Analyzing The Post-Trump Trade War Landscape: A Wall Street Bets View

Table of Contents

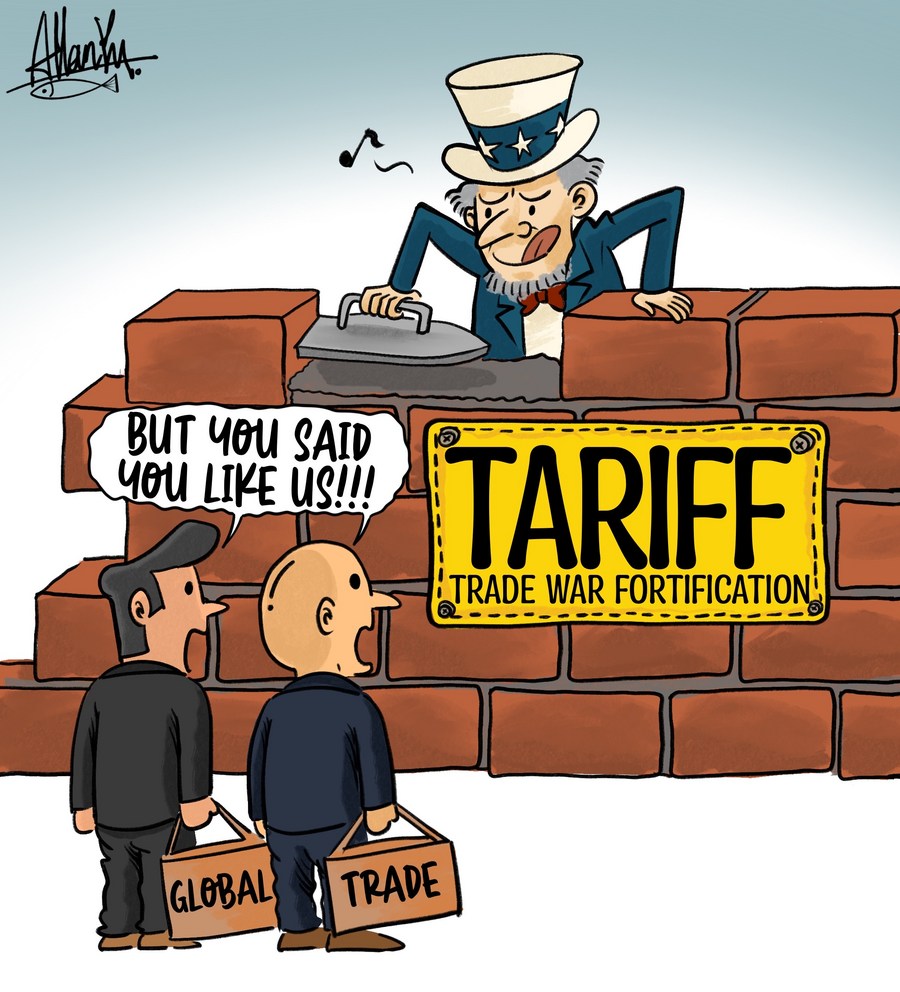

The Legacy of Tariffs and Trade Disputes

The Trump administration's "America First" approach resulted in a wave of tariffs and trade disputes that continue to reverberate through the global economy. Understanding this legacy is crucial for assessing the Post-Trump Trade War landscape.

Lingering Effects on Specific Industries

The impact of these trade wars varied widely across different sectors. Some industries benefited from protectionist measures, while others suffered significant losses.

- Agriculture: Farmers faced retaliatory tariffs from key trading partners, impacting exports and farm incomes. The USMCA (United States-Mexico-Canada Agreement) aimed to mitigate some of these impacts, but challenges remain. Keywords: tariff impact, agricultural trade, USMCA.

- Manufacturing: The steel and aluminum industries saw initial price increases due to tariffs, but ultimately faced reduced global competitiveness and supply chain disruptions. Keywords: manufacturing jobs, steel tariffs, global competitiveness.

- Technology: The tech sector faced significant challenges, particularly in its relationship with China, resulting in ongoing tensions and uncertainty regarding intellectual property and market access. Keywords: tech trade war, China trade, intellectual property.

Supply chain disruptions caused by the trade war continue to impact businesses worldwide, leading to increased costs and uncertainty. Rebuilding resilient and diversified supply chains is a major challenge for many companies navigating the Post-Trump Trade War landscape. The trade deficit also remains a significant concern, requiring ongoing strategic adjustments from businesses and governments alike.

The Shifting Geopolitical Landscape

The Trump administration's trade policies significantly altered relationships with key trading partners.

- China: The trade war with China led to increased tensions and a restructuring of global supply chains. The resulting geopolitical risk remains significant. Keywords: China trade relations, geopolitical risk, US-China trade.

- European Union: Relations with the EU also suffered, with disagreements over tariffs and regulatory issues. Keywords: EU trade relations, transatlantic trade.

The rise of new trade blocs and regional agreements further complicates the landscape, creating both opportunities and challenges for businesses adapting to this new global order. Navigating this complex geopolitical reality is crucial for understanding the Post-Trump Trade War landscape.

Wall Street Bets Sentiment and Investment Strategies

The impact of the trade war extended far beyond traditional Wall Street, profoundly affecting the sentiment and investment strategies of retail investors active on platforms like Wall Street Bets.

