Are High Stock Market Valuations A Cause For Concern? BofA Says No.

Table of Contents

BofA's Argument: Why High Valuations Aren't Necessarily Negative

BofA's contrarian viewpoint rests on several key pillars. They argue that the current high stock market valuations are justifiable, given the current economic climate.

Low Interest Rates: Historically low interest rates significantly impact stock valuations. When borrowing costs are low, companies can invest more readily, boosting earnings and making stocks more attractive relative to bonds. This environment encourages investment in equities, driving up prices and leading to what some might perceive as high stock market valuations. This is a key factor in BofA's positive assessment.

Strong Corporate Earnings: Robust corporate profits are another crucial element supporting BofA's argument. Many companies have reported impressive earnings growth, demonstrating the underlying strength of the economy and justifying current elevated stock prices. This strong performance contributes to higher price-to-earnings ratios (P/E ratios), a common metric used to assess stock market valuations.

Technological Innovation: The transformative power of technological innovation fuels long-term growth prospects, a factor often overlooked in short-term valuation assessments. Breakthroughs in areas such as artificial intelligence, biotechnology, and renewable energy are expected to drive significant economic expansion, supporting higher stock market valuations over the long term. This potential for future growth helps justify current high stock market valuations, according to BofA.

Inflationary Pressures: While inflation might seem to pose a threat to valuations, BofA's analysis suggests that controlled inflation can actually support corporate pricing power and, subsequently, earnings growth. However, this is a nuanced point, and runaway inflation would undoubtedly pose a significant risk.

- Key points of BofA's reasoning: Low interest rates, strong corporate earnings, technological innovation, and potentially manageable inflation.

- Data Point (example): Insert relevant data or quote from a BofA report here, if available, citing the source properly.

Counterarguments: Potential Risks Associated with High Valuations

While BofA presents a compelling case, it's crucial to acknowledge the potential risks associated with high stock market valuations.

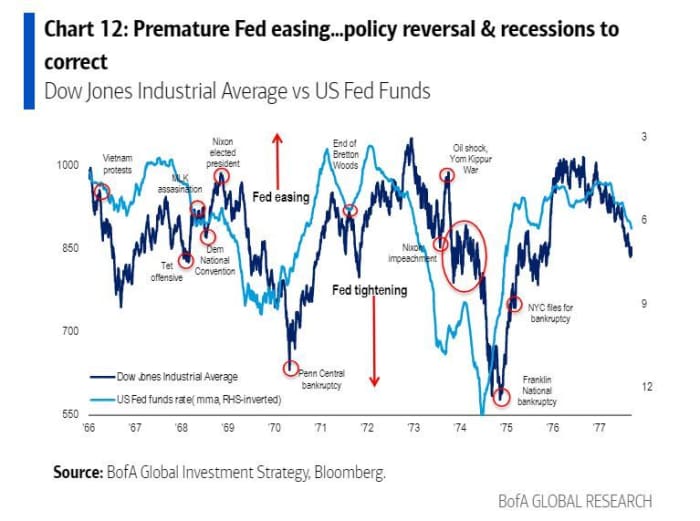

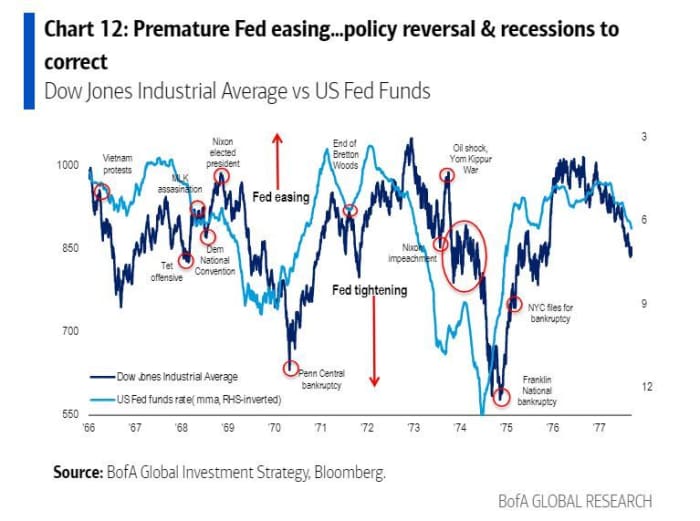

Market Corrections: High valuations increase the likelihood of market corrections or even crashes. History is replete with examples of periods of high stock market valuation followed by significant declines. Investors need to be prepared for potential volatility and price adjustments.

