Apple Stock: Navigating Key Levels Ahead Of Q2 Earnings

Table of Contents

Analyzing Current Apple Stock Price and Recent Trends

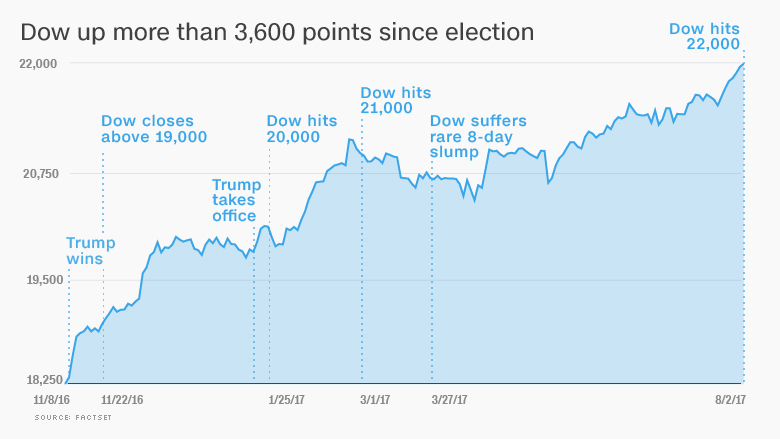

As of [Insert Current Date and Time], Apple stock (AAPL) is trading at $[Insert Current Apple Stock Price]. Recent price movements have been [Describe recent price trends – e.g., relatively flat, upward trending, downward trending]. This follows [mention significant recent events, e.g., the launch of the new iPhone 15, concerns about slowing demand in China, a positive analyst report].

-

Recent performance compared to market averages (S&P 500, Nasdaq): Apple's performance has [outperformed/underperformed/mirrored] the S&P 500 and Nasdaq over the past [time period – e.g., month, quarter, year]. This indicates [analysis of relative performance – e.g., strength/weakness relative to the broader market].

-

Impact of recent news headlines on Apple stock price: Positive news, such as strong pre-orders for a new product, generally leads to [price increase/positive momentum]. Conversely, negative news, such as supply chain disruptions or disappointing sales figures, tends to result in [price decrease/negative momentum].

-

Technical analysis of charts – identify support and resistance levels: A technical analysis of Apple's stock chart reveals preliminary support around $[Support Level 1] and resistance at $[Resistance Level 1]. These levels are significant because [explain reasons based on chart patterns]. We also observe a potential breakout above $[Resistance Level 2] could trigger further gains.

-

Key indicators like trading volume and RSI: Increased trading volume alongside a rising RSI (Relative Strength Index) suggests [bullish/bearish] sentiment, while decreasing volume with a falling RSI indicates the opposite. Monitoring these indicators is key to understanding the strength of price movements.

Key Support and Resistance Levels for Apple Stock

Support levels represent price points where buying pressure is expected to outweigh selling pressure, potentially preventing further declines. Resistance levels are price points where selling pressure is anticipated to overcome buying pressure, potentially halting further price increases.

For Apple stock, key support levels to watch include:

- Psychological levels: $150, $160 represent significant psychological barriers. A break below $150 could trigger further selling.

- Historical support and resistance levels: Previous highs and lows at $[Specific Price Points] provide insight into potential support and resistance zones.

- Moving averages: The 50-day moving average is currently at $[Price], while the 200-day moving average is at $[Price]. A break above the 200-day MA is often considered a bullish signal.

- Fibonacci retracement levels: Based on recent price swings, key Fibonacci retracement levels lie around $[Price Points]. These levels often serve as areas of support or resistance.

Factors Influencing Apple Stock Performance Before and After Q2 Earnings

Several factors will influence Apple's stock performance around its Q2 earnings announcement:

-

Macroeconomic factors impacting the tech sector: Rising interest rates and persistent inflation could negatively impact investor sentiment towards growth stocks, including Apple.

-

Potential Q2 earnings surprises – both positive and negative: Analysts currently forecast earnings per share (EPS) of $[EPS Estimate] and revenue of $[Revenue Estimate]. Beating these expectations could lead to a positive price reaction, while falling short could trigger a sell-off.

-

Impact of new product announcements or launches: Any announcements regarding new products or services will heavily influence investor expectations and Apple's stock price.

-

Analyst expectations for Q2 earnings: Consensus estimates from analysts provide a benchmark for assessing whether Apple meets or exceeds expectations.

-

Potential impact of iPhone sales on overall results: iPhone sales typically account for a significant portion of Apple's revenue. Strong iPhone sales are generally positive for the stock.

-

Influence of services revenue growth: Apple's services segment (App Store, Apple Music, iCloud, etc.) is a key driver of growth and profitability. Strong services revenue growth is generally viewed positively by investors.

-

Expected impact of supply chain disruptions (if any): Ongoing or new supply chain disruptions could negatively impact Apple's production and sales, potentially affecting its stock price.

Assessing the Risk and Reward of Apple Stock

Investing in Apple stock carries inherent risks:

- Volatility of the tech sector: The tech sector is known for its volatility, and Apple's stock price can fluctuate significantly in response to market news and sentiment.

- Dependence on a few key products: Apple's performance is heavily reliant on the success of its flagship products (iPhone, iPad, Mac). A decline in demand for these products could hurt Apple's financial performance.

- Global economic uncertainty: Global economic downturns can negatively impact consumer spending and demand for Apple products.

- Long-term growth potential of Apple: Despite these risks, Apple's strong brand, innovative products, and expanding services business provide significant potential for long-term growth.

Conclusion

Navigating Apple stock successfully ahead of and after Q2 earnings requires careful consideration of key support and resistance levels, such as $[List Key Support/Resistance Levels]. Remember to weigh potential positive factors like strong iPhone sales and services revenue growth against negative factors including macroeconomic headwinds and potential supply chain issues. Before making any investment decisions regarding Apple stock, thoroughly research and understand the factors influencing its price. Use this analysis of key levels and influencing factors to inform your strategy for navigating the volatility surrounding Apple stock ahead of and after the Q2 earnings announcement. Stay informed about Apple stock and other market movements to make well-informed investment choices.

Featured Posts

-

8 Stock Market Rise On Euronext Amsterdam Following Trump Tariff Announcement

May 25, 2025

8 Stock Market Rise On Euronext Amsterdam Following Trump Tariff Announcement

May 25, 2025 -

The Disappearance Case Studies And Analysis

May 25, 2025

The Disappearance Case Studies And Analysis

May 25, 2025 -

China And Us Trade A Race Against Time To Secure Trade Deal Benefits

May 25, 2025

China And Us Trade A Race Against Time To Secure Trade Deal Benefits

May 25, 2025 -

The Woody Allen Sexual Abuse Case Sean Penns Perspective

May 25, 2025

The Woody Allen Sexual Abuse Case Sean Penns Perspective

May 25, 2025 -

Escape To The Country Choosing The Right Rural Property

May 25, 2025

Escape To The Country Choosing The Right Rural Property

May 25, 2025