Applying For Finance Loans: A Step-by-Step Guide

Table of Contents

Assessing Your Eligibility for Finance Loans

Before you even start searching for finance loans, it's crucial to understand your eligibility. This involves several key steps:

Checking Your Credit Score

A crucial first step in the finance loan application process is checking your credit score. Lenders use this number to assess your creditworthiness – your ability to repay borrowed funds. A good credit score significantly improves your chances of loan approval and securing favorable interest rates.

- Understand your credit report: Obtain a copy of your credit report from the major credit bureaus to identify any errors or inaccuracies that may be impacting your score.

- Identify and correct errors: If you find any mistakes on your report, dispute them immediately with the relevant credit bureau. Incorrect information can negatively affect your credit rating.

- Improve your score through responsible financial behavior: Consistent on-time payments, keeping credit utilization low, and maintaining a diverse credit history are all key factors in building a strong credit score. This is crucial for securing better terms on your finance loans.

Keyword variations: Credit rating, credit history, creditworthiness, credit report, credit score improvement.

Determining Your Loan Needs and Amount

Carefully consider the purpose of your loan and how much you need. Borrowing the right amount is key to successful loan management. Overborrowing can lead to financial strain, while underborrowing may not fully meet your needs.

- Create a realistic budget: Before applying for any finance loans, create a detailed budget outlining your current income and expenses. This will help you determine a manageable loan amount and repayment schedule.

- Explore different loan types: Different types of finance loans exist, each with its own terms and conditions. Personal loans, business loans, mortgage loans, and student loans are just a few examples. Consider which loan type best suits your needs.

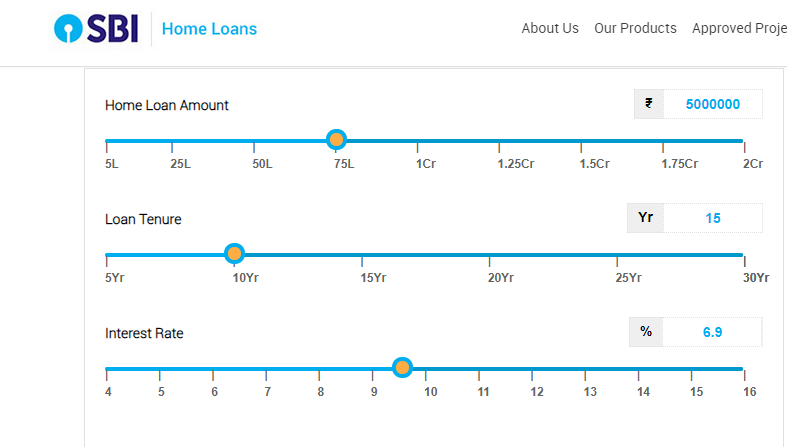

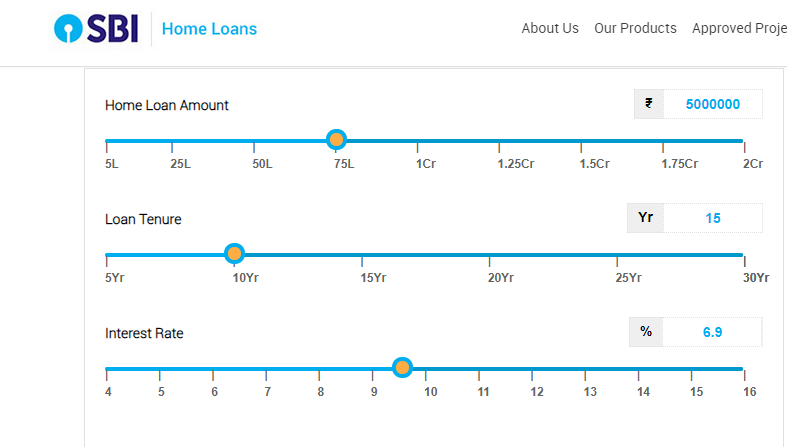

- Compare interest rates and fees: Interest rates and fees vary widely between lenders. Shop around and compare offers to find the most favorable terms for your finance loans. Understanding the Annual Percentage Rate (APR) is critical.

Keyword variations: Loan amount, loan purpose, loan repayment, budget planning, loan types, personal loan, business loan, mortgage loan, interest rate comparison, APR.

Gathering Required Documents

Having all the necessary documents ready will streamline your application process significantly. Missing documentation can lead to delays and even rejection. Be prepared!

- Proof of income: This usually includes pay stubs, tax returns, or bank statements demonstrating your income stability.

- Bank statements: These show your financial history and ability to manage your accounts.

