Applying For Tribal Loans With Bad Credit: A Guide To Direct Lenders

Table of Contents

H2: Understanding Tribal Loans

H3: What are Tribal Loans?

Tribal loans are short-term loans offered by lending institutions owned and operated by Native American tribes. These lenders operate on tribal land, often under their own sovereign laws, which allows them to offer lending services that may differ from traditional banks. Understanding these differences is crucial when considering bad credit tribal loans.

H3: How Tribal Loans Differ from Traditional Loans

Tribal loans, especially those marketed for bad credit tribal loans, often have different characteristics than loans from traditional banks:

- Faster Approval Process: Tribal lenders may offer a quicker approval process compared to traditional banks, sometimes providing same-day funding.

- Less Stringent Credit Score Requirements: One of the major attractions of tribal loans for bad credit is the often less stringent credit score requirements. However, this doesn't mean no credit check is performed.

- Potentially Higher Interest Rates: Because of the higher risk associated with lending to borrowers with bad credit, interest rates on tribal loans can be significantly higher than traditional loans. Always compare rates before applying for bad credit tribal loans.

- Different Repayment Terms: Repayment terms can vary significantly, offering flexibility but requiring careful consideration to avoid debt traps.

H3: Are Tribal Loans Right for You?

Tribal loans for bad credit can be a lifeline for those facing financial emergencies and unable to secure a loan through traditional channels. However, they are not a perfect solution for everyone. Carefully weigh the pros and cons:

Pros:

- Accessibility for borrowers with bad credit.

- Potentially faster approval process.

- Flexible repayment options (in some cases).

Cons:

- High interest rates.

- Potential for predatory lending practices (if not careful).

- Short repayment terms can make it difficult to manage.

Only apply for a tribal loan if you are confident you can manage the repayment schedule and understand the associated costs.

H2: Finding Reputable Direct Tribal Lenders

Navigating the tribal loan landscape requires caution. Many illegitimate lenders prey on those with bad credit.

H3: Identifying Legitimate Lenders

To avoid scams and predatory lending practices, always take these precautions when looking for direct tribal lenders:

- Check for Licensing and Registration: Ensure the lender is properly licensed and registered with the appropriate tribal authorities.

- Read Online Reviews and Testimonials: Check independent review sites to gauge the experiences of other borrowers.

- Be Wary of Guaranteed Approval: No legitimate lender guarantees approval. Be suspicious of lenders making such claims.

- Avoid Lenders Requiring Upfront Fees: Legitimate lenders do not require upfront fees for loan applications.

H3: Comparing Loan Offers from Different Lenders

Never commit to the first loan offer you receive. Carefully compare offers from multiple direct tribal lenders:

- Use Online Comparison Tools: Utilize online resources to compare interest rates, fees, and repayment terms.

- Carefully Read the Loan Agreement: Thoroughly review all terms and conditions before signing any agreement.

- Understand All Fees and Charges: Be aware of all associated fees, including origination fees, late payment penalties, and prepayment penalties.

H3: The Application Process

Applying for a tribal loan generally involves:

- Completing an online application with accurate personal and financial information.

- Providing necessary documentation, such as proof of income and identification.

- Reviewing and signing the loan agreement.

- Receiving funds, usually within a short timeframe.

H2: Managing Tribal Loans Responsibly

Taking out a tribal loan with bad credit requires responsible financial management.

H3: Understanding Your Repayment Obligations

Carefully read and understand your repayment schedule. Make payments on time to avoid late fees and damage to your credit score, even though it's not directly reported to credit bureaus in the same way traditional loans are.

H3: Budgeting and Financial Planning

Implement responsible borrowing habits:

- Create a Realistic Budget: Track your income and expenses to ensure you can comfortably afford your loan payments.

- Track Your Spending: Monitor your spending habits to identify areas where you can reduce expenses.

- Explore Credit Counseling Services: If you are struggling with debt, consider seeking professional credit counseling services.

H3: What to do if You are Struggling to Repay

If you find yourself unable to make your loan payments, contact your lender immediately. Explore options like repayment plans or hardship programs. Ignoring the issue will only worsen the situation.

3. Conclusion

Securing Tribal Loans with Bad Credit can provide much-needed financial relief, but it's crucial to approach the process responsibly. By understanding the nuances of tribal lending, identifying reputable direct tribal lenders, and managing your loan carefully, you can increase your chances of a positive outcome. Remember to compare offers, read the fine print, and prioritize responsible borrowing habits. Explore your options for tribal loans with bad credit today and find a reputable direct tribal lender that fits your budget. Don't let bad credit hold you back—take control of your finances and find the right solution for your needs.

