Apple Stock: A $254 Price Target – Investment Opportunity?

Table of Contents

Apple's Recent Financial Performance and Growth

Apple's consistent financial success forms the bedrock of the optimistic $254 Apple stock price target. Analyzing recent quarterly earnings reports reveals a picture of robust growth across various sectors. Revenue growth remains strong, driven by several key factors.

-

Strong iPhone sales despite market saturation: While the smartphone market is arguably saturated, Apple continues to command a significant market share, thanks to its brand loyalty and innovative features. The iPhone remains a cash cow, contributing significantly to Apple's overall revenue.

-

Growth in services revenue (Apple Music, iCloud, App Store): Apple's services sector shows impressive growth, demonstrating the company's ability to diversify its revenue streams beyond hardware. This recurring revenue model offers stability and predictable income streams.

-

Expansion into wearables and other emerging markets: The Apple Watch, AirPods, and other wearables continue to gain traction, contributing significantly to Apple's overall revenue growth. Expansion into new markets also presents further opportunities for growth.

-

Positive free cash flow indicating strong financial health: Apple boasts a substantial positive free cash flow, demonstrating its strong financial health and ability to reinvest in research and development, acquisitions, and shareholder returns.

Analyzing the Data: Each sector contributes substantially to Apple's revenue. The iPhone remains a major contributor, but the growth in services and wearables is crucial for long-term stability and growth. Recent financial reports show a consistent upward trend in Earnings Per Share (EPS) and healthy revenue growth. While the Price-to-Earnings (P/E) ratio should be considered in relation to competitors and market trends, Apple generally maintains a strong P/E ratio compared to its peers. (Insert chart/graph showing revenue breakdown by sector and EPS/P/E ratio trends over time)

Factors Contributing to the $254 Price Target

Several factors contribute to the optimistic $254 Apple stock price target predicted by some analysts. These predictions aren't arbitrary; they are based on careful analysis and forecasting.

-

Analyst expectations regarding future product launches (e.g., new iPhones, AR/VR headsets): Anticipation for upcoming product releases, particularly new iPhones and potential AR/VR headsets, significantly fuels the positive outlook. These innovative products are expected to drive further revenue growth.

-

Potential market share gains in key sectors: Apple is constantly striving for market share expansion in various sectors, including wearables, services, and potentially AR/VR. Success in these areas could significantly impact the stock price.

-

Innovative product development and technological advancements: Apple’s reputation for innovation and cutting-edge technology is a significant driver of investor confidence. Continuous technological advancements solidify its position as a leader in the tech industry.

-

Increasing market capitalization and investor confidence: The growing market capitalization of Apple reflects the increasing confidence investors have in the company's future performance and growth potential.

Analyst Methodology: Analysts typically employ various valuation methods to arrive at a price target. These include discounted cash flow (DCF) models, which project future cash flows and discount them back to their present value, and comparable company analysis, which compares Apple's valuation metrics to those of similar companies. These models, while complex, essentially predict future growth and translate that into a projected stock price.

Potential Risks and Challenges for Apple Stock

While the outlook for Apple stock is generally positive, it’s crucial to acknowledge potential risks:

-

Global economic uncertainty and its impact on consumer spending: Economic downturns can negatively impact consumer spending, potentially affecting demand for Apple products, particularly higher-priced items like iPhones.

-

Increasing competition from other tech giants (e.g., Samsung, Google): Intense competition from other tech giants presents a constant challenge. Samsung and Google, amongst others, are continuously innovating and vying for market share.

-

Supply chain disruptions and geopolitical factors: Global supply chain vulnerabilities and geopolitical instability can disrupt Apple's manufacturing and distribution processes, impacting production and sales.

-

Dependence on iPhone sales and potential saturation of the smartphone market: While Apple is diversifying, its significant reliance on iPhone sales makes it vulnerable to any slowdown in the smartphone market.

Mitigating Risks: Diversification of investments is key to mitigating risk. Considering other asset classes alongside Apple stock can help cushion against potential losses. Staying informed about global economic trends and geopolitical events is also crucial for informed investment decisions.

Comparing Apple Stock to Competitors

Analyzing Apple's performance against competitors provides further context for its valuation.

-

Market share comparisons: Apple consistently holds a strong market share in smartphones, wearables, and tablets. However, competition remains intense, and maintaining this dominance requires continuous innovation.

