Australia's Opposition Promises $9 Billion Budget Improvement

Table of Contents

Key Areas Targeted for Budget Improvement

The opposition's plan for a $9 billion budget improvement centers around three key pillars: increased efficiency in government spending, targeted tax reforms, and strategic investments in growth-generating sectors. Let's examine each in detail.

Increased Efficiency in Government Spending

The opposition proposes significant cost-cutting measures within the public sector, focusing on eliminating redundancies and streamlining operations. This involves:

- Reducing administrative costs: A comprehensive review of government departments aims to identify and eliminate unnecessary layers of bureaucracy, leading to projected savings of $2 billion. This includes a potential reduction in consulting fees and a more efficient procurement process.

- Streamlining government departments: Consolidating overlapping functions across various departments is anticipated to reduce staffing costs and improve overall efficiency, contributing an estimated $1.5 billion in savings.

- Modernizing IT infrastructure: Investing in updated technology across government agencies will aim to improve workflow and reduce inefficiencies, generating further savings and improving service delivery.

These measures are expected to generate significant savings, improving the overall efficiency of government operations and freeing up resources for other priorities. The emphasis on government efficiency and cost-cutting measures is a central theme in the opposition's fiscal strategy.

Targeted Tax Reforms

The opposition's plan also includes strategic tax reforms designed to both increase revenue and stimulate economic activity. These include:

- Targeted tax cuts for low- and middle-income earners: The proposal suggests modest tax cuts for individuals earning below a certain threshold, boosting disposable income and stimulating consumer spending. This is expected to contribute to economic growth while remaining fiscally responsible.

- Review of corporate tax rates: A review of the current corporate tax rates is proposed, with the aim of making Australia more competitive internationally and attracting further investment. The projected increase in foreign direct investment could offset any potential revenue loss from the lower rates.

- Closing tax loopholes: The opposition intends to close several identified loopholes that result in significant revenue leakage, potentially generating a substantial increase in government revenue.

These tax policy changes are designed to enhance both the fairness and efficiency of the Australian tax system, ultimately contributing to a healthier budget position.

Investing in Growth-Generating Sectors

A crucial element of the opposition's plan involves investing in sectors with high growth potential, stimulating long-term economic expansion. This includes:

- Infrastructure investment: Increased funding for vital infrastructure projects – roads, railways, and renewable energy – aims to create jobs and improve productivity, driving economic growth and contributing to long-term budget sustainability.

- Education and skills development: Investing in education and vocational training will equip the workforce with the skills needed for the future, boosting productivity and competitiveness in the global market.

- Technology and innovation: Supporting innovation and technological advancements will create new industries and high-paying jobs, stimulating economic growth and diversification.

These investments are not merely expenditures but strategic steps toward fostering sustainable economic growth, which will in turn contribute positively to the long-term health of the Australian budget.

Analysis of the Opposition's Plan

While the opposition's $9 billion budget improvement plan presents an ambitious vision, a critical analysis of its feasibility and challenges is necessary.

Feasibility and Challenges

Achieving the proposed $9 billion improvement presents significant challenges.

- Economic forecasts: The success of the plan is contingent upon accurate economic forecasts and the ability to meet projected revenue targets. Unforeseen economic downturns could significantly impact the plan's effectiveness.

- Policy implementation: The effective implementation of the proposed reforms across numerous government departments and agencies requires meticulous planning and efficient execution. Any delays or setbacks could undermine the projected savings.

- Political realities: The successful implementation also hinges on securing parliamentary support and overcoming potential political opposition.

Independent economic analysts offer varying perspectives on the plan's feasibility, highlighting the need for cautious optimism and robust monitoring mechanisms.

Comparison with Current Government Policies

The opposition's plan differs significantly from the current government's approach. While the current government has focused on targeted tax cuts for specific groups, the opposition's approach aims for a broader fiscal strategy encompassing efficiency gains, strategic tax reforms, and growth-focused investment. The long-term impacts of these different approaches remain to be seen. The key difference lies in the balance between immediate tax relief and long-term investment in infrastructure and skills development.

Conclusion: Evaluating Australia's Opposition's $9 Billion Budget Improvement Plan – A Call to Action

The opposition's promise of a $9 billion budget improvement is a significant undertaking, built on a three-pronged strategy focusing on enhanced government efficiency, strategic tax reforms, and investments in growth-generating sectors. While the plan presents a compelling vision, its feasibility depends on accurate economic forecasting, effective implementation, and navigating potential political challenges. The plan’s success hinges on a coordinated approach across various government departments and a commitment to long-term fiscal responsibility. This detailed analysis highlights the complexities involved in achieving such a substantial budget improvement. To stay informed and contribute to the ongoing national conversation, learn more about Australia's budget, engage in the political discourse, and inform yourself about Australia's budget improvement plans. Your participation is crucial in shaping Australia's fiscal future.

