Are You Selling On EBay, Vinted, Or Depop? Watch Out For HMRC Nudge Letters

Table of Contents

Understanding Your Tax Obligations as an Online Seller

Selling goods online, whether on eBay, Vinted, Depop, or other platforms, brings financial rewards, but it also comes with tax responsibilities. Ignoring these can lead to penalties, so understanding your obligations is crucial.

The Capital Gains Tax Threshold

Capital Gains Tax (CGT) is a tax on profits made from selling assets, including items sold online. If your profits from online selling exceed the annual CGT allowance, you'll need to pay tax on the excess.

- Examples of taxable items: Clothes, electronics, collectibles, and anything sold for more than you purchased it for.

- Calculating profits: Profit = Selling Price - Purchase Price - Selling Fees - Other Expenses (e.g., postage, packaging).

- The current CGT allowance: Check the latest HMRC guidance for the current allowance, as this figure changes. Failing to account for this can result in an HMRC nudge letter. Keywords: "Capital Gains Tax," "CGT allowance," "taxable profits," "online selling tax."

Record Keeping for Online Sellers

Meticulous record-keeping is paramount to avoiding HMRC penalties. Keep detailed records of all your transactions and expenses.

- What records to keep: Sales records (date, item sold, price, buyer details), purchase records (date, item purchased, price, proof of purchase), expense records (postage, packaging, advertising, platform fees), and bank statements.

- Using accounting software: Software like Xero or Quickbooks can simplify record-keeping and generate reports for tax purposes.

- Digital record-keeping options: Utilize cloud storage or dedicated accounting apps for easy access and security. Keywords: "record keeping," "accounting software," "sales records," "online selling expenses," "tax compliance."

Different Tax Treatments for Various Selling Platforms

While the core principles remain the same, subtle differences might exist depending on the platform.

- eBay: eBay provides sales data that can be used for tax purposes, but you are still responsible for tracking expenses.

- Vinted: Vinted often handles some aspects of payment processing, which may affect how you report your income.

- Depop: Similar to Vinted, understanding Depop's payment system and how it relates to your tax returns is crucial. Keywords: "eBay tax," "Vinted tax," "Depop tax," "online marketplace tax."

What to Do if You Receive an HMRC Nudge Letter

Receiving an HMRC nudge letter can be unsettling, but a prompt and appropriate response is vital.

Don't Ignore the Letter

Ignoring an HMRC nudge letter is a mistake. It won't make it go away, and it can lead to serious consequences.

- Potential consequences: Further investigation, penalties, interest charges, and legal action.

- Steps to take immediately: Read the letter carefully, note the deadline, gather the necessary information. Keywords: "HMRC letter response," "ignore HMRC letter," "tax penalties," "online selling penalties."

Gathering Your Information

HMRC might request various documents to verify your income and expenses. Be prepared to provide:

- Sales records: Detailed records of every sale, including dates, amounts, and buyer information.

- Expense records: Receipts, invoices, and bank statements related to your online selling activities.

- Bank statements: Statements showing transactions related to your online selling business. Keywords: "HMRC information request," "tax documents," "online selling records."

Seeking Professional Help

If you're struggling to understand your tax obligations or respond to the letter, seek professional assistance.

- Benefits of professional tax advice: Accurate tax calculations, compliance with regulations, peace of mind.

- Finding a qualified tax advisor: Consult the Association of Chartered Certified Accountants (ACCA) or other relevant professional bodies. Keywords: "tax advisor," "accountant," "online selling tax advice," "tax professional."

Preventing Future HMRC Nudge Letters

Proactive steps can significantly reduce the risk of receiving more HMRC nudge letters.

Proactive Tax Planning

Implement strategies to streamline your tax process and stay compliant.

- Regular record-keeping: Maintain meticulous records throughout the year, rather than scrambling at tax time.

- Understanding tax thresholds: Stay informed about the annual CGT allowance and other relevant thresholds.

- Seeking professional advice: Consult a tax advisor for personalized guidance. Keywords: "tax planning," "prevent HMRC letters," "online selling tax strategy."

Staying Updated on Tax Laws

Tax laws can change, so staying informed is essential.

- Resources for staying updated: The official HMRC website, tax newsletters, and professional tax advisors. Keywords: "HMRC updates," "tax law changes," "online selling tax updates."

Conclusion: Take Control of Your Online Selling Taxes

Understanding your tax obligations as an online seller is crucial. Responding promptly and appropriately to HMRC nudge letters, maintaining accurate records, and proactively planning your taxes are essential steps to avoid future complications. Accurate record-keeping and timely responses to HMRC communications are key to preventing further HMRC nudge letters. Review your online selling activities, ensure compliance with HMRC regulations, and seek professional advice if needed. Don't let HMRC nudge letters catch you off guard—take control of your online selling taxes today!

