Analyzing The Potential Of A Canadian Tire And Hudson's Bay Combination

Table of Contents

The current economic climate has many businesses reassessing strategies, leading to increased speculation about potential mergers and acquisitions in the Canadian retail sector. One intriguing hypothetical scenario involves a combination of two Canadian retail giants: Canadian Tire and Hudson's Bay Company (HBC). This article will analyze the potential benefits and drawbacks of such a merger, considering its impact on market share, synergies, and the overall Canadian consumer experience. We'll explore the potential for synergy, competitive advantages, regulatory hurdles, and the broader economic implications of this hypothetical acquisition.

<h2>Synergies and Enhanced Market Share</h2>

A merger between Canadian Tire and HBC presents significant opportunities for synergy and expanded market share within the Canadian retail landscape. The combination of these two retail powerhouses would create a behemoth, reshaping the competitive landscape.

<h3>Expanded Product Portfolio and Customer Base</h3>

Canadian Tire's strength lies in its hardware, sporting goods, and automotive products, while HBC excels in apparel, home furnishings, and luxury goods. This complementary nature offers immense potential:

- Increased customer reach: Accessing a broader customer base beyond each company's existing demographics.

- Reduced reliance on single product categories: Diversifying revenue streams and mitigating risks associated with fluctuations in specific markets.

- Potential for cross-selling: Leveraging existing customer relationships to promote products from both brands, boosting sales across the combined entity.

- Loyalty program integration: Combining the respective loyalty programs could create a more comprehensive and rewarding experience, further enhancing customer retention. This combined loyalty program could offer significant advantages for consumers and improve data collection for targeted marketing efforts.

<h3>Economies of Scale and Cost Reduction</h3>

Consolidation would offer substantial cost-saving opportunities through economies of scale:

- Negotiating better supplier prices: Increased purchasing power would lead to significantly better wholesale deals.

- Optimizing store locations: Analyzing existing store footprints to identify redundancies and streamline operations, potentially leading to closures but also more strategically placed new locations.

- Streamlined supply chain: Combining logistics and distribution networks could improve efficiency and reduce transportation costs.

However, these efficiencies might come at a cost. Careful workforce management is crucial to mitigate potential job losses, ensuring a smooth transition and minimizing negative social impacts. A responsible approach to workforce integration will be critical to the success of such a merger.

<h2>Competitive Advantages and Challenges</h2>

The combined entity would undoubtedly present a formidable competitor, especially against industry giants like Walmart and Amazon.

<h3>Increased Competition with Walmart and Amazon</h3>

A Canadian Tire and HBC merger could result in several competitive advantages:

- Enhanced online presence: Combining online platforms and enhancing e-commerce capabilities could improve reach and convenience.

- Improved omnichannel experience: Offering a seamless shopping experience across physical stores and online platforms would enhance customer satisfaction.

- Leveraging data analytics for targeted marketing: Combining customer data could allow for highly effective, personalized marketing campaigns.

However, adapting to the dynamic e-commerce landscape remains a challenge. Maintaining a competitive edge requires continuous investment in technology and innovative strategies to counter the dominance of online retail giants.

<h3>Regulatory Hurdles and Antitrust Concerns</h3>

Such a significant merger would inevitably face scrutiny from the Competition Bureau of Canada. Concerns about market dominance and monopolistic practices could lead to:

- Potential for regulatory investigation: A thorough assessment of the merger's impact on competition is highly probable.

- Need for concessions to ensure fair competition: The Competition Bureau might require divestitures or other measures to prevent anti-competitive behaviour.

- Impact on smaller retailers: The combined entity's market power could put pressure on smaller competitors, potentially forcing some out of business.

The likelihood of approval will depend heavily on the concessions offered by the merging companies and the Bureau's assessment of the overall competitive landscape.

<h2>Impact on Consumers and the Canadian Economy</h2>

The merger’s consequences for consumers and the Canadian economy require careful consideration.

<h3>Potential Price Changes and Product Availability</h3>

The impact on consumer pricing and product availability is uncertain:

- Potential for price increases or decreases due to economies of scale: Cost reductions could lead to lower prices, but increased market power could also incentivize price increases.

- Changes in product assortment: The combined entity might discontinue certain product lines, impacting consumer choice.

- Impact on consumer choice: While a wider selection might be available, the reduction in competition could limit consumer choice in the long run. However, a more comprehensive loyalty program and expanded product offerings could ultimately benefit consumers.

<h3>Job Creation and Economic Growth</h3>

The merger's impact on employment is complex:

- Potential job losses in certain areas: Overlapping roles and store closures could lead to job losses.

- Potential job creation in others (e.g., technology, management): New roles in areas like e-commerce, data analytics, and management might be created.

- Impact on regional economies: Store closures could negatively affect local economies, while new investments could create positive economic impact elsewhere.

The long-term economic implications will depend on the merger's success in creating efficiencies, innovating, and adapting to changing market conditions.

<h2>Conclusion: Assessing the Future of a Canadian Tire and Hudson's Bay Combination</h2>

A hypothetical merger between Canadian Tire and Hudson's Bay presents both significant opportunities and considerable challenges. While synergies, increased market share, and cost reductions are potentially substantial benefits, regulatory hurdles, potential job losses, and the impact on consumer choice require careful consideration. The success of such a combination will hinge on effectively navigating regulatory scrutiny, managing workforce integration, and adapting to the ever-evolving retail landscape. The potential economic and social implications are far-reaching and warrant thorough analysis.

