Apple (AAPL) Stock: Important Price Levels And Future Predictions

Table of Contents

Key Historical Price Levels of Apple (AAPL) Stock

Analyzing Apple's historical price action reveals significant support and resistance levels that have shaped its price movements. Identifying these levels provides valuable context for understanding potential future price behavior. By studying past price points, investors can gain a better understanding of the stock's potential reactions to different market conditions.

-

All-Time Highs: Apple has reached several all-time highs throughout its history, often coinciding with significant product launches (like the iPhone) or periods of robust economic growth. Charting these highs helps identify potential areas of future resistance. For example, reaching a previous all-time high can often trigger profit-taking among investors.

-

Significant Lows: Periods of market downturn or company-specific challenges have resulted in significant lows in AAPL's stock price. These lows often act as strong support levels, representing points where buying pressure overwhelms selling pressure.

-

Support and Resistance Levels: Throughout its trading history, AAPL has shown consistent support and resistance at specific price points. These levels represent psychological barriers and often indicate potential turning points in the stock's price trajectory. Identifying these levels using technical analysis tools can be beneficial in formulating trading strategies.

-

Specific Examples:

- Date: October 2021; Price: ~$150. This period saw a pullback after reaching record highs, providing a significant support level.

- Date: March 2020; Price: ~$53. This low point reflected the broader market crash triggered by the COVID-19 pandemic.

- Date: January 2016; Price: ~$92. A low point following concerns about slowing iPhone sales.

Analyzing Current Apple (AAPL) Stock Price and Support/Resistance

As of [Insert Current Date], AAPL stock is trading at [Insert Current Price]. This price is [relative position – e.g., above/below] key historical support/resistance levels identified earlier.

-

Current Support: [Insert current support level] could provide a strong base for further price increases. A break below this level could signal further downward pressure.

-

Current Resistance: [Insert current resistance level] is a crucial hurdle for the stock to overcome. Breaking through this resistance could signal a significant upward move.

-

Technical Indicators: Analyzing technical indicators like moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) provides further insights into the current market sentiment and potential price direction. A bullish crossover of moving averages, for instance, can be a positive signal.

-

Fundamental Analysis: Strong revenue growth, high profitability, and a solid balance sheet point towards a healthy financial state for Apple. However, factors like macroeconomic conditions and competitive pressures need to be considered in the overall analysis. Consider the impact of things like supply chain issues and changing consumer behavior.

-

Trading Strategies: Investors can use these support and resistance levels to inform their trading strategies. Setting stop-loss orders at key support levels can limit potential losses, while identifying potential entry points near support levels can help maximize returns.

Factors Influencing Future Apple (AAPL) Stock Predictions

Predicting the future price of any stock is inherently challenging, but analyzing various factors can offer valuable insights. Several key elements impact the potential future performance of AAPL stock:

-

Macroeconomic Factors: Inflation, interest rates, and overall economic growth significantly influence the stock market. A recessionary environment could negatively impact investor sentiment and affect AAPL's stock price.

-

Apple's Financial Health: Consistent revenue growth, high profit margins, and a strong balance sheet indicate a healthy financial position for Apple. Analyzing earnings reports and quarterly financial statements is crucial.

-

Competitive Landscape: Apple faces competition from various companies in different segments of the market. Its ability to innovate and maintain its competitive edge will play a crucial role in its future performance. Monitoring the performance of competitors, such as Samsung and Google, is crucial for assessing Apple's market position.

-

Upcoming Product Releases: New product releases and their market reception significantly influence AAPL's stock price. Anticipation surrounding new iPhones, Macs, or other products can create substantial market fluctuations.

Potential Future Price Scenarios for Apple (AAPL) Stock

Based on the analysis, several potential price scenarios are possible for AAPL stock:

-

Bullish Scenario: Continued strong revenue growth, successful product launches, and a positive macroeconomic environment could drive the price towards [Insert Price Target]. This scenario assumes continued innovation and strong consumer demand.

-

Bearish Scenario: A significant economic downturn, increased competition, or unforeseen negative events (e.g., supply chain disruptions) could push the price down to [Insert Price Target]. This outcome necessitates a pessimistic outlook regarding the economy and Apple's performance.

-

Neutral Scenario: A relatively stable market environment and moderate growth could lead to a sideways movement in the price, remaining within the range of [Insert Price Range]. This assumes that the positive and negative aspects largely balance each other out.

It's crucial to remember that these are potential scenarios, not guaranteed outcomes. The actual price movement of AAPL stock will depend on various factors, many of which are unpredictable.

Conclusion: Investing in Apple (AAPL) Stock: A Summary and Call to Action

This analysis highlighted key historical and current price levels for Apple (AAPL) stock and explored potential future price scenarios based on various factors. It’s crucial to remember that investing in the stock market involves risk. Thorough research, understanding your risk tolerance, and diversification are paramount. Before making any investment decisions related to Apple (AAPL) stock, conduct further in-depth research, consider your risk tolerance, and consult with a qualified financial advisor. Staying updated on AAPL stock price levels and future market predictions is key to informed decision-making. Remember that past performance is not indicative of future results. Keep a close eye on Apple (AAPL) stock price levels and future market predictions to make informed investment decisions.

Featured Posts

-

Porsche 911 80 Millio Forintert Egyedi Extrak

May 24, 2025

Porsche 911 80 Millio Forintert Egyedi Extrak

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Debate

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Debate

May 24, 2025 -

Trump E L Unione Europea L Effetto Dei Dazi Del 20 Sulla Moda

May 24, 2025

Trump E L Unione Europea L Effetto Dei Dazi Del 20 Sulla Moda

May 24, 2025 -

Witness The Power Ferrari Challenge Racing Days In South Florida

May 24, 2025

Witness The Power Ferrari Challenge Racing Days In South Florida

May 24, 2025 -

Is An Escape To The Country Right For You A Realistic Look

May 24, 2025

Is An Escape To The Country Right For You A Realistic Look

May 24, 2025

Latest Posts

-

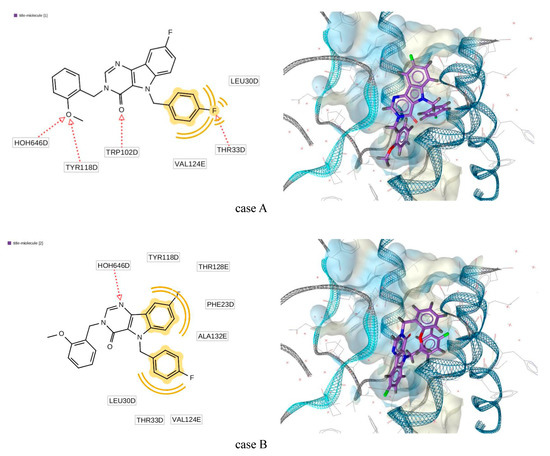

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025 -

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025

The Future Of Museum Programs Post Trump Funding Cuts

May 24, 2025 -

Claiming Italian Citizenship Changes To The Law On Great Grandparents

May 24, 2025

Claiming Italian Citizenship Changes To The Law On Great Grandparents

May 24, 2025 -

The Future Of Ai Hardware Open Ai And Jony Ives Potential Partnership

May 24, 2025

The Future Of Ai Hardware Open Ai And Jony Ives Potential Partnership

May 24, 2025 -

Updated Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025

Updated Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025