AT&T Raises Alarm Over Extreme Cost Increase In Broadcom's VMware Plan

Table of Contents

The Magnitude of the Cost Increase

Broadcom's proposed acquisition of VMware represents a staggering financial undertaking. While the exact figures remain subject to negotiation and regulatory scrutiny, reports indicate an exorbitant price increase far exceeding initial market predictions. This "extreme" cost increase, as characterized by AT&T, is not merely a minor deviation from expectations; it represents a potential paradigm shift in the valuations of enterprise software giants.

- Specific Numbers: While precise figures are still emerging, reports suggest a price increase significantly higher than analyst projections, potentially reaching tens of billions of dollars more than initially anticipated.

- Industry Comparison: Compared to similar acquisitions in the tech sector, Broadcom's offer for VMware is considered exceptionally high, raising concerns about inflated valuations and potential market instability. Experts point to a potential "bidding war" effect contributing to the exorbitant price.

- Expert Opinions: Industry analysts and experts have echoed AT&T's concerns, noting that the proposed price could set a dangerous precedent for future acquisitions in the tech industry, potentially creating a bubble and hindering innovation.

AT&T's Arguments Against the Increased Cost

AT&T's alarm over Broadcom's VMware plan stems from several key concerns. The company argues that the dramatically inflated price tag poses substantial risks, not only to AT&T itself but to the entire telecommunications ecosystem.

- Impact on AT&T's Operational Costs: The increased cost of VMware products and services, a vital component of AT&T's infrastructure, could severely impact their operational budgets and bottom line, potentially leading to reduced investment in other crucial areas.

- Potential Price Hikes for Consumers: AT&T's increased operational costs, driven by the higher prices resulting from the Broadcom acquisition, could translate into higher prices for consumers, potentially limiting access to essential telecommunication services.

- Concerns About Reduced Competition: The acquisition could lead to reduced competition within the market, potentially stifling innovation and giving Broadcom undue market power, harming consumers and businesses alike.

- Legal Challenges: The possibility of legal challenges from AT&T and other stakeholders concerned about the potential for anti-competitive practices remains a significant factor.

