Apple Price Target Lowered, But Is Wedbush Right To Remain Bullish?

Table of Contents

The Reasons Behind the Lowered Apple Price Target

Several factors contribute to the recent reduction in Apple's price target. These are not isolated incidents but rather interconnected challenges that affect the overall Apple stock price and investor sentiment.

Weakening Consumer Demand

Inflation and persistent economic uncertainty are significantly impacting consumer spending, particularly on discretionary items like electronics. This slowdown in consumer electronics spending directly affects Apple's revenue streams.

- Market research firm Counterpoint Research reported a [insert percentage]% decline in global smartphone shipments in Q[insert quarter], citing reduced consumer confidence as a key factor.

- Apple's recent earnings reports showed a [insert percentage]% decrease in iPhone sales compared to the same period last year. This points to a potential softening of demand, even for Apple's flagship product.

- The impact extends beyond iPhones. Sales of Macs, iPads, and wearables are also expected to be affected by the general weakening consumer demand for premium electronics.

Supply Chain Challenges

Persistent supply chain disruptions continue to pose a significant challenge for Apple. Geopolitical tensions, particularly those related to China, further complicate the situation. These disruptions directly impact Apple's production capacity and delivery timelines.

- Lockdowns in China and other geopolitical factors have led to production delays and shortages of key components. This affects Apple's ability to meet consumer demand and maintain its production schedule.

- Increased shipping costs and logistical complexities add to the overall cost of production, impacting Apple's profitability margins.

- The ongoing uncertainty around supply chain stability contributes to the overall risk assessment of Apple's stock.

Increased Competition

The smartphone and technology markets are increasingly competitive. Samsung, Google, and other tech giants are aggressively vying for market share with innovative products and aggressive pricing strategies. This intensifies the pressure on Apple.

- Android operating systems continue to gain market share globally, posing a direct challenge to Apple's iOS ecosystem.

- Competitors are releasing increasingly sophisticated products with comparable features at lower price points, putting pressure on Apple's pricing strategy.

- Apple needs to continually innovate and maintain its brand image to stay ahead of the competition and justify its premium pricing.

Wedbush's Bullish Outlook: Understanding Their Rationale

Despite the lowered Apple price target by other analysts, Wedbush Securities maintains a bullish outlook. Their rationale hinges on several key factors:

Long-Term Growth Potential

Wedbush emphasizes Apple's strong long-term growth potential, viewing current headwinds as temporary setbacks. Their bullish Apple prediction rests on several pillars.

- Apple's strong brand loyalty ensures a stable customer base, even amidst economic downturns.

- Continued innovation in existing product lines and the introduction of new products will stimulate demand and drive growth.

- Expansion into new and emerging markets, particularly in India and other developing economies, presents significant growth opportunities.

Service Revenue Growth

Apple's services segment – encompassing Apple Music, iCloud, Apple TV+, and other subscription services – is a crucial driver of recurring revenue and profitability. This segment shows consistent growth and resilience even during market downturns.

- Apple's services revenue continues to show a robust growth trajectory, demonstrating the effectiveness of its subscription-based model.

- Future expansion and potential monetization of existing services represent significant opportunities for revenue diversification and growth.

- The increased integration of services across Apple's product ecosystem enhances the overall value proposition for consumers.

Innovation and Future Products

Wedbush's bullish forecast also incorporates the expected impact of Apple's future innovations and product launches. Anticipated new products and technological advancements are expected to maintain Apple's competitive edge.

- Rumors of new product launches, such as a more affordable AR/VR headset or significant upgrades to the iPhone and Apple Watch, suggest that Apple continues to innovate and expand its product portfolio.

- Technological advancements in areas such as AI and machine learning are likely to further enhance Apple's products and services, contributing to long-term growth.

- These innovations should help Apple to attract new customers and retain existing ones.

