August Deadline: Treasury Flags Potential US Debt Limit Crisis

Table of Contents

The debt ceiling, simply put, is the total amount of money the US government is legally allowed to borrow to meet its existing obligations. When this limit is reached, the government can no longer borrow to pay its bills – leading to a potential default. This seemingly technicality has massive implications for the US financial system and the global economy. The political implications are equally significant, with the potential for partisan gridlock further exacerbating the crisis.

The August Deadline: A Ticking Clock

The Treasury Department has warned that the US could reach its debt limit as early as [Insert Projected Date Here, e.g., August 1st, 2024]. This isn't merely a political squabble; it's a potential economic time bomb. Failing to raise the debt ceiling before this deadline could trigger a cascade of devastating consequences.

- Projected Deadline: [Insert Projected Date Here, e.g., August 1st, 2024], according to current Treasury Department estimates. This date could shift based on incoming tax revenue and government spending.

- Consequences of Default: A failure to raise the debt ceiling would result in the US government defaulting on its debt obligations. This would likely lead to a government shutdown, impacting essential services. A credit rating downgrade would almost certainly follow, increasing borrowing costs for the government and the private sector.

- Economic Uncertainty: The uncertainty surrounding the debt ceiling debate is already impacting markets, creating volatility and potentially hindering economic growth. Businesses may postpone investments, and consumer confidence could plummet.

Potential Economic Consequences of a US Debt Limit Crisis

The potential economic consequences of a US Debt Limit Crisis are far-reaching and deeply concerning. The ripple effects could be felt globally.

- Increased Interest Rates: A default or even the threat of default would likely lead to a significant increase in interest rates, making borrowing more expensive for individuals, businesses, and the government itself.

- Reduced Consumer Confidence and Spending: Economic uncertainty creates fear and uncertainty, potentially causing consumers to reduce spending and investment. This decrease in demand could trigger a recession.

- Negative Impact on the Stock Market: The stock market is highly sensitive to economic news, and a US debt default would likely trigger a major sell-off, eroding investor confidence and potentially wiping out trillions of dollars in value.

- Potential for a Recession: A US debt crisis could easily push the economy into a recession, characterized by high unemployment, decreased consumer spending, and reduced business investment.

- Global Market Instability: The US economy plays a crucial role in the global financial system. A US debt default would send shockwaves across international markets, potentially triggering a global financial crisis.

Political Implications and Bipartisan Gridlock

The US debt limit crisis is not just an economic issue; it is deeply intertwined with political maneuvering and partisan gridlock.

- Democratic and Republican Positions: [Insert current positions of Democrats and Republicans regarding the debt ceiling and potential compromises]. These positions often evolve during negotiations.

- Political Posturing and Brinkmanship: Historically, debt ceiling debates have been characterized by political posturing and brinkmanship, with both parties using the issue as leverage for their agendas.

- Historical Precedents: The US has faced debt ceiling standoffs before, each with its own set of consequences and resolutions. Examining these precedents can offer insight into the current situation and potential outcomes.

- Role of the Media and Public Opinion: Media coverage and public opinion play a significant role in shaping the narrative around the debt ceiling debate and influencing political decisions.

What Happens Next? Possible Resolutions to the US Debt Limit Crisis

Several scenarios could unfold. Each carries different consequences.

- Raising the Debt Ceiling Without Conditions: The simplest solution, but often politically challenging due to differing opinions on government spending.

- Raising the Debt Ceiling with Spending Cuts Attached: A compromise that involves negotiating spending cuts in exchange for raising the debt ceiling, which can be contentious and slow down the process.

- Short-Term Debt Limit Increase: A temporary solution that buys time for negotiations, but prolongs the uncertainty and risk.

- Potential for Legal Challenges: Legal challenges could arise depending on the actions taken or not taken by Congress.

Avoiding a US Debt Limit Crisis: A Call to Action

The looming August deadline for the US Debt Limit Crisis necessitates immediate action. The potential economic consequences are dire, and the political challenges significant. We must prevent a potential catastrophic economic event. Stay informed, contact your elected officials, and demand a responsible solution. Understanding the implications of this US debt crisis is crucial for every citizen. Use hashtags like #DebtCeilingCrisis #FiscalResponsibility #SaveTheEconomy to raise awareness and encourage responsible fiscal policy. The future of the US economy depends on it.

Featured Posts

-

Benny Blanco Cheating Rumors What We Know About The Selena Gomez Relationship Buzz

May 11, 2025

Benny Blanco Cheating Rumors What We Know About The Selena Gomez Relationship Buzz

May 11, 2025 -

Jessica Simpson On Feeling Like She Let People Down Comparing Success To Britney And Christina

May 11, 2025

Jessica Simpson On Feeling Like She Let People Down Comparing Success To Britney And Christina

May 11, 2025 -

District Final Loss For Norfolk Catholic Against Archbishop Bergan

May 11, 2025

District Final Loss For Norfolk Catholic Against Archbishop Bergan

May 11, 2025 -

Lily Collins Sexy New Calvin Klein Campaign Photos

May 11, 2025

Lily Collins Sexy New Calvin Klein Campaign Photos

May 11, 2025 -

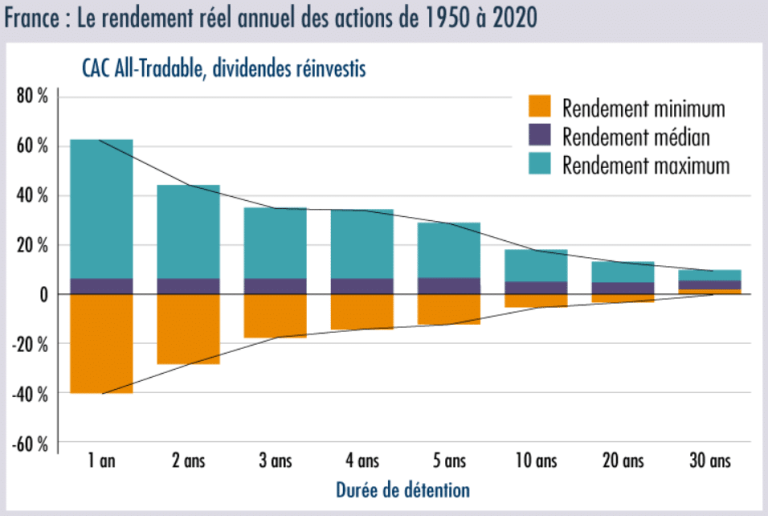

Diversification D Investissement Reduire Les Risques Et Maximiser Les Profits

May 11, 2025

Diversification D Investissement Reduire Les Risques Et Maximiser Les Profits

May 11, 2025