Are High Stock Market Valuations A Concern? BofA Says No. Here's Why.

Table of Contents

The current state of the stock market is characterized by relatively high valuations, leaving many investors questioning whether a correction is imminent. Concerns about overvalued stocks are certainly valid, prompting anxieties about potential market downturns. However, Bank of America (BofA) offers a surprisingly optimistic perspective, arguing that current valuations aren't necessarily a cause for alarm. This article delves into BofA's reasoning and examines the key factors underpinning their belief that high stock market valuations don't automatically signal impending trouble.

BofA's Key Arguments Against Valuation Concerns

BofA's optimistic outlook on high stock market valuations rests on several key pillars. They contend that current prices are justified by a combination of strong corporate performance, supportive monetary policy, and the promise of long-term growth fueled by technological innovation.

Strong Corporate Earnings and Profitability

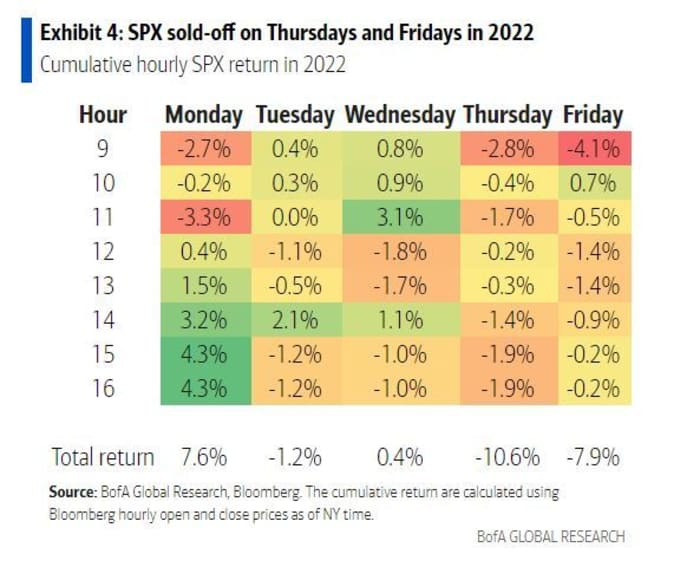

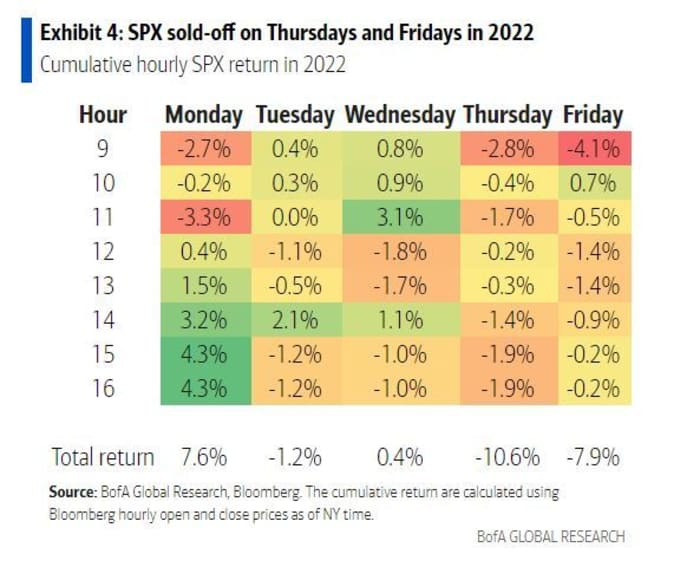

BofA's central argument hinges on the robust performance of corporate America. They point to strong earnings growth and healthy profit margins as evidence that current stock prices are, in fact, sustainable. This isn't just speculation; it's backed by data. The S&P 500, for example, has shown consistent earnings growth in recent quarters, defying predictions of a significant slowdown.

- Stronger-than-expected earnings reports from major companies: Many leading corporations have exceeded analysts' expectations, demonstrating resilience in the face of economic uncertainty.

- Increased corporate profitability despite economic headwinds: Despite inflationary pressures and supply chain challenges, many companies have managed to maintain or even improve their profitability through effective cost management and pricing strategies.

- Positive forward-looking guidance from businesses: Many companies are projecting continued growth in the coming quarters, indicating confidence in their future prospects and bolstering BofA's optimistic view.

This combination of robust current performance and positive future projections forms a cornerstone of BofA's argument against immediate concerns over high stock valuations.

