Are Stretched Stock Market Valuations A Risk? BofA's Response

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's analysis points towards a market characterized by high valuations across various sectors. While the firm hasn't explicitly declared a blanket "overvalued" assessment, their reports consistently highlight the elevated levels of several key valuation metrics. They suggest that while some sectors might be justified given strong fundamentals, others are exhibiting signs of being stretched. This is crucial because these high stock valuations increase the potential for market corrections.

- Specific valuation metrics used by BofA: BofA employs a range of metrics, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation ratios. Their analysis often includes comparisons to historical averages and industry benchmarks.

- BofA's assessment of individual sectors and their valuations: BofA's reports typically offer a granular breakdown, evaluating valuations across different sectors. Some sectors, fueled by robust growth and innovation, might show higher valuations that appear more justifiable. Others might appear significantly overvalued compared to their historical trends and fundamentals.

- Comparison to historical valuation data: A crucial component of BofA's analysis involves comparing current valuations to historical data. This provides crucial context, helping determine whether current levels represent a significant deviation from historical norms, thereby increasing the risk of a market correction. High stock valuations relative to historical averages raise concerns about potential future price declines.

Factors Contributing to Stretched Valuations (According to BofA)

Several factors, according to BofA, contribute to potentially stretched valuations in the stock market. These interconnected dynamics paint a complex picture of market conditions. Understanding these drivers is essential for anticipating future market behavior.

- Low interest rates and their impact on stock prices: Prolonged periods of low interest rates incentivize investors to seek higher returns elsewhere, often driving capital into the stock market, thereby pushing up prices. This low-interest rate environment can inflate asset bubbles, including overvalued stocks.

- Quantitative easing and its effect on liquidity: Quantitative easing policies implemented by central banks inject significant liquidity into the financial system. This increased liquidity can further fuel asset price inflation, contributing to higher stock valuations. The increased money supply, without corresponding economic growth, can lead to inflated asset prices.

- Strong corporate earnings growth (or lack thereof): While strong earnings growth can justify higher valuations, BofA's analysis often assesses whether the current earnings justify the elevated price levels. Disconnects between earnings growth and stock price increases can indicate overvaluation. A significant gap signals a potential risk of market correction.

- Investor sentiment and market psychology: Market psychology plays a crucial role. Periods of extreme optimism and exuberance can lead to investors overlooking fundamental valuation metrics and driving prices beyond justifiable levels. Overconfidence and speculative trading can exacerbate high stock valuations and increase the vulnerability to market corrections.

BofA's Assessment of the Risks Associated with Stretched Valuations

BofA acknowledges the significant risks associated with stretched stock market valuations. Their analysis highlights several potential downsides for investors.

