Apple Stock Performance: Q2 Earnings Beat Forecasts

Table of Contents

Q2 Earnings: A Detailed Breakdown (Apple Q2 Earnings)

Apple's Q2 2024 earnings report painted a picture of robust financial health. The company smashed expectations across the board, delivering exceptional revenue growth and exceeding EPS forecasts. Let's break down the key financial figures:

- Revenue: Apple reported a revenue of [Insert Actual Revenue Figure Here], representing a [Insert Percentage Change]% increase compared to the same period last year. This surpasses analyst predictions of [Insert Analyst Prediction Here].

- Earnings Per Share (EPS): Apple's EPS reached [Insert Actual EPS Figure Here], significantly higher than the anticipated [Insert Analyst Prediction Here]. This demonstrates strong profitability and efficient operations.

- Net Income: The company reported a net income of [Insert Actual Net Income Here], showcasing a healthy bottom line.

- Operating Margin: Apple's operating margin remained impressively high at [Insert Actual Operating Margin Here]%, indicating efficient cost management and strong pricing power.

<br>

(Insert chart/graph here visually representing revenue, EPS, and comparison to previous year and analyst expectations)

These impressive figures showcase a clear trajectory of growth for Apple, driven by a combination of factors we'll explore in the next section. Key factors contributing to these positive results include strong iPhone sales, growth in the Services sector, and effective supply chain management.

Key Drivers of Apple's Strong Performance (Apple Stock Growth Drivers)

Apple's Q2 success wasn't a fluke; it was driven by a confluence of factors that point to the company's enduring strength. Let's examine the key contributors:

- iPhone Sales: The iPhone continues to be a major revenue driver. Strong sales of the iPhone 14 series, combined with continued demand for older models, contributed significantly to overall revenue growth.

- Services Revenue: Apple's Services segment, including the App Store, Apple Music, iCloud, and AppleCare, continues its upward trajectory. This recurring revenue stream provides stability and growth potential.

- Wearables Growth: The Apple Watch and AirPods continue to gain popularity, driving strong growth in the wearables category. This highlights Apple's ability to innovate and expand into new product segments.

- Mac Sales: While facing some headwinds in the PC market, Apple maintained strong sales of its Mac lineup, leveraging its premium brand positioning and loyal customer base.

- Supply Chain Improvement: Apple successfully navigated global supply chain challenges, ensuring a consistent supply of its products to meet strong consumer demand.

Successful Marketing Campaigns: Apple's sophisticated marketing and branding strategies continued to resonate with consumers, driving demand for its products.

Investor Reaction and Future Outlook for Apple Stock (Apple Stock Forecast)

The market reacted positively to Apple's stellar Q2 earnings. The stock price saw a [Insert Percentage Change]% increase immediately following the release of the report, reflecting investor confidence in Apple's future prospects.

- Stock Price Prediction: Analysts are generally bullish on Apple's future performance, with many predicting continued growth in the coming quarters. Several analysts have set price targets for Apple stock at [Insert Range of Analyst Price Targets Here].

- Analyst Ratings: Most analysts maintain a "Buy" or "Overweight" rating on Apple stock, highlighting their positive sentiment towards the company.

- Market Sentiment: The overall market sentiment toward Apple remains positive, reflecting investor confidence in the company's long-term growth trajectory.

- Future Growth Potential: Apple's strong financial performance, innovative product pipeline, and expanding Services segment point to significant future growth potential.

- Potential Challenges: However, potential challenges remain, including a potential global economic slowdown, increased competition, and ongoing supply chain uncertainties.

Conclusion: Apple Stock Performance – A Promising Future?

Apple's Q2 earnings report delivered exceptional results, exceeding expectations across key metrics. The strong performance was driven by robust iPhone sales, impressive growth in the Services sector, and successful navigation of supply chain complexities. While potential challenges exist, the overall outlook for Apple stock remains promising, supported by positive analyst sentiment and the company's proven ability to innovate and adapt to market dynamics. To stay informed about Apple stock performance and to explore potential investment opportunities, consider conducting thorough research and consulting with a financial advisor. Understanding the nuances of Apple stock analysis and its future trajectory is key for making informed investment decisions based on the positive Q2 results. Consider exploring further avenues of Apple stock investment.

