Are Stretched Stock Market Valuations A Risk? BofA Weighs In

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's valuation analysis often relies on a combination of traditional and more nuanced metrics to assess the overall health and potential risks within the market. Their concerns stem from a confluence of factors, primarily focusing on valuation multiples.

-

High Price-to-Earnings (P/E) Ratios: BofA likely points to elevated P/E ratios across various sectors as a significant indicator of potentially stretched valuations. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, implying a potentially inflated market price.

-

Elevated Price-to-Sales (P/S) Ratios: Similarly, high price-to-sales ratios, particularly in rapidly growing tech sectors, may be highlighted as a concern. While high growth justifies some premium, excessively high P/S ratios can signal overvaluation.

-

Methodology: BofA uses a range of models and analyses, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions, to determine if current market capitalization reflects fair value. They also consider macroeconomic factors like interest rates and inflation.

-

Specific Sectors: BofA's reports may single out certain sectors or asset classes as being particularly overvalued, potentially citing specific examples of companies with high valuation multiples but questionable long-term growth prospects.

-

Dissenting Opinions: While BofA's perspective carries significant weight, it's crucial to acknowledge that other financial institutions might hold differing views. Some may argue that current valuations are justified by low interest rates or strong future earnings growth. A thorough investor should always seek multiple perspectives.

Understanding the Risks of High Valuations

Investing in overvalued assets carries inherent risks, primarily the potential for capital loss. If the market corrects, and valuations revert to more historical norms, investors holding overvalued assets could experience significant losses.

-

Market Corrections and Crashes: Historically, periods of high valuations have often been followed by market corrections or even crashes. The dot-com bubble of the late 1990s and the 2008 financial crisis serve as stark examples of this risk.

-

Types of Risks: High valuations increase several types of risks:

- Increased Volatility: Overvalued markets tend to be more volatile, meaning prices can swing dramatically in short periods.

- Reduced Returns: Even if a market doesn't crash, high valuations can lead to lower future returns, as the potential for significant price appreciation is diminished.

- Interest Rate Sensitivity: Rising interest rates can significantly impact valuations, especially for growth stocks that rely on future earnings discounted at lower rates. Higher rates make those future earnings less valuable today.

-

Impact of Interest Rate Hikes: The Federal Reserve's actions to combat inflation via interest rate hikes directly influence market valuations. Higher rates increase borrowing costs for companies, reducing profitability and potentially impacting stock prices.

Strategies for Navigating Stretched Valuations

Navigating a market with potentially stretched stock market valuations requires a proactive and well-considered investment strategy.

-

Risk Mitigation: The most effective way to mitigate the risks associated with high valuations is through careful portfolio diversification and risk management.

-

Portfolio Diversification: Diversifying across different asset classes reduces the overall risk of your portfolio. Instead of concentrating solely in equities, consider allocating a portion of your assets to bonds, real estate, or other alternative investments.

-

Defensive Investing: A shift towards a more defensive investing strategy might be considered, focusing on companies with lower valuations, steady earnings, and less sensitivity to economic downturns. Value investing, focusing on companies trading below their intrinsic value, is a strategy to consider.

-

Asset Allocation: Rebalance your portfolio regularly to maintain your desired asset allocation. This involves selling some overvalued assets and reinvesting in undervalued ones.

-

Long-Term Investment: Maintain a long-term investment horizon. Short-term market fluctuations should not dictate your long-term investment decisions. Avoid panic selling during market downturns. Focus on the fundamental strength of your underlying investments.

The Role of Portfolio Diversification

Diversification is paramount in mitigating the risks of stretched stock market valuations.

-

Diversification Strategies: Diversify across various sectors, market caps (large, mid, small), and geographies. International diversification helps reduce exposure to specific market risks.

-

Risk Tolerance: Your asset allocation should align with your risk tolerance. Conservative investors might allocate a larger portion to bonds and less to stocks, while more aggressive investors might accept higher equity exposure.

-

Investment Portfolio: Regularly review and adjust your portfolio to reflect changes in your risk tolerance, market conditions, and financial goals.

Conclusion

BofA's concerns regarding stretched stock market valuations underscore the importance of a prudent and adaptable investment strategy. While a market correction isn't inevitable, understanding the potential risks associated with high valuations is crucial for every investor. Don't let potentially stretched stock market valuations catch you off guard. Proactively review your investment strategy, consider risk mitigation techniques like portfolio diversification, and consult a financial advisor to ensure your portfolio is well-positioned for the current market environment and address concerns about stretched stock market valuations. A proactive approach to risk management is key to navigating the complexities of the current market.

