Are Trump's Tariffs Killing Small Businesses?

Table of Contents

H2: Increased Import Costs: A Crushing Blow for Small Businesses

Trump's tariffs significantly increased the cost of imported goods, a critical factor for many small businesses reliant on international sourcing. This increase directly impacts their bottom line, forcing difficult choices regarding pricing and profitability.

-

Impact on Raw Materials and Components: Many small businesses, particularly in manufacturing and retail, depend on imported raw materials and components. Tariffs on these inputs directly translate into higher manufacturing costs, making it difficult to compete on price.

-

Price Increases and Consumer Spending: Faced with increased costs, small businesses are often forced to raise prices for their products or services. This can lead to a decrease in consumer spending, especially when larger corporations with more negotiating power can absorb some of the increased costs more effectively.

-

Competitive Disadvantage: Larger corporations often have greater financial resources and leverage to negotiate better deals with suppliers, mitigating the impact of tariffs more effectively than smaller businesses. This creates a significant competitive disadvantage for small businesses, potentially squeezing them out of the market.

-

Industries Significantly Affected: Sectors such as manufacturing, particularly those relying heavily on imported steel and aluminum, and retail, particularly those importing consumer goods, felt the brunt of increased import costs.

H2: Disrupted Supply Chains: The Ripple Effect of Tariffs

The imposition of tariffs created significant disruptions to global supply chains, leading to delays, increased costs, and unpredictability for small businesses.

-

Lengthened Supply Chains and Delays: Tariffs often necessitate sourcing materials from alternative suppliers, often further away geographically, leading to longer lead times and increased transportation costs.

-

Challenges in Sourcing Alternative Suppliers: Finding reliable alternative suppliers that meet quality standards and offer competitive pricing is challenging and time-consuming, potentially delaying production and impacting sales.

-

Inventory Management Difficulties: Unpredictable trade policies and tariff changes make it incredibly difficult to manage inventory effectively. Businesses risk overstocking or understocking, leading to financial losses or production delays.

-

Added Logistical Burdens and Expenses: Navigating the complexities of tariffs, including paperwork, customs inspections, and potential disputes, adds significant logistical burdens and expenses for small businesses, impacting their already-thin margins.

