Wave Quantum. Is this a temporary setback or a sign of deeper challenges?

- Long-Term Prospects and Growth Potential: D-Wave Quantum's long-term prospects depend on several factors, including technological advancements, successful partnerships, and the overall adoption of quantum computing technology. The company's financial health and its ability to secure funding are also crucial.

- Financial Health and Future Plans: Analyzing D-Wave Quantum's financial statements, strategic plans, and research and development efforts can help assess its resilience and long-term viability. [Mention any relevant information available publicly].

- Risks and Opportunities: Investing in quantum computing involves inherent risks, but the potential rewards are significant. A balanced perspective, considering both the risks and opportunities, is vital for making informed investment decisions.

Conclusion

The D-Wave Quantum (QBTS) stock drop on Monday was likely a multifaceted event, influenced by a combination of factors. The broader tech sector downturn, while not the sole cause, contributed to the negative market sentiment. The absence of company-specific negative news suggests that external pressures and competitive dynamics played a significant role. Analyzing trading volume and considering the competitive landscape provides further context for understanding the stock's performance. While the short-term outlook might be uncertain, the long-term potential of D-Wave Quantum and the quantum computing market remains significant.

Call to Action: Understanding the dynamics behind the D-Wave Quantum (QBTS) stock drop is crucial for investors navigating the quantum computing market. Stay informed on the latest developments in the quantum computing sector and continue to analyze the D-Wave Quantum stock to make informed investment decisions. Monitor QBTS stock performance and stay updated on relevant news to effectively manage your quantum computing investments. Understanding the interplay between market sentiment, company news, and competition is key to navigating the volatile world of QBTS stock and other quantum computing investments.

Featured Posts

-

Tariff Wars Pose Significant Risk To Ryanairs Expansion Buyback Program Unveiled

May 21, 2025

Tariff Wars Pose Significant Risk To Ryanairs Expansion Buyback Program Unveiled

May 21, 2025 -

Optimalisatie Van Uw Abn Amro Kamerbrief Certificaten Verkoop

May 21, 2025

Optimalisatie Van Uw Abn Amro Kamerbrief Certificaten Verkoop

May 21, 2025 -

The Factors Contributing To D Wave Quantum Inc S Qbts Stock Price Increase

May 21, 2025

The Factors Contributing To D Wave Quantum Inc S Qbts Stock Price Increase

May 21, 2025 -

Real Madrid In Yeni Teknik Direktoerue Ve Arda Gueler In Gelecegi

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Ve Arda Gueler In Gelecegi

May 21, 2025 -

Employee Quits Pub Landlords Response Is Shocking

May 21, 2025

Employee Quits Pub Landlords Response Is Shocking

May 21, 2025

Latest Posts

-

Giakoymakis To Mls Ton Perimenei

May 21, 2025

Giakoymakis To Mls Ton Perimenei

May 21, 2025 -

I Pithanotita Epistrofis Toy Giakoymaki Sto Mls

May 21, 2025

I Pithanotita Epistrofis Toy Giakoymaki Sto Mls

May 21, 2025 -

To Mellon Toy Giakoymaki Epistrofi Sto Mls

May 21, 2025

To Mellon Toy Giakoymaki Epistrofi Sto Mls

May 21, 2025 -

Obstacles To A Successful Mls Transfer For Giorgos Giakoumakis

May 21, 2025

Obstacles To A Successful Mls Transfer For Giorgos Giakoumakis

May 21, 2025 -

Giorgos Giakoumakis Understanding His Reduced Appeal To Mls Teams

May 21, 2025

Giorgos Giakoumakis Understanding His Reduced Appeal To Mls Teams

May 21, 2025