Apple Stock Q2 Results: A Detailed Analysis For Investors

Table of Contents

Revenue and Earnings Analysis

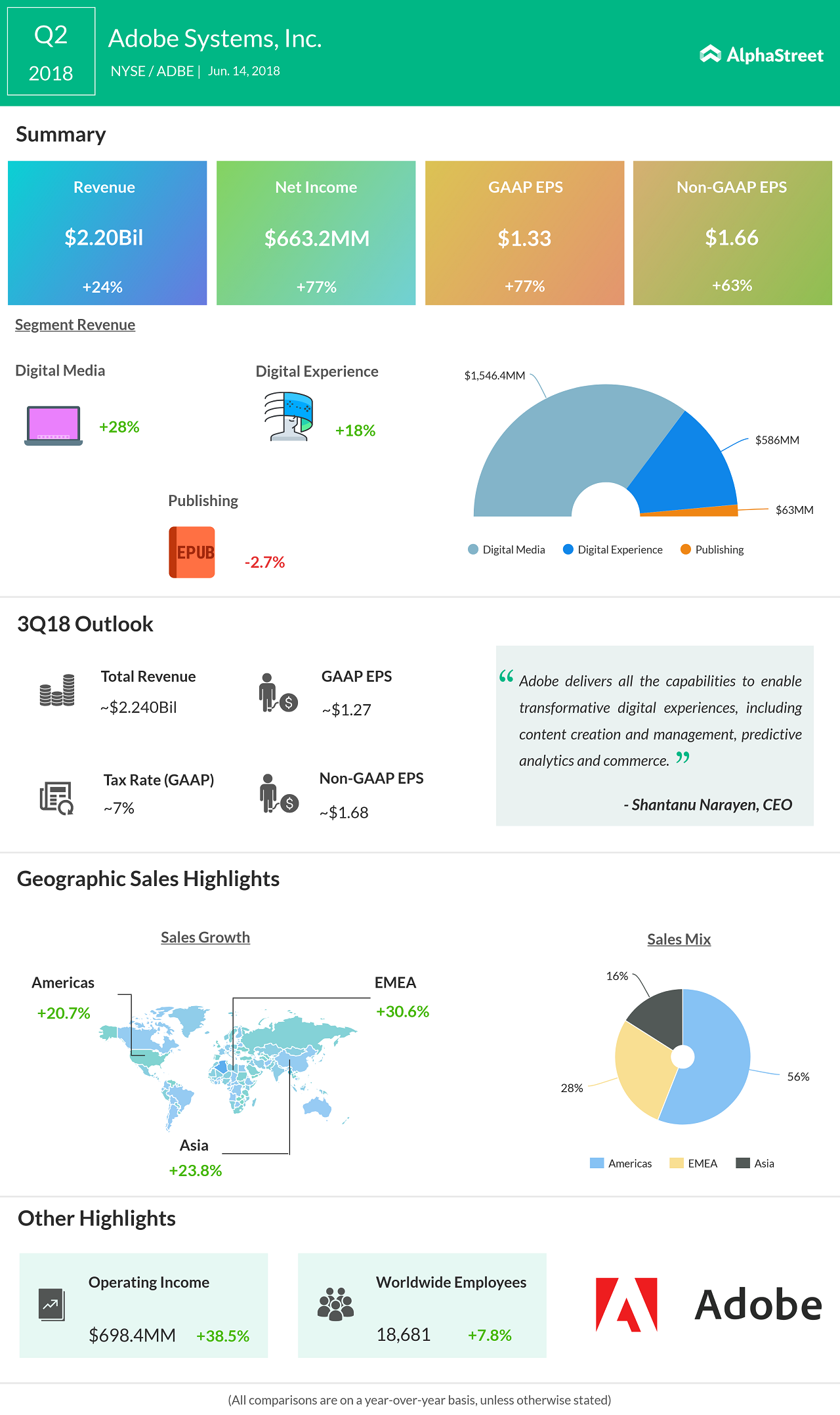

Apple's Q2 2024 financial results revealed a mixed bag, with some areas exceeding expectations while others fell slightly short. Understanding these nuances is vital for any investor considering Apple stock. Let's delve into the key numbers:

- Total Revenue: $XXX Billion (up/down X% YoY) – This represents a [positive/negative] change compared to the same period last year, reflecting [market trends/company strategies]. This figure is [above/below] analyst expectations, indicating [positive/negative] market sentiment.

