Analyzing The Impact Of Trump's XRP Endorsement On Institutional Investment

Table of Contents

Pre-Endorsement Sentiment Towards XRP Among Institutional Investors

Before considering any potential Trump endorsement, it's crucial to understand the prevailing sentiment among institutional investors regarding XRP. This sentiment is heavily influenced by two primary factors: risk assessment and market performance.

Risk Assessment and Regulatory Uncertainty

The regulatory landscape surrounding XRP is complex and fraught with uncertainty. This uncertainty significantly impacts institutional investment decisions.

- SEC Lawsuits: The ongoing legal battles between Ripple Labs (the company behind XRP) and the Securities and Exchange Commission (SEC) cast a long shadow over the cryptocurrency's future.

- Ripple's Legal Battles: The outcome of these lawsuits will significantly determine XRP's regulatory classification and its viability in the US market.

- Uncertainty about XRP's Classification as a Security: This is a major hurdle for institutional investors, many of whom are legally restricted from investing in securities deemed unregistered.

These factors create a significant barrier to entry for institutional investors, who prioritize regulatory clarity and legal compliance above all else. The perceived legal risk associated with XRP makes it a less attractive investment compared to other cryptocurrencies with clearer regulatory pathways.

Performance and Market Volatility

XRP's price history reveals periods of significant volatility. This inherent instability raises concerns about its long-term viability as a stable investment asset.

- Historical Price Charts: Analyzing XRP's historical price performance demonstrates considerable price fluctuations, reflecting its sensitivity to market sentiment and regulatory news.

- Market Capitalization: While XRP boasts a substantial market capitalization, its ranking relative to other cryptocurrencies fluctuates, indicating ongoing market uncertainty.

- Trading Volume: XRP's trading volume is often subject to substantial spikes and dips, reflecting periods of high speculation and risk-taking behavior.

These factors contribute to institutional investors’ hesitation, as they often favor assets with more predictable price action and lower volatility.

Immediate Impact of a Hypothetical Trump Endorsement

A hypothetical Trump endorsement of XRP would likely trigger a significant and immediate market reaction.

Short-Term Price Volatility and Trading Activity

- Expected Price Surge: A Trump endorsement would likely lead to a rapid surge in XRP's price, driven by increased demand and speculative buying.

- Increased Trading Volume: We can expect to see a dramatic increase in trading volume as investors rush to buy and sell XRP, leading to significant market fluctuations.

- Potential for Short Squeezes: The price surge could also potentially trigger short squeezes, as investors who bet against XRP (short selling) would be forced to buy back their positions to limit potential losses.

The psychological impact of such a high-profile endorsement cannot be underestimated. It would dramatically alter investor behavior, prioritizing emotional response over fundamental analysis in the short term.

Increased Media Attention and Public Perception

The endorsement would garner immense media attention, significantly influencing public perception and potentially impacting institutional investment decisions.

- News Articles: Major news outlets would extensively cover the event, shaping public opinion and influencing investment decisions.

- Social Media Discussions: Social media platforms would buzz with discussions surrounding XRP, amplifying the positive sentiment created by the endorsement.

- Changes in Public Sentiment: A positive endorsement from Trump could generate a significant shift in public sentiment towards XRP, making it more attractive to both retail and institutional investors.

This increased positive media coverage could, in the short term, sway institutional investors towards a more favorable view of XRP, despite the lingering regulatory concerns.

Long-Term Effects on Institutional Investment in XRP

While a short-term price surge is likely, the long-term impact of a Trump endorsement on institutional investment in XRP remains uncertain.

Shifting Risk-Reward Profiles

A Trump endorsement would likely alter the perceived risk-reward profile of XRP.

- Increased Legitimacy: The endorsement would lend a degree of legitimacy to XRP, potentially attracting investors who previously held reservations.

- Potential for Mainstream Adoption: Increased visibility could accelerate mainstream adoption, further increasing its value and appeal to institutional investors.

- Lingering Regulatory Risks: However, the ongoing regulatory uncertainty remains a significant concern that could limit institutional investment despite any positive sentiment.