Low Interest Rates and Abundant Liquidity

The current low-interest-rate environment and the abundance of liquidity in the market also contribute significantly to BofA's assessment. Low borrowing costs encourage companies to invest and expand, while readily available capital fuels investor appetite for riskier assets, including stocks.

- Impact of quantitative easing and low borrowing costs: Years of quantitative easing and historically low interest rates have injected significant liquidity into the financial system, driving up asset prices, including stocks.

- Increased investor appetite for riskier assets: With low returns on safer investments like bonds, investors are more willing to accept higher risk in pursuit of potentially higher returns from stocks.

- Continued support from central banks: While the pace of monetary easing may be slowing, central banks remain committed to supporting economic growth, which indirectly supports stock market valuations.

Technological Innovation and Long-Term Growth Potential

Beyond immediate economic factors, BofA highlights the transformative power of technological innovation as a key driver of long-term market growth. This technological revolution is expected to fuel significant expansion in various sectors, justifying higher valuations.

- Growth in sectors like artificial intelligence, renewable energy, and biotechnology: These sectors are poised for explosive growth, creating opportunities for substantial returns on investment.

- Long-term prospects for disruptive technologies: The emergence of disruptive technologies constantly reshapes industries, creating new investment opportunities and driving future growth.

- Potential for above-average returns in innovative companies: Companies at the forefront of technological innovation often offer the potential for significantly higher returns than more established, less dynamic businesses.

Counterarguments and Addressing Potential Risks

While BofA presents a compelling case, it's crucial to acknowledge potential counterarguments and risks. High valuations, by their very nature, invite scrutiny.

Valuation Metrics and Their Limitations

Commonly used valuation metrics, such as the Price-to-Earnings (P/E) ratio, can be misleading. They can be easily misinterpreted and fail to capture the nuances of individual company performance and future growth prospects.

- Sector-specific variations in valuation multiples: Different sectors have different growth trajectories and risk profiles, leading to significant variations in acceptable valuation multiples.

- The impact of accounting practices on reported earnings: Accounting methods can significantly affect reported earnings, potentially distorting valuation metrics.

- The difficulty in accurately forecasting future growth: Predicting future growth with precision is inherently challenging, making it difficult to definitively assess whether current valuations are justified.

Geopolitical and Economic Uncertainty

Geopolitical instability, inflation, supply chain disruptions, and unexpected economic downturns pose significant risks. These factors can easily impact corporate profitability and investor sentiment, potentially leading to a market correction.

- Potential impact of rising interest rates: Increases in interest rates can dampen economic growth and reduce investor appetite for riskier assets, leading to lower stock valuations.

- Risks associated with global conflicts and trade wars: Geopolitical tensions can disrupt supply chains, increase input costs, and negatively impact corporate profits.

- The effects of supply chain bottlenecks on corporate profits: Ongoing supply chain disruptions can constrain production, increase costs, and negatively impact corporate profitability.

Conclusion

While high stock market valuations raise legitimate concerns, BofA's analysis suggests that several factors mitigate these risks. Strong corporate earnings, low interest rates, and the potential for long-term growth driven by technological innovation offer a counterbalance to valuation anxieties. However, investors should remain acutely aware of potential risks associated with economic and geopolitical uncertainty. Understanding the complexities of stock market valuations is crucial for informed investment decisions. Continue your research into high stock market valuations and make informed choices based on your individual risk tolerance and investment goals. Remember to consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

Koriun Inversiones Desentranando Su Fraudulento Esquema Ponzi

May 17, 2025

Koriun Inversiones Desentranando Su Fraudulento Esquema Ponzi

May 17, 2025 -

Free Severance Streaming How To Watch Every Episode On Demand

May 17, 2025

Free Severance Streaming How To Watch Every Episode On Demand

May 17, 2025 -

Live Score Knicks Vs Trail Blazers March 13 2025 77 77

May 17, 2025

Live Score Knicks Vs Trail Blazers March 13 2025 77 77

May 17, 2025 -

Boston Celtics Ownership Change 6 1 Billion Sale Sparks Debate Among Fans

May 17, 2025

Boston Celtics Ownership Change 6 1 Billion Sale Sparks Debate Among Fans

May 17, 2025 -

I Episkepsi Tramp Sti Saoydiki Aravia Leptomereies Apo Tin Megaloprepi Teleti Ypodoxis

May 17, 2025

I Episkepsi Tramp Sti Saoydiki Aravia Leptomereies Apo Tin Megaloprepi Teleti Ypodoxis

May 17, 2025