Analyzing The Potential Of Sub-3% Mortgage Rates In Canada's Housing Market

Table of Contents

The Allure of Sub-3% Mortgage Rates and Increased Affordability

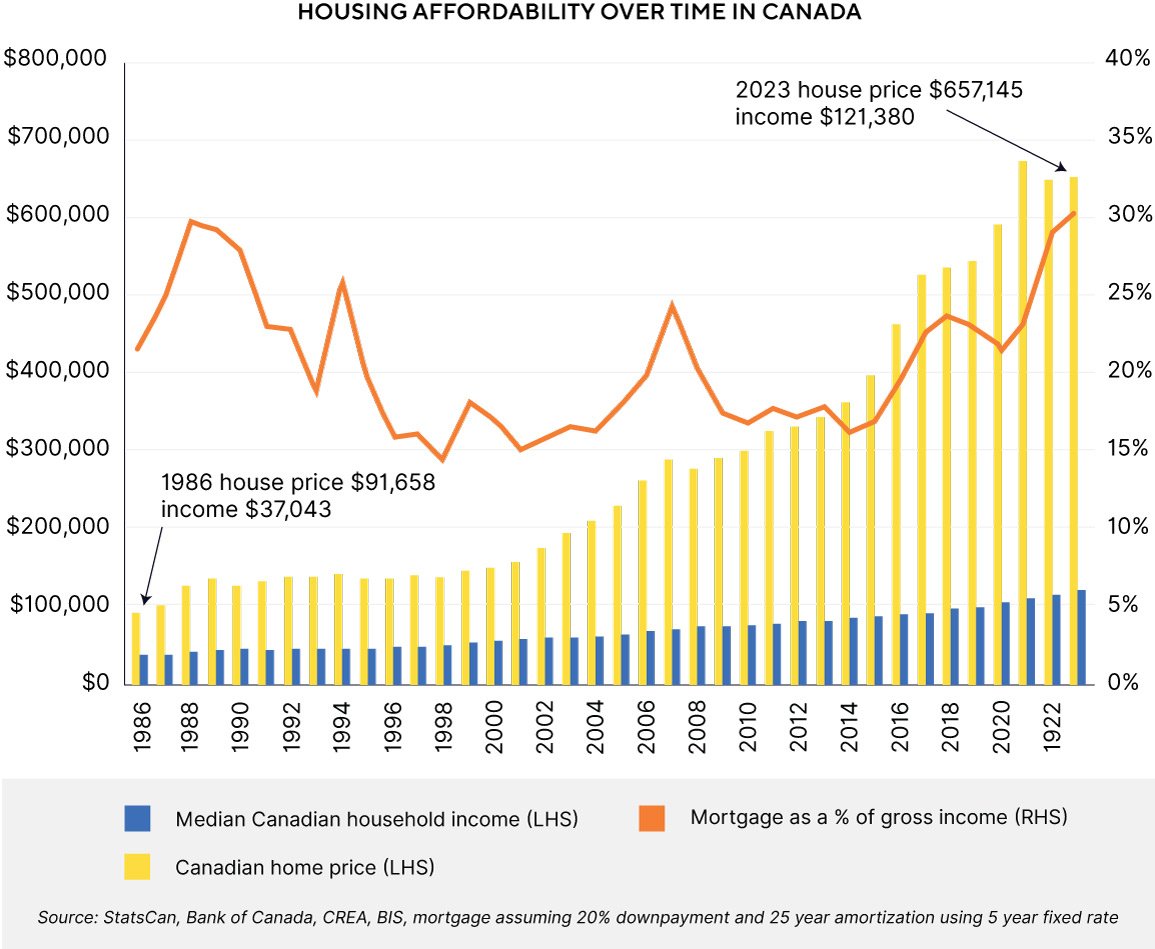

The prospect of sub-3% mortgage rates in Canada is incredibly enticing for prospective homebuyers. These historically low rates significantly boost purchasing power, making homeownership more accessible to a wider range of individuals and families.

Impact on Purchasing Power

Lower mortgage rates translate directly into a greater borrowing capacity. For example, a buyer previously approved for a $500,000 mortgage at 5% might now qualify for a significantly larger loan at 2.99%, potentially increasing their purchasing power by $50,000-$100,000 or more, depending on the amortization period and other factors.

- Increased borrowing capacity: Lower rates mean monthly payments are lower for the same loan amount, allowing buyers to borrow more.

- Larger down payments possible: With lower monthly payments, buyers can allocate a larger portion of their income towards a down payment, potentially accessing higher-priced properties.

- Access to higher-priced properties: The combined effect of increased borrowing capacity and potentially larger down payments opens doors to homes previously out of reach.