Conclusion

The lowered Apple price target reflects concerns about weakening consumer demand, persistent supply chain issues, and increased competition. However, Wedbush's bullish outlook highlights Apple's long-term growth potential, driven by its robust services segment and anticipated future product innovations. Investors must weigh these opposing perspectives carefully. While the current economic climate presents challenges, Apple's strong brand loyalty, innovative capabilities, and expanding service revenue streams offer a counterbalance. Conduct thorough research, consider your personal risk tolerance, and analyze the latest data before making investment decisions. Understanding the Apple price target requires a careful consideration of both short-term challenges and long-term growth prospects. A comprehensive Apple stock price analysis is crucial before committing to any investment strategy. The ongoing debate surrounding the Apple price target underscores the importance of staying informed and adapting your investment approach to the dynamic realities of the market.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Analysis

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Analysis

May 25, 2025 -

The Prince His Money Manager And Monacos Corruption Scandal

May 25, 2025

The Prince His Money Manager And Monacos Corruption Scandal

May 25, 2025 -

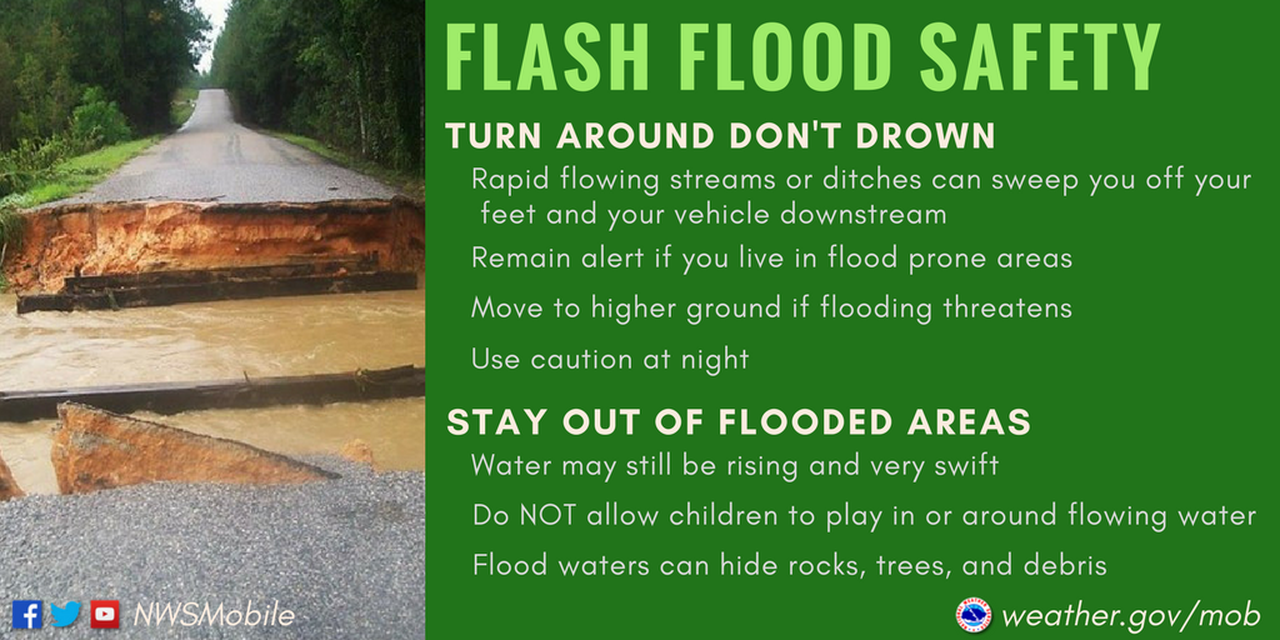

What Is A Flash Flood Essential Information On Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Essential Information On Flood Warnings And Alerts

May 25, 2025 -

Amundi Msci World Ii Ucits Etf A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf A Guide To Net Asset Value Nav

May 25, 2025 -

Understanding The Philips 2025 Annual General Meeting Agenda

May 25, 2025

Understanding The Philips 2025 Annual General Meeting Agenda

May 25, 2025