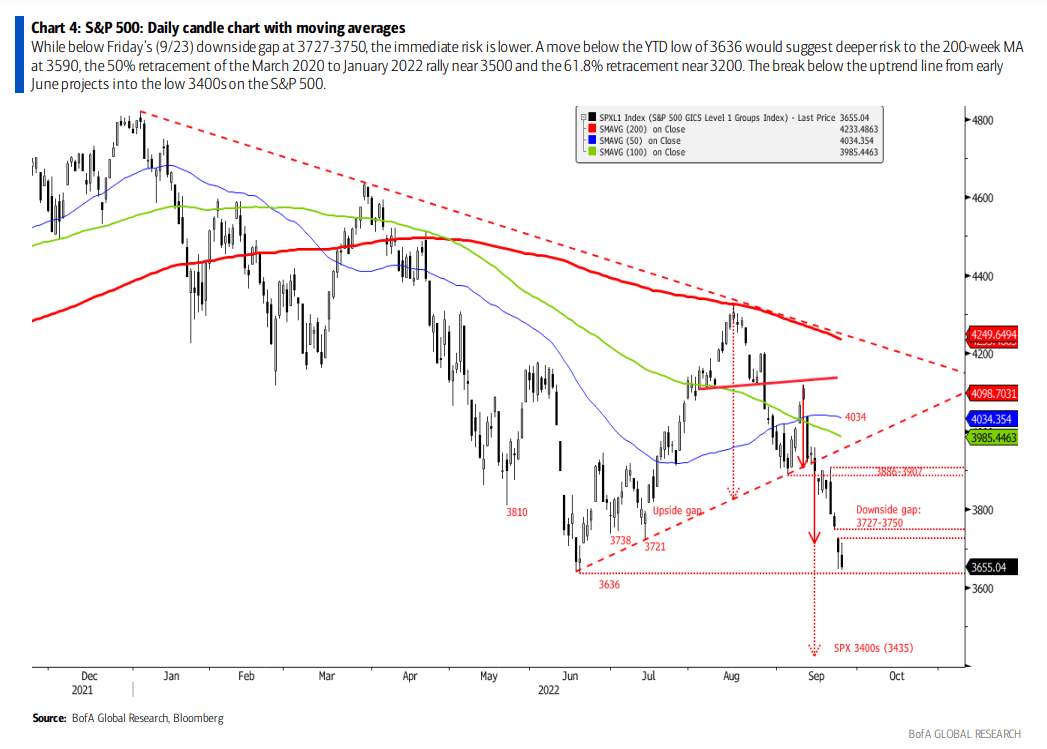

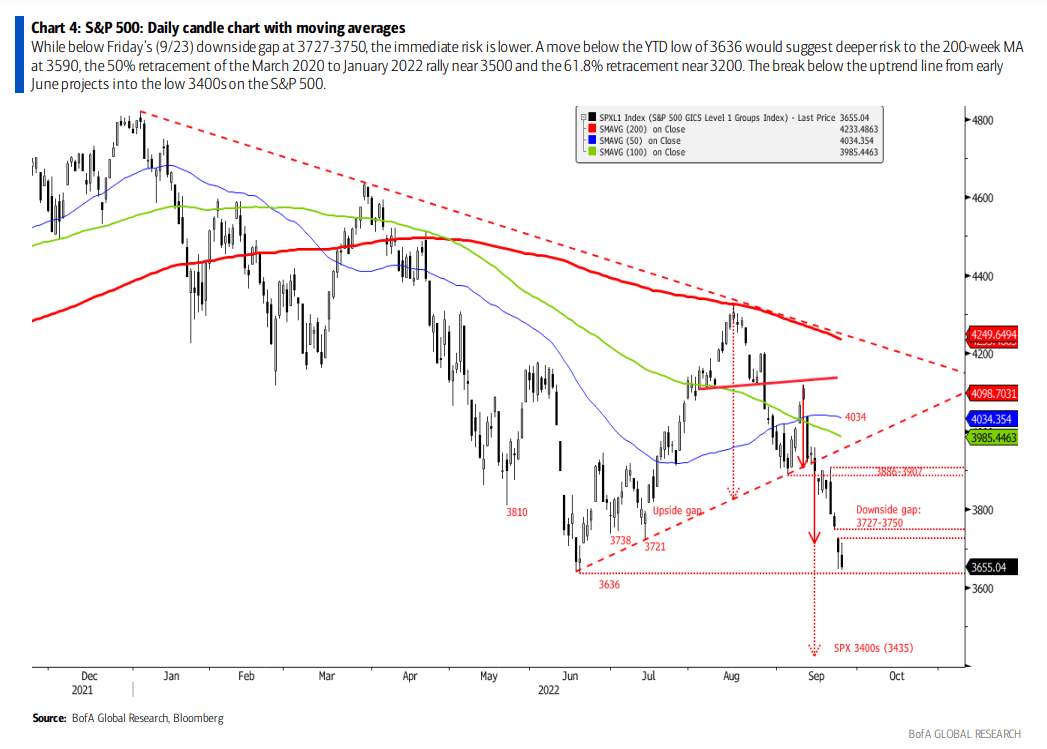

- Increased market volatility and potential for corrections: High valuations make markets more susceptible to sharp corrections. Negative news or shifts in investor sentiment can trigger significant price declines. Overvalued stocks are inherently more vulnerable to price drops.

