Apple Stock Dips Below Key Levels Before Q2 Earnings

Table of Contents

Factors Contributing to Apple Stock Dip

The recent decline in Apple stock price isn't isolated; it reflects broader market anxieties and specific challenges facing Apple. Several key factors contribute to this dip:

-

Increased Market Volatility: Rising inflation and aggressive interest rate hikes by central banks globally have created significant market volatility. Investors are becoming more risk-averse, leading to sell-offs across various sectors, including tech stocks like Apple. This uncertainty impacts investment decisions and overall market sentiment. The fear of a potential recession further exacerbates this situation.

-

Concerns about Slowing Consumer Demand: The rising cost of living is impacting consumer spending. Electronics, while often considered discretionary purchases, are vulnerable to decreased demand in an economic downturn. Concerns about reduced consumer spending on Apple products like iPhones, iPads, and Macs are contributing to the negative sentiment surrounding Apple stock.

-

Persistent Supply Chain Disruptions: Although improving, supply chain issues continue to pose challenges for Apple's production and sales. Geopolitical instability, component shortages, and logistical bottlenecks can impact the availability of Apple products and potentially affect revenue growth. These ongoing disruptions create uncertainty for investors.

-

Negative Investor Sentiment Surrounding the Broader Tech Sector: The tech sector as a whole has faced headwinds recently. Concerns about overvaluation in some tech companies and slower growth prospects have led to a general decline in investor confidence in the sector, impacting Apple stock alongside its peers.

-

Potential Impact of Geopolitical Instability: Geopolitical events, such as the ongoing war in Ukraine and rising tensions in other regions, create uncertainty in the global economy and can negatively impact Apple's global operations and supply chains. This added uncertainty contributes to the overall risk associated with investing in Apple stock.

-

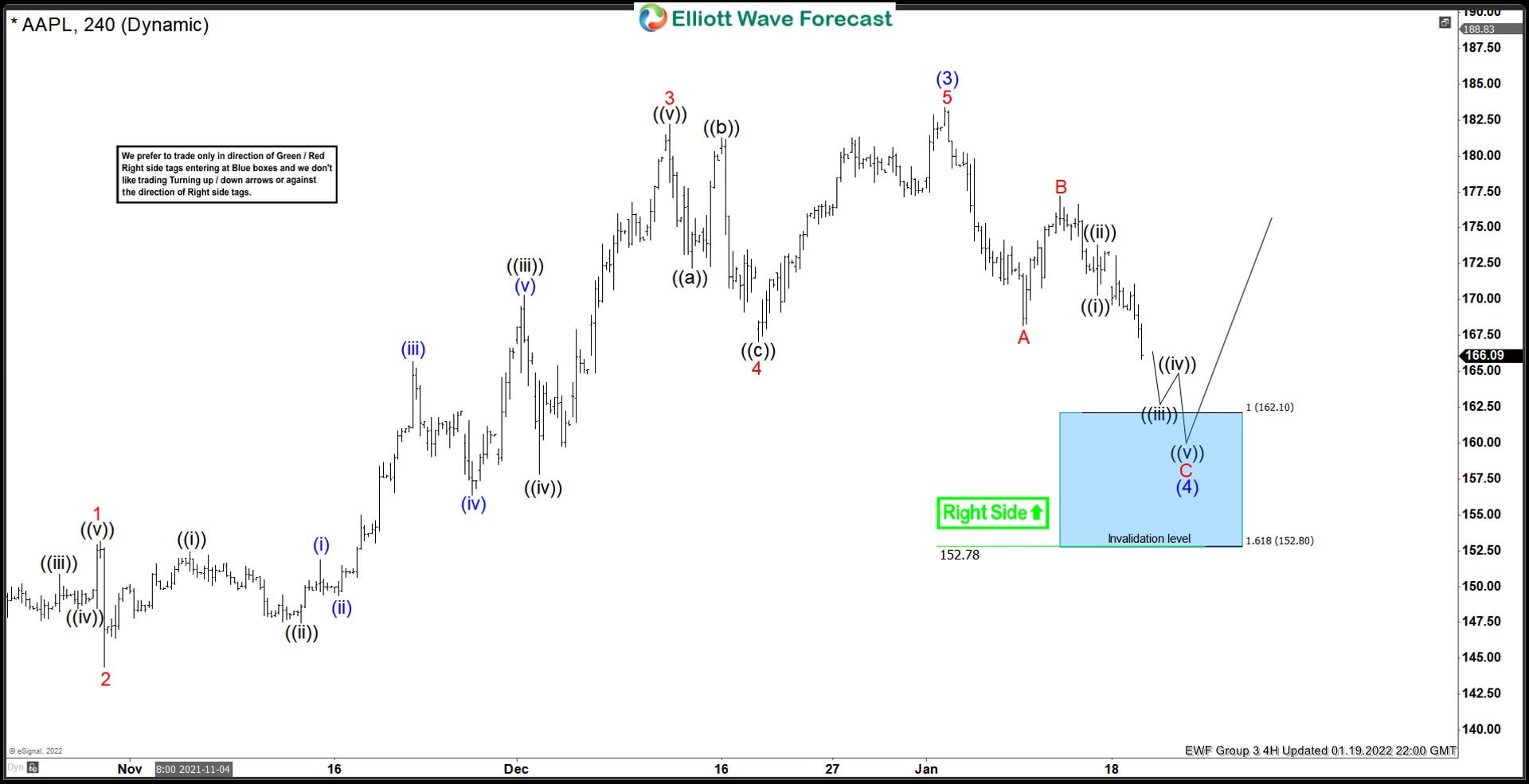

Technical Indicators: A closer look at technical indicators, such as moving averages and relative strength index (RSI), reveals a bearish trend in Apple stock. These indicators suggest a potential continuation of the downward trend, although they are not definitive predictors of future price movements.

