Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Hit: A Breakdown

The $900 million tariff represents a substantial blow to Apple's profitability. This figure reflects increased import costs resulting from tariffs imposed on various Apple products manufactured primarily in China. These tariffs, implemented as part of the ongoing US-China trade war, significantly increase the cost of importing these goods into the US.

-

Products Affected: The tariffs impact a range of Apple products, including iPhones, AirPods, MacBooks, and Apple Watches. The specific components and finished goods subject to tariffs are constantly evolving, making it a dynamic situation for Apple's supply chain management.

-

Origin and Mechanism: The affected products are largely manufactured in China, making Apple particularly vulnerable to these tariffs. The mechanism is straightforward: for each imported product, Apple now pays an additional percentage of its value to the US government, directly impacting its profit margins.

-

Impact on Profit Margins: The exact impact on Apple's profit margins depends on several factors, including the specific tariff rates on each product and the elasticity of demand for Apple products. However, the $900 million figure directly represents a reduction in Apple's overall profitability. This added cost is likely to either reduce Apple's profits or necessitate price increases on their products.

Impact on Apple's Financial Performance

The $900 million tariff impact is already visible in Apple's financial performance. The announcement has undeniably contributed to a significant decline in Apple's stock price, impacting investor sentiment and raising concerns about future earnings.

-

Stock Price Decline: Following the tariff announcement, Apple's stock experienced a noticeable drop, reflecting investor apprehension regarding the company's future financial outlook. The exact percentage decrease varies depending on the timeframe considered, but the impact is clearly negative.

-

Analyst Predictions: Financial analysts have revised their earnings forecasts for Apple downward, reflecting the added financial burden imposed by the tariffs. These revised predictions reflect a reduced expectation of profitability for Apple in the coming quarters.

-

Investment Strategies: Apple's future investment strategies may be altered to mitigate the effects of the tariffs. This could involve exploring alternative manufacturing locations, diversifying its supply chain, or absorbing the costs.

-

Production and Supply Chain Changes: Apple is actively exploring ways to lessen its dependence on Chinese manufacturing and potentially shift some production to other countries. However, this is a complex and lengthy process, meaning these changes won't provide immediate relief from the tariff impacts.

Broader Implications of the Trade War

The impact on Apple extends far beyond the $900 million figure. It highlights the vulnerability of global supply chains and the pervasive uncertainty created by the ongoing US-China trade war.

-

US-China Trade Tensions: The escalating trade war between the US and China creates a volatile and unpredictable environment for businesses operating globally. Further tariff increases remain a significant threat.

-

Impact on Other Tech Companies: Many other technology companies rely heavily on Chinese manufacturing. The tariffs are impacting the entire technology sector, not just Apple.

-

Potential for Further Tariff Increases: The possibility of future tariff increases remains a significant concern, adding to the uncertainty faced by investors and impacting long-term strategic planning for companies such as Apple.

-

Investor Uncertainty: The ongoing trade war has injected significant uncertainty into the global market, affecting investor confidence and impacting investment decisions across various sectors.

Strategies for Investors Amidst the Apple Stock Slump

The Apple stock slump presents both risks and opportunities for investors. A well-informed approach is essential for navigating this volatile period.

-

Buying Apple Stock: Buying Apple stock at its current price presents a potential opportunity for long-term investors who believe in Apple's long-term growth prospects despite the short-term tariff challenges. However, it's crucial to weigh the potential risks involved.

-

Portfolio Diversification: Diversification remains a crucial element of a sound investment strategy to mitigate risk. Don't concentrate investments solely on Apple or any single technology company.

-

Mitigating Tariff Impacts: Investors should closely monitor developments in the US-China trade relations and adjust their investment strategies accordingly. Understanding the potential for future tariff impacts is key.

-

Alternative Investment Options: Investors should explore other investment options in the technology sector or beyond to balance their portfolio risk. This could include other tech companies less reliant on Chinese manufacturing or investments in sectors less vulnerable to trade disputes.