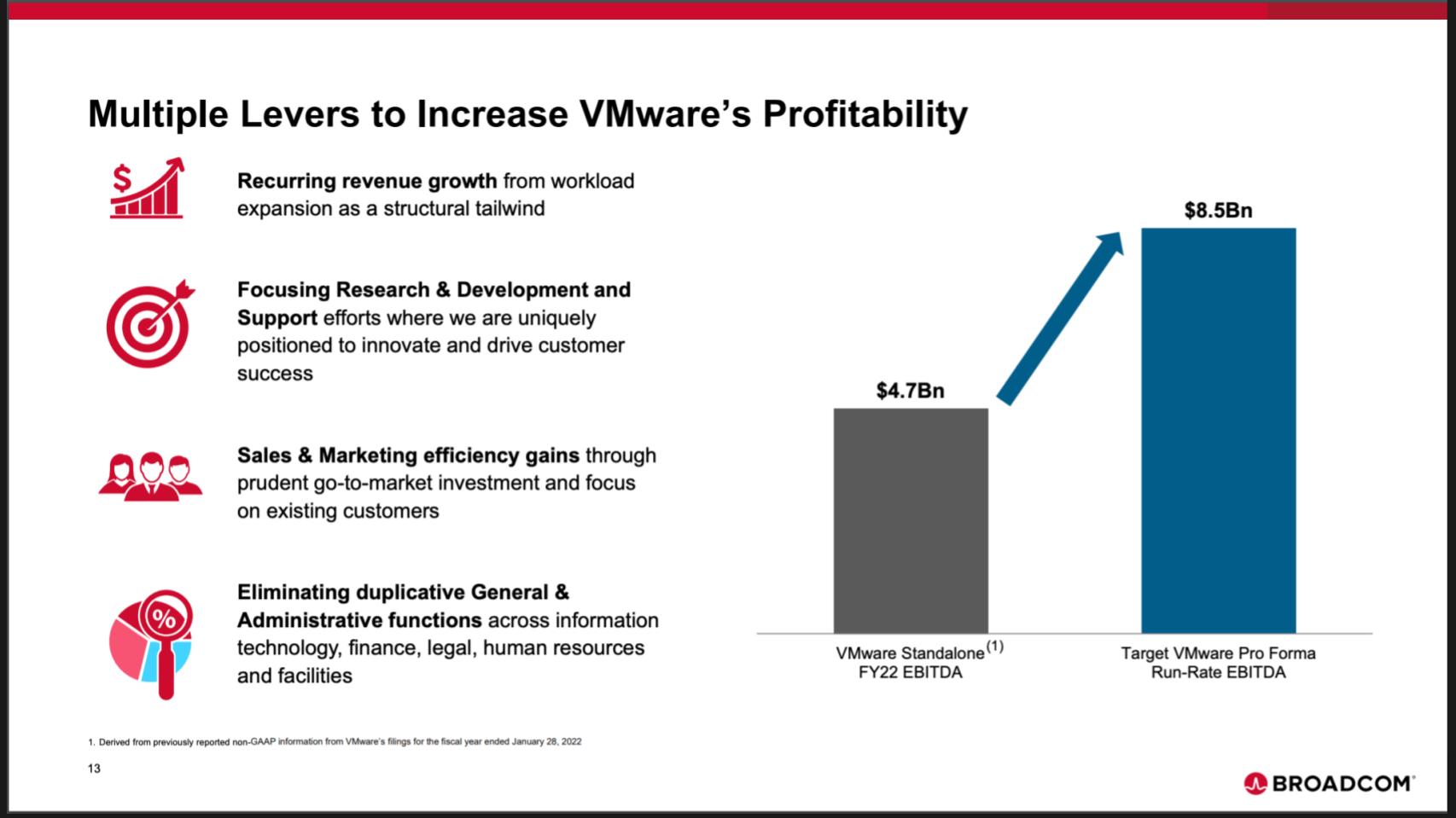

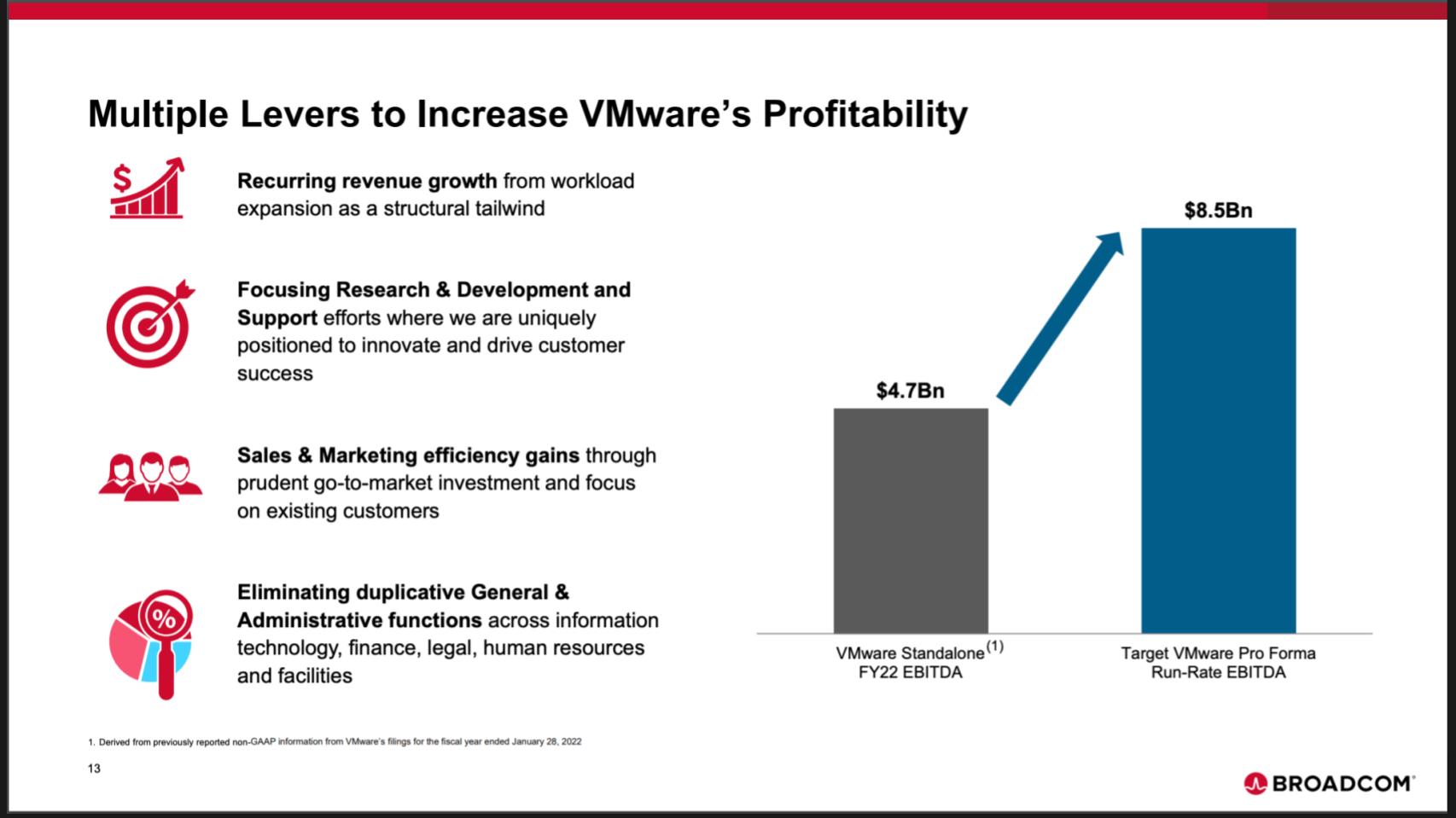

Broadcom's Response and Justification

Broadcom, in response to criticism, has defended its proposed acquisition, citing strategic synergies and long-term benefits.

- Stated Benefits: Broadcom emphasizes the potential for increased efficiency, enhanced security, and improved integration of VMware's technologies into its existing portfolio.

- Justification for High Cost: The company likely points to VMware's market position, its innovative technologies, and the potential for significant future returns as justification for the steep price.

- Concessions: While Broadcom hasn't publicly announced major concessions, the ongoing negotiations likely involve attempts to address regulatory concerns and alleviate some of the industry's anxieties.

Potential Implications for the Telecommunications Industry

The impact of Broadcom's VMware plan extends far beyond the immediate players involved. The implications for the broader telecommunications industry are potentially transformative.

- Impact on Network Infrastructure Costs: Increased VMware licensing costs could directly translate into higher network infrastructure costs for all telecommunications companies, influencing their pricing strategies and competitive landscapes.

- Changes in Service Offerings: The acquisition could lead to changes in the types of services offered to consumers and businesses, potentially impacting market diversity and innovation.

- Effects on Competition Among Telecommunications Providers: A less competitive environment could lead to reduced innovation, higher prices, and less choice for consumers and businesses relying on telecommunications services.

Conclusion: The Future of Broadcom's VMware Plan and its Impact

