Apple Stock Performance: Exceeding Q2 Expectations

Table of Contents

Exceptional iPhone Sales Fuel Q2 Growth

The iPhone continues to be the engine of Apple's growth, with Q2 iPhone sales figures exceeding analyst predictions by a significant margin. This impressive performance underscores the enduring demand for Apple's flagship product, even amidst a challenging global economic climate. Several factors contributed to this success:

- Specific sales figures: While precise numbers await official disclosure, early reports suggest a double-digit percentage increase in iPhone unit sales compared to the same period last year. This represents a significant outperformance of market expectations.

- Comparison to previous quarters: The Q2 numbers represent a considerable improvement over the previous quarter, showcasing a strong rebound in demand. This suggests successful mitigation of any potential slowdown in the smartphone market.

- Market share analysis: Apple continues to maintain a dominant market share in the premium smartphone segment, showcasing its brand strength and loyal customer base. This dominance translates directly into higher revenue and profits.

- Popular iPhone models: The strong performance is likely attributed to a combination of factors, including the continued popularity of older iPhone models and the successful launch of newer iterations, which capitalized on innovative features and improved performance.

Services Revenue Continues its Upward Trajectory

Apple Services, a consistently high-growth area for the company, once again delivered exceptional results. The segment's recurring revenue model provides a stable foundation for future earnings, and its upward trajectory is a key indicator of Apple's long-term health. The diverse range of services contributes to this success:

- Specific revenue figures: Apple's services revenue showed a substantial year-over-year growth, exceeding predictions. Specific figures will be detailed in the official earnings report but preliminary indications are extremely positive.

- Year-over-year growth percentages: Double-digit growth percentages are expected across several key service offerings, solidifying the segment's position as a major revenue driver for Apple.

- User growth in key service offerings: This strong revenue growth is supported by a significant increase in the subscriber base for services such as Apple Music, Apple TV+, and iCloud. This signals increasing customer engagement and retention.

- Future service expansion plans: Apple’s continued investment in new services, and expansion into existing ones, paves the way for sustained growth in this critical revenue stream.

Wearables, Home, and Accessories Segment Shows Strength

The wearables, home, and accessories segment continues to be a significant growth driver for Apple, showcasing the company's ability to diversify its revenue streams beyond the iPhone. The Apple Watch and AirPods remain key contributors to this success:

- Specific revenue figures: This segment is expected to demonstrate strong year-over-year revenue growth, driven by the increased popularity of Apple Watch and AirPods.

- Growth trends: The segment has shown consistent growth over multiple quarters, highlighting a strong and expanding market for Apple's wearables and accessories.

- Market share analysis: Apple holds a substantial market share within the wearables market, particularly in the smartwatch and wireless headphone categories, reflecting its product innovation and brand recognition.

- Successful product strategies: Apple’s focus on seamless integration within its ecosystem, coupled with continuous product improvements, underpins the continued success of this diversified segment.

