Assessing Nvidia's Risks: Geopolitical Factors Beyond The China Focus

Table of Contents

US-China Tech Cold War & Supply Chain Diversification

The escalating US-China tech cold war presents a significant challenge to Nvidia. Export controls and sanctions targeting advanced AI chips directly affect Nvidia's revenue streams and market share.

Impact of Export Controls and Sanctions

The restrictions on the export of Nvidia's high-performance chips, such as the A100 and H100, to China have already impacted sales. This necessitates a multifaceted response:

- Impact on specific product lines: The restrictions have forced Nvidia to develop alternative chips, like the A800, for the Chinese market, though these offer reduced performance. This impacts revenue projections and potentially market share in the high-performance computing sector.

- Alternative markets and mitigation strategies: Nvidia is actively pursuing growth in other regions, focusing on Europe, North America, and other Asian markets less affected by US sanctions. This diversification, however, involves significant investment and logistical challenges.

- Legal challenges and lobbying efforts: Nvidia, alongside other tech companies, actively engages in lobbying efforts to influence the scope and application of export controls, potentially leading to legal challenges or modifications of the restrictions.

Supply Chain Resilience and Reshoring

Reducing reliance on specific regions for manufacturing and supply chains is crucial for Nvidia's long-term stability. This involves significant challenges and costs:

- Potential locations for new manufacturing facilities: Nvidia may explore expanding manufacturing in countries like Taiwan (despite geopolitical risks), South Korea, or even within the US, leveraging government incentives.

- Trade-offs between cost and geopolitical stability: Establishing manufacturing in politically stable regions may increase costs, requiring careful balancing of risk and profitability.

- Government incentives and subsidies: Government subsidies and tax breaks in various countries are playing a significant role in influencing Nvidia’s decisions regarding the location of new production facilities, especially in the context of reshoring and near-shoring.

Geopolitical Instability and Regional Conflicts

Global political instability and regional conflicts significantly impact semiconductor demand and supply chains, affecting Nvidia across its sectors.

Impact of Global Tensions on Semiconductor Demand

Geopolitical tensions can lead to reduced investment in technology sectors, impacting demand for Nvidia's products.

- Regions experiencing conflict and their influence: Conflicts in Eastern Europe and other volatile regions can suppress demand for Nvidia’s chips across its product segments. Uncertainty often leads to decreased capital expenditure in technology, particularly from organizations in the affected regions.

- Impact on different Nvidia product segments: The gaming segment, while relatively resilient, can be affected by economic downturns resulting from geopolitical instability. The data center and automotive segments are more directly affected by broader macroeconomic trends and uncertainties.

- Disruptions to global trade: Conflicts and sanctions can disrupt global trade routes, leading to delays and increased costs for Nvidia's supply chain and impacting the timely delivery of products to customers.

Resource Scarcity and Price Volatility

Geopolitical instability affects the availability and pricing of raw materials crucial for semiconductor production.

- Specific raw materials crucial for Nvidia's production: Nvidia's manufacturing relies on a complex supply chain involving numerous rare earth minerals and other materials, making it vulnerable to price fluctuations driven by geopolitical events.

- Potential price fluctuations and their impact on profitability: Fluctuations in raw material prices can directly impact Nvidia's profitability, squeezing margins and making accurate financial forecasting more challenging.

- Strategies to mitigate supply chain risks: Nvidia is likely exploring strategies such as securing long-term contracts with suppliers, diversifying sourcing, and investing in research and development of alternative materials to reduce its reliance on vulnerable supply chains.