- Impact on different buyer segments: First-time homebuyers, in particular, stand to benefit immensely, while upgraders might find it easier to move into larger or more desirable properties.

Stimulating Market Activity

The availability of sub-3% mortgage rates is likely to inject renewed vigor into the Canadian housing market. Lower borrowing costs incentivize buyers to enter the market, leading to increased competition and potentially faster sales turnover.

- Increased competition among buyers: Higher demand in the face of limited supply can drive up prices.

- Potential price increases: Increased buyer activity can lead to upward pressure on home prices.

- Faster sales turnover: Properties may sell more quickly due to higher demand.

- Recent market data: While specific data points will need to be referenced based on the current market conditions, observing sales volumes and price changes in areas with prevalent sub-3% mortgage rates can provide valuable insights.

Potential Risks and Challenges Associated with Sub-3% Mortgage Rates

While the allure of sub-3% mortgage rates is undeniable, it's crucial to acknowledge the potential risks and challenges associated with such low borrowing costs.

Fueling a Housing Bubble

The combination of low mortgage rates and other factors such as limited housing supply could lead to an unsustainable increase in home prices, potentially creating a housing bubble.

- Increased risk of price corrections: If the market becomes overheated, a sharp correction could occur, leading to price declines and financial hardship for some homeowners.

- Potential for market instability: Rapid price increases followed by sharp drops can create significant market volatility.

- Impact on future homebuyers: If a bubble bursts, future homebuyers could face a significantly less favorable market.

- Historical parallels: Examining historical housing market booms and busts in Canada and other countries can offer valuable lessons and insights into potential risks.

Impact on the Canadian Economy

Exceptionally low mortgage rates can have broad implications for the Canadian economy. The Bank of Canada carefully monitors these trends to manage inflation and maintain economic stability.

- Potential for increased inflation: Increased consumer spending fueled by easier access to credit can contribute to inflationary pressures.

- Impact on the Bank of Canada’s monetary policy: The Bank of Canada may need to adjust its interest rate policies to counter potential inflationary effects.

- Long-term economic stability: Sustained periods of low interest rates can potentially impact long-term economic stability and create vulnerabilities.

Increased Household Debt

Sub-3% mortgage rates, while beneficial for some, can also contribute to rising household debt levels. This poses a significant risk, particularly if interest rates rise unexpectedly.

- Vulnerability to interest rate increases: Higher debt levels make households more vulnerable to interest rate hikes, potentially leading to financial difficulties.

- Impact on consumer spending: Increased debt servicing costs can reduce disposable income, affecting consumer spending and overall economic activity.

- Potential financial stress on households: High debt levels can create considerable financial stress and vulnerability for many households.

Predicting the Future: What Lies Ahead for Canadian Housing with Sub-3% Mortgages?

Predicting the future of the Canadian housing market with sub-3% mortgages is a complex undertaking, requiring careful consideration of various factors.

Market Forecasting and Analysis

Several scenarios are possible, depending on the future trajectory of interest rates, economic growth, and other macroeconomic factors.

- Continued low rates: If interest rates remain low for an extended period, we could see sustained price increases and heightened market activity.

- Gradual rate increases: A gradual increase in interest rates could moderate market activity and potentially prevent a housing bubble from forming.

- Sharp rate hikes: A sudden and significant increase in interest rates could trigger a market correction, leading to price declines and potentially impacting mortgage affordability.

- Regional variations: The impact of sub-3% mortgage rates might vary significantly across different regions of Canada, depending on local market dynamics and housing supply.

Strategies for Homebuyers and Sellers

Navigating this uncertain market requires a well-informed approach.

- For homebuyers: Thorough research, securing pre-approval for a mortgage, and negotiating strategically are crucial.

- For sellers: Understanding market conditions, pricing competitively, and working with experienced real estate agents are key strategies.

Conclusion

The potential impact of sub-3% mortgage rates on Canada's housing market is a double-edged sword. While these low rates offer increased affordability and stimulate market activity, they also carry risks such as fueling a housing bubble, increasing household debt, and potentially impacting broader economic stability. The future trajectory of the market will depend on several factors, including future interest rate adjustments and economic growth. It's crucial to carefully weigh the potential benefits and risks before making any major housing decisions. Stay updated on sub-3% mortgage rates and their implications for the Canadian housing market, and seek professional financial and real estate advice to navigate this complex and dynamic landscape effectively. Understanding the implications of low mortgage rates in Canada is key to making informed decisions about your personal financial situation before acting on sub-3% mortgage opportunities.