What are your thoughts on this potential Canadian Tire and HBC merger? Discuss the implications of a combined Canadian Tire and Hudson's Bay Company for the future of Canadian retail. Let's continue the discussion and analyze this important topic in the Canadian retail landscape.

Featured Posts

-

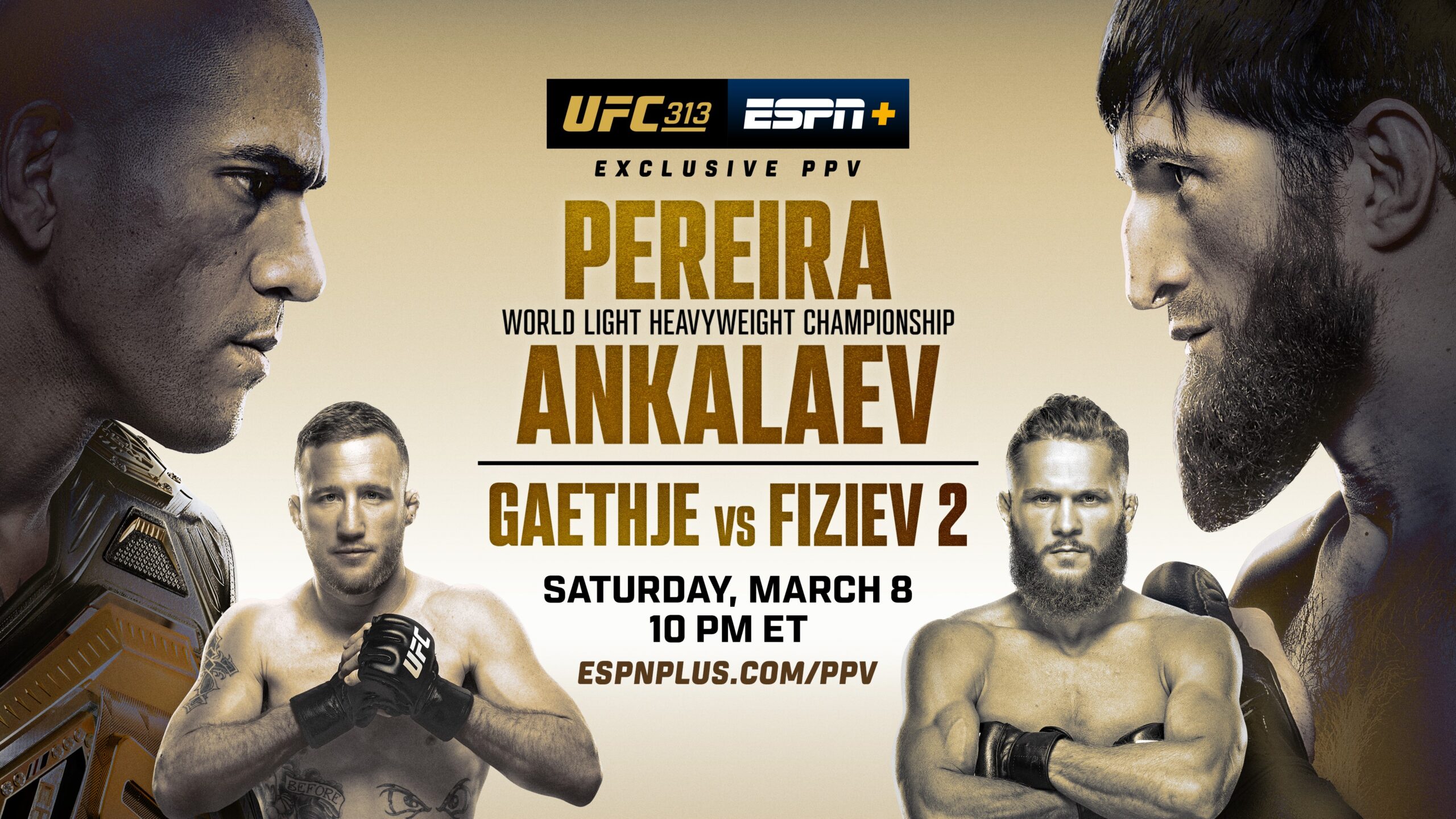

Ufc 313 Preview Your Guide To The Fights Tickets And How To Watch

May 19, 2025

Ufc 313 Preview Your Guide To The Fights Tickets And How To Watch

May 19, 2025 -

Eurovision Song Contest 2025 Date And Location Confirmed

May 19, 2025

Eurovision Song Contest 2025 Date And Location Confirmed

May 19, 2025 -

Uber Mumbai Pet Travel Guide How To Book Safely

May 19, 2025

Uber Mumbai Pet Travel Guide How To Book Safely

May 19, 2025 -

School Employee Among Fsu Shooting Victims Familys Complex Background

May 19, 2025

School Employee Among Fsu Shooting Victims Familys Complex Background

May 19, 2025 -

Ufc 313 Preview Rookie Report A Look At The Rising Stars

May 19, 2025

Ufc 313 Preview Rookie Report A Look At The Rising Stars

May 19, 2025