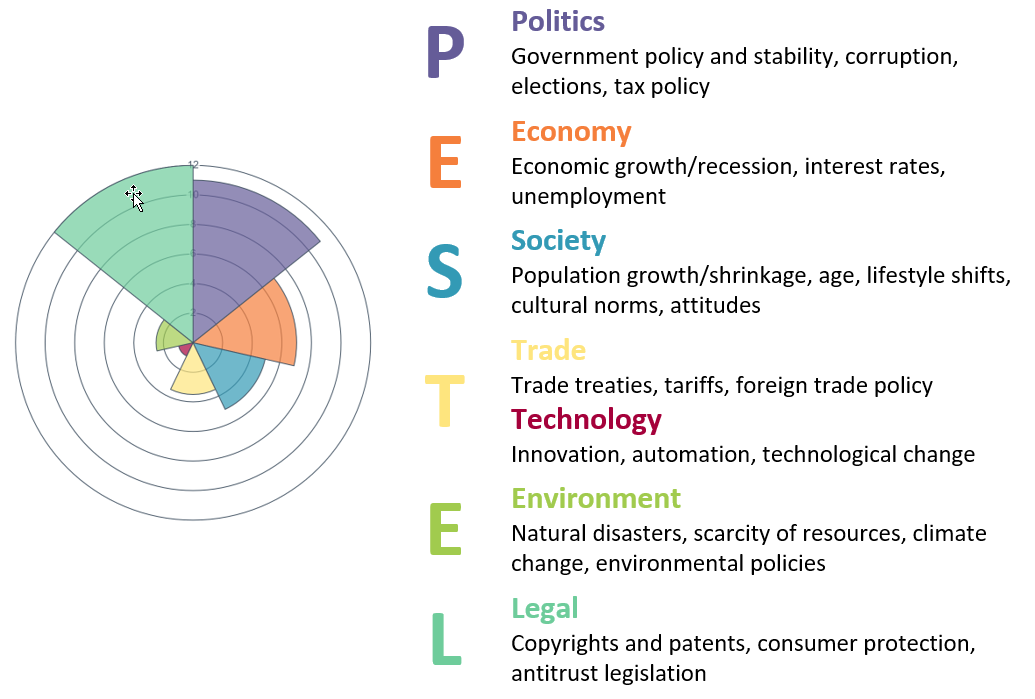

Regulatory Scrutiny and Antitrust Concerns

Nvidia faces increasing regulatory scrutiny and antitrust concerns globally.

Increased Global Regulatory Oversight

Governments are increasingly regulating the tech industry, impacting companies like Nvidia.

- Regulations impacting the semiconductor industry: Data privacy regulations (like GDPR), antitrust laws, and export controls impact Nvidia's operations and business strategies across various geographies.

- Potential for increased antitrust investigations and fines: Nvidia's market position makes it susceptible to antitrust investigations, especially in the context of potential mergers and acquisitions.

- Impact of data privacy regulations on Nvidia's data center business: Stringent data privacy regulations affect Nvidia's data center clients and necessitate compliance measures, potentially adding operational costs.

Competition and Market Consolidation

The competitive landscape and potential mergers and acquisitions significantly influence Nvidia's market position.

- Key competitors and their strategies: AMD and Intel are key competitors, and their strategies, including potential acquisitions, directly influence Nvidia's market share and innovation.

- Potential acquisitions and their impact on Nvidia: Nvidia's own acquisitions and the acquisitions made by its competitors can reshape the competitive landscape, impacting both opportunities and threats.

- Implications of market consolidation on innovation and competition: Market consolidation can potentially stifle innovation and reduce competition if not properly regulated.

Conclusion

Understanding Nvidia geopolitical risks is crucial for investors and stakeholders. While China remains a key focus, a broader perspective reveals a wider range of challenges impacting Nvidia's future. From the US-China tech war and supply chain fragility to global instability and regulatory pressures, these factors demand proactive mitigation strategies. Further analysis into the specific geopolitical implications for each of Nvidia's market segments is essential for a comprehensive assessment of the company's long-term prospects. Proactive monitoring of evolving Nvidia geopolitical risks and their potential impact on the company’s operations is recommended.

