Analyzing The Economic Effects Of U.S.-China Tariff Rollbacks

Table of Contents

Impact on Consumer Prices

Tariff reductions, a key component of U.S.-China tariff rollbacks, are expected to significantly impact consumer goods prices in both the US and China. Lower tariffs translate to decreased import costs, potentially leading to decreased inflation and increased purchasing power for consumers. This could stimulate consumer spending and overall economic activity.

- Examples of affected goods: Electronics (smartphones, laptops), clothing and apparel, furniture, and various household goods were among the items heavily impacted by previous tariffs. Rollbacks will directly influence their prices.

- Statistical data and projections: While precise projections are difficult due to market volatility, economic models suggest that even moderate tariff reductions could lead to a measurable decrease in the Consumer Price Index (CPI) in both countries. For example, a study by [cite a relevant economic research paper or institution] projected a [insert percentage]% decrease in CPI following a complete rollback of tariffs on [specify goods].

- Price changes before and after: Analyzing price changes before tariff increases, during their implementation, and post-rollback will provide critical data to assess the actual impact on consumers. This analysis should account for other factors influencing prices, like supply chain disruptions and currency fluctuations.

- Limitations and unforeseen consequences: It's important to acknowledge that not all price reductions will be directly proportional to the tariff reductions. Factors like transportation costs, retailer markups, and shifts in global supply chains can influence final consumer prices.

Effects on Business Investment and Growth

Reduced tariffs resulting from U.S.-China tariff rollbacks are likely to positively impact business investment and economic growth in both countries. The decreased cost of imported goods and raw materials can lower production costs, making businesses more competitive and encouraging increased investment.

- Supply chain adjustments and disruptions: The previous tariff wars led to significant supply chain disruptions. Rollbacks should facilitate the restoration of smoother and more efficient supply chains, boosting productivity.

- Impact on manufacturing and production: Lower input costs due to tariff reductions will incentivize increased manufacturing and production, leading to job creation and economic growth. This is particularly relevant for sectors heavily reliant on imported goods.

- Economic growth forecasts: Economic forecasting models often incorporate tariff rates as a key variable. A shift towards lower tariffs would likely result in upward revisions of GDP growth forecasts for both the US and China.

- Uncertainty and investor confidence: The level of uncertainty surrounding future trade policy significantly impacts investor confidence. Clear and consistent signals about tariff reductions can significantly bolster investor confidence, encouraging further investment.

Changes in International Trade Flows

U.S.-China tariff rollbacks will significantly alter international trade patterns. The potential for increased bilateral trade between the two economic giants is substantial. This could also trigger wider changes in global trade flows.

- Changes in import and export volumes: A reduction or elimination of tariffs will likely lead to a surge in bilateral trade volume, with increased exports from both countries. Data on import/export volumes before, during, and after tariff changes will be crucial for analysis.

- Trade diversion and trade creation effects: Tariff reductions can lead to "trade creation," where cheaper goods replace more expensive domestically produced goods. Conversely, "trade diversion" might occur if a country shifts imports away from a more efficient producer to one with preferential tariff treatment.

- Shifts in global supply chains: Businesses may re-evaluate their global supply chains in response to tariff rollbacks, potentially leading to relocation of production facilities and shifts in sourcing strategies.

- Impact on trade agreements and international relations: The success of U.S.-China tariff rollbacks could set a positive precedent for future trade negotiations, influencing the dynamics of global trade agreements and international relations.

Specific Sectoral Analyses

Analyzing the impact of U.S.-China tariff rollbacks across specific sectors provides a more granular understanding of their effects. For instance, the agriculture sector could see a significant boost in exports to China, while the technology sector might experience increased competition and adjustments in global production networks. Detailed data on each sector's performance before, during, and after tariff changes will help determine the long-term effects.

Geopolitical Implications of U.S.-China Tariff Rollbacks

Beyond purely economic factors, U.S.-China tariff rollbacks have significant geopolitical implications. Improved trade relations often pave the way for increased cooperation on other global issues, altering global power dynamics.

- Increased cooperation on global issues: Easing trade tensions can foster greater collaboration on issues like climate change, pandemics, and nuclear proliferation.

- Impact on US-China relations: Reduced trade friction can lead to improved overall relations between the two countries, influencing areas like technology transfer and human rights discussions.

- Changes in the global trade landscape: Successful tariff rollbacks could influence other countries' trade policies and encourage a more cooperative and less protectionist global trade environment.

Conclusion: Understanding the Long-Term Effects of U.S.-China Tariff Rollbacks

The economic impact of U.S.-China tariff rollbacks is multifaceted, affecting consumer prices, business investment, international trade flows, and geopolitical relations. While the potential benefits, such as reduced inflation and increased economic growth, are significant, it is crucial to carefully analyze potential negative consequences, including trade diversion and supply chain adjustments. To fully grasp the long-term effects, continuous monitoring of key economic indicators, such as CPI, GDP growth, and trade volumes, is essential.

