Are High Stock Market Valuations A Concern? BofA Weighs In.

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's analysis of current stock market valuations utilizes a multifaceted approach, incorporating various metrics to gauge the overall health and potential risks within the equity market. Their valuation analysis frequently employs traditional methods like price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and other market multiples to assess whether market capitalization accurately reflects underlying company performance and future growth potential. They also incorporate forward-looking estimates to account for potential future earnings and revenue growth.

-

Key Findings: BofA's recent reports often highlight specific sectors as being overvalued, while others are considered undervalued based on their rigorous analysis of market multiples and growth prospects. The specific details vary depending on the prevailing economic climate and the performance of different sectors. For example, at a certain time they might highlight the technology sector as potentially overvalued while favoring certain value stocks in more stable sectors.

-

Overvalued and Undervalued Sectors: BofA’s research may identify specific sectors that are considered overvalued due to high P/E ratios or unsustainable growth rates. Conversely, they might also identify sectors with strong fundamentals but lower valuations, representing potentially attractive investment opportunities. These findings are regularly updated and should be viewed within the context of their latest published reports.

-

Quantitative Metrics: Their analyses routinely utilize key metrics like forward P/E ratios, PEG ratios (Price/Earnings to Growth), and dividend yields to pinpoint potential overvaluation or undervaluation in specific stocks and sectors.

-

BofA's Outlook: BofA's predictions for future valuation changes are dynamic and reflect the ever-evolving economic landscape and market sentiment. Their outlook regularly incorporates considerations of interest rate changes, inflation, and economic growth projections. Their predictions should therefore be interpreted in conjunction with their full reports and understanding of their methodologies.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these drivers is critical for assessing the sustainability of these levels.

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies, fueling investment and driving up corporate earnings. This, in turn, supports higher stock prices as investors seek higher returns. Low interest rates also make bonds less attractive, encouraging investment in equities.

-

Quantitative Easing (QE): Past QE programs injected significant liquidity into the markets, boosting asset prices across the board, including equities. This abundance of liquidity further fueled investment and pushed valuations higher.

-

Economic Growth (or Expectations of it): Periods of strong economic growth, or even strong expectations of it, typically lead to higher corporate profits and increased investor confidence, contributing to higher stock market valuations.

-

Investor Sentiment and Speculation: Positive investor sentiment and market speculation can inflate asset prices beyond what might be justified by fundamentals alone, creating a speculative bubble that can be prone to sudden corrections.

-

Technological Innovation: Breakthroughs in technology often drive significant growth in specific sectors, leading to exceptionally high valuations for companies at the forefront of innovation.

Risks Associated with High Stock Market Valuations

High stock market valuations inherently carry significant risks. Investors should be aware of these potential downsides.

-

Market Correction or Crash: High valuations make markets more susceptible to corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic downturn could trigger a sharp decline in prices.

-

Rising Interest Rates: Increases in interest rates typically lead to lower stock valuations as borrowing becomes more expensive for companies, reducing profits and making bonds a more attractive alternative for investors.

-

Inflation Risk: High inflation erodes the purchasing power of future earnings, negatively impacting company valuations and investor returns. Unexpected inflation spikes can trigger abrupt market reactions.

-

Portfolio Diversification and Risk Management: To mitigate these risks, a diversified investment portfolio is crucial. Spreading investments across different asset classes and sectors can help reduce overall portfolio volatility and risk. Implementing appropriate risk management strategies is critical to protecting capital during market downturns.

BofA's Recommendations for Investors

BofA's investment recommendations vary depending on investor risk tolerance and time horizon. Their analyses usually incorporate various strategies.

-

High-Risk Tolerance Investors: Investors with a high-risk tolerance might be advised to consider growth stocks in innovative sectors, accepting higher volatility in pursuit of potentially higher returns.

-

Low-Risk Tolerance Investors: Investors with a lower risk tolerance might be recommended to focus on more defensive stocks, high-quality bonds, or other less volatile assets.

-

Asset Allocation: BofA's recommendations for asset allocation typically involve diversification across various asset classes to balance risk and return. This could involve a mix of equities, bonds, real estate, and other assets.

