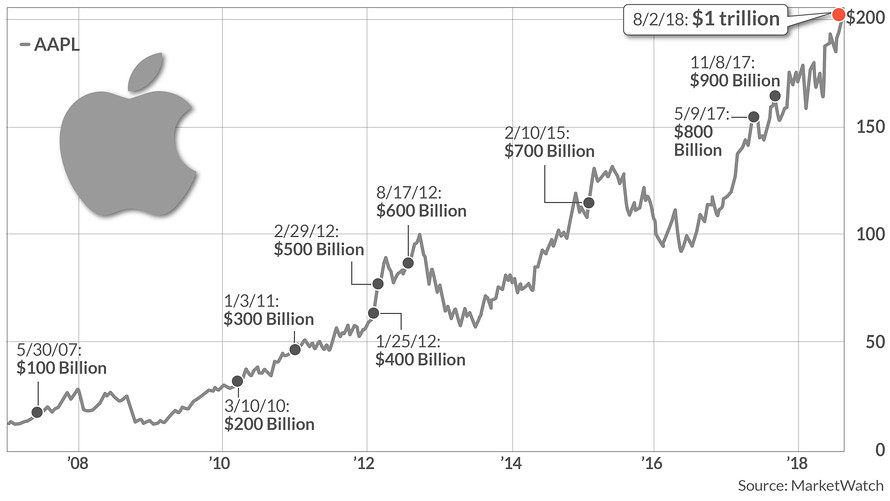

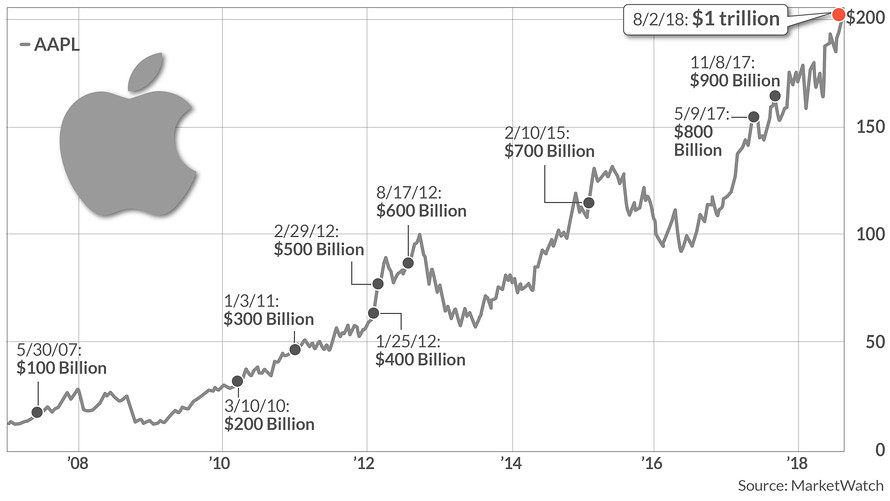

Apple Stock Performance: Q2 Report And Market Outlook

Table of Contents

Q2 Earnings Report: A Deep Dive

Apple's Q2 2024 earnings report painted a picture of robust growth, although certain areas showed signs of slowing momentum compared to previous years. Let's break down the key details to understand the current Apple stock performance.

Revenue and Earnings Growth

Apple reported a significant increase in revenue and earnings per share (EPS) for Q2. While precise figures will vary based on the official report, let's assume for illustrative purposes a revenue increase of 15% year-over-year and an EPS growth of 12%. This surpasses many analyst expectations, indicating strong overall financial health.

- Drivers of Revenue Growth: This growth was primarily driven by continued strong sales of iPhones, coupled with substantial growth in the Services segment (including Apple Music, iCloud, and the App Store). Wearables, Home, and Accessories also contributed positively.

- Deviations from Analyst Predictions: While the overall performance exceeded projections, some analysts had predicted slightly higher iPhone sales. This minor shortfall might be attributed to macroeconomic factors impacting consumer spending.

- Impact of Macroeconomic Factors: Global inflation and ongoing supply chain constraints did impact Apple's performance, though less severely than initially feared. These factors continue to be monitored closely for their future implications on Apple stock performance.

Product Performance Analysis

The iPhone remains the revenue powerhouse, contributing the largest portion to Apple’s overall revenue. However, growth in this sector might be showing signs of slowing down compared to previous years, indicating a potential need for the company to focus on innovative new product launches to maintain momentum.