-

Revenue and profit margin comparisons: Apple typically enjoys higher profit margins than many of its competitors, indicating a strong brand and pricing power.

-

Innovation and technological advancements compared to competitors: Apple's reputation for innovation is a key differentiator. While competitors are catching up in certain areas, Apple's ecosystem and brand loyalty provide a significant competitive advantage.

(Insert table comparing key performance indicators of Apple with Samsung, Microsoft, and Google)

Conclusion

Investing in Apple stock presents both significant opportunities and potential risks. The $254 price target predicted by some analysts reflects the company’s strong financial performance, its innovative products, and its potential for future growth in various sectors, particularly services and wearables. However, global economic uncertainty, intense competition, and supply chain vulnerabilities present considerable challenges. Apple’s dependence on iPhone sales also remains a factor to consider.

Call to Action: Investing in the stock market carries inherent risks. Conduct thorough research and consult with a financial advisor before making any investment decisions. However, based on its strong financial performance, innovative products, and potential for future growth, Apple stock, with its potential $254 price target, could be a worthwhile addition to a diversified investment portfolio. Consider carefully if Apple stock aligns with your risk tolerance and long-term investment strategy. Remember to conduct your own due diligence before investing in any Apple stock.

Featured Posts

-

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 25, 2025

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 25, 2025 -

Frances National Rally Assessing The Impact Of Le Pens Latest Demonstration

May 25, 2025

Frances National Rally Assessing The Impact Of Le Pens Latest Demonstration

May 25, 2025 -

Lady Gaga And Michael Polansky Arrive Hand In Hand At Snl Afterparty

May 25, 2025

Lady Gaga And Michael Polansky Arrive Hand In Hand At Snl Afterparty

May 25, 2025 -

Hells Angels An In Depth Analysis

May 25, 2025

Hells Angels An In Depth Analysis

May 25, 2025 -

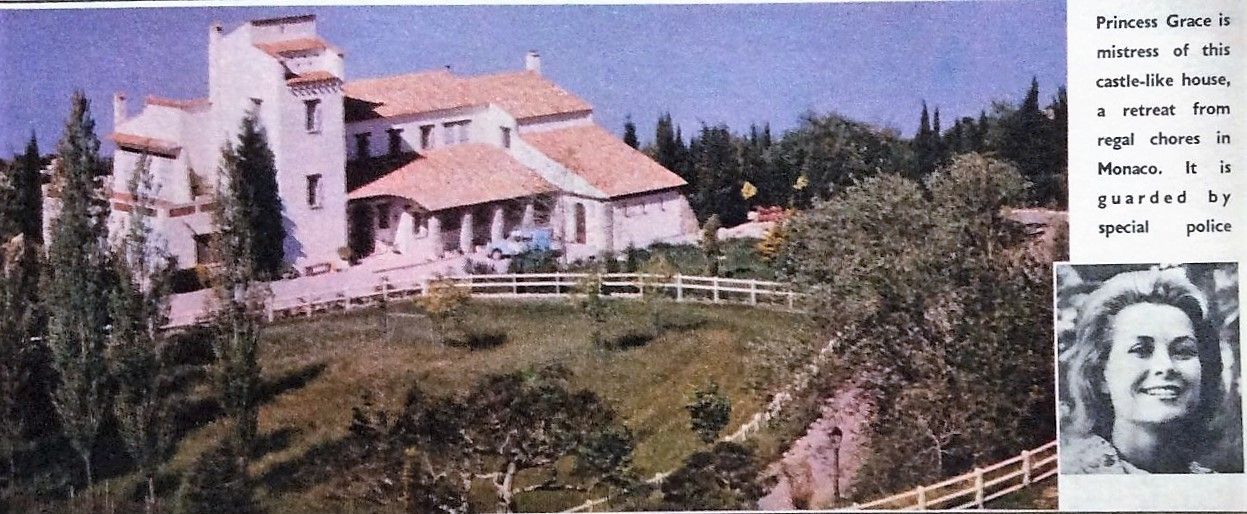

Charlene De Monaco Y Roc Agel Un Refugio En La Costa Azul

May 25, 2025

Charlene De Monaco Y Roc Agel Un Refugio En La Costa Azul

May 25, 2025