- Vulnerability to negative economic news or interest rate hikes: Unexpected negative economic news or a surprise increase in interest rates can trigger a rapid unwinding of inflated valuations, leading to substantial losses for investors. High stock valuations amplify the impact of negative economic events.

- Potential for reduced investment returns: Investing in overvalued assets typically translates to lower future returns compared to investments made at more reasonable valuations. High initial prices decrease potential for future gains. This makes diversification particularly important.

- Specific sectors most at risk due to high valuations: BofA's reports often identify specific sectors that exhibit particularly stretched valuations, making them more vulnerable to price corrections. These high-risk sectors should be carefully evaluated.

BofA's Recommendations for Investors

In light of their analysis, BofA typically advises investors to adopt a cautious and diversified approach.

- Diversification strategies: Spread investments across different asset classes and sectors to mitigate the risk associated with overvalued stocks. A well-diversified portfolio offers a cushion against market corrections.

- Sector-specific recommendations: BofA may recommend avoiding sectors exhibiting particularly high valuations and instead focusing on undervalued or fairly valued sectors with strong fundamentals. Targeted sector selection minimizes exposure to high-risk stocks.

- Risk management techniques: Employ risk management strategies such as stop-loss orders to limit potential losses during market corrections. Risk management protects investments from significant losses during market downturns.

- Importance of long-term investing strategies versus short-term trading: BofA generally advocates for long-term investment strategies, emphasizing the importance of riding out market fluctuations rather than engaging in short-term speculative trading. Long-term strategies mitigate the impact of short-term market volatility.

Conclusion: Navigating the Risks of Stretched Stock Market Valuations

BofA's analysis highlights the risks associated with stretched stock market valuations, emphasizing the potential for increased market volatility and reduced investment returns. They advocate for a cautious approach, emphasizing the importance of diversification, risk management, and long-term investment strategies. Understanding BofA's perspective on stretched stock market valuations is crucial for informed investment decisions. Stay informed, consult with a financial professional, and develop a robust strategy to navigate these potential risks. Remember to regularly assess your portfolio and adjust your investment strategy based on evolving market conditions and updated analysis of stretched stock market valuations.

Featured Posts

-

The Ultimate Bargain Hunt How To Save Money On Everything

May 29, 2025

The Ultimate Bargain Hunt How To Save Money On Everything

May 29, 2025 -

Talk To Me Trailer Sally Hawkins Frightening Performance In Bring Her Back

May 29, 2025

Talk To Me Trailer Sally Hawkins Frightening Performance In Bring Her Back

May 29, 2025 -

Trump Grants Pardon To Reality Show Couple Convicted Of Financial Crimes

May 29, 2025

Trump Grants Pardon To Reality Show Couple Convicted Of Financial Crimes

May 29, 2025 -

Ipa O Ilon Mask Apoxorei Apo Tin Kyvernisi Tramp Kritiki Sto Megalo Omorfo Nomosxedio

May 29, 2025

Ipa O Ilon Mask Apoxorei Apo Tin Kyvernisi Tramp Kritiki Sto Megalo Omorfo Nomosxedio

May 29, 2025 -

Alastqlal Rmz Alkramt Walsyadt

May 29, 2025

Alastqlal Rmz Alkramt Walsyadt

May 29, 2025

Latest Posts

-

Glastonbury 2025 Ticket Resale Dates Times And Prices

May 30, 2025

Glastonbury 2025 Ticket Resale Dates Times And Prices

May 30, 2025 -

Selena Gomez Achieves Top 10 With Unreleased Track

May 30, 2025

Selena Gomez Achieves Top 10 With Unreleased Track

May 30, 2025 -

Is Selena Gomezs Next Big Hit Already A Top 10

May 30, 2025

Is Selena Gomezs Next Big Hit Already A Top 10

May 30, 2025 -

Selena Gomez New Top 10 Hit Before Official Release

May 30, 2025

Selena Gomez New Top 10 Hit Before Official Release

May 30, 2025 -

Mqawmt Aljdar Walastytan Altwse Alastytany Fy 13 Hya Flstynya

May 30, 2025

Mqawmt Aljdar Walastytan Altwse Alastytany Fy 13 Hya Flstynya

May 30, 2025