- Tax returns: Tax returns provide further verification of your income and financial situation.

- Identification documents: A valid driver's license or passport is typically required.

- Business plan (if applicable): If applying for a business loan, a well-written business plan is essential.

Keyword variations: Loan application documents, required paperwork, supporting documentation, proof of income, bank statements, tax returns.

Choosing the Right Finance Loan Provider

With so many lenders available, selecting the right one is crucial for obtaining favorable terms on your finance loans.

Comparing Interest Rates and Fees

Don't settle for the first offer you receive. Take the time to compare interest rates, fees, and repayment terms from multiple lenders. Even small differences in interest rates can significantly impact the total cost of your loan.

- Use online loan comparison tools: Several websites offer comparison tools to help you find the best rates and terms for your needs.

- Check lender reviews and ratings: Read reviews from other borrowers to gauge a lender's reputation for customer service and fairness.

- Consider the lender's reputation and customer service: Choose a reputable lender with a history of providing excellent customer service.

Keyword variations: Loan interest rates, loan fees, APR, loan comparison websites, lender reviews, customer service.

Understanding Loan Terms and Conditions

Before signing any loan agreement, thoroughly review all the terms and conditions. Understanding these details will protect you from unexpected fees or penalties.

- Repayment schedule: Understand the frequency and amount of your payments.

- Prepayment penalties: Check if there are penalties for paying off your loan early.

- Late payment fees: Be aware of the fees charged for late payments.

- Default consequences: Understand the consequences of failing to make your payments.

Keyword variations: Loan agreement, loan terms, loan conditions, repayment terms, prepayment penalty, late payment fee, default.

Completing the Finance Loan Application

The final stage involves completing and submitting your application. Accuracy is paramount at this step.

Filling Out the Application Form Accurately

Provide accurate and complete information on the application form. Inconsistent or inaccurate information can lead to delays or rejection.

- Double-check all details: Carefully review your application form before submitting it to ensure accuracy.

- Ensure consistency across all documents: Make sure that the information on your application form matches the information on your supporting documents.

- Seek clarification if needed: If you have any questions about the application process, contact the lender for clarification.

Keyword variations: Loan application form, application process, online loan application, application accuracy.

Submitting Your Application

Once you've completed your application, submit it according to the lender's instructions. Keep track of your application's progress.

- Track your application status: Most lenders provide online tools to track the status of your application.

- Follow up if necessary: If you haven't heard back from the lender within a reasonable timeframe, follow up to inquire about the status of your application.

- Be prepared to provide additional information if requested: The lender may request additional information during the application process. Be prepared to provide it promptly.

Keyword variations: Submitting loan application, loan application status, application tracking, additional documentation.

Conclusion

Applying for finance loans can seem complicated, but by following these steps – assessing your eligibility, choosing the right provider, and completing the application accurately – you can significantly increase your chances of success. Remember to thoroughly research different finance loan options, compare rates and terms, and always read the fine print before signing any agreement. Don't hesitate to seek professional financial advice if needed. Start your journey towards securing the finance loans you need today!

Featured Posts

-

E750 Million Investment Cabinet Expands Green Home Loan Program With Eu Funding

May 28, 2025

E750 Million Investment Cabinet Expands Green Home Loan Program With Eu Funding

May 28, 2025 -

Over The Counter Birth Control Increased Access And Its Implications After Roe V Wade

May 28, 2025

Over The Counter Birth Control Increased Access And Its Implications After Roe V Wade

May 28, 2025 -

Baseball Book Review Perfect For Opening Day

May 28, 2025

Baseball Book Review Perfect For Opening Day

May 28, 2025 -

Climate Whiplash A Growing Threat To Cities Worldwide

May 28, 2025

Climate Whiplash A Growing Threat To Cities Worldwide

May 28, 2025 -

Prakiraan Cuaca Detail Jawa Barat 7 Mei 2024 Hujan Hingga Petang

May 28, 2025

Prakiraan Cuaca Detail Jawa Barat 7 Mei 2024 Hujan Hingga Petang

May 28, 2025

Latest Posts

-

Le Depute Laurent Jacobelli Un Portrait Du Representant De La Moselle

May 30, 2025

Le Depute Laurent Jacobelli Un Portrait Du Representant De La Moselle

May 30, 2025 -

Laurent Jacobelli Actions Et Positions Politiques A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Actions Et Positions Politiques A L Assemblee Nationale

May 30, 2025 -

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025 -

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025 -

Laurent Jacobelli Depute Rn De La Moselle Vice President Du Groupe A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Depute Rn De La Moselle Vice President Du Groupe A L Assemblee Nationale

May 30, 2025