Featured Posts

-

Lotto Winner Winning Shop Revealed Big Prize Awaits

May 28, 2025

Lotto Winner Winning Shop Revealed Big Prize Awaits

May 28, 2025 -

Best Tribal Loans For Bad Credit Direct Lenders Guaranteed Approval

May 28, 2025

Best Tribal Loans For Bad Credit Direct Lenders Guaranteed Approval

May 28, 2025 -

Eight Game Winning Streak Over For Angels After Marlins Loss

May 28, 2025

Eight Game Winning Streak Over For Angels After Marlins Loss

May 28, 2025 -

Alejandro Garnachos Autograph Snub A Social Media Reaction

May 28, 2025

Alejandro Garnachos Autograph Snub A Social Media Reaction

May 28, 2025 -

Marlins Defeat Nationals Stowers And Conine Lead The Charge

May 28, 2025

Marlins Defeat Nationals Stowers And Conine Lead The Charge

May 28, 2025

Latest Posts

-

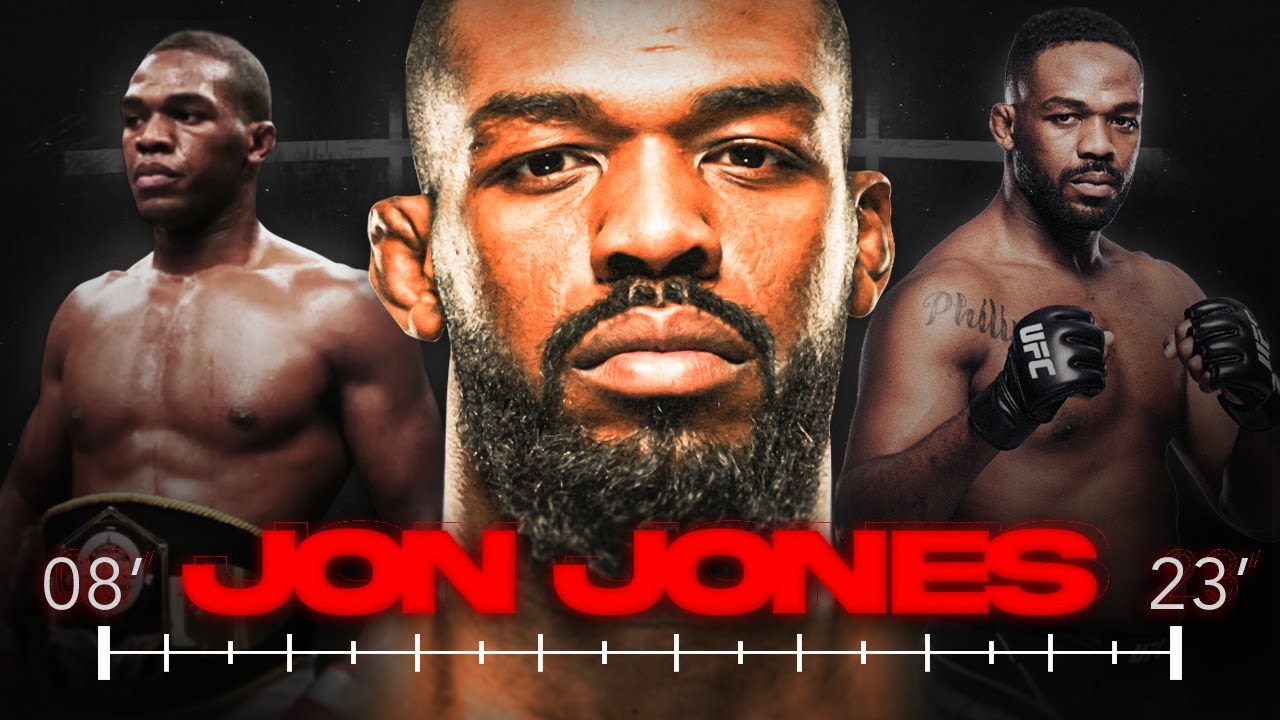

Jon Jones Reveals Fight Injuries Sustained During Hasbulla Sparring

May 30, 2025

Jon Jones Reveals Fight Injuries Sustained During Hasbulla Sparring

May 30, 2025 -

Jon Joness Injury Details On His Daily Training With Hasbulla

May 30, 2025

Jon Joness Injury Details On His Daily Training With Hasbulla

May 30, 2025 -

Six Months To Prepare Jon Joness Aspinall Fight Demand

May 30, 2025

Six Months To Prepare Jon Joness Aspinall Fight Demand

May 30, 2025 -

The Cormier Jones Rivalry Why It Continues To Define Jon Jones Career

May 30, 2025

The Cormier Jones Rivalry Why It Continues To Define Jon Jones Career

May 30, 2025 -

Tom Aspinall Responds To Jon Jones Public Criticism

May 30, 2025

Tom Aspinall Responds To Jon Jones Public Criticism

May 30, 2025