Meme Stock Reactions to Trade Policy Changes

Trade-related news and market volatility often triggered dramatic swings in meme stock prices. Social media chatter played a significant role in shaping investor sentiment and driving these price fluctuations.

- Example: News of escalating trade tensions could lead to a sell-off in certain sectors, while positive developments could trigger a buying frenzy. Keywords: meme stock volatility, retail investor behavior, social media sentiment.

Understanding the influence of social media sentiment and the unique dynamics of the meme stock market is critical for interpreting market reactions to trade policy changes.

Analyzing Opportunities and Risks in a Post-Trade War World

The Post-Trump Trade War landscape presents a mixed bag of opportunities and risks. Identifying these is key to successful investment strategies.

- Opportunities: Sectors benefiting from reshoring or regionalization of supply chains may offer attractive investment opportunities. Keywords: investment opportunities, reshoring, supply chain diversification.

- Risks: Industries still grappling with the lingering effects of tariffs and supply chain disruptions face considerable challenges. Keywords: risk management, portfolio diversification, geopolitical risk.

Diversification and a thorough understanding of geopolitical risks are crucial for navigating the uncertainties of this evolving environment. Careful risk management is paramount in the Post-Trump Trade War landscape.

The Biden Administration's Trade Policy and its Impact

President Biden's approach to trade differs significantly from his predecessor's. Understanding this shift is crucial for predicting the future.

A Comparison with Trump's Approach

While Trump focused on bilateral deals and aggressive tariffs, Biden emphasizes multilateral cooperation and a rules-based international trading system. Keywords: Biden vs. Trump trade policy, multilateralism, bilateral trade.

Focus on Key Trade Issues

Biden's administration prioritizes strengthening alliances, addressing climate change through trade policy, and combating unfair trade practices. Keywords: Biden trade priorities, climate trade, fair trade practices.

Predictions for the Future of US Trade Policy

While predicting the future is inherently uncertain, we can anticipate a continued focus on strengthening alliances and reforming the World Trade Organization (WTO). The overall direction suggests a move towards a more collaborative and rules-based approach to international trade. Keywords: future of US trade, WTO reform, international trade agreements.

Conclusion

The Post-Trump Trade War landscape presents both challenges and opportunities for investors. While the immediate impact of Trump's policies is still being felt, the Biden administration's approach offers a different path forward. Understanding the lingering effects on various industries, the shifting geopolitical dynamics, and the sentiment of Wall Street Bets investors is crucial for navigating this complex environment. By carefully analyzing the risks and opportunities, and staying informed about evolving trade policies, investors can position themselves for success in the ongoing reshaping of global trade. Continue your research on the Post-Trump Trade War landscape and develop a robust investment strategy tailored to this dynamic environment.

Featured Posts

-

Pokemon Tcg Pocket New Crown Zenith Unexpected Cards Delight Fans

May 29, 2025

Pokemon Tcg Pocket New Crown Zenith Unexpected Cards Delight Fans

May 29, 2025 -

Ipa O Tramp Eyxetai Ston Mpainten Grigori Anarrosi

May 29, 2025

Ipa O Tramp Eyxetai Ston Mpainten Grigori Anarrosi

May 29, 2025 -

Boise State Vs Utah State Aggies Claim First Mountain West Gymnastics Crown

May 29, 2025

Boise State Vs Utah State Aggies Claim First Mountain West Gymnastics Crown

May 29, 2025 -

Arcane Season 2 Jinx And Ekko Return In Iconic Song Finale

May 29, 2025

Arcane Season 2 Jinx And Ekko Return In Iconic Song Finale

May 29, 2025 -

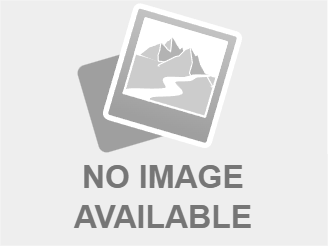

Athletic Club Jugadores Historicos Que Llevaron El Dorsal 23

May 29, 2025

Athletic Club Jugadores Historicos Que Llevaron El Dorsal 23

May 29, 2025

Latest Posts

-

L Ingenierie Des Castors En Drome Comparaison De Deux Sites D Etude

May 31, 2025

L Ingenierie Des Castors En Drome Comparaison De Deux Sites D Etude

May 31, 2025 -

Droits Pour Le Vivant Le Combat Pour La Justice Des Etoiles De Mer

May 31, 2025

Droits Pour Le Vivant Le Combat Pour La Justice Des Etoiles De Mer

May 31, 2025 -

Evaluation De L Impact Des Amenagements Castors Sur Deux Cours D Eau Dromois

May 31, 2025

Evaluation De L Impact Des Amenagements Castors Sur Deux Cours D Eau Dromois

May 31, 2025 -

Justice Pour Les Etoiles De Mer Une Question De Droits Pour Le Vivant

May 31, 2025

Justice Pour Les Etoiles De Mer Une Question De Droits Pour Le Vivant

May 31, 2025 -

L Ingenierie Castor En Drome Comparaison De Deux Cas D Etude

May 31, 2025

L Ingenierie Castor En Drome Comparaison De Deux Cas D Etude

May 31, 2025