-

Sector-Specific Recommendations: Their sector-specific recommendations reflect their valuation analysis and outlook for different economic scenarios. They may suggest overweighting undervalued sectors and underweighting overvalued ones.

Conclusion:

BofA's assessment of current high stock market valuations points to a complex interplay of macroeconomic factors and investor sentiment. While economic growth and low interest rates have contributed to high valuations, the associated risks of a market correction, rising interest rates, and inflation remain significant. BofA’s recommendations emphasize the importance of a well-diversified portfolio tailored to individual risk tolerance and investment goals. Understanding high stock market valuations is crucial for effective investment planning. Conduct thorough research and consult a financial advisor to navigate the current market conditions effectively.

Featured Posts

-

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025

Wynne Evans Denies Wrongdoing Amidst Show Of Support

May 09, 2025 -

Palantirs Potential A Trillion Dollar Valuation By The End Of The Decade

May 09, 2025

Palantirs Potential A Trillion Dollar Valuation By The End Of The Decade

May 09, 2025 -

King Zvinuvachuye Maska Ta Trampa U Zradi Detali Zayavi Pismennika

May 09, 2025

King Zvinuvachuye Maska Ta Trampa U Zradi Detali Zayavi Pismennika

May 09, 2025 -

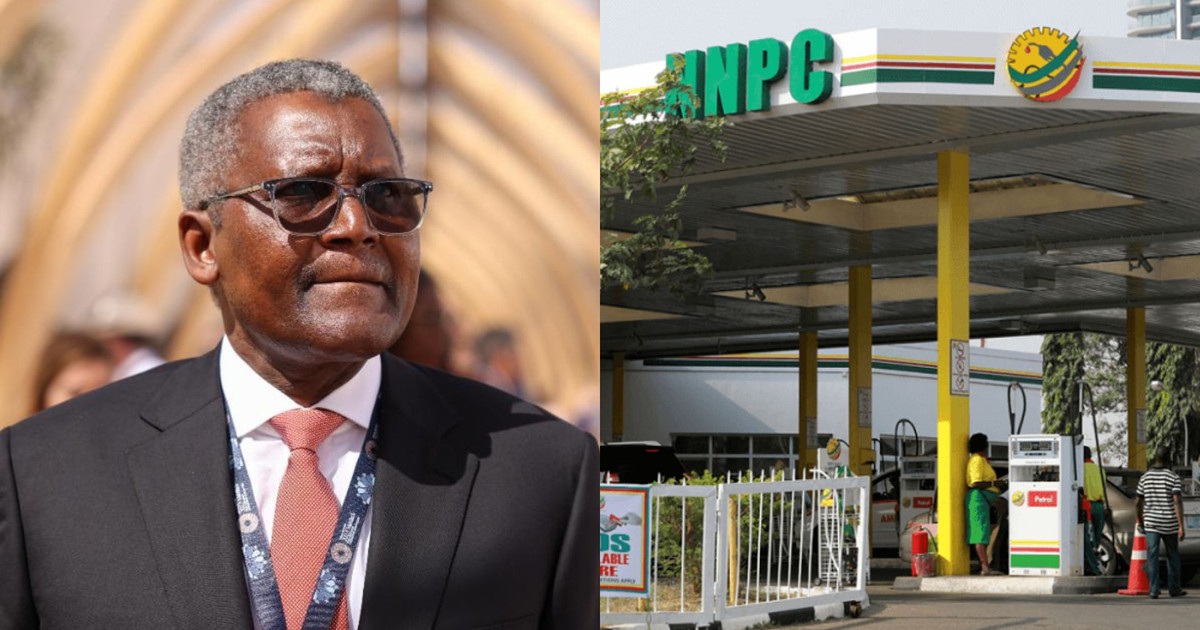

Analyzing The Correlation Between Dangote And Nnpc Petrol Prices

May 09, 2025

Analyzing The Correlation Between Dangote And Nnpc Petrol Prices

May 09, 2025 -

Analyzing The I Control You Moment Jack Doohan And Flavio Briatore On Netflix

May 09, 2025

Analyzing The I Control You Moment Jack Doohan And Flavio Briatore On Netflix

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025