Featured Posts

-

Porsche Now Labubu

May 24, 2025

Porsche Now Labubu

May 24, 2025 -

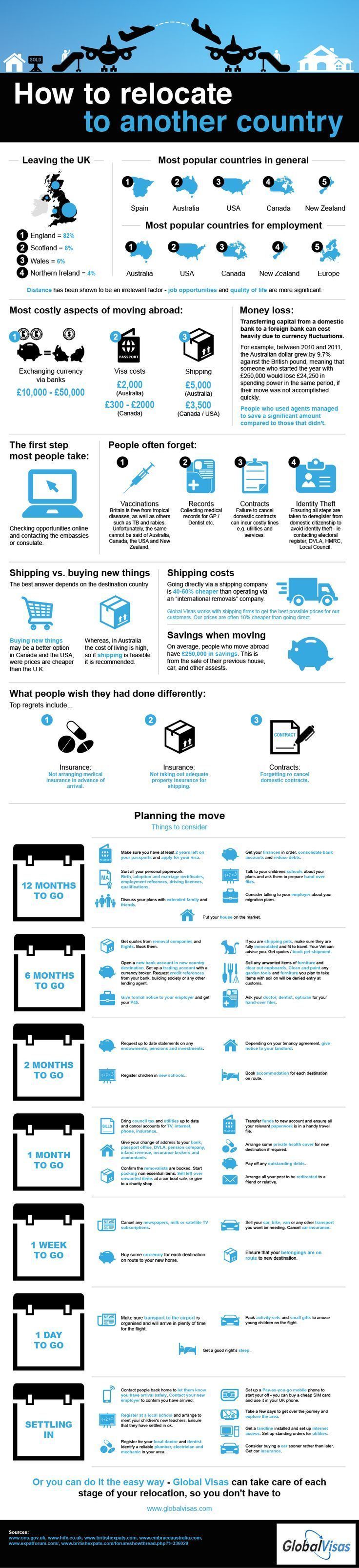

A Successful Escape To The Country Tips And Advice For Relocating

May 24, 2025

A Successful Escape To The Country Tips And Advice For Relocating

May 24, 2025 -

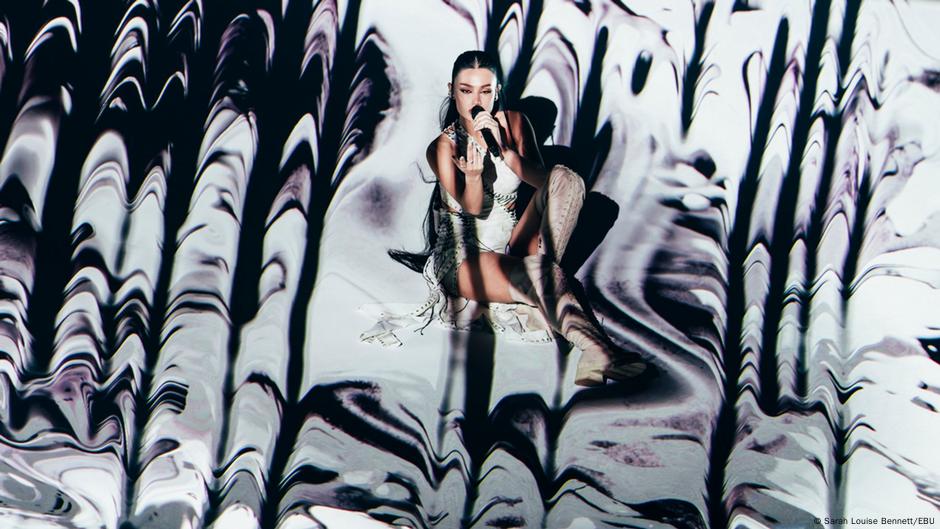

Chetyre Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025

Chetyre Pobeditelya Evrovideniya 2025 Po Versii Konchity Vurst

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 24, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025 -

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025