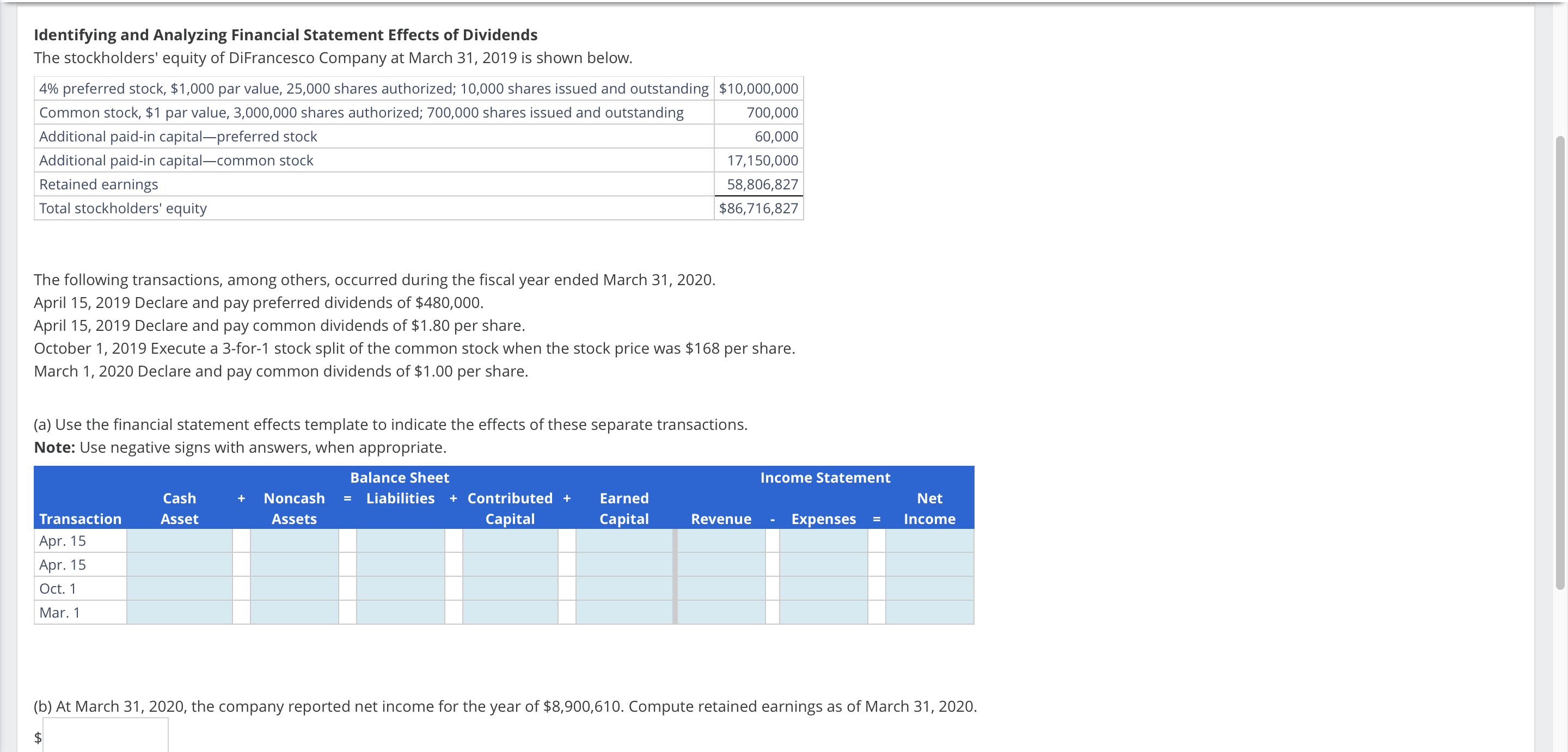

Analyzing The Impact Of X's Debt Sale On Its Financial Future

Table of Contents

X Corp's recent announcement of a significant debt sale has sent ripples through the financial markets, raising crucial questions about the long-term implications for the company's financial health. Analyzing the impact of X Corp's debt sale on its financial future is vital for investors, analysts, and stakeholders alike. This article will delve into the short-term and long-term effects of this strategic move, examining its immediate impact on liquidity, the potential long-term risks associated with increased debt, the strategic rationale behind the decision, and the market's response. We will assess whether this debt sale positions X Corp for sustainable growth or introduces significant financial vulnerabilities.

Immediate Effects of the Debt Sale on X Corp's Liquidity and Cash Flow

The immediate effect of X Corp's debt sale is a substantial injection of cash into the company's coffers. This influx of capital directly improves X Corp's liquidity, providing immediate relief for working capital needs and offering greater flexibility in managing short-term debt obligations. The proceeds from the sale can be used to pay down existing high-interest debt, leading to a reduction in interest expense and improved profitability.

- Increased cash reserves: The sale significantly bolsters X Corp's cash reserves, providing a financial buffer against unexpected economic downturns or operational challenges.

- Reduced reliance on short-term, high-interest debt: By leveraging the debt sale proceeds to pay down expensive short-term loans, X Corp can reduce its overall borrowing costs and enhance its financial stability.

- Potential for improved credit ratings: The reduction in debt levels could potentially lead to an upgrade in X Corp's credit rating, making future borrowing cheaper and easier.