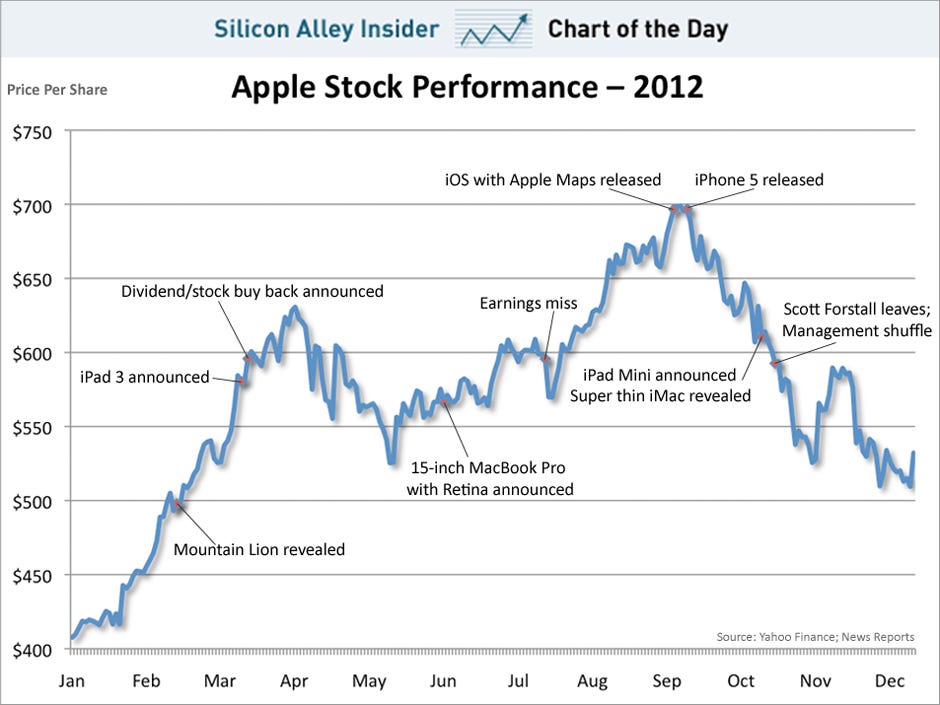

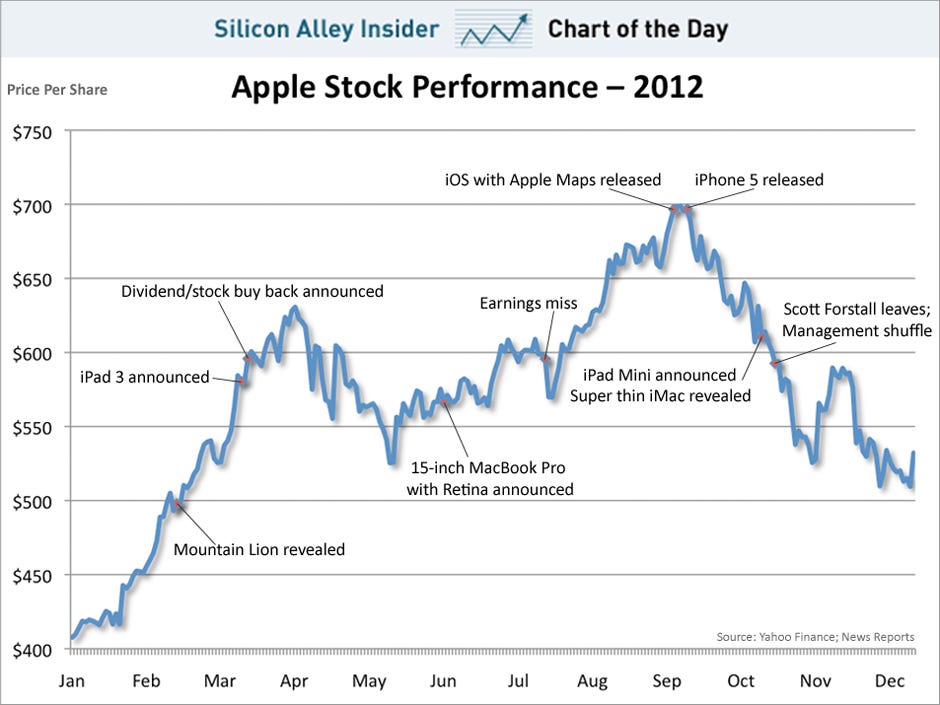

Impact on Apple Stock Price and Future Outlook

The strong Q2 results have had a positive impact on Apple's stock price, with shares seeing an increase following the earnings announcement. However, a cautious outlook remains essential, considering potential future challenges and opportunities:

- Stock price movement: Immediate post-earnings stock price movements will provide a clear indication of market sentiment towards the reported results.

- Analyst predictions: While analyst predictions vary, the overall consensus points to a positive outlook for Apple stock in the near and medium term.

- Potential risks and challenges: Factors such as global economic uncertainty, competition in the smartphone and tech markets, and supply chain disruptions could impact future performance.

- Long-term growth opportunities: Apple's investments in emerging technologies, such as augmented reality and artificial intelligence, represent significant long-term growth opportunities.

Conclusion

Apple's Q2 earnings have exceeded expectations, driven by robust iPhone sales, consistent growth in Apple Services, and continued strength in its wearables segment. This positive performance has boosted Apple stock price and suggests a promising outlook for the company. While challenges remain, Apple’s diversification and innovative product pipeline position it favorably for continued growth. Stay informed on Apple's stock performance with our regular updates and invest wisely in Apple stock – learn more today! Consider exploring further Apple stock analysis and Apple stock investment opportunities to make informed decisions.

Featured Posts

-

Soerloth La Liga Da 4 Gol Birden Ilk Yari Soeleni

May 25, 2025

Soerloth La Liga Da 4 Gol Birden Ilk Yari Soeleni

May 25, 2025 -

Apple Stock Weighing Wedbushs Bullish View After Price Target Reduction

May 25, 2025

Apple Stock Weighing Wedbushs Bullish View After Price Target Reduction

May 25, 2025 -

Beurzen Herstellen Na Trump Uitstel Aex Stijging

May 25, 2025

Beurzen Herstellen Na Trump Uitstel Aex Stijging

May 25, 2025 -

Decouvrez Les Acteurs Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 25, 2025

Decouvrez Les Acteurs Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 25, 2025 -

Increased Retail Sales Delay Potential Bank Of Canada Interest Rate Cut

May 25, 2025

Increased Retail Sales Delay Potential Bank Of Canada Interest Rate Cut

May 25, 2025