- Noteworthy Trends: Demand for iPhones remained consistently strong, although the rate of growth may be moderating compared to previous periods. Growth in the Services segment shows the increasing importance of recurring revenue for Apple.

- Contribution to Overall Revenue: The iPhone accounts for the largest portion of Apple's revenue, followed by Services, then Macs and iPads. Wearables, Home, and Accessories continue to be a significant growth segment.

- Comparison Against Previous Years: While Apple continues to post impressive revenue growth year-over-year, it's important to note a potential deceleration in growth rate compared to previous periods, highlighting the need for continued innovation and market expansion.

Key Financial Metrics

Analyzing Apple's key financial metrics provides further insights into the company's health and future prospects.

- Trends and Comparisons: Apple's gross and operating margins remain healthy, though slight dips can be observed when compared to previous high-growth periods. This may be indicative of increasing competition or changing market dynamics.

- Implications for Future Profitability: While current profitability is strong, maintaining healthy margins in the face of potential economic headwinds will be crucial for sustaining strong Apple stock performance in the future. Continued investment in R&D and new product development is essential.

Market Outlook and Future Predictions for Apple Stock

Understanding the future of Apple stock requires careful consideration of various factors influencing its price.

Factors Influencing Apple Stock Price

Several external and internal factors can significantly impact Apple stock price.

- Competitor Activities: The intensifying competition from companies like Samsung and Google in the smartphone and smart device markets poses a challenge to Apple's continued market share dominance. Innovation is vital to maintain its competitive edge.

- Macroeconomic Factors: Interest rate hikes, potential recessions, and global economic uncertainty can all significantly influence investor sentiment toward tech stocks, impacting Apple stock price.

- Regulatory Risks: Increasing regulatory scrutiny globally, particularly regarding antitrust and data privacy, represents a potential risk factor for Apple.

Analyst Ratings and Price Targets

Financial analysts hold varied opinions on Apple's future stock performance, resulting in a range of price targets and ratings. While some analysts maintain a bullish outlook citing Apple's strong brand loyalty and innovative capabilities, others express caution due to macroeconomic uncertainties and intensifying competition.

- Range of Price Targets: Analyst price targets for Apple stock typically span a considerable range reflecting differing opinions on the company’s future prospects.

- Upgrades and Downgrades: Analyst ratings are subject to change based on new information, macroeconomic shifts, and company performance.

Long-Term Growth Potential

Despite near-term challenges, Apple possesses significant long-term growth potential.

- Growth in Emerging Markets: Expanding into and penetrating emerging markets presents a significant opportunity for Apple's future revenue growth.

- Promising New Product Categories: Continued investment in areas like augmented reality (AR), virtual reality (VR), and electric vehicles could drive future growth.

- Maintaining a Competitive Edge: Innovation, superior user experience, and a strong brand identity remain vital for Apple to maintain its competitive advantage.

Conclusion

Apple's Q2 report demonstrates robust financial performance, with strong revenue and earnings growth largely driven by iPhone sales and the increasingly significant Services segment. However, potential slowing growth in certain sectors and external macroeconomic factors warrant careful consideration. While the long-term growth prospects for Apple remain strong due to its brand loyalty, innovation capabilities, and opportunities in emerging markets, investors must remain mindful of competitive pressures and regulatory risks. Understanding Apple stock performance is a continuous process requiring diligent research and awareness of market trends.

Call to Action: Stay informed on Apple stock performance and future market trends by regularly checking reputable financial news sources and conducting your own thorough research before making any investment decisions. Understanding Apple stock performance is crucial for informed investing in the tech sector. Continue your research on Apple stock and other related tech stocks to make smart investment choices.

Featured Posts

-

Bundesliga Aufstieg Der Hsv Und Seine Euphorie

May 25, 2025

Bundesliga Aufstieg Der Hsv Und Seine Euphorie

May 25, 2025 -

From Rowing Machine To 2 2 Million A Fathers Fight For His Son

May 25, 2025

From Rowing Machine To 2 2 Million A Fathers Fight For His Son

May 25, 2025 -

Seeking Change Facing Punishment A Guide To Protecting Yourself

May 25, 2025

Seeking Change Facing Punishment A Guide To Protecting Yourself

May 25, 2025 -

Flash Flood Emergency Preparedness Protecting Yourself And Your Family

May 25, 2025

Flash Flood Emergency Preparedness Protecting Yourself And Your Family

May 25, 2025 -

Ferraris Inaugural Service Centre In Bengaluru What To Expect

May 25, 2025

Ferraris Inaugural Service Centre In Bengaluru What To Expect

May 25, 2025