- Potential for increased operational flexibility: With improved liquidity and reduced debt burden, X Corp can now explore new opportunities for growth and expansion without being overly constrained by financial limitations.

Long-Term Implications of Increased Debt on X Corp's Financial Health

While the immediate benefits are clear, the increased debt levels resulting from the sale also introduce long-term risks. X Corp's debt-to-equity ratio will inevitably rise, potentially impacting its financial health if not managed carefully. Higher debt levels translate to increased interest expense, which can significantly eat into profitability, especially if revenue growth fails to keep pace.

- Increased interest expense impacting profitability: The added interest payments on the newly issued debt will directly reduce net income, potentially impacting investor returns and share value.

- Potential for reduced credit rating if debt levels become unsustainable: If X Corp fails to manage its debt responsibly, leading to an excessively high debt-to-equity ratio, credit rating agencies might downgrade its rating, increasing its borrowing costs and potentially hindering future growth.

- Higher cost of future borrowing: A lower credit rating translates to higher interest rates on any future debt financing, placing further pressure on profitability.

- Risk of financial distress during economic downturns: Periods of economic recession can severely impact a company's revenue. High debt levels during such times can strain cash flows and increase the risk of financial distress or even bankruptcy.

Strategic Considerations Behind X Corp's Decision to Sell Debt

X Corp's decision to sell debt wasn't arbitrary. The strategic rationale likely involves a careful assessment of the company's growth prospects and available financing options. The proceeds could be earmarked for strategic acquisitions, research and development, or capital expenditure programs designed to fuel expansion and enhance market competitiveness. Alternatively, the company might be refinancing existing high-cost debt to lower its overall interest expense.

- Specific strategic goals: The debt sale might be integral to a larger strategic plan aimed at market share expansion, technological innovation, or geographic diversification.

- Evaluation of alternative financing methods: Before opting for a debt sale, X Corp likely evaluated alternative financing options such as equity financing or asset sales. The decision to sell debt suggests that the company considered it the most suitable option given its current circumstances and risk tolerance.

- Analysis of the risk-reward profile: The company’s leadership carefully weighed the potential risks of increased debt against the anticipated rewards from pursuing its strategic objectives.

Market Reaction and Investor Sentiment Following the Debt Sale

The market's response to X Corp's debt sale has been mixed. Stock price fluctuations immediately following the announcement offer insights into investor sentiment. While some investors view the debt sale as a positive sign of aggressive growth strategy, others are concerned about the increased debt burden. Credit rating agencies will closely monitor X Corp's financial performance and debt management to assess its creditworthiness.

- Stock price performance: Analyzing the stock price's trajectory before, during, and after the announcement provides a crucial gauge of market confidence in X Corp's strategy.

- Analyst ratings and recommendations: Financial analysts will issue revised ratings and recommendations based on their assessment of the debt sale's impact on X Corp's financial prospects.

- Changes in investor confidence levels: Investor confidence levels, reflected in trading volumes and stock prices, will reveal whether the market perceives the debt sale as a positive or negative development.

- Credit rating agency assessments: Credit rating agencies' actions and statements regarding the debt sale will significantly influence investor perception and borrowing costs for X Corp.

Conclusion: Assessing the Long-Term Financial Outlook After X Corp's Debt Sale

Analyzing the impact of X Corp's debt sale requires a balanced perspective. While the immediate injection of cash offers significant benefits in terms of liquidity and operational flexibility, the increased debt levels introduce long-term financial risks. The success of this strategic move hinges on X Corp's ability to manage its debt responsibly and generate sufficient revenue growth to offset increased interest expenses. Monitoring X Corp's financial performance, including key metrics like its debt-to-equity ratio, interest coverage ratio, and credit rating, will be critical in evaluating the long-term impact of this debt sale. To stay updated on X Corp’s financial performance and the ongoing effects of this debt sale, visit our website regularly for further analysis.

Featured Posts

-

Open Ai Unveils Simplified Voice Assistant Development Tools

Apr 28, 2025

Open Ai Unveils Simplified Voice Assistant Development Tools

Apr 28, 2025 -

Auto Dealers Intensify Opposition To Mandatory Ev Sales

Apr 28, 2025

Auto Dealers Intensify Opposition To Mandatory Ev Sales

Apr 28, 2025 -

Mets Send Nez To Syracuse Megill Joins Starting Rotation

Apr 28, 2025

Mets Send Nez To Syracuse Megill Joins Starting Rotation

Apr 28, 2025 -

Nascars Bubba Wallace Inspires Austin Teens Before Cota Race

Apr 28, 2025

Nascars Bubba Wallace Inspires Austin Teens Before Cota Race

Apr 28, 2025 -

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

Latest Posts

-

Faster Nuclear Power Plants Trump Administrations New Approach

May 11, 2025

Faster Nuclear Power Plants Trump Administrations New Approach

May 11, 2025 -

Nuclear Power Plant Construction Trump Team Weighs Faster Timeline

May 11, 2025

Nuclear Power Plant Construction Trump Team Weighs Faster Timeline

May 11, 2025 -

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 11, 2025

Trump Administration Considers Speeding Up Nuclear Power Plant Construction

May 11, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 11, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 11, 2025 -

The Shrinking Chinese Market A Threat To Bmw Porsche And Competitors

May 11, 2025

The Shrinking Chinese Market A Threat To Bmw Porsche And Competitors

May 11, 2025