The long-term success of XRP will hinge on resolving the regulatory uncertainty surrounding it. Only with increased regulatory clarity can institutions confidently integrate XRP into their portfolios.

Impact on Institutional Portfolio Diversification Strategies

If regulatory clarity improves, institutional investors might adjust their portfolio diversification strategies to include XRP.

- Allocation Strategies: Institutional investors would likely allocate a portion of their cryptocurrency holdings to XRP, depending on its perceived risk and potential returns.

- Risk Management Techniques: Sophisticated risk management techniques would be employed to mitigate the volatility inherent in cryptocurrencies like XRP.

- Hedging Against Market Volatility: Investors might use XRP as a hedge against market volatility, taking advantage of its potential for growth and diversification benefits.

The decision to integrate XRP into institutional portfolios will ultimately depend on a careful evaluation of its risk-reward profile and its potential contribution to overall portfolio diversification.

Conclusion

Trump's potential endorsement of XRP would undoubtedly have a significant, albeit complex, impact on institutional investment. The immediate effect would likely be a sharp price increase and heightened media attention, but the long-term success depends heavily on resolving the ongoing regulatory challenges. The interplay of regulatory clarity and market sentiment is crucial in shaping institutional investor decisions. Understanding the complexities surrounding Trump's potential influence on XRP investments is crucial for navigating the ever-changing world of cryptocurrency investment. Continue researching the evolving landscape of cryptocurrency regulation and the impact of public figures on market dynamics to make informed decisions regarding investing in XRP or similar cryptocurrencies.

Featured Posts

-

Lewis Capaldi Looks Happy And Healthy In New Photo With Unexpected Friend

May 07, 2025

Lewis Capaldi Looks Happy And Healthy In New Photo With Unexpected Friend

May 07, 2025 -

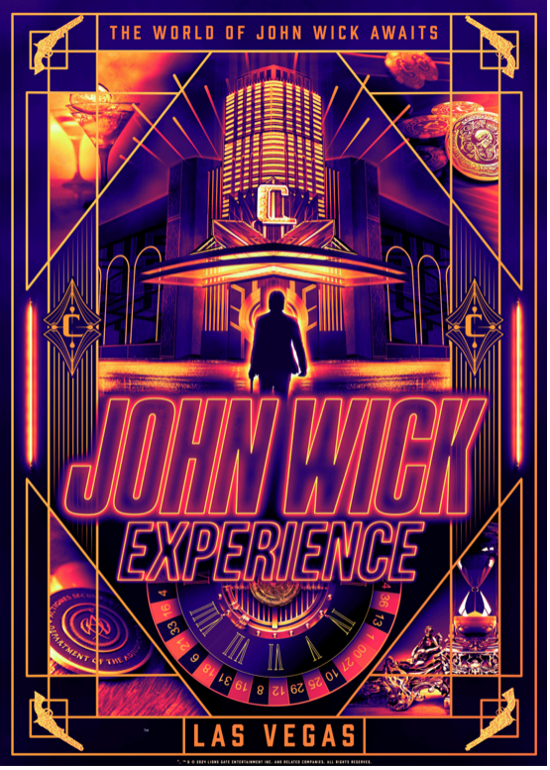

Baba Yaga In Las Vegas A John Wick Themed Immersive Experience

May 07, 2025

Baba Yaga In Las Vegas A John Wick Themed Immersive Experience

May 07, 2025 -

Stansted Airports New Casablanca Connection Everything You Need To Know

May 07, 2025

Stansted Airports New Casablanca Connection Everything You Need To Know

May 07, 2025 -

April 12th Lotto Results Check The Jackpot Numbers

May 07, 2025

April 12th Lotto Results Check The Jackpot Numbers

May 07, 2025 -

Dragon Quest I And Ii Hd 2 D Remake Tops Famitsus Most Wanted March 9 2025

May 07, 2025

Dragon Quest I And Ii Hd 2 D Remake Tops Famitsus Most Wanted March 9 2025

May 07, 2025