We encourage readers to stay informed about developments in U.S.-China trade relations and the ongoing effects of U.S.-China tariff rollbacks on the global economy. Further research into specific sectoral impacts and the evolution of global supply chains will be vital for effective economic forecasting and policy-making. Analyzing the effects of U.S.-China tariff rollbacks is crucial for understanding the future direction of the global economy.

Featured Posts

-

Slobodna Dalmacija Promijenjeni Di Caprio Fotografije Koje Ce Vas Iznenaditi

May 13, 2025

Slobodna Dalmacija Promijenjeni Di Caprio Fotografije Koje Ce Vas Iznenaditi

May 13, 2025 -

Hannovers Fussball Frust Drohkulisse Und Die Folgen In Der 2 Liga

May 13, 2025

Hannovers Fussball Frust Drohkulisse Und Die Folgen In Der 2 Liga

May 13, 2025 -

I Plimmyra Poy Allakse Tin Istoria Nea Ereyna Gia Ton Kataklysmo Tis Mesogeioy

May 13, 2025

I Plimmyra Poy Allakse Tin Istoria Nea Ereyna Gia Ton Kataklysmo Tis Mesogeioy

May 13, 2025 -

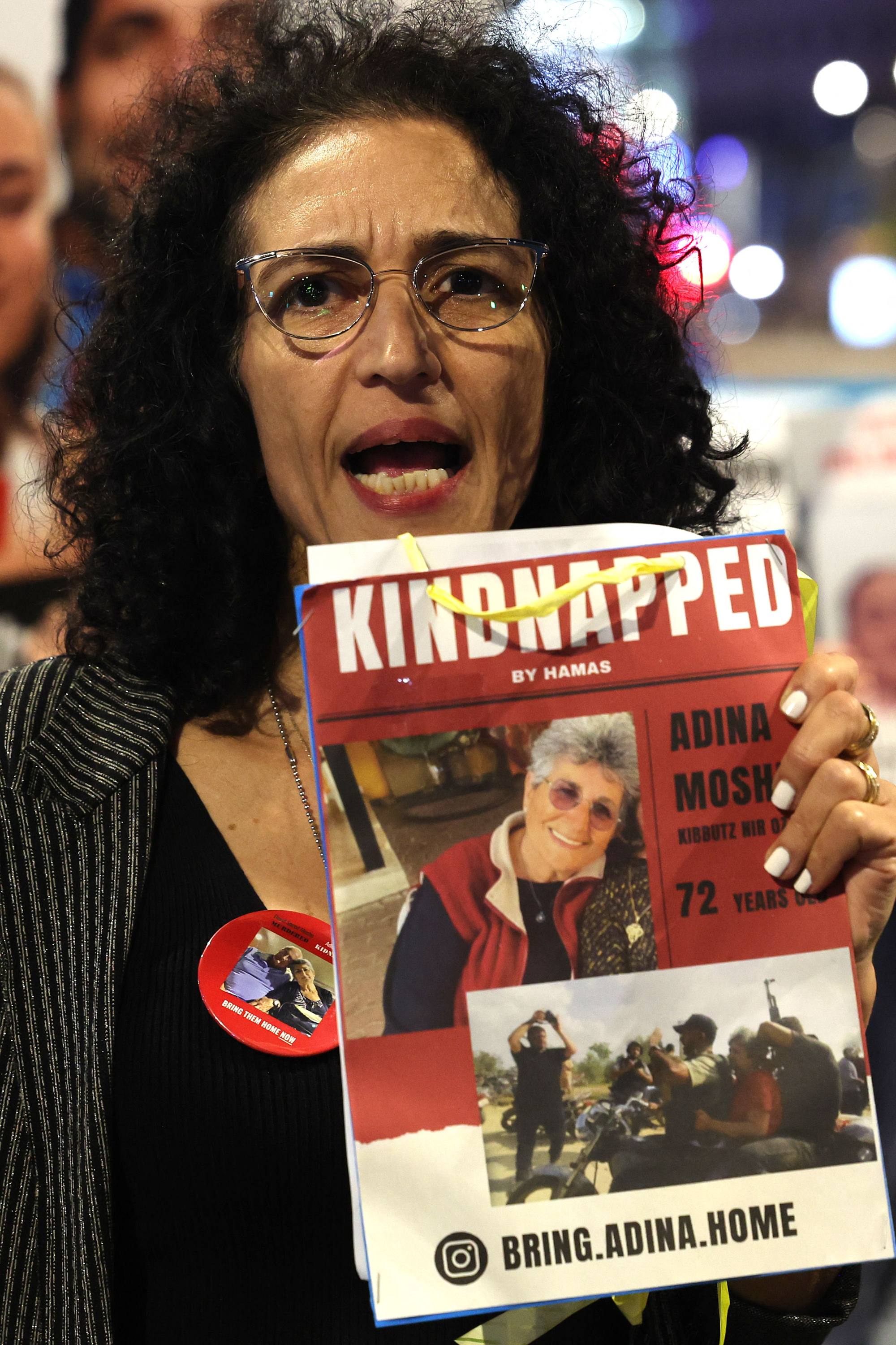

Gaza Hostages The Lingering Nightmare For Families

May 13, 2025

Gaza Hostages The Lingering Nightmare For Families