Featured Posts

-

Apurate Quedan 3 Dias Para Clases De Boxeo En Edomex

Apr 30, 2025

Apurate Quedan 3 Dias Para Clases De Boxeo En Edomex

Apr 30, 2025 -

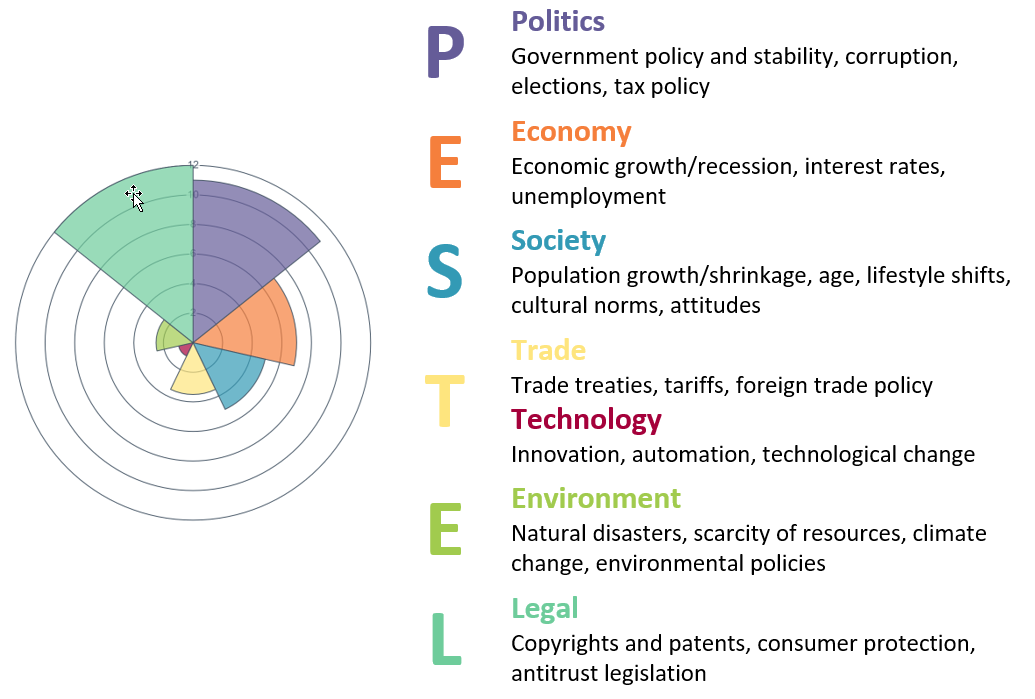

Dau Tu Gop Von Nhan Dien Va Tranh Cac Cong Ty Co Dau Hieu Lua Dao

Apr 30, 2025

Dau Tu Gop Von Nhan Dien Va Tranh Cac Cong Ty Co Dau Hieu Lua Dao

Apr 30, 2025 -

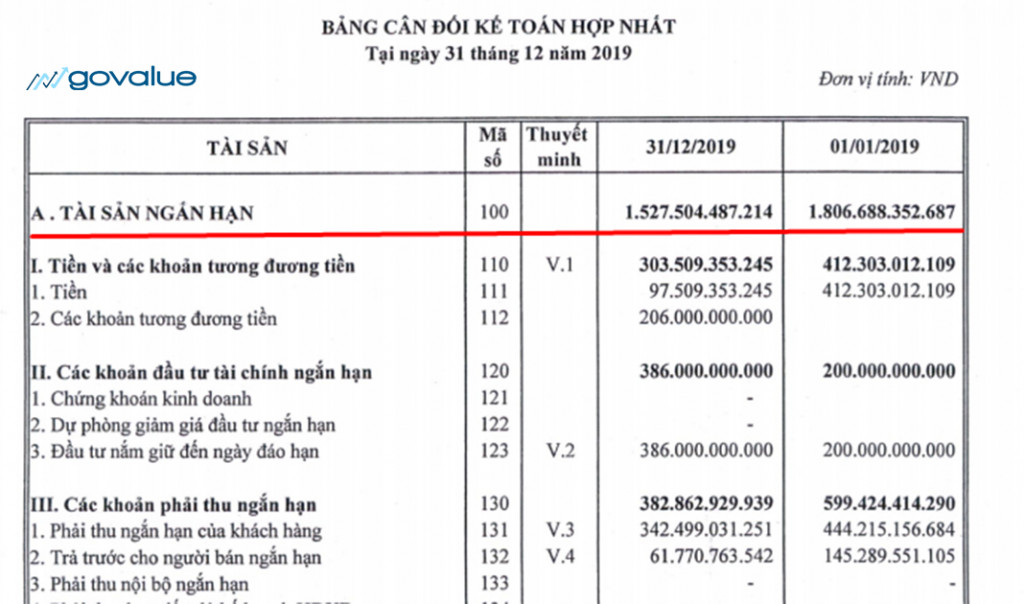

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

Apr 30, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

Apr 30, 2025 -

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 30, 2025

Ohio Train Derailment Lingering Toxic Chemicals In Buildings

Apr 30, 2025 -

Panthers Aim For Back To Back Success 8th Pick In The Nfl Draft

Apr 30, 2025

Panthers Aim For Back To Back Success 8th Pick In The Nfl Draft

Apr 30, 2025