Conclusion

The $900 million tariff impact on Apple has undeniably caused a significant slump in its stock price, highlighting the vulnerabilities of tech giants reliant on global supply chains and susceptible to geopolitical tensions. The ongoing trade war creates significant uncertainty for investors. Understanding the complexities of the Apple stock slump and the broader implications of the $900 million tariff impact is crucial for informed investment decisions. Stay informed about further developments in the US-China trade relations and adjust your investment strategy accordingly to navigate this period of uncertainty in the Apple stock market and beyond. Consider consulting a financial advisor before making any significant decisions regarding your Apple stock portfolio.

Featured Posts

-

Serious M56 Motorway Collision Car Overturn And Casualty

May 25, 2025

Serious M56 Motorway Collision Car Overturn And Casualty

May 25, 2025 -

Mercedes F1 Toto Wolff Offers Further Insight Into George Russells Contract

May 25, 2025

Mercedes F1 Toto Wolff Offers Further Insight Into George Russells Contract

May 25, 2025 -

Demna At Gucci Design Direction And Future Collections

May 25, 2025

Demna At Gucci Design Direction And Future Collections

May 25, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025 -

Peremozhtsi Yevrobachennya 2014 2023 De Voni Zaraz

May 25, 2025

Peremozhtsi Yevrobachennya 2014 2023 De Voni Zaraz

May 25, 2025

Latest Posts

-

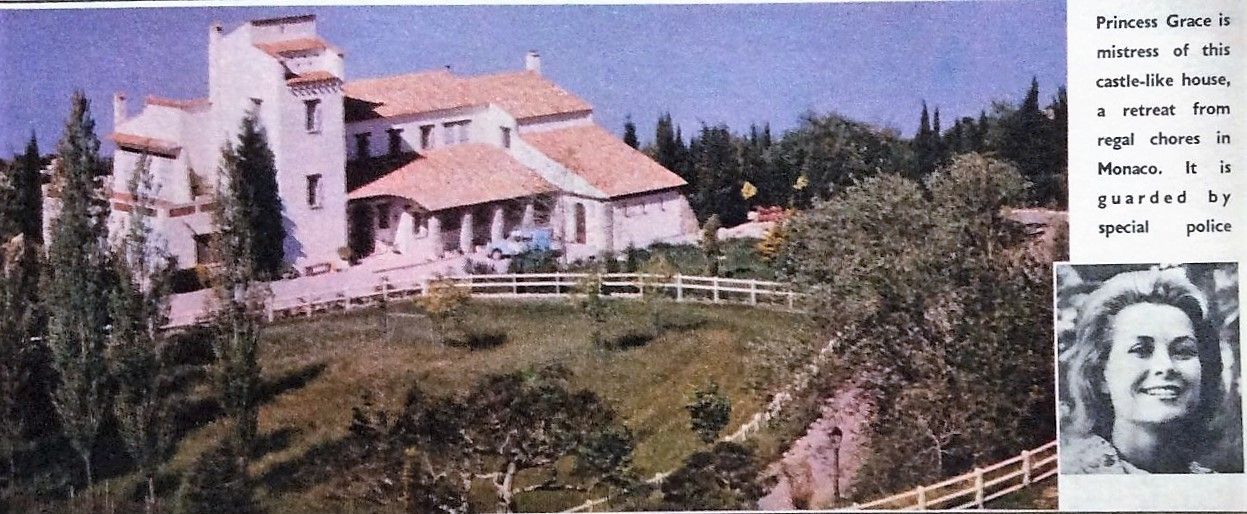

Charlene De Monaco Y Roc Agel Un Refugio En La Costa Azul

May 25, 2025

Charlene De Monaco Y Roc Agel Un Refugio En La Costa Azul

May 25, 2025 -

Charlene De Monaco El Lino Perfecto Para El Otono

May 25, 2025

Charlene De Monaco El Lino Perfecto Para El Otono

May 25, 2025 -

Florentino Perez Y El Real Madrid Un Legado En El Futbol

May 25, 2025

Florentino Perez Y El Real Madrid Un Legado En El Futbol

May 25, 2025 -

La Finca Roc Agel Historia Y Detalles De La Propiedad Grimaldi

May 25, 2025

La Finca Roc Agel Historia Y Detalles De La Propiedad Grimaldi

May 25, 2025 -

La Gestion De Florentino Perez En El Real Madrid Exitos Y Fracasos

May 25, 2025

La Gestion De Florentino Perez En El Real Madrid Exitos Y Fracasos

May 25, 2025