Valuation Metrics: While P/E ratios are commonly used, other valuation metrics like the Shiller PE (CAPE ratio) offer a longer-term perspective and can paint a different picture. These metrics can help provide a more nuanced view, but their limitations must also be considered. Over-reliance on any single metric can be misleading.

Geopolitical Risks: Unforeseen geopolitical events—wars, political instability, or trade disputes—can significantly impact market sentiment and cause sharp corrections, regardless of underlying economic fundamentals. These external factors can dramatically affect stock market valuations.

Interest Rate Hikes: Future interest rate increases by central banks, aimed at curbing inflation, can negatively impact stock prices by increasing borrowing costs for companies and reducing investor appetite for equities. This could lead to a decline in high stock market valuations.

- Arguments against BofA's optimism: The inherent risk of market corrections, the limitations of valuation metrics, geopolitical uncertainties, and the impact of potential interest rate hikes.

- Example of historical correction: The dot-com bubble burst of 2000 or the 2008 financial crisis serve as stark reminders of the potential for significant market downturns, even after periods of high stock market valuations.

A Balanced Perspective: Considering Both Sides of the Coin

Navigating the complexities of high stock market valuations requires a balanced perspective.

Risk Tolerance: Investors must carefully assess their own risk tolerance. Those with a lower risk tolerance might choose to allocate a smaller portion of their portfolio to equities, opting for more conservative investments.

Diversification Strategies: Diversification remains a cornerstone of sound investment strategy. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk.

Long-Term Investing: A long-term investment horizon is crucial for weathering market fluctuations. Short-term market movements should be viewed within the context of a longer-term investment strategy.

Professional Advice: Seeking advice from a qualified financial advisor is essential, especially in navigating the complexities of high stock market valuations. A professional can help create a personalized investment plan tailored to individual circumstances and risk tolerance.

- Key risks and rewards: High potential returns versus the risk of significant corrections.

- Practical advice: Diversify, consider your risk tolerance, invest for the long term, and consult a financial advisor.

Conclusion: Navigating the Uncertainties of High Stock Market Valuations

BofA's optimistic outlook on high stock market valuations highlights the potential for continued growth driven by low interest rates, strong corporate earnings, and technological innovation. However, counterarguments emphasizing the risk of market corrections, geopolitical uncertainties, and potential interest rate hikes underscore the need for caution. High stock market valuations represent a complex issue with both opportunities and significant risks.

The key takeaway is that informed decision-making is paramount. Investors should carefully consider their own risk tolerance, diversify their portfolios, adopt a long-term investment strategy, and, most importantly, seek professional financial advice before making any significant investment decisions related to high stock market valuations. Conduct thorough research and understand the potential implications of elevated stock prices before committing your capital.

Featured Posts

-

Russias Spring Offensive A Weather Dependent Endgame

Apr 30, 2025

Russias Spring Offensive A Weather Dependent Endgame

Apr 30, 2025 -

Netflix Top 10 A 13 Year Old Easter Bunny Movie With Hugh Jackman

Apr 30, 2025

Netflix Top 10 A 13 Year Old Easter Bunny Movie With Hugh Jackman

Apr 30, 2025 -

Kham Pha Nha Vo Dich Dau Tien Trong Lich Su Giai Bong Da Thanh Nien Sinh Vien Quoc Te

Apr 30, 2025

Kham Pha Nha Vo Dich Dau Tien Trong Lich Su Giai Bong Da Thanh Nien Sinh Vien Quoc Te

Apr 30, 2025 -

Revelatii In Dosarele X Posibilitatea Unei Noi Anchete

Apr 30, 2025

Revelatii In Dosarele X Posibilitatea Unei Noi Anchete

Apr 30, 2025 -

Amanda Owens Ambitious Plans Post Separation From Husband

Apr 30, 2025

Amanda Owens Ambitious Plans Post Separation From Husband

Apr 30, 2025