H2: Reduced Export Opportunities: A Double-Edged Sword

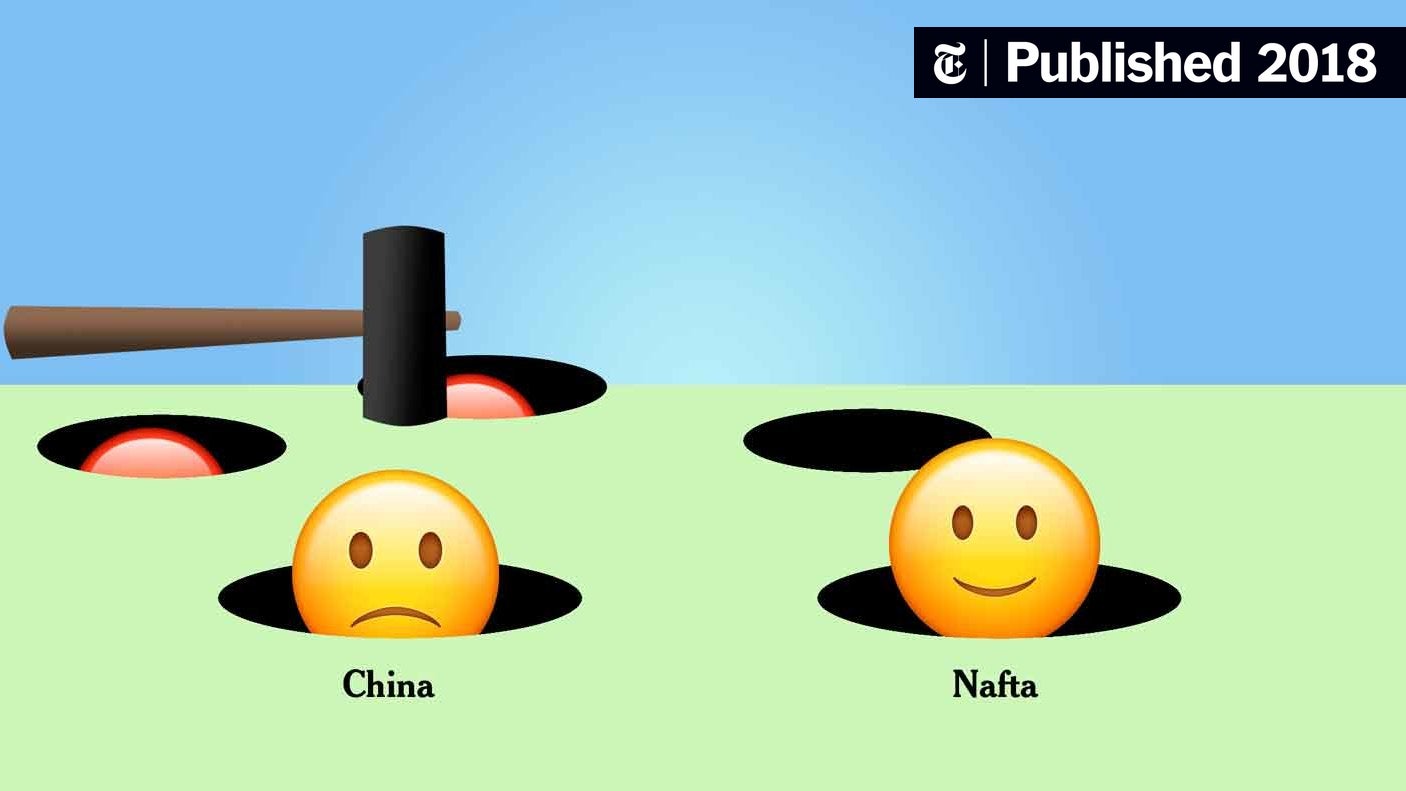

While tariffs aimed to protect domestic industries, they often backfired, leading to retaliatory tariffs from other countries and limiting export opportunities for US small businesses.

-

Retaliatory Tariffs: Other countries often responded to US tariffs with their own, creating a trade war scenario that negatively impacted US small businesses trying to export their goods and services.

-

Limited Market Access: The imposition of tariffs and trade disputes reduced market access for US small businesses in key international markets, hindering their growth and potential.

-

Loss of Revenue and Growth: Reduced export opportunities translated directly into lost revenue and diminished growth prospects for many small businesses relying on international sales.

-

Impact on Global Competitiveness: The overall impact of tariffs on US small businesses has negatively affected their global competitiveness, making it harder for them to compete with businesses from other countries.

H3: The Impact on Specific Sectors

The agricultural sector, for example, faced significant challenges due to tariffs imposed by China on soybeans and other agricultural products. Similarly, manufacturers relying on imported steel and aluminum experienced substantial cost increases. Retail businesses importing consumer goods also faced increased pricing pressures. Detailed case studies from these sectors could highlight the real-world impacts of these tariffs on individual small businesses.

3. Conclusion:

In conclusion, the impact of Trump's tariffs on small businesses was multifaceted and complex. Increased import costs, disrupted supply chains, and reduced export opportunities all contributed to significant challenges for countless small businesses across diverse sectors. While the overall economic effect of these tariffs is still being debated, the evidence strongly suggests they placed an additional burden on an already vulnerable segment of the American economy. To further understand the long-term effects, it's vital to explore government reports like those from the Small Business Administration (SBA) and the Congressional Research Service. Understanding the effect of tariffs on small businesses is crucial for shaping informed discussions about future trade policies and supporting the backbone of the American economy. We need to examine the continuing impact of Trump's tariff impact and the effect of tariffs on small businesses to ensure the stability and growth of our nation's small businesses.

Featured Posts

-

L Avis D Un Animateur Concernant L Arrivee De Cyril Hanouna Sur M6

May 12, 2025

L Avis D Un Animateur Concernant L Arrivee De Cyril Hanouna Sur M6

May 12, 2025 -

Highlander Reboot Henry Cavill To Star In Amazon Series

May 12, 2025

Highlander Reboot Henry Cavill To Star In Amazon Series

May 12, 2025 -

Tales From The Track Tickets Win Your Entry

May 12, 2025

Tales From The Track Tickets Win Your Entry

May 12, 2025 -

Raznye Otsenki Reytinga Zelenskogo Pozitsiya Dzhonsona I Trampa

May 12, 2025

Raznye Otsenki Reytinga Zelenskogo Pozitsiya Dzhonsona I Trampa

May 12, 2025 -

Nine Cardinals In The Running The Future Of The Catholic Church

May 12, 2025

Nine Cardinals In The Running The Future Of The Catholic Church

May 12, 2025

Latest Posts

-

Young Influencers Transition From Kamala Harris Campaign To Congress

May 13, 2025

Young Influencers Transition From Kamala Harris Campaign To Congress

May 13, 2025 -

From Social Media Influencer To Political Candidate A Gen Zs Journey

May 13, 2025

From Social Media Influencer To Political Candidate A Gen Zs Journey

May 13, 2025 -

Kamala Harris Influencer Seeks Congressional Seat A Gen Z Story

May 13, 2025

Kamala Harris Influencer Seeks Congressional Seat A Gen Z Story

May 13, 2025 -

From Kamala Harris Influencer To Congressional Candidate Gen Zs Political Rise

May 13, 2025

From Kamala Harris Influencer To Congressional Candidate Gen Zs Political Rise

May 13, 2025 -

Cp Music Productions A Father Son Musical Journey

May 13, 2025

Cp Music Productions A Father Son Musical Journey

May 13, 2025