Featured Posts

-

Subsystem Malfunction Forces Blue Origin To Cancel Rocket Launch

Apr 22, 2025

Subsystem Malfunction Forces Blue Origin To Cancel Rocket Launch

Apr 22, 2025 -

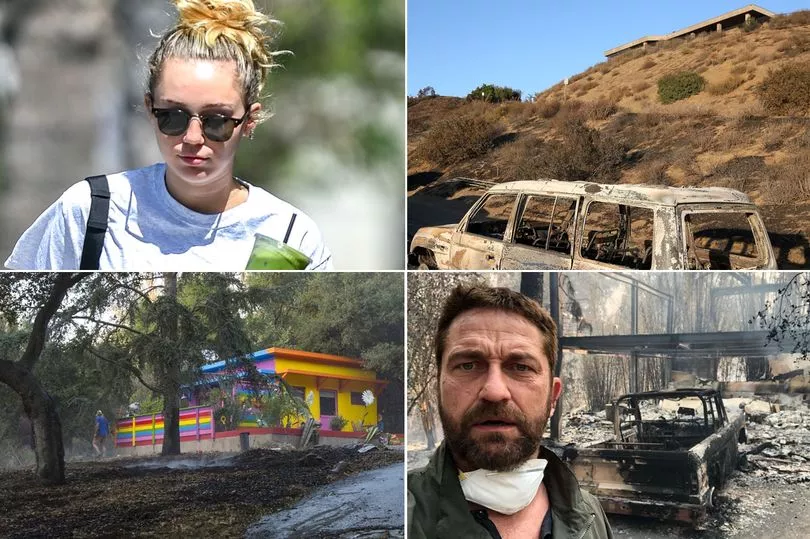

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 22, 2025 -

Assessing The Impact Of Tariffs On Chinas Exports

Apr 22, 2025

Assessing The Impact Of Tariffs On Chinas Exports

Apr 22, 2025 -

Ev Mandate Faces Renewed Opposition From Car Dealers

Apr 22, 2025

Ev Mandate Faces Renewed Opposition From Car Dealers

Apr 22, 2025 -

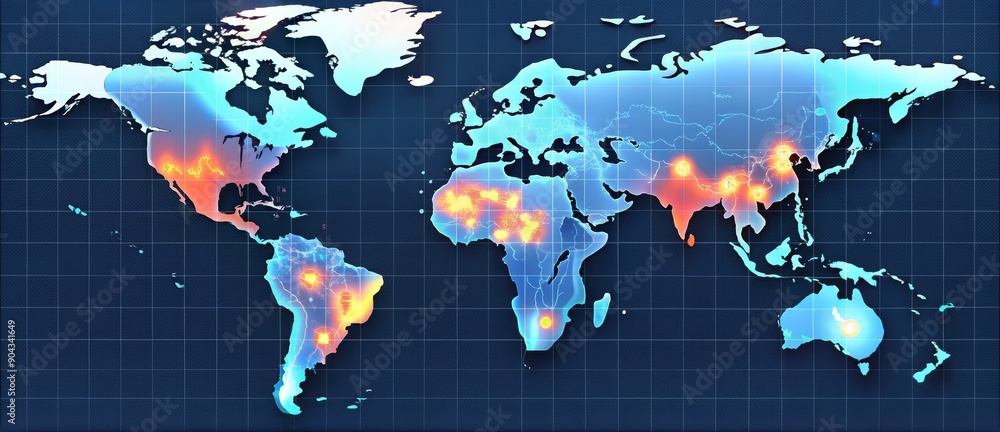

A Geographic Overview Of The Countrys Newest Business Hotspots

Apr 22, 2025

A Geographic Overview Of The Countrys Newest Business Hotspots

Apr 22, 2025

Latest Posts

-

New Spring Collection Elizabeth Stewarts Designs For Lilysilk

May 10, 2025

New Spring Collection Elizabeth Stewarts Designs For Lilysilk

May 10, 2025 -

Go Compare Drops Wynne Evans After Strictly Come Dancing Scandal

May 10, 2025

Go Compare Drops Wynne Evans After Strictly Come Dancing Scandal

May 10, 2025 -

Celebrity Stylist Elizabeth Stewart Designs Exclusive Capsule Collection For Lilysilk

May 10, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Capsule Collection For Lilysilk

May 10, 2025 -

Elizabeth Stewart X Lilysilk Spring 2024 Collaboration Unveiled

May 10, 2025

Elizabeth Stewart X Lilysilk Spring 2024 Collaboration Unveiled

May 10, 2025 -

Elizabeth Stewart And Lilysilk Partner For A Stunning Spring Collection

May 10, 2025

Elizabeth Stewart And Lilysilk Partner For A Stunning Spring Collection

May 10, 2025