Baazar Style Retail: Buy Recommendation & ₹400 Price Target (JM Financial)

Table of Contents

Growth Potential of Baazar Style Retail in India

Baazar style retail, characterized by its localized, community-focused approach, is uniquely positioned to capitalize on the vast underserved market in India. This presents a compelling investment opportunity.

Untapped Market Potential

India's massive population, particularly its large rural segment, represents a huge untapped market for retail. This potential is further amplified by:

- Expanding Rural Markets: Increasing disposable incomes in rural areas are fueling demand for a wider range of goods and services.

- E-commerce Penetration: The rapid adoption of e-commerce, even in smaller cities and towns, provides a significant growth avenue for Baazar Style Retail.

- Trust and Familiarity: The local, community-based nature of baazar style retail fosters trust and familiarity, crucial factors in driving consumer preference.

Competitive Advantages

Baazar Style Retail's success stems from several key competitive advantages:

- Hyperlocal Focus: Its hyperlocal business model allows for tailored product offerings and efficient delivery, catering to the specific needs of individual communities.

- Agile Supply Chain: A robust and efficient supply chain ensures consistent product availability and minimizes operational costs.

- Strong Customer Relationships: Building strong relationships with local communities fosters customer loyalty and repeat business.

- Technology Integration: Leveraging technology for inventory management, customer relationship management (CRM), and targeted marketing enhances operational efficiency and customer engagement.

Financial Performance & Valuation

JM Financial's report paints a rosy picture of Baazar Style Retail's financial health, bolstering their positive outlook.

Strong Financials

The report highlights several key positive financial indicators:

- Robust Revenue Growth: Significant year-on-year revenue growth demonstrates strong market traction and increasing consumer demand. (Specific data from the JM Financial report should be inserted here if available).

- Healthy Profit Margins: Impressive profit margins indicate efficient operations and strong pricing power. (Specific data from the JM Financial report should be inserted here if available).

- Stable Debt Levels: Low debt levels signal financial stability and resilience to economic fluctuations. (Specific data from the JM Financial report should be inserted here if available).

- Positive Cash Flow: A consistently positive cash flow indicates healthy business operations and the ability to fund future growth. (Specific data from the JM Financial report should be inserted here if available).

Rationale for ₹400 Price Target

JM Financial's ₹400 price target is based on a comprehensive valuation analysis, incorporating:

- Discounted Cash Flow (DCF) Analysis: A DCF model projects future cash flows and discounts them to their present value, providing a robust valuation metric. (Details of the DCF model used, if available from the report, should be included here).

- Comparable Company Analysis: Comparing Baazar Style Retail's performance and valuation metrics with similar companies in the sector provides further validation of the price target. (Specific comparable companies and their metrics should be mentioned if available from the report).

Risks & Challenges

While the outlook for Baazar Style Retail is largely positive, potential risks and challenges should be acknowledged:

Potential Downsides

Investors should consider these potential risks:

- Intense Competition: The growing popularity of the sector may attract more competitors, potentially increasing competitive pressure.

- Regulatory Hurdles: Changes in government regulations could impact the company's operations and profitability.

- Economic Slowdown: A broader economic downturn could reduce consumer spending, affecting demand for the company's products and services.

- Operational Challenges: Maintaining efficient operations and managing supply chain complexities are ongoing challenges.

Conclusion: Investing in the Future of Baazar Style Retail

JM Financial's report presents a compelling case for investing in Baazar Style Retail. The company demonstrates strong growth potential, positive financial performance, and a clear path to future success. The ₹400 price target, supported by robust valuation analysis, makes this a potentially lucrative investment opportunity. With its "Buy" recommendation, JM Financial encourages investors to consider Baazar Style Retail for its significant return potential. Learn more about investing in Baazar Style Retail and its potential for significant returns. (Insert links to relevant resources here).