Featured Posts

-

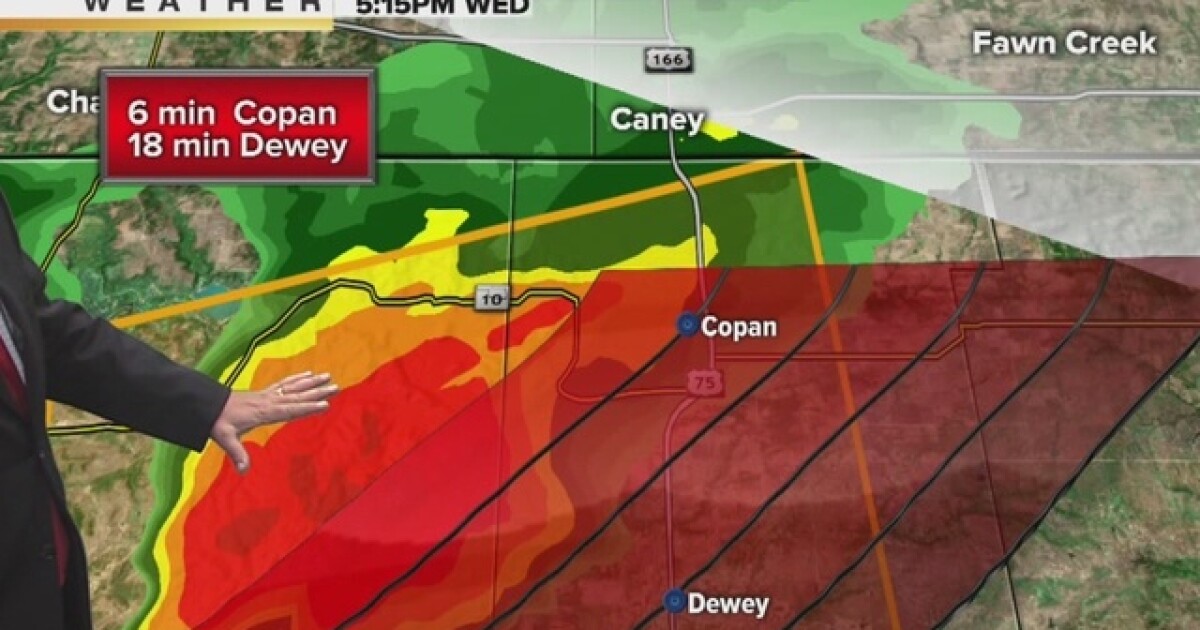

Winter Weather Alert Tulsa Streets Receiving Pre Treatment

May 02, 2025

Winter Weather Alert Tulsa Streets Receiving Pre Treatment

May 02, 2025 -

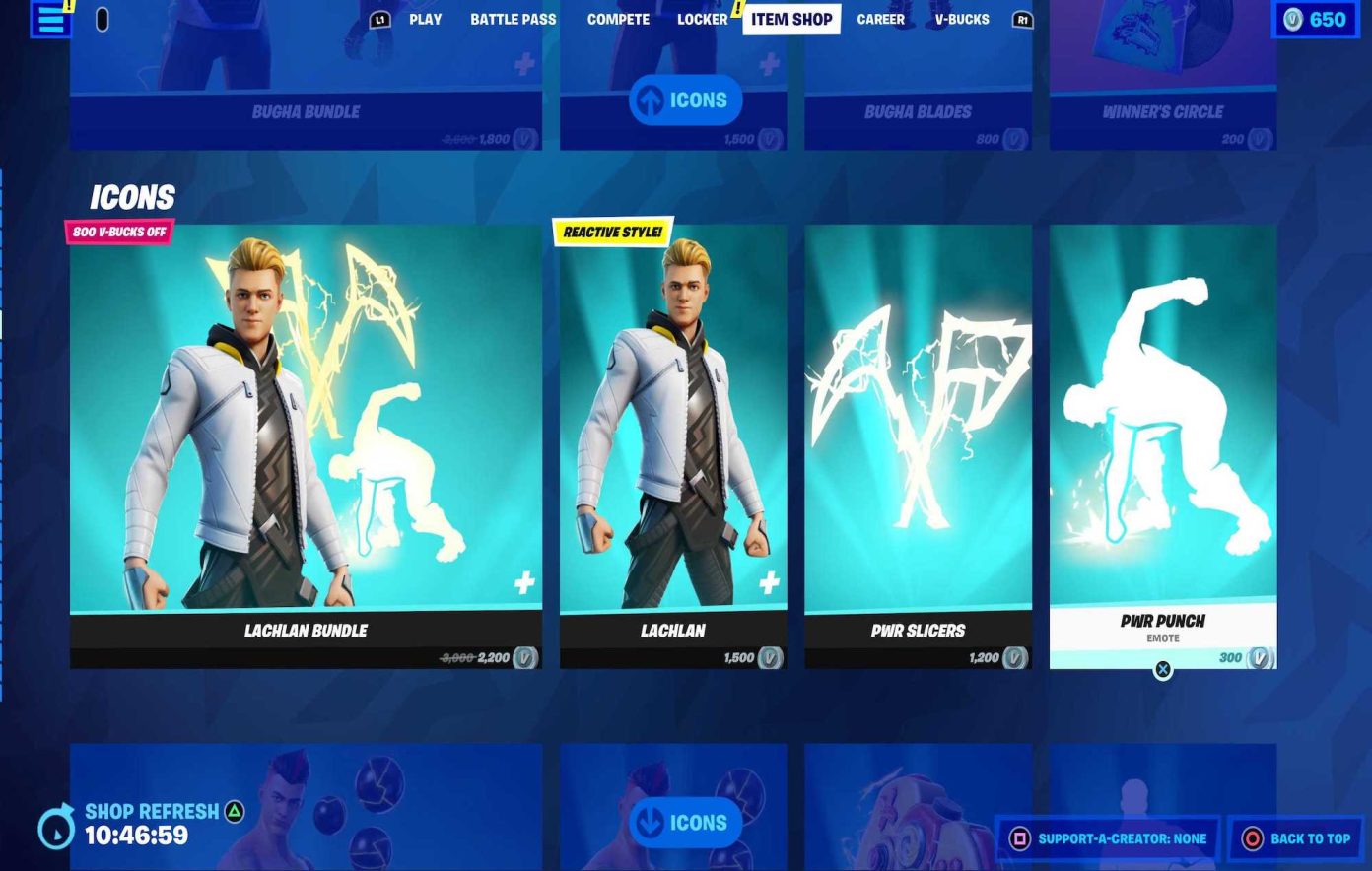

Are Highly Requested Fortnite Skins Returning To The Item Shop 1000 Days Later

May 02, 2025

Are Highly Requested Fortnite Skins Returning To The Item Shop 1000 Days Later

May 02, 2025 -

5 Effective Ways To Foster Mental Health Acceptance In Your Community

May 02, 2025

5 Effective Ways To Foster Mental Health Acceptance In Your Community

May 02, 2025 -

The Harry Potter Remake 6 Crucial Elements For Success

May 02, 2025

The Harry Potter Remake 6 Crucial Elements For Success

May 02, 2025 -

Tributes Pour In After Death Of Actress Priscilla Pointer

May 02, 2025

Tributes Pour In After Death Of Actress Priscilla Pointer

May 02, 2025

Latest Posts

-

Dijon Trois Hommes Sauvagement Agresses Au Lac Kir

May 10, 2025

Dijon Trois Hommes Sauvagement Agresses Au Lac Kir

May 10, 2025 -

Dijon Ou Donner Ses Cheveux Pour Une Bonne Cause

May 10, 2025

Dijon Ou Donner Ses Cheveux Pour Une Bonne Cause

May 10, 2025 -

Don De Cheveux A Dijon Comment Participer Et Quelles Associations Soutenir

May 10, 2025

Don De Cheveux A Dijon Comment Participer Et Quelles Associations Soutenir

May 10, 2025 -

Enquete Dijon Vehicule Projete Contre Un Mur Rue Michel Servet Les Circonstances De L Accident

May 10, 2025

Enquete Dijon Vehicule Projete Contre Un Mur Rue Michel Servet Les Circonstances De L Accident

May 10, 2025 -

Dijon Rue Michel Servet Explication De L Accident Ou Un Vehicule A Percute Un Mur

May 10, 2025

Dijon Rue Michel Servet Explication De L Accident Ou Un Vehicule A Percute Un Mur

May 10, 2025