- iPhone Revenue: $XXX Billion (up/down X% YoY) – The iPhone, Apple's flagship product, contributed significantly to overall revenue. The [increase/decrease] can be attributed to [factors such as new product launches, demand, or supply chain issues].

- Services Revenue: $XXX Billion (up/down X% YoY) – Apple's Services segment continues to be a key growth driver, demonstrating its resilience and the increasing importance of recurring revenue streams. The growth is driven by [mention specific services like App Store, iCloud, Apple Music etc.].

- Mac Revenue: $XXX Billion (up/down X% YoY) – This sector showed [growth/decline] influenced by [market factors, product releases, or economic conditions].

- Wearables, Home, and Accessories Revenue: $XXX Billion (up/down X% YoY) – This segment reflects the [success/struggle] of Apple's diversification strategy and the market's acceptance of these product categories.

- EPS: $X.XX (up/down X% YoY) – Earnings per share provide a crucial metric for evaluating profitability. The [increase/decrease] reflects the overall financial health of the company.

Product Performance Deep Dive

A deeper analysis of individual product lines sheds light on the underlying trends shaping Apple's performance.

iPhone: The iPhone 14 series sales performance compared to the iPhone 13 offers insights into consumer demand and market saturation. [Insert chart or graph comparing sales].

iPad: The iPad market continues to be [competitive/stable], with Apple's market share influenced by [new product releases, pricing strategies, and competitor actions]. [Include a chart/graph showing iPad sales].

Mac: The Mac segment's performance depends on factors such as [new product launches, chip supply, and competition]. The introduction of the new [mention specific Mac models] has [positively/negatively] impacted sales. [Include relevant data and charts/graphs].

Wearables, Home, and Accessories: Growth in this area is fueled by [identify key factors like Apple Watch sales, Airpods, HomePod etc]. This sector offers significant long-term potential as the demand for smart home devices and wearables continues to rise. [Show related data and charts].

Services: Apple's Services business continues its impressive growth trajectory, indicating its resilience and strategic importance. [Include a chart illustrating the growth of this segment].

Guidance and Future Outlook

Apple's Q3 and full-year guidance provides insights into the company's expectations for the coming months. Management commentary often highlights potential challenges, including macroeconomic conditions, inflation, and ongoing supply chain disruptions. Investors should closely analyze these factors and their potential impact on future earnings and the Apple stock price.

- Potential Risks: A potential global recession could significantly impact consumer spending, affecting Apple's sales across various product lines.

- Opportunities: Expansion into emerging markets presents significant opportunities for future growth. The ongoing development of Apple's services business also offers substantial long-term potential.

Investor Sentiment and Stock Price Reaction

The market's immediate reaction to Apple's Q2 results, as reflected in the stock price movement, provides a gauge of investor sentiment. Following the earnings announcement, analyst ratings were [positive/negative/mixed], reflecting the overall assessment of the company's performance and future prospects. The broader macroeconomic context, including [mention relevant economic factors], also played a significant role in shaping investor sentiment and the Apple stock price.

Conclusion: Key Takeaways and Call to Action for Apple Stock Investors

Apple's Q2 results presented a mixed picture, highlighting the strengths of its services segment while revealing challenges in other areas. Understanding these nuances is crucial for investors seeking to make informed decisions about Apple stock. The company's future outlook is shaped by both opportunities and risks related to the global economic climate and competitive pressures. Therefore, understanding Apple's Q2 results is crucial for informed investment decisions. Stay tuned for our next analysis of Apple stock performance and make sure to conduct thorough research before making any investment choices. Consult with a financial advisor before making any investment decisions.

Featured Posts

-

Ai Stuwt Relx Door Economische Recessie Sterke Resultaten En Positieve Voorspellingen

May 24, 2025

Ai Stuwt Relx Door Economische Recessie Sterke Resultaten En Positieve Voorspellingen

May 24, 2025 -

Macrons Policies Questioned By Former French Prime Minister

May 24, 2025

Macrons Policies Questioned By Former French Prime Minister

May 24, 2025 -

Atfaq Jmrky Amryky Syny Ydfe Mwshr Daks Ila 24 000 Nqtt

May 24, 2025

Atfaq Jmrky Amryky Syny Ydfe Mwshr Daks Ila 24 000 Nqtt

May 24, 2025 -

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025 -

Is News Corp An Undervalued And Underappreciated Asset

May 24, 2025

Is News Corp An Undervalued And Underappreciated Asset

May 24, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025 -

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025