May 13, 2025 -

Neue Oberschule Braunschweig Bericht Zum Amokalarm Und Massnahmen

May 13, 2025

Neue Oberschule Braunschweig Bericht Zum Amokalarm Und Massnahmen

May 13, 2025

Latest Posts

-

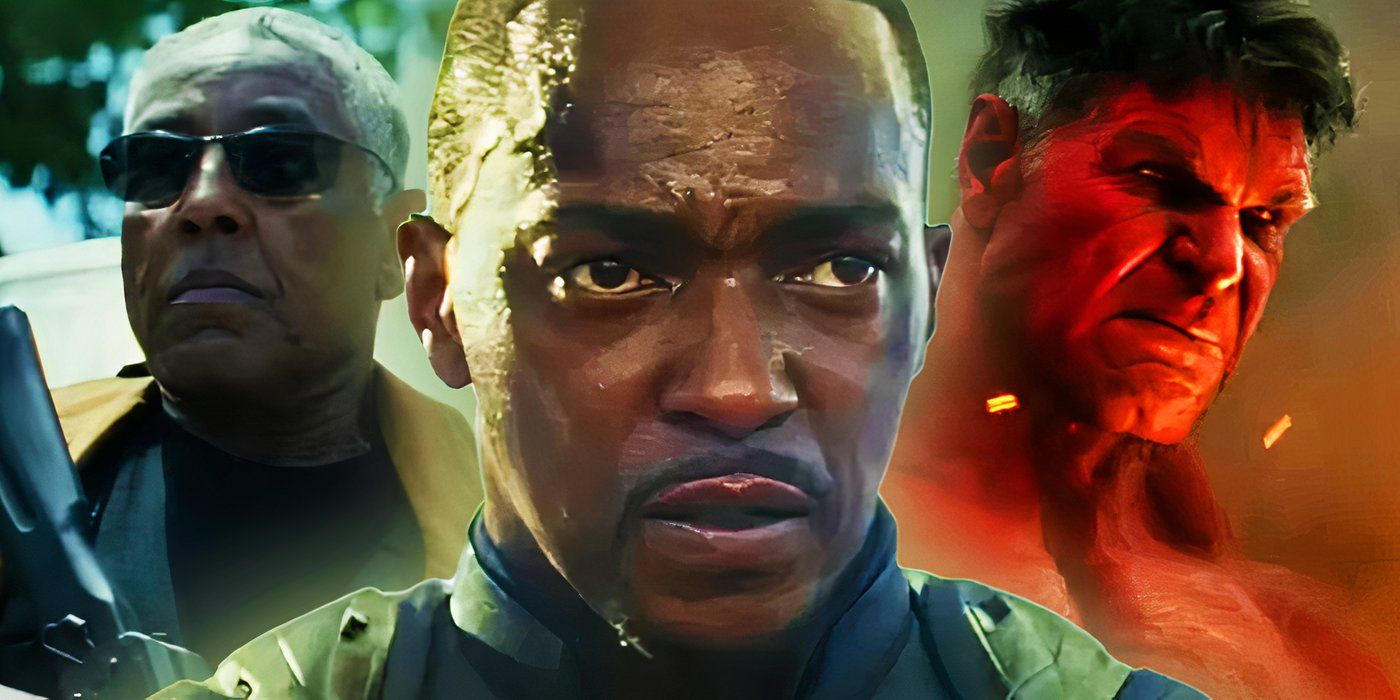

Captain America Brave New Worlds Underwhelming Box Office Performance

May 14, 2025

Captain America Brave New Worlds Underwhelming Box Office Performance

May 14, 2025 -

Captain America 4 Box Office Lower Than Expected Returns Analyzed

May 14, 2025

Captain America 4 Box Office Lower Than Expected Returns Analyzed

May 14, 2025 -

Captain America Brave New World Box Office A Disappointing Start For The Mcu

May 14, 2025

Captain America Brave New World Box Office A Disappointing Start For The Mcu

May 14, 2025 -

2 D Disney Animation Style Captain America Brave New World Featuring Sam Wilson And Red Hulk

May 14, 2025

2 D Disney Animation Style Captain America Brave New World Featuring Sam Wilson And Red Hulk

May 14, 2025 -

Sam Wilson And Red Hulk A Disney 2 D Animated Vision Of Captain America Brave New World

May 14, 2025

Sam Wilson And Red Hulk A Disney 2 D Animated Vision Of Captain America Brave New World

May 14, 2025