AT&T's concerns regarding the extreme cost increase in Broadcom's VMware acquisition plan highlight significant risks for the telecommunications industry and consumers. While Broadcom maintains its position, the potential for decreased competition, inflated prices, and reduced innovation casts a long shadow. The ultimate outcome of this deal will shape the future of the industry and remains a crucial issue to monitor. Stay informed about further developments in Broadcom's VMware plan and its implications for the future of the telecommunications industry by following reputable news sources and regulatory updates. This is a story that warrants close attention as it unfolds.

Featured Posts

-

Swiatek Alcaraz And Sinner Key Contenders At The French Open

May 28, 2025

Swiatek Alcaraz And Sinner Key Contenders At The French Open

May 28, 2025 -

Alcaraz And Swiateks Strong Starts At The French Open

May 28, 2025

Alcaraz And Swiateks Strong Starts At The French Open

May 28, 2025 -

Blake Lively And Justin Baldoni A Lister Entangled In Legal Battle

May 28, 2025

Blake Lively And Justin Baldoni A Lister Entangled In Legal Battle

May 28, 2025 -

National Lottery Unveils Winning Locations For Six Figure Euro Millions Prizes

May 28, 2025

National Lottery Unveils Winning Locations For Six Figure Euro Millions Prizes

May 28, 2025 -

Michael B Jordan And Hailee Steinfeld All Smiles At The Sinner Premiere

May 28, 2025

Michael B Jordan And Hailee Steinfeld All Smiles At The Sinner Premiere

May 28, 2025

Latest Posts

-

Pakistan Crypto Councils Rapid Global Expansion In 50 Days

May 29, 2025

Pakistan Crypto Councils Rapid Global Expansion In 50 Days

May 29, 2025 -

Pakistan Crypto Council 50 Days Of Global Progress

May 29, 2025

Pakistan Crypto Council 50 Days Of Global Progress

May 29, 2025 -

Downtown Seattle Welcomes Back Pcc Community Markets With Innovative Design

May 29, 2025

Downtown Seattle Welcomes Back Pcc Community Markets With Innovative Design

May 29, 2025 -

Air Jordan 2025 May Sneaker Release Roundup

May 29, 2025

Air Jordan 2025 May Sneaker Release Roundup

May 29, 2025 -

New Pcc Community Markets Store Opens In Downtown Seattle Details Inside

May 29, 2025

New Pcc Community Markets Store Opens In Downtown Seattle Details Inside

May 29, 2025