Analyzing Apple's Q1 Performance and its Impact

Apple's Q1 2024 earnings report offers crucial insights into the company's current performance and investor sentiment. While a thorough analysis is beyond the scope of this article, here's a summary of key aspects:

-

Review of Key Performance Indicators: The Q1 report revealed [insert actual figures if available - e.g., revenue growth, iPhone sales, services revenue, etc.]. Comparing these numbers to previous quarters and analyst expectations provides valuable context for the current Apple stock situation.

-

Comparison with Analyst Expectations: It is vital to compare the actual Q1 results to the previously predicted figures. A significant deviation, either positive or negative, influences investor perceptions of Apple's future performance.

-

Product Category Performance: The performance of individual product lines (iPhone, iPad, Mac, Services) offers granular insight into market demand and potential future trends. Strong performance in one category might offset weaknesses in another, which is important to consider when evaluating overall stock performance.

-

Impact on Investor Confidence: A positive surprise in Q1 earnings might boost investor confidence, potentially mitigating the negative impacts of other factors mentioned above. Conversely, a weaker-than-expected performance could further drive down the Apple stock price.

Potential Implications for Apple's Q2 Earnings

Predicting Apple's Q2 earnings with certainty is challenging, but by analyzing existing information, we can outline potential scenarios:

-

Analyst Predictions: Numerous financial analysts provide forecasts for Apple's Q2 earnings per share (EPS) and revenue. These predictions represent a collective market sentiment and offer a benchmark against which to compare actual results.

-

Upside and Downside Risks: Several factors could positively or negatively impact Q2 results. Stronger-than-expected demand for new products, successful supply chain optimizations, and positive macroeconomic trends could drive upside potential. Conversely, continued economic uncertainty, persistent supply chain disruptions, and increased competition could exert downward pressure on Q2 performance.

-

Impact of the Economic Climate: The overall economic environment significantly influences consumer spending and business investment. A positive economic outlook could improve the outlook for Apple's Q2, while a downturn could reduce sales.

-

Strategic Moves by Apple: Apple's strategic decisions, such as product launches, marketing campaigns, and price adjustments, will play a crucial role in its Q2 performance. These strategic moves can either mitigate risks or exacerbate the negative impacts of the external factors mentioned before.

What to Expect from Apple's Q2 Earnings Call

The Apple Q2 earnings call is a significant event for investors. Close attention should be paid to:

-

Key Discussion Topics: Expect management to address Q2 performance, provide updated guidance for future quarters, and discuss strategies for navigating the current economic environment.

-

Investor and Analyst Questions: The Q&A session is particularly important. Investors and analysts will likely focus on questions concerning supply chain issues, consumer demand, competition, and long-term growth prospects.

-

Management's Commentary on Future Guidance: Management's commentary on future performance will be highly influential in shaping market sentiment and predicting future price movements for Apple stock. Any change to long-term growth projections will significantly influence the Apple stock price.

Conclusion

The recent dip in Apple stock below key levels raises concerns ahead of its Q2 earnings report. Several factors, including market volatility, economic uncertainty, and supply chain issues, contribute to this decline. While Apple’s Q1 performance provides some insight, predicting Q2 remains challenging. Analyzing analyst forecasts and anticipating management's commentary on the upcoming earnings call are crucial for investors.

Call to Action: Stay informed about the upcoming Apple Q2 earnings announcement and its impact on Apple stock. Monitor market trends and expert analysis to make informed investment decisions regarding your Apple stock holdings. Understanding these factors will help you navigate the complexities surrounding Apple stock and other tech stocks in the current market. Carefully consider your investment strategy and risk tolerance before making any decisions regarding your Apple stock portfolio.

Featured Posts

-

Naomi Kempbell 55 Rokiv Garyachi Foto Supermodeli

May 25, 2025

Naomi Kempbell 55 Rokiv Garyachi Foto Supermodeli

May 25, 2025 -

Arrest In Deadly Myrtle Beach Hit And Run Case

May 25, 2025

Arrest In Deadly Myrtle Beach Hit And Run Case

May 25, 2025 -

Analyzing The Week That Upset Joe Bidens Post Presidency Plans

May 25, 2025

Analyzing The Week That Upset Joe Bidens Post Presidency Plans

May 25, 2025 -

Monaco Corruption Scandal The Prince And His Financial Advisor

May 25, 2025

Monaco Corruption Scandal The Prince And His Financial Advisor

May 25, 2025 -

Dazi Trump Al 20 Analisi Dell Effetto Su Nike Lululemon E Il Mercato Della Moda

May 25, 2025

Dazi Trump Al 20 Analisi Dell Effetto Su Nike Lululemon E Il Mercato Della Moda

May 25, 2025