Featured Posts

-

Barcelonas Fiery Response Condemning Tebas And La Ligas Conduct

May 15, 2025

Barcelonas Fiery Response Condemning Tebas And La Ligas Conduct

May 15, 2025 -

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit Tegen Baas

May 15, 2025 -

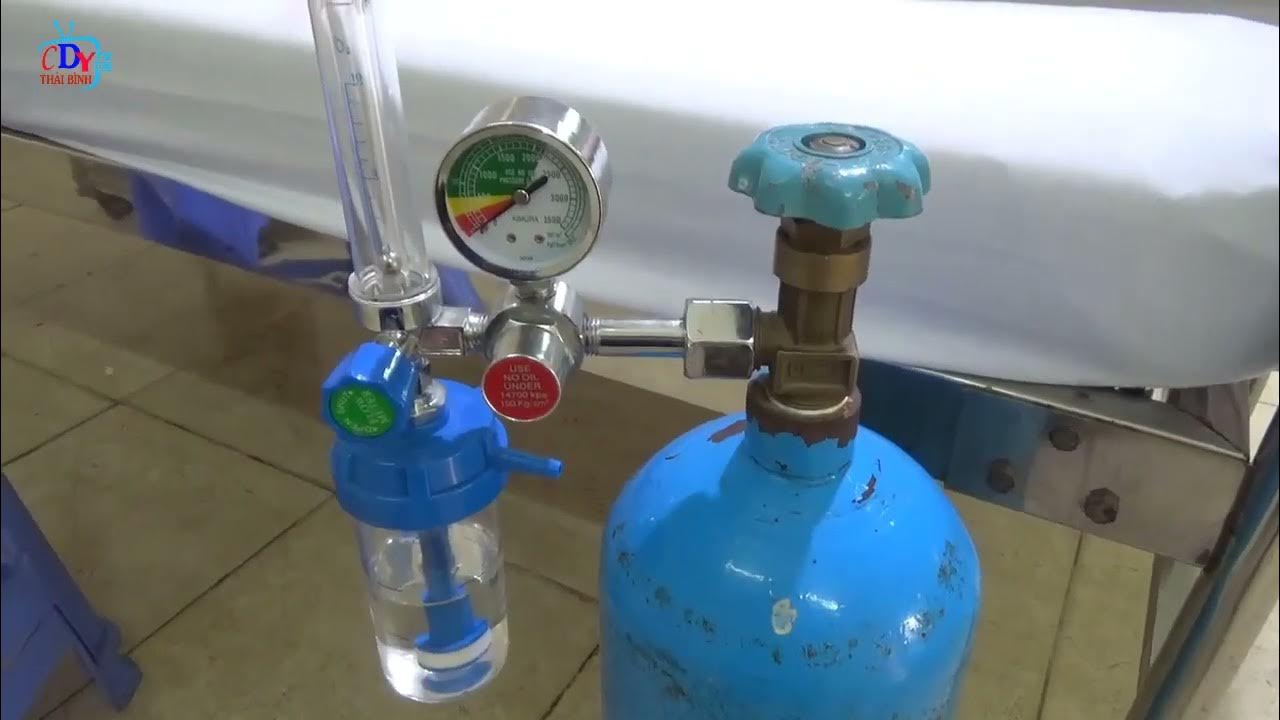

Thoi Gian Xong Hoi Phu Hop Voi Tung Doi Tuong Va Tinh Trang Suc Khoe

May 15, 2025

Thoi Gian Xong Hoi Phu Hop Voi Tung Doi Tuong Va Tinh Trang Suc Khoe

May 15, 2025 -

Jiskefets Ere Zilveren Nipkowschijf Een Mijlpaal Na Twee Decennia

May 15, 2025

Jiskefets Ere Zilveren Nipkowschijf Een Mijlpaal Na Twee Decennia

May 15, 2025 -

Barcelona Slams La Liga President Tebas Over Inappropriate Behavior

May 15, 2025

Barcelona Slams La Liga President Tebas Over Inappropriate Behavior

May 15, 2025