Featured Posts

-

2025 Indy Car Championship Predicting Rll Racings Performance

May 12, 2025

2025 Indy Car Championship Predicting Rll Racings Performance

May 12, 2025 -

Young Driver Scholarship Rahals Commitment To Future Talent

May 12, 2025

Young Driver Scholarship Rahals Commitment To Future Talent

May 12, 2025 -

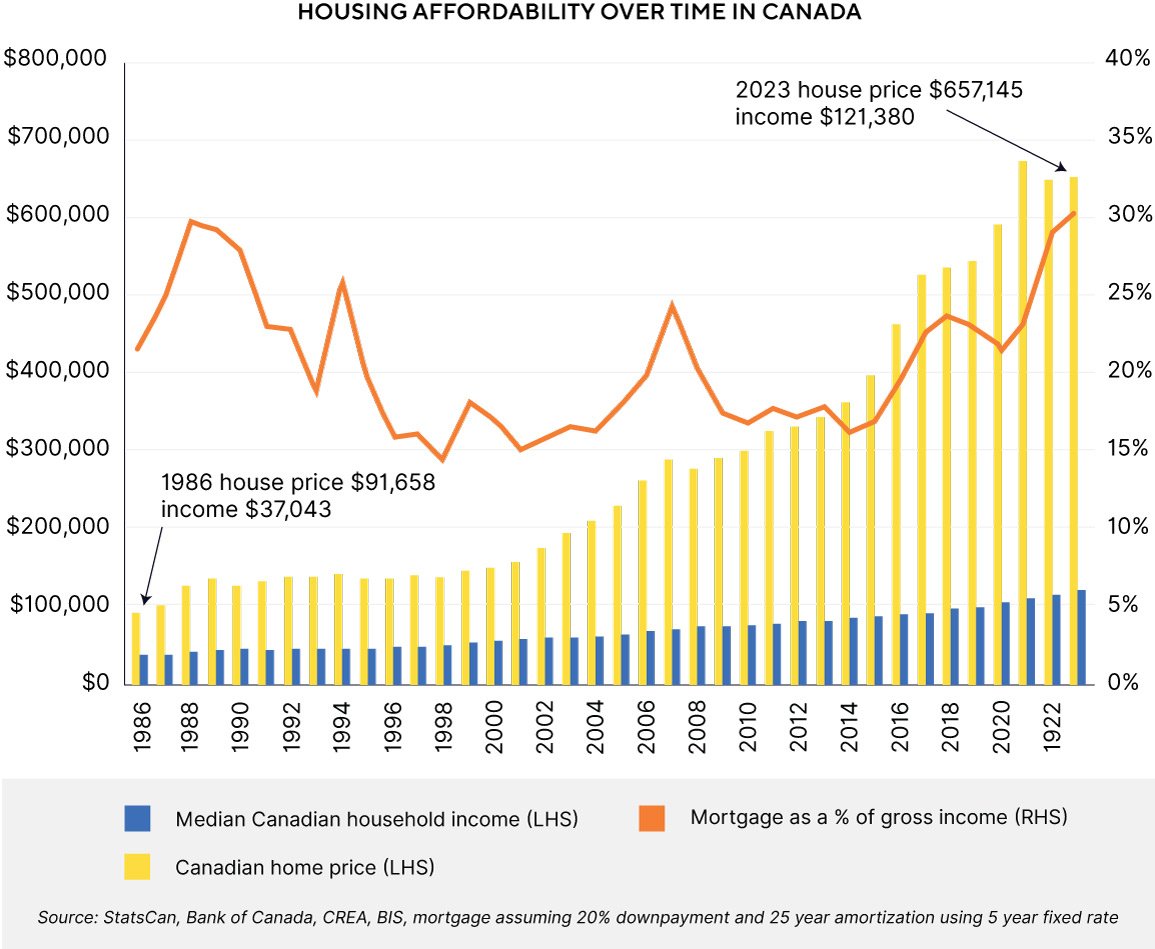

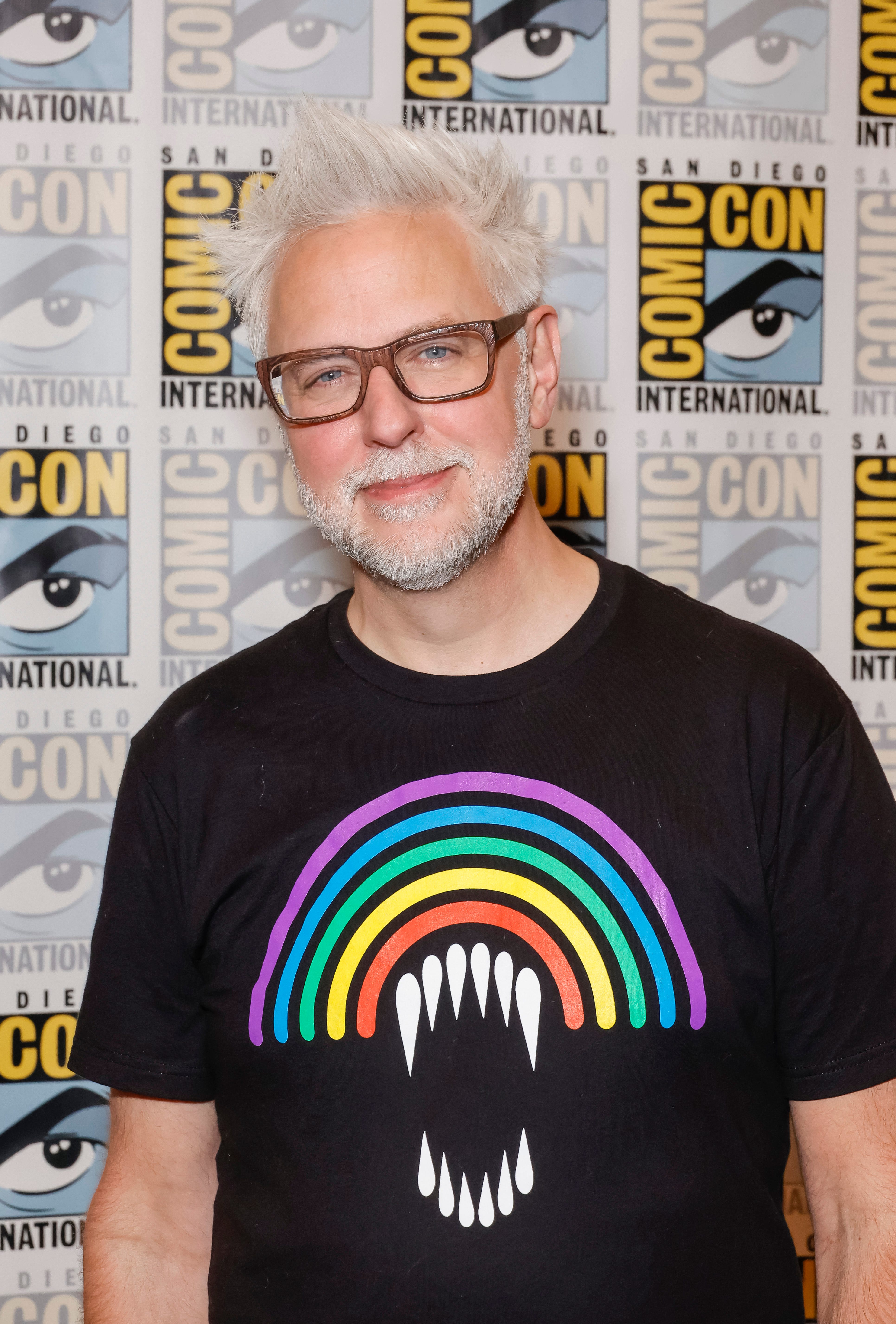

James Gunn Confirms Henry Cavills Mistreatment By Former Dc Executives

May 12, 2025

James Gunn Confirms Henry Cavills Mistreatment By Former Dc Executives

May 12, 2025 -

Tam Krwz Ke Jwte Pr Mdah Ka Waqeh Swshl Mydya Pr Rdeml Ky Lhr

May 12, 2025

Tam Krwz Ke Jwte Pr Mdah Ka Waqeh Swshl Mydya Pr Rdeml Ky Lhr

May 12, 2025 -

Decoding Aaron Judges Push Ups The 2025 On Field Message Explained

May 12, 2025

Decoding Aaron Judges Push Ups The 2025 On Field Message Explained

May 12, 2025

Latest Posts

-

Ofitsialnoe Razreshenie Rpts Smozhet Vesti Religioznuyu Deyatelnost V Myanme

May 13, 2025

Ofitsialnoe Razreshenie Rpts Smozhet Vesti Religioznuyu Deyatelnost V Myanme

May 13, 2025 -

Religioznaya Deyatelnost Rpts V Myanme Novoe Soglashenie

May 13, 2025

Religioznaya Deyatelnost Rpts V Myanme Novoe Soglashenie

May 13, 2025 -

Herthas Crisis Boateng And Kruse Offer Contrasting Viewpoints

May 13, 2025

Herthas Crisis Boateng And Kruse Offer Contrasting Viewpoints

May 13, 2025 -

The Boateng Kruse Debate Understanding Herthas Struggles

May 13, 2025

The Boateng Kruse Debate Understanding Herthas Struggles

May 13, 2025 -

Razreshenie Na Religioznuyu Deyatelnost Dlya Rpts V Myanme

May 13, 2025

Razreshenie Na Religioznuyu Deyatelnost Dlya Rpts V Myanme

May 13, 2025