Featured Posts

-

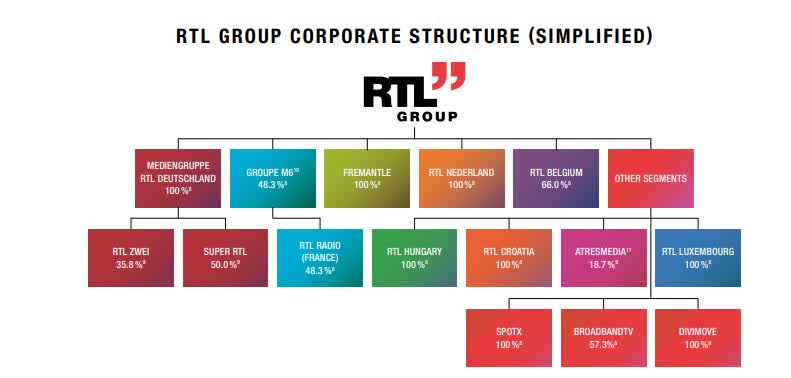

Is Rtl Groups Streaming Business Finally Profitable Analyzing The Latest Results

May 20, 2025

Is Rtl Groups Streaming Business Finally Profitable Analyzing The Latest Results

May 20, 2025 -

Giakoymakis I Megali Proklisi Toy Mls

May 20, 2025

Giakoymakis I Megali Proklisi Toy Mls

May 20, 2025 -

Agatha Christies Poirot Adaptations And Legacy

May 20, 2025

Agatha Christies Poirot Adaptations And Legacy

May 20, 2025 -

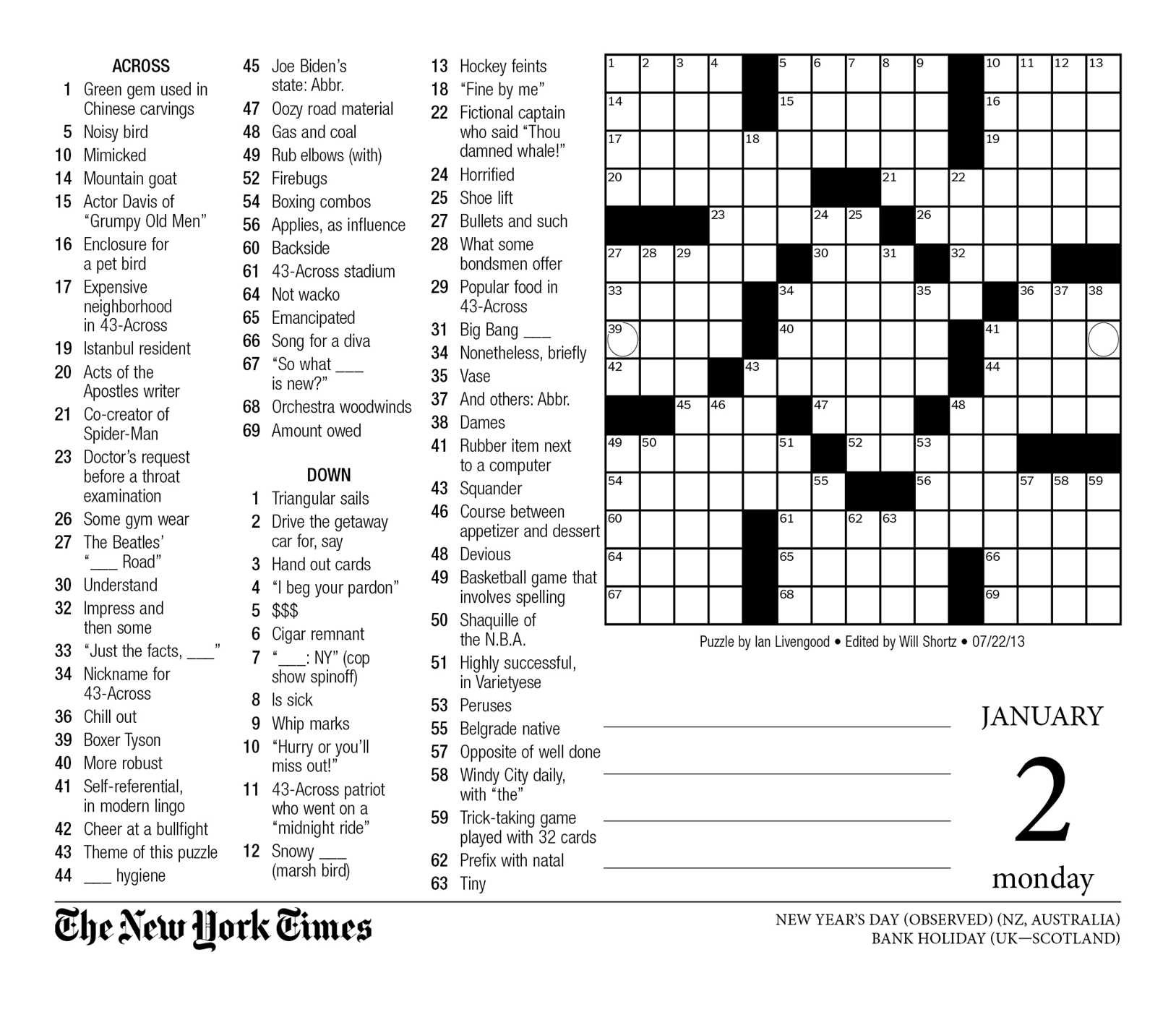

Nyt Mini Crossword Solutions For March 8

May 20, 2025

Nyt Mini Crossword Solutions For March 8

May 20, 2025 -

Philippines To Receive Another Us Missile System Hegseth Announces Deployment

May 20, 2025

Philippines To Receive Another Us Missile System Hegseth Announces Deployment

May 20, 2025