Apple Stock (AAPL): Important Price Levels And Their Implications

Table of Contents

Key Support Levels for Apple Stock (AAPL)

A support level in stock trading represents a price point where buying pressure is strong enough to prevent a further decline. Historically, Apple Stock (AAPL) has demonstrated several key support levels. Identifying these levels can be invaluable for investors looking to potentially buy at a discount or to gauge the potential downside risk.

Let's examine a few significant historical support levels (Note: Specific price levels are subject to change and require up-to-date market data. This information is for illustrative purposes only.):

- $130: This level has acted as support on several occasions in the past, holding the price from significant drops. A break below this could signal further weakening.

- $100: This psychological level often acts as a strong support barrier. A breach below this level would likely trigger significant selling pressure and potentially indicate a more bearish trend.

- $80: While a lower support, this level historically has represented a substantial drop and would likely indicate major concerns within the market regarding Apple’s future performance.

Implications of a Break Below Support Levels:

- Potential for further price declines: A breach of support can trigger a cascade effect, with more investors selling their shares, accelerating the downward trend.

- Increased investor concern and potential selling pressure: A drop below a key support level often signals negative sentiment, leading to more selling pressure.

- Impact on technical indicators: Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), will likely reflect the negative momentum.

Economic factors such as a recession or a significant drop in consumer spending could exert downward pressure on AAPL stock price, pushing it below key support levels.

Key Resistance Levels for Apple Stock (AAPL)

Conversely, a resistance level represents a price point where selling pressure is strong enough to prevent further price increases. Breaking above these levels can be a bullish signal, indicating stronger investor confidence.

Considering historical data for Apple Stock (AAPL) (again, remember that these are examples, and current levels will differ):

- $180: This level has frequently acted as a significant resistance level, preventing major price breakthroughs.

- $200: This psychological barrier represents a major hurdle for AAPL. A decisive break above this level could signal a strong bullish trend.

- $220: This level represents a significant higher price target for AAPL and a break above would show incredible strength in the market for this stock.

Implications of a Break Above Resistance Levels:

- Potential for further price increases: Breaking above resistance can trigger buying pressure, leading to further price appreciation.

- Increased investor confidence and potential buying pressure: A move above resistance typically signals positive sentiment, attracting more buyers.

- Impact on technical indicators: Technical indicators will reflect the positive momentum, confirming the bullish trend.

Factors such as strong product launches, positive earnings reports, or overall positive market sentiment can push AAPL above key resistance levels.

Analyzing Apple Stock (AAPL) Price Trends and Patterns

Analyzing price trends and patterns is crucial for predicting future price movements of Apple Stock (AAPL). Several techniques can help investors make more informed decisions:

- Chart patterns: Identifying patterns like head and shoulders, double tops/bottoms, and triangles can provide insights into potential price reversals or continuations.

- Moving averages: Following 50-day and 200-day moving averages can signal trend direction and potential support/resistance levels. A bullish crossover (50-day crossing above 200-day) often suggests a positive trend.

- Technical indicators: Using indicators like RSI, MACD, and Bollinger Bands can help gauge momentum, identify overbought/oversold conditions, and confirm potential trend changes.

How Trends and Patterns Inform Investment Decisions:

- Identify potential entry and exit points.

- Assess the strength and sustainability of price movements.

- Manage risk by setting stop-loss orders based on support levels.

Factors Influencing Apple Stock (AAPL) Price

Numerous factors influence the price of Apple Stock (AAPL). Understanding these factors is essential for accurate price prediction and risk management.

- Macroeconomic factors: Interest rate changes, inflation levels, and overall economic growth significantly affect investor sentiment and market performance.

- Product releases and innovations: The success of new products like iPhones, iPads, and Macs directly impacts Apple's revenue and stock price.

- Competitor actions and market share dynamics: Competition from companies like Samsung and Google influences Apple's market share and investor confidence.

- Investor sentiment and news events: Positive news, such as strong earnings reports or positive reviews of new products, typically boosts the stock price. Conversely, negative news can lead to price declines.

Interrelation of Factors and Impact on AAPL Price: These factors are interconnected. For example, a strong economy might increase consumer spending, boosting demand for Apple products, which in turn increases the AAPL stock price. Conversely, rising interest rates might curb consumer spending, potentially lowering the AAPL stock price.

Conclusion: Making Informed Decisions about Apple Stock (AAPL)

Understanding key support and resistance levels for Apple Stock (AAPL), along with analyzing price trends and patterns, is crucial for making informed investment decisions. Remember that external factors such as macroeconomic conditions, product launches, and competition also play a significant role in AAPL's price movements. Before investing in Apple Stock (AAPL) or engaging in any AAPL investing strategy, thorough research is vital. Consider consulting a financial advisor to discuss your investment goals and risk tolerance before making any decisions about AAPL price predictions or AAPL stock analysis. Remember that stock trading involves risk, and there's no guarantee of profits. Conduct your due diligence and invest wisely.

Featured Posts

-

250k London Theft Prompts Jenson Button To Stay Away From Uk

May 25, 2025

250k London Theft Prompts Jenson Button To Stay Away From Uk

May 25, 2025 -

Dr Terrors House Of Horrors A Complete Guide

May 25, 2025

Dr Terrors House Of Horrors A Complete Guide

May 25, 2025 -

Les Gens D Ici Us Et Coutumes

May 25, 2025

Les Gens D Ici Us Et Coutumes

May 25, 2025 -

Naomi Kampel Mpikini Kai Xalarosi Stis Maldives

May 25, 2025

Naomi Kampel Mpikini Kai Xalarosi Stis Maldives

May 25, 2025 -

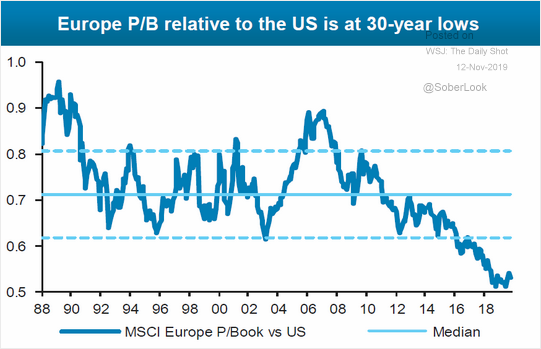

De Snelle Marktdraai Europese Aandelen En De Vergelijking Met Wall Street

May 25, 2025

De Snelle Marktdraai Europese Aandelen